-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

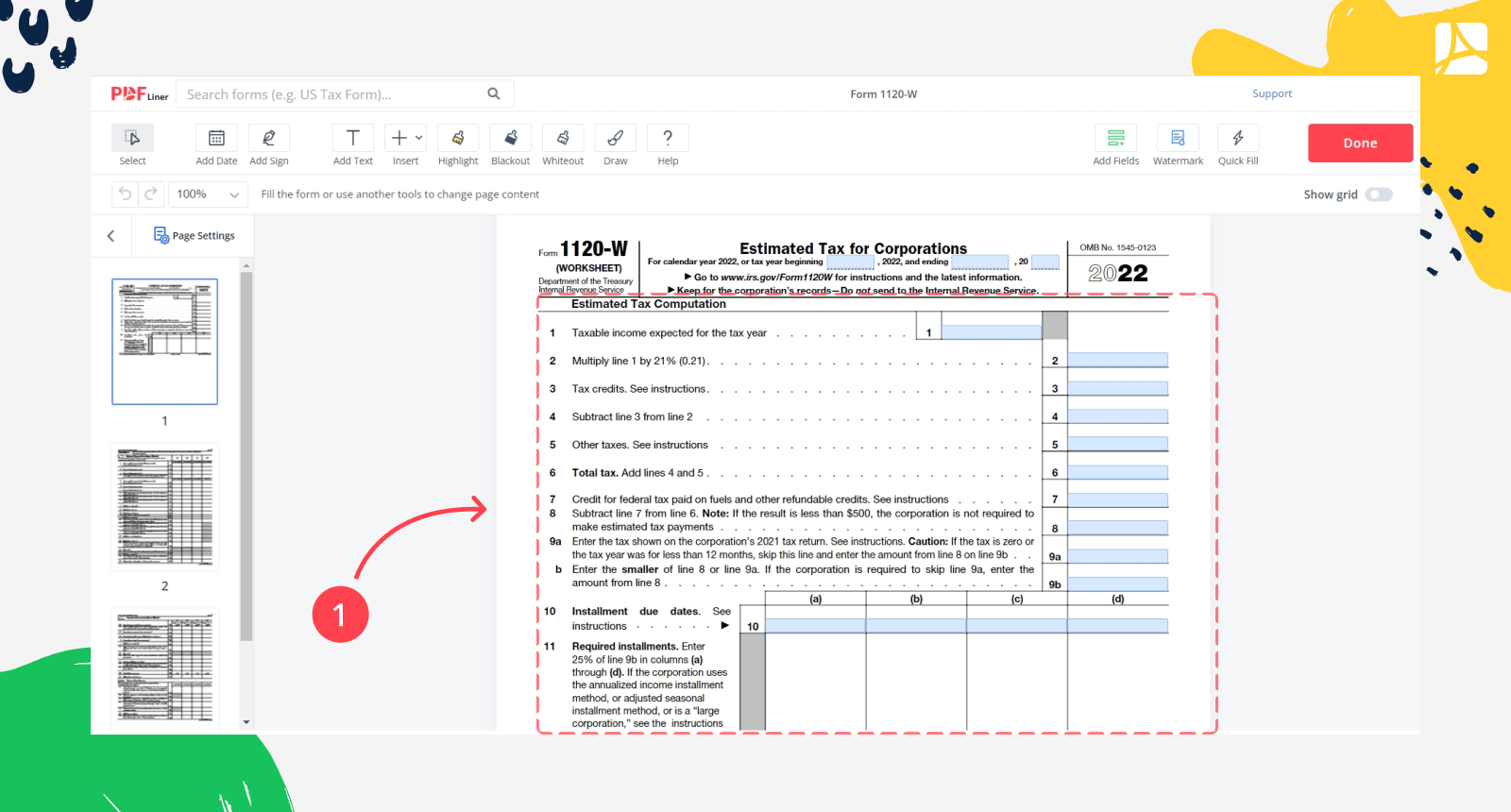

Form 1120-W

Get your Form 1120-W in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 1120-W?

1120-W is the form used for evaluating corporations’ tax liability and determining their estimated tax installment amount. A corporation is obliged to submit this blank if it owes at least $500 for the current fiscal year.

What I Need IRS Form 1120 W for

- you need the fillable 1120-W form for your corporation’s tax liability estimation;

- and for figuring out the amount of your estimated tax installments;

- as well as for paying your estimated tax.

The installments must be paid by the fifteenth day of the fourth, sixth, ninth, and twelfth months of the fiscal year. In case the due date falls on a holiday or weekend, the payment must be processed within the next business day.

How to Fill Out Form 1120-W

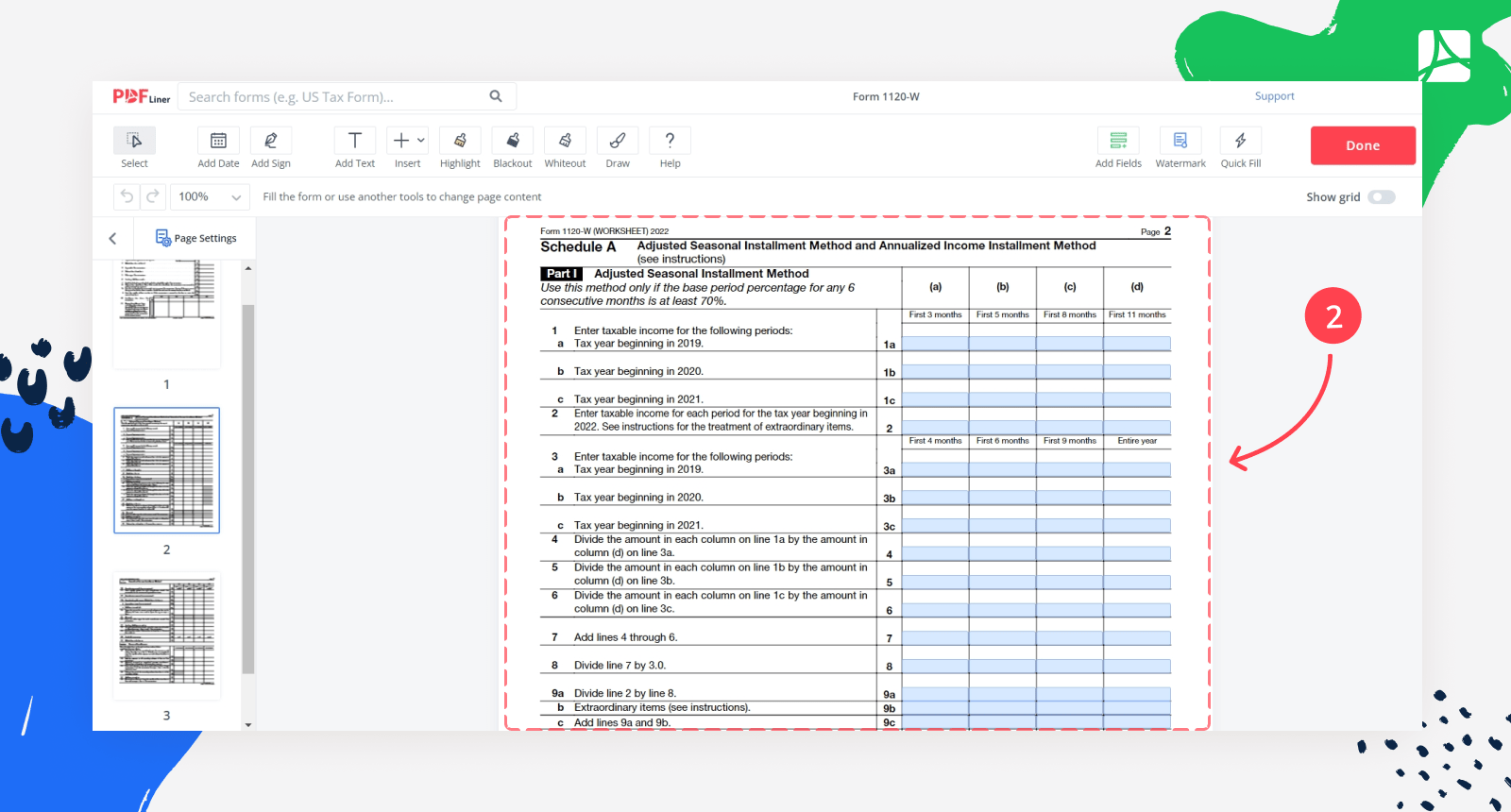

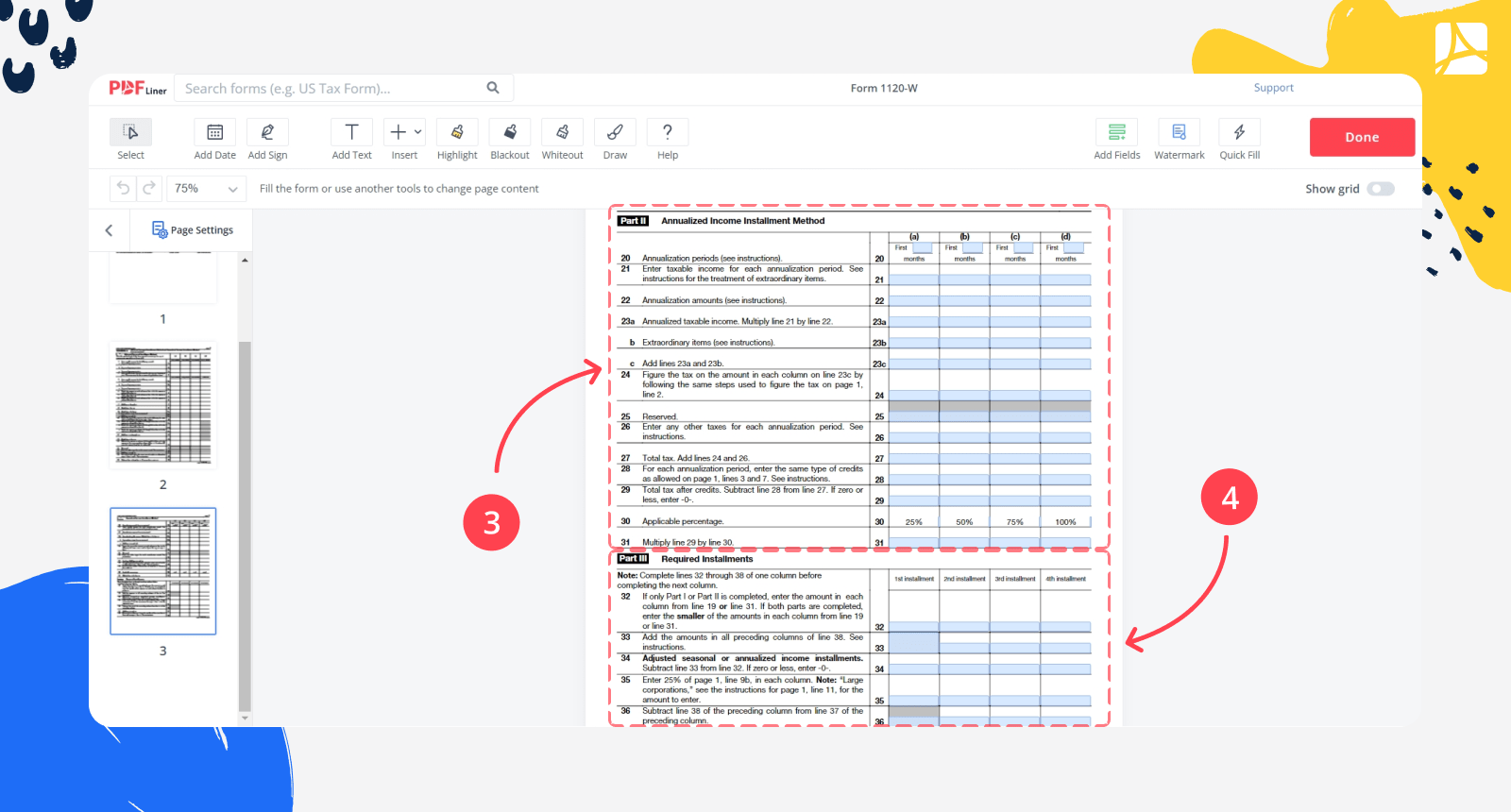

The 1120-W form is a 3-page (and 3-part) document that may seem challenging to fill out. Read the instructions by the IRS on completion or contact your bookkeeper for help if the task seems way too unclear to you.

Don’t forget that with PDFLiner, you can:

- find and fill out the PDF of form 1120-W;

- e-sign it within a matter of just a few minutes;

- download form 1120-W for further storage;

- or print it out if that’s your ultimate goal.

Bear in mind that with PDFLiner, you’re free to complete your 1120-W blank online without even having to spend time looking for the doc non-stop or scanning it (or even printing it out, for that matter). Let PDFLiner become your go-to tax management solution.

Organizations That Work With Form 1120 W

The Internal Revenue Service (IRS).

Related to Form 1120-W Documents

FAQ: Let’s Go Through Form 1120-W Popular Questions

-

Who needs to file 1120W form?

Businesses that are structured as corporations and expect to make more than $500 in income taxes per year, should use Form 1120-W to estimate their quarterly tax payments.

-

What information is included in 1120 W form?

The form includes two main parts:

- Worksheet that let's you calculate your Estimated Tax Computation.

- Schedule A or Adjusted Seasonal Installment Method and Annualized Income Installment Method that includes 3 parts with different calculation methods.

-

What is the deadline for form 1120W?

The tax year is divided into four sections, with each section having its own due date. The due dates are typically the 15th day of the 4th, 6th, 9th, and 12th months, but if any of those days falls on a weekend or holiday, the installment is due on the next regular business day.

Fillable online Form 1120-W