-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Tax Forms - page 2

-

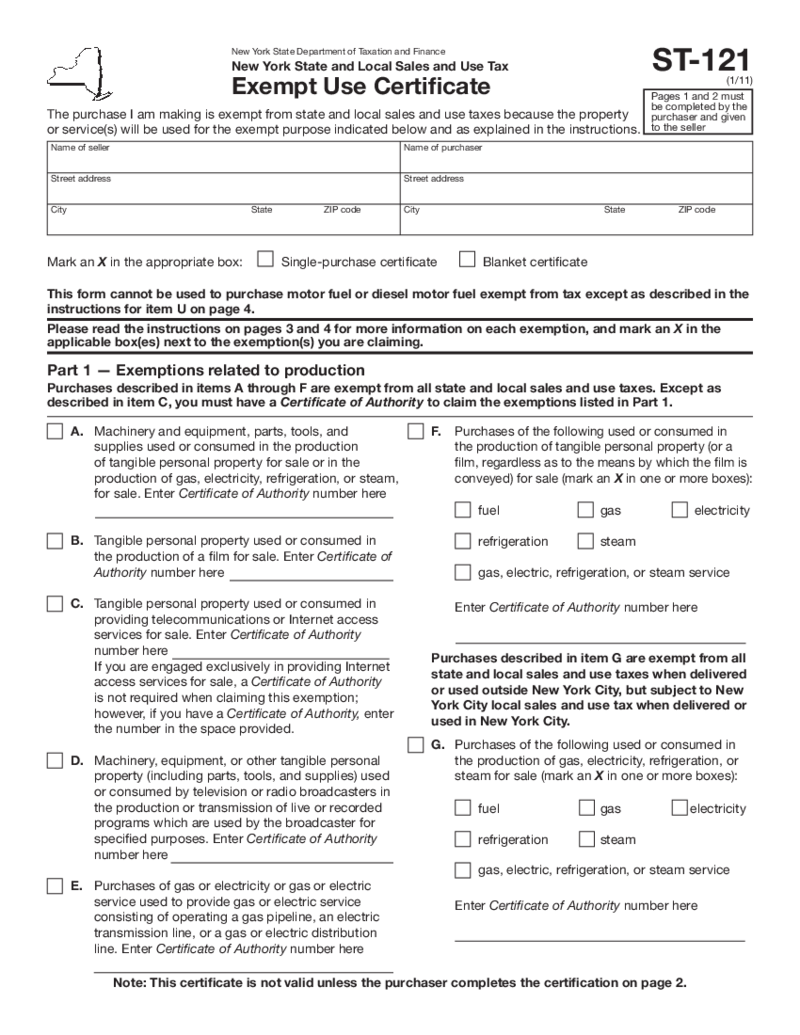

New York Form ST-121

What Is New York Form ST-121?

New York Form ST 121, also known as the "Exempt Use Certificate," is a form used by businesses and organizations in New York State to claim exemption from paying sales tax on certain purchases. Nys Tax Exempt Form S

New York Form ST-121

What Is New York Form ST-121?

New York Form ST 121, also known as the "Exempt Use Certificate," is a form used by businesses and organizations in New York State to claim exemption from paying sales tax on certain purchases. Nys Tax Exempt Form S

-

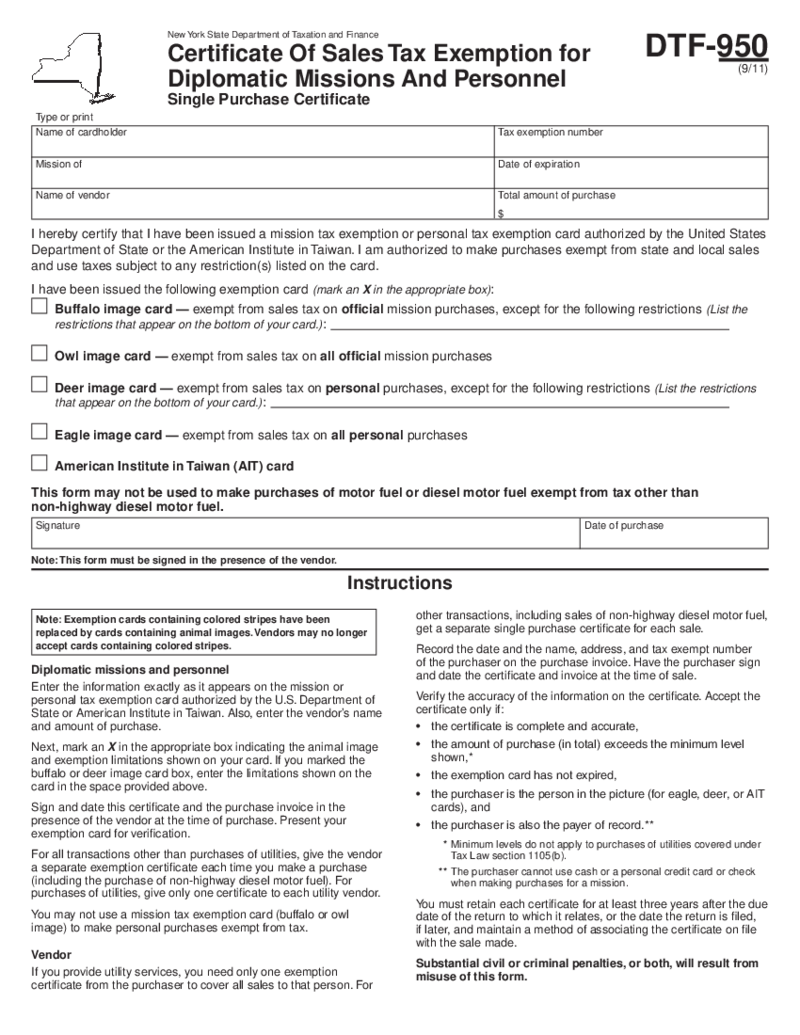

New York Form DTF-950

What Is New York Form DTF-950?

DTF 950 Tax Exemption Form used by the New York State Department of Taxation and Finance to claim a refund of sales tax paid on fuel used in a diesel-powered vehicle in New York State. To receive reimbursement, you should fi

New York Form DTF-950

What Is New York Form DTF-950?

DTF 950 Tax Exemption Form used by the New York State Department of Taxation and Finance to claim a refund of sales tax paid on fuel used in a diesel-powered vehicle in New York State. To receive reimbursement, you should fi

FAQ:

-

Where can I get New York State and New York City tax return forms?

Where can I get New York State and New York City tax return forms?

You can get all the New York state tax extension forms, tax reports, and other types of forms at the Department of Taxation and Finance website. You have to make sure that the form is what you were looking for. Another option is to use PDFLiner. You will be able to quickly find the document there and edit it online. -

Where do you send tax forms for New York?

It depends on the form’s specifics. Usually, the NYS Department of Taxation and Finance asks to send them forms online or by email indicated in the document. If they need to receive the original made on paper you will see the address in the form within the instructions provided by the Department.

-

Where to download New York state tax forms for previous years?

You have to consult with the Department of Taxation and Finance before you send any tax forms from previous years. There is a support team that is able to answer your questions on the website. It is better to always keep a copy of the document on your device. PDFLiner may help you to save the forms wherever you want them.

-

Where to mail amended New York state tax forms?

Amended state tax forms must be filed electronically to the Department of Taxation and Finance. You will see the address inside the form. You have to follow deadlines and provide attachments the Department asks for.