-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

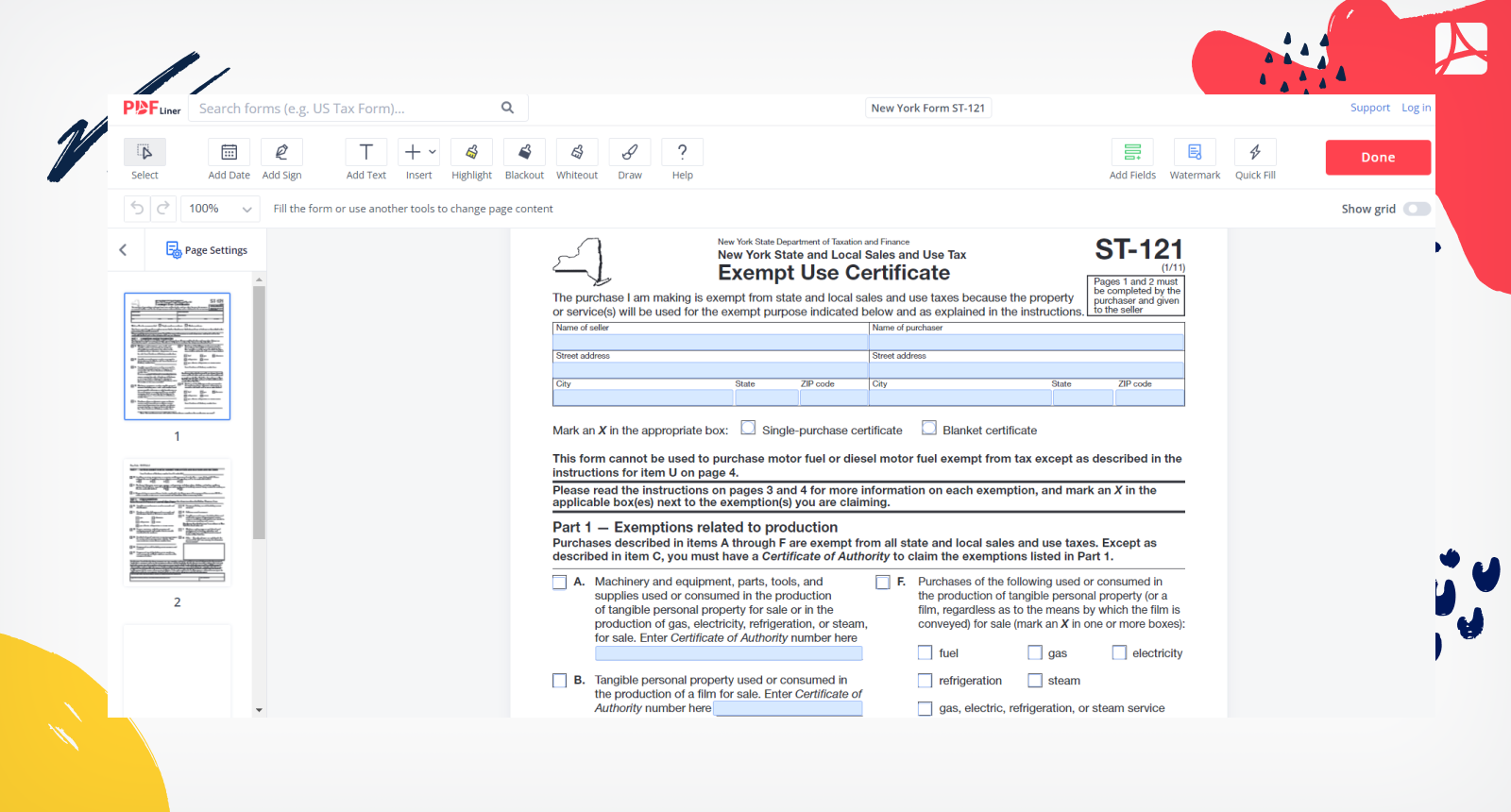

New York Form ST-121

Get your New York Form ST-121 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is New York Form ST-121?

New York Form ST 121, also known as the "Exempt Use Certificate," is a form used by businesses and organizations in New York State to claim exemption from paying sales tax on certain purchases. Nys Tax Exempt Form St 121 must be completed and provided to the seller in order for the exemption to be valid. Examples of exemptions that can be claimed on form ST 121 include purchases made for resale, purchases made by charitable organizations, and purchases made by the government.

Who Should Use New York Form ST-121?

The ST-121 form should be used by businesses and organizations that are eligible for exemption from paying sales tax on certain purchases made in New York State. Examples of entities that may use the form include:

- Retailers who purchase items for resale will not charge sales tax on those items when they are sold to customers;

- Charitable organizations that are exempt from paying sales tax on purchases made for their charitable activities;

- Government entities that are exempt from paying sales tax on purchases made for official government use;

- Religious, educational, and other non-profit organizations are exempt from paying sales tax on purchases made for their activities;

- Some other entities that may qualify for exemption such as Indian tribes, religious organizations and schools.

How To Fill Out New York Form ST-121

Form ST 121, the Exempt Use Certificate, is a simple form that can be filled out by the business or organization claiming the exemption. Here are the steps to fill out the form:

- Enter the name, address, and taxpayer identification number (TIN) of the business or organization claiming the exemption in the "Purchaser's Information" section at the top of the form.

- In the "Exemption Claimed" section, check the box corresponding to the type of exemption being claimed. For example, if the business claims an exemption for purchases made for resale, check the box next to "Resale."

- In the "Description of Property or Services" section, provide a brief description of the property or services being purchased and the intended use of the property or services.

- In the "Certification" section, the authorized person must sign and date the form.

- Keep the copy ST121 form with your business records, as you may be required to present it in case of an audit.

Also remember that it's essential to claim the exemption only when it applies to the purchase and have a valid reason to claim it, as it's illegal to claim exemptions when they don't use, and you could face penalties.

How To Get New York Form ST-121

You can obtain form ST 121 in several ways:

- Online: Right now the form can be downloaded from the PDFliner website.

- By Phone: You can call the New York State Department of Taxation and Finance to request a form be mailed to you.

- In Person: You can visit a New York State Department of Taxation and Finance office to pick up a copy of the form in person.

- From the seller: Some sellers may have the form available on their premises or may be able to provide it to you upon request.

It's important to note that each form must be completed separately for each purchase and once completed, it should be given to the seller at the time of purchase.

Fillable online New York Form ST-121