-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

UK Government Documents

-

Apply For Vehicle Tax (Form V10)

What is a V10 Form DVLA?

Not every taxpayer knows what is a V10 form until they need to pay their taxes and fill out the documents. Using this form, you can tax not only a car but motorcycle and other vehicles except for heavy-goods vehicles. Form V10 was

Apply For Vehicle Tax (Form V10)

What is a V10 Form DVLA?

Not every taxpayer knows what is a V10 form until they need to pay their taxes and fill out the documents. Using this form, you can tax not only a car but motorcycle and other vehicles except for heavy-goods vehicles. Form V10 was

-

DVLA D1 Form - Application for a Driving Licence

What Is the UK DVLA D1 form?

DVLA D1 form must be applied by every citizen of the UK or resident of this country who spends 185+ days there in case they want to obtain a driver’s license after passing the test. This form grants the right to pass the

DVLA D1 Form - Application for a Driving Licence

What Is the UK DVLA D1 form?

DVLA D1 form must be applied by every citizen of the UK or resident of this country who spends 185+ days there in case they want to obtain a driver’s license after passing the test. This form grants the right to pass the

-

Form V888

What Is Form V888?

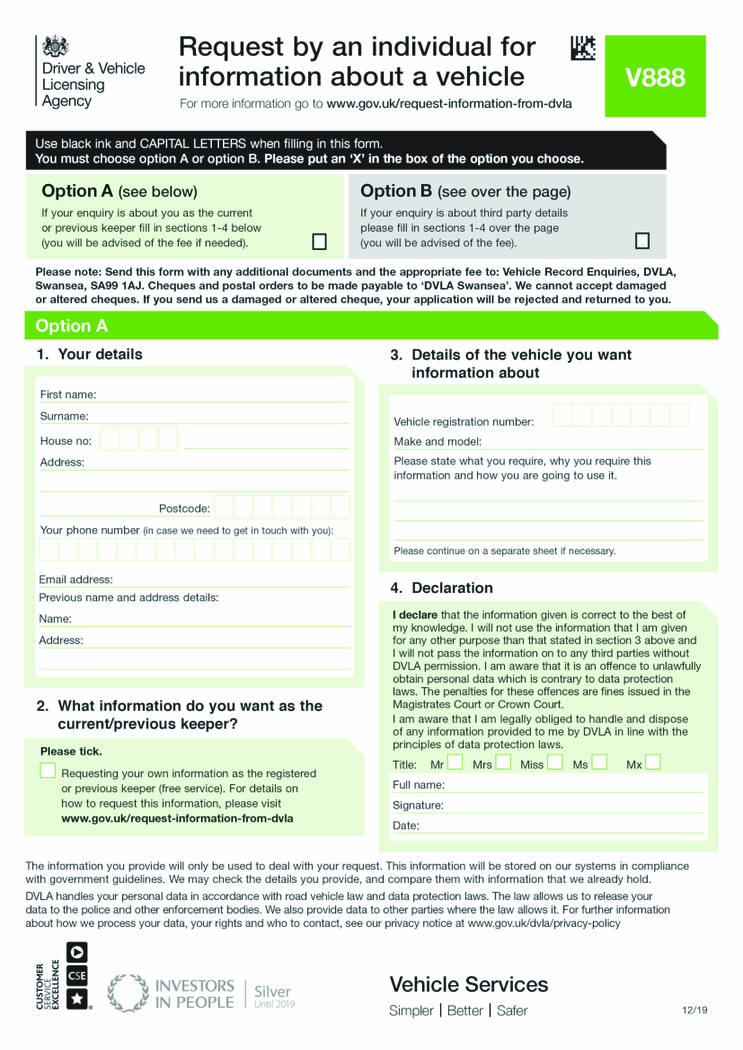

The V888 form is titled Request by an Individual for Information about a Vehicle. It was introduced by the UK’s Driver and Vehicle Licensing Agency and can be used to obtain information concerning a certain vehicle.

Form V888

What Is Form V888?

The V888 form is titled Request by an Individual for Information about a Vehicle. It was introduced by the UK’s Driver and Vehicle Licensing Agency and can be used to obtain information concerning a certain vehicle.

-

Form D2

What Is DVLA Form D2?

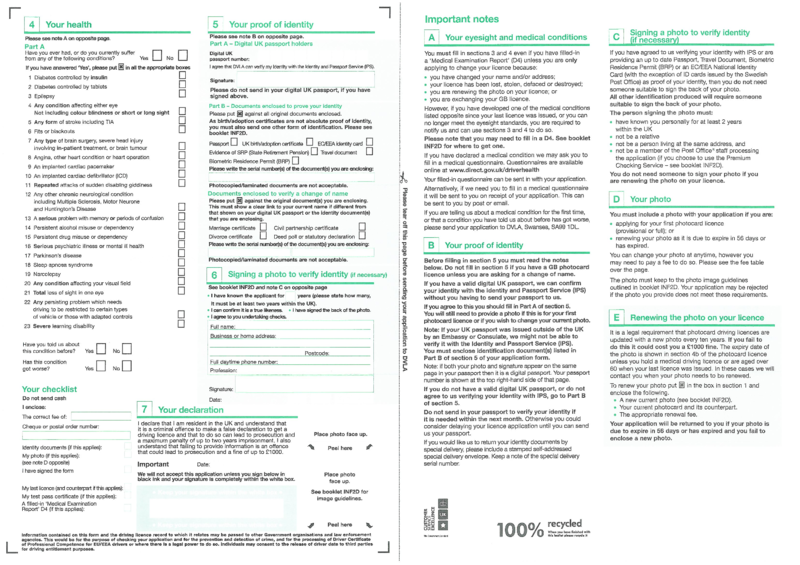

It’s a document used for applying for a license to drive lorries, buses, and minibuses in the UK. If you’re currently looking to download D2 form or fill it out online, today’s your lucky day. In our lengthy catalog

Form D2

What Is DVLA Form D2?

It’s a document used for applying for a license to drive lorries, buses, and minibuses in the UK. If you’re currently looking to download D2 form or fill it out online, today’s your lucky day. In our lengthy catalog

-

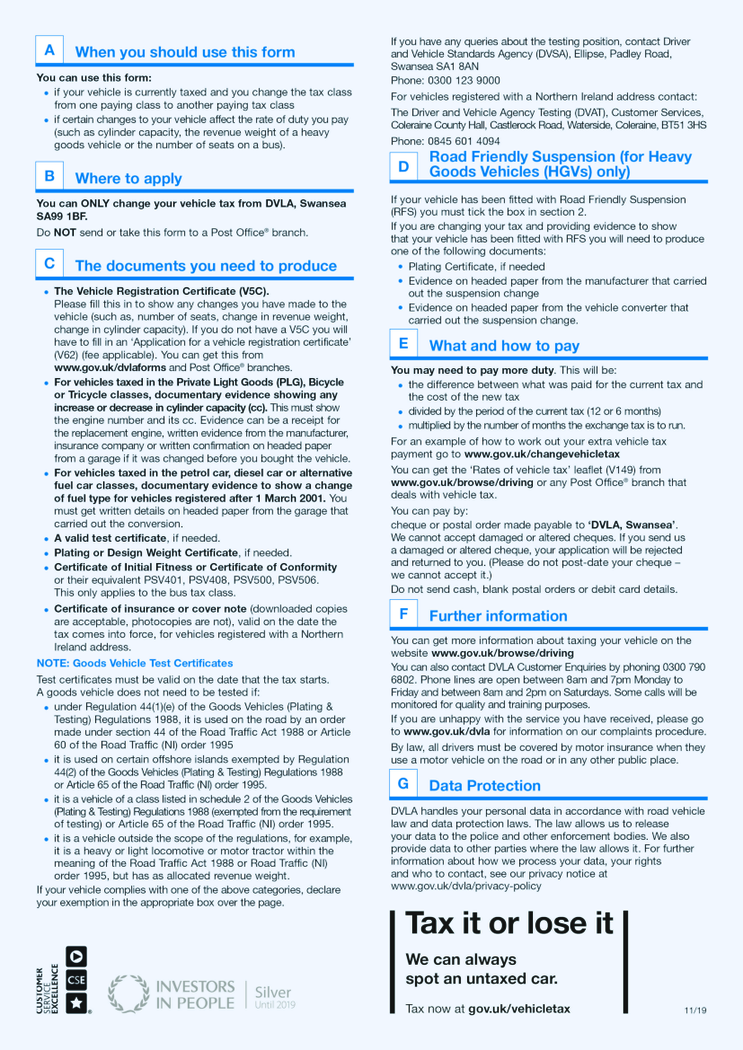

Application to change a vehicle s tax class (V70)

What Is a DVLA V70 form?

The V70 form is the document that vehicle owners use to change the tax class of a vehicle. The amount of tax you have to pay for your vehicle depends on the tax class.

Application to change a vehicle s tax class (V70)

What Is a DVLA V70 form?

The V70 form is the document that vehicle owners use to change the tax class of a vehicle. The amount of tax you have to pay for your vehicle depends on the tax class.

-

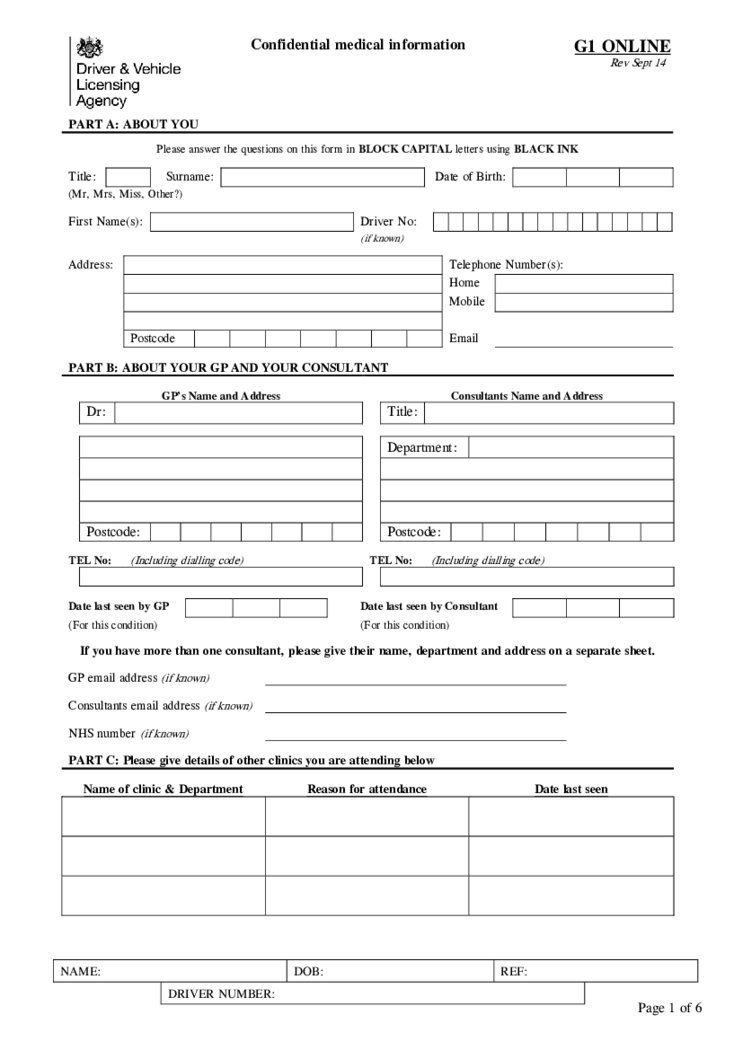

Report your medical condition (form G1)

The Driving and Vehicle Licensing Agency (DVLA) plays a vital role in maintaining the safety of our roads. One of their responsibilities is ensuring that all drivers are medically fit to drive. In this article, we'll explore the DVLA Form G1, a crucial document f

Report your medical condition (form G1)

The Driving and Vehicle Licensing Agency (DVLA) plays a vital role in maintaining the safety of our roads. One of their responsibilities is ensuring that all drivers are medically fit to drive. In this article, we'll explore the DVLA Form G1, a crucial document f

-

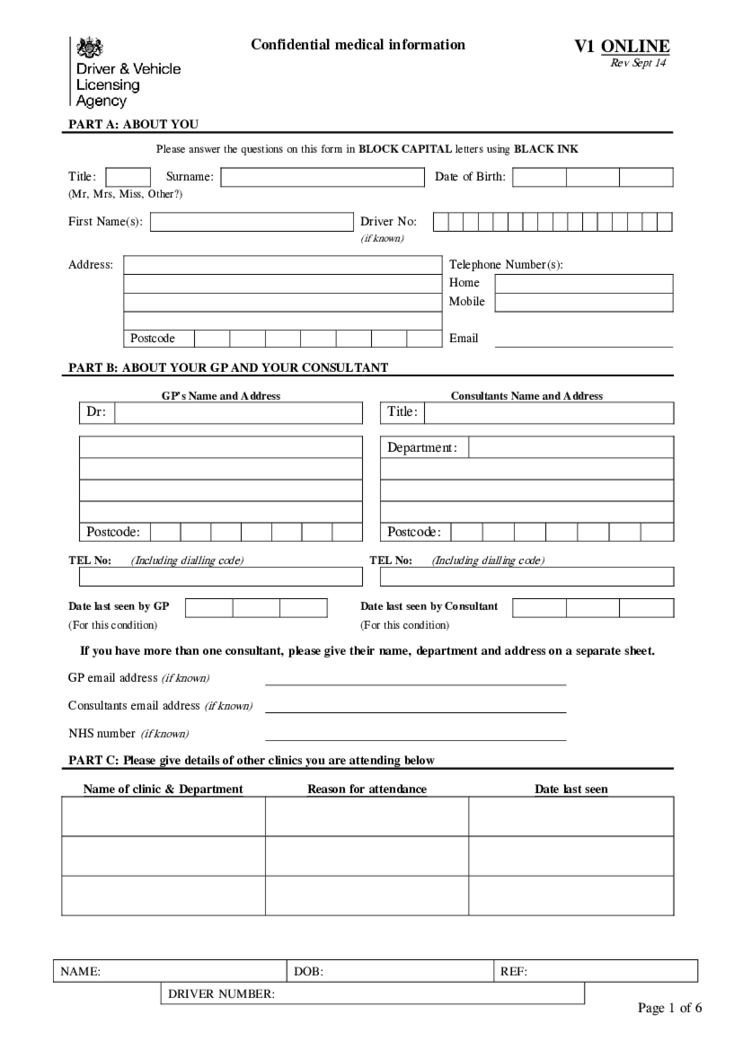

Report your medical condition (form V1)

Driving safely is critical for all road users, and this includes drivers with medical conditions. That's where DVLA forms V1, D796, and DR1 come into play. These forms play a key role in ensuring that drivers suffering from certain medical conditions can safely o

Report your medical condition (form V1)

Driving safely is critical for all road users, and this includes drivers with medical conditions. That's where DVLA forms V1, D796, and DR1 come into play. These forms play a key role in ensuring that drivers suffering from certain medical conditions can safely o

-

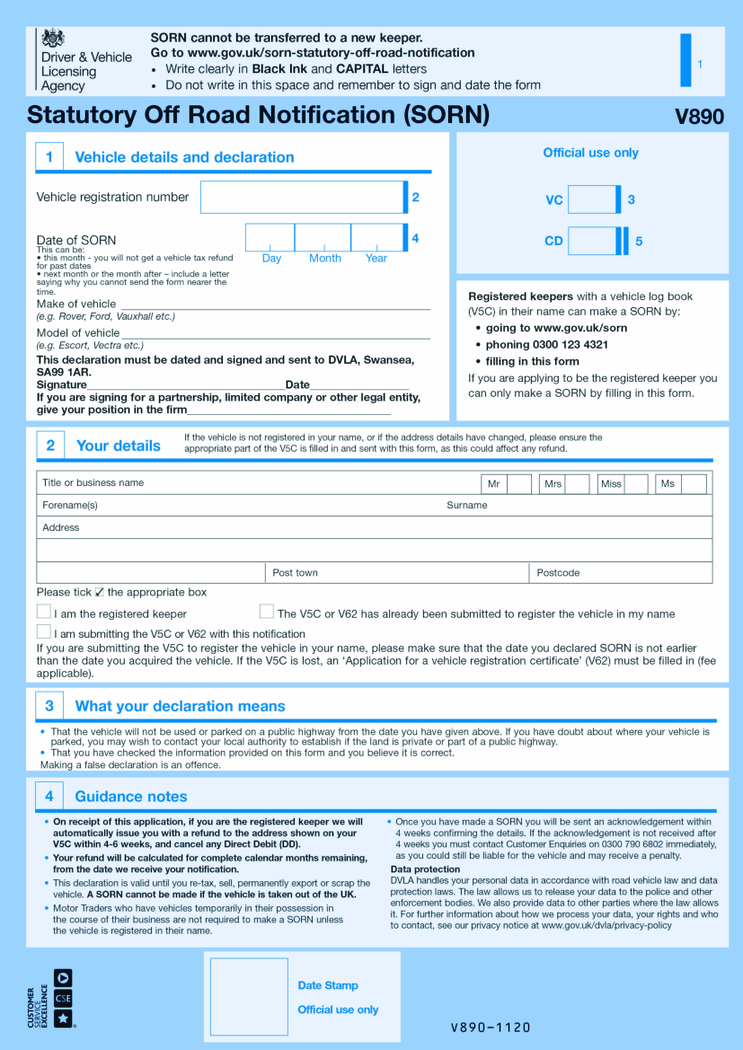

Form V890

What Is a V890 Form?

The fillable V890 form is also known as a SORN document or statutory off-road notification. You have to download the V890 form if you need to notify the authorities that your vehicle is on the road. Since it is not a business agreemen

Form V890

What Is a V890 Form?

The fillable V890 form is also known as a SORN document or statutory off-road notification. You have to download the V890 form if you need to notify the authorities that your vehicle is on the road. Since it is not a business agreemen

-

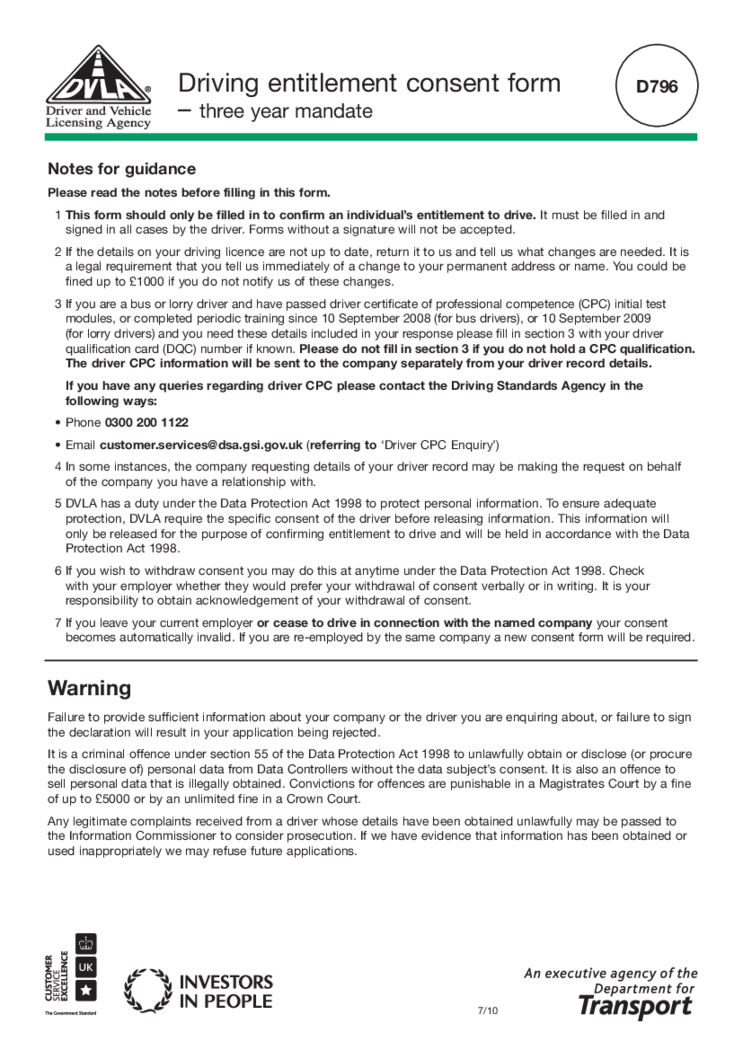

DVLA D796 Form

What is the DVLA D796 Form?

The DVLA D796 form is known as the "Driving Entitlement Consent Form". It is used to give permission to a third party, such as an employer or driving school, to view your driving record and entitlements. This can be u

DVLA D796 Form

What is the DVLA D796 Form?

The DVLA D796 form is known as the "Driving Entitlement Consent Form". It is used to give permission to a third party, such as an employer or driving school, to view your driving record and entitlements. This can be u

-

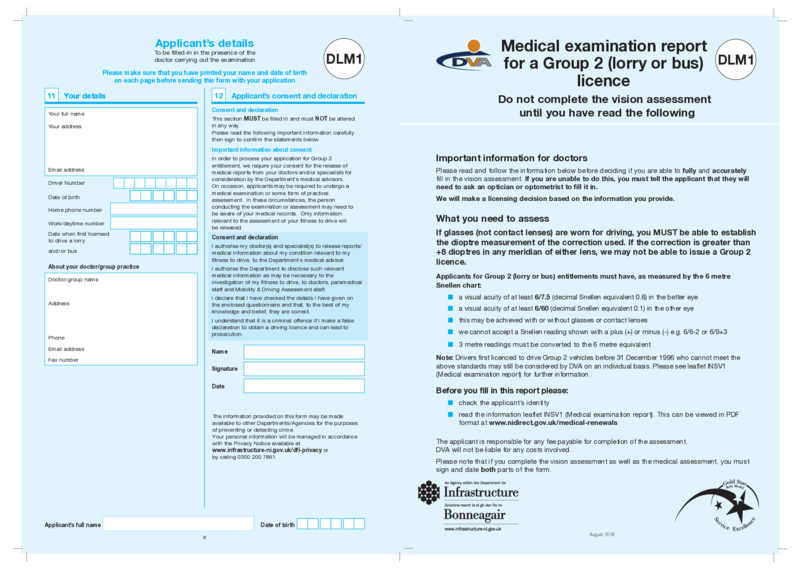

DLM1 Form, Medical report for a Group 2 (lorry or bus) licence

What Is DLM1 Form?

The DLM1 form is an assessment of your health and fitness to drive. The form asks about things like your eyesight, hearing, epilepsy, diabetes, and sleep apnea. You’ll also need to declare any physical or mental health conditions

DLM1 Form, Medical report for a Group 2 (lorry or bus) licence

What Is DLM1 Form?

The DLM1 form is an assessment of your health and fitness to drive. The form asks about things like your eyesight, hearing, epilepsy, diabetes, and sleep apnea. You’ll also need to declare any physical or mental health conditions

-

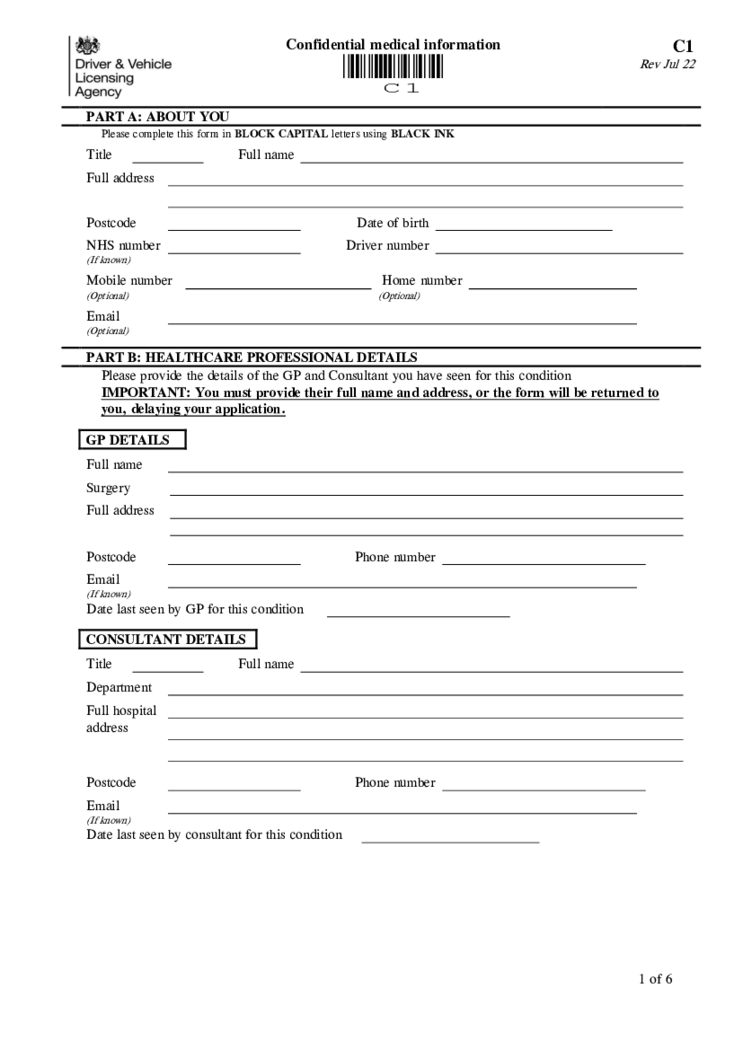

DVLA C1 Form - Confirmation medical information

Understanding the C1 Form DVLA

Driving is an essential part of everyday life for many individuals. Whether for work, leisure, or domestic purposes, operating a vehicle requires a certain level of health and physical capability. To ensure that drivers can

DVLA C1 Form - Confirmation medical information

Understanding the C1 Form DVLA

Driving is an essential part of everyday life for many individuals. Whether for work, leisure, or domestic purposes, operating a vehicle requires a certain level of health and physical capability. To ensure that drivers can

-

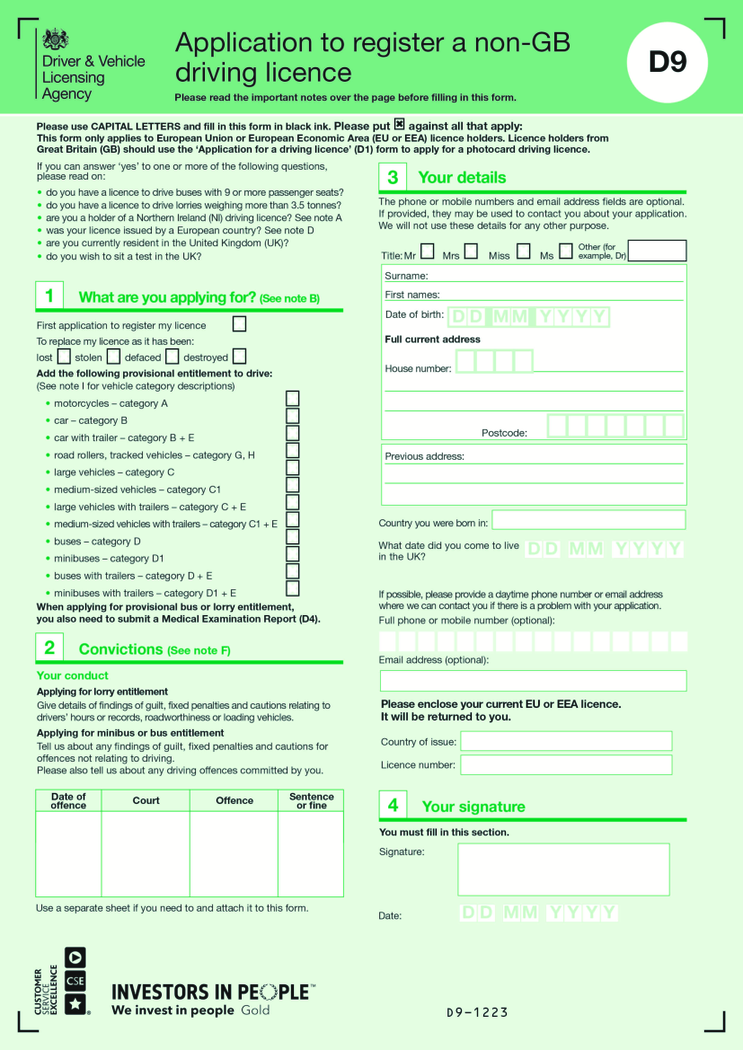

Application to register a non-GB driving licence (form D9)

Everything You Need to Know About the D9 Application

As an international driver holding a non-GB driving license, you may be at a loss on how to register your license. This task is possible and straightforward with Form D9 - an application form designed f

Application to register a non-GB driving licence (form D9)

Everything You Need to Know About the D9 Application

As an international driver holding a non-GB driving license, you may be at a loss on how to register your license. This task is possible and straightforward with Form D9 - an application form designed f

What Are UK Government Documents?

UK government documents function as essential sources of information, policies, and regulations issued by governmental organizations in the United Kingdom. These docs incorporate a wide range of materials, including reports, white papers, legislation, official statements, and guidelines. They provide transparency, guidance, and accountability in the governance of the country.

Examples of when UK government document forms are used include budget reports, parliamentary bills, policy briefs, ministerial statements, and official guidance on topics such as healthcare, education, taxation, and environmental regulations. Government documents UK play a critical role in informing citizens, businesses, and organizations about the functioning and decisions of the UK government. Also, these documents collect and record information about UK citizens for government purposes.

Most Popular Government Documents UK

Below, we’ve listed 5 most widely used UK government docs with their brief descriptions:

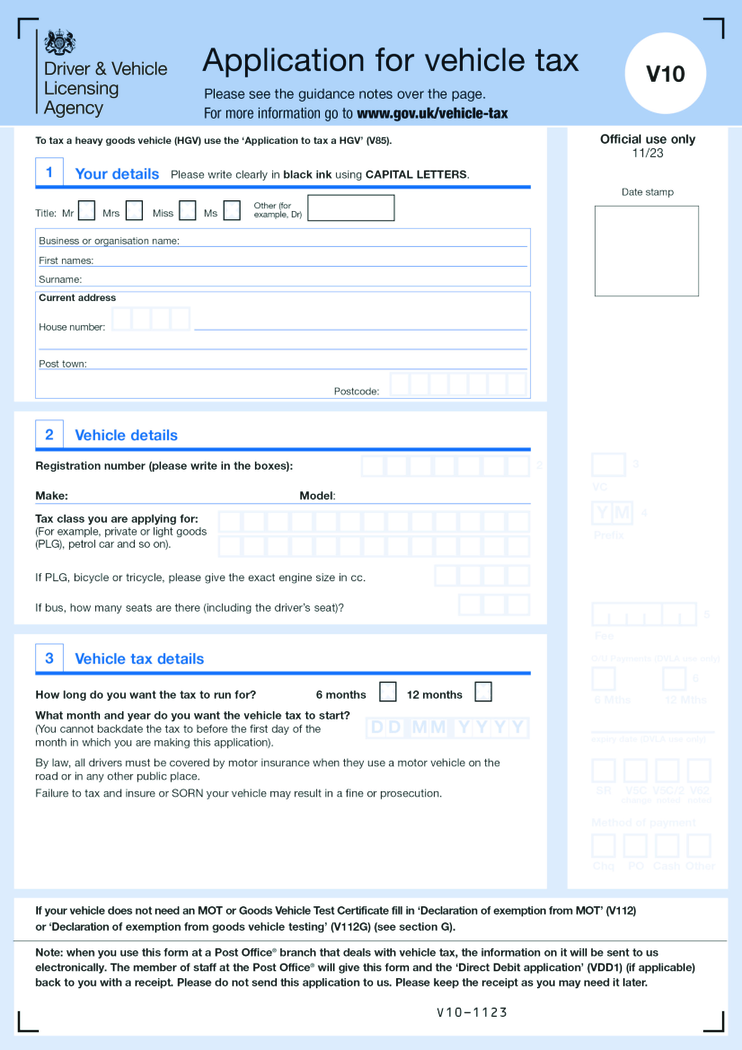

- Application For Vehicle Tax (Form V10). Form V10 is utilized by individuals in the United Kingdom to apply for vehicle tax or to declare a vehicle as tax-exempt. It requires comprehensive information about the vehicle, including its registration number, make, model, and owner's details. This form is submitted to the Driver and Vehicle Licensing Agency (DVLA) to ensure that vehicles on UK roads are properly taxed and comply with the necessary regulations.

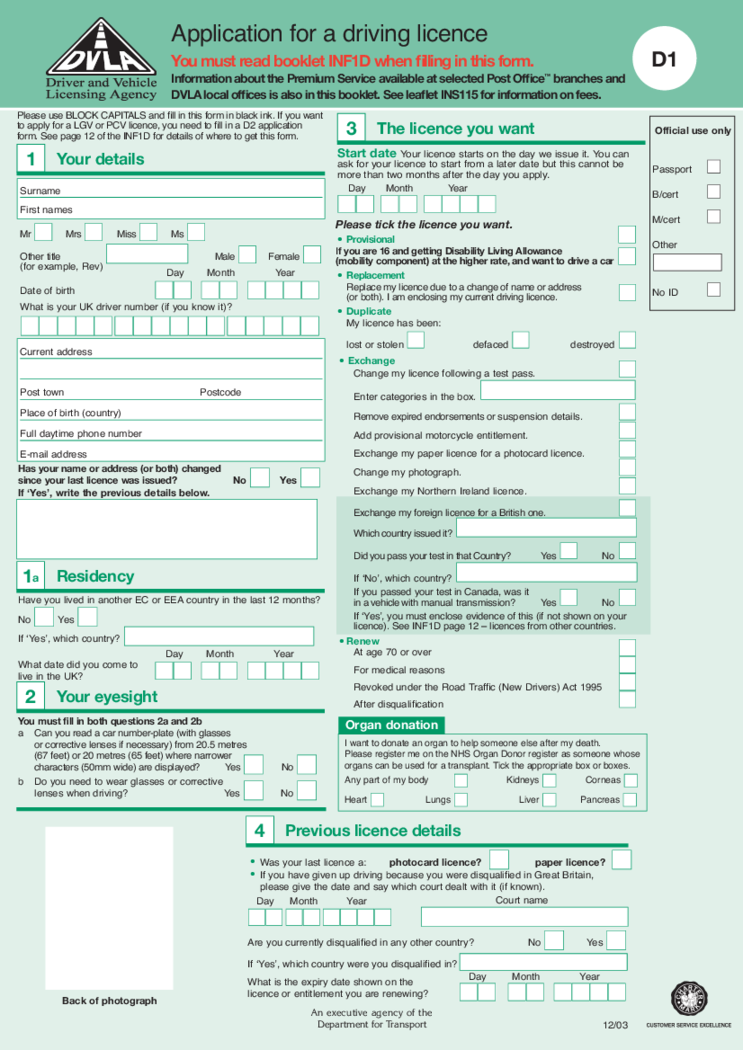

- Application for a Driving License (DVLA D1 Form). This doc is utilized to apply for a driving license in the UK. It collects personal info, including the applicant's name, address, date of birth, and National Insurance number. The form also includes sections to provide details about any medical conditions or disabilities that may affect driving abilities. By completing this form and submitting it to the DVLA, individuals can initiate the process of obtaining a driving license.

- Application for a Vehicle Registration Certificate (DVLA V62 Form). This form is utilized to apply for a vehicle registration certificate (V5C) in the UK. It is typically used when the original V5C is lost, stolen, damaged, or needs to be updated. The form requires information about the vehicle, including its registration number, make, model, and previous owner's details. By completing this form and submitting it to the DVLA, individuals can obtain a new or updated vehicle registration certificate.

- UK Passport Application (Form C1). Form C1 is the application form for a UK passport. It collects personal information, including the applicant's name, address, date of birth, and citizenship details. The form also includes sections to provide details about previous passports, any name changes, and additional information required for specific passport types. Completing and submitting this form enables individuals to apply for or renew their UK passports.

- Statutory Sick Pay (SSP) Form. This doc is used by employers in the UK to record and manage employees' entitlement to statutory sick pay. It collects information such as the employee's name, National Insurance number, and dates of sickness absence. This form helps employers calculate and document the statutory sick pay to be provided to eligible employees based on the relevant guidelines and regulations.

These frequently used UK government documents play a crucial role in various aspects of individuals' lives, from vehicle taxation and driving license applications to passport issuance and sick pay management. By using these forms and submitting them to the appropriate government agencies, individuals can fulfill their obligations and exercise their rights within the framework of UK regulations. With PDFLiner, you can effortlessly fill out these forms online. It’s a fast, easy, typo-prof, and paperless method of dealing with your administrative tasks.

Where to Get UK Government Documents?

In our inexhaustible database of pre-designed document templates, you can find a wide range of UK government forms to cater to your specific needs. PDFLiner offers a comprehensive collection of these forms, ensuring convenience and efficiency in accessing the necessary documents.

With PDFLiner's intuitive online service, you can not only locate the required UK government forms but also take full advantage of the platform's editing tools. Customize these forms to your requirements directly online, making modifications, additions, or deletions as necessary. Here, you’ll forget about scanning or printing and enjoy working online in the on-the-go format.

Last but not least, PDFLiner enables easy sharing of the edited forms with other recipients, allowing for collaborative workflows and seamless digital submissions. Experience the convenience of PDFLiner as you access, edit, and manage UK government forms effortlessly.