-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Quit Claim Deed Forms

-

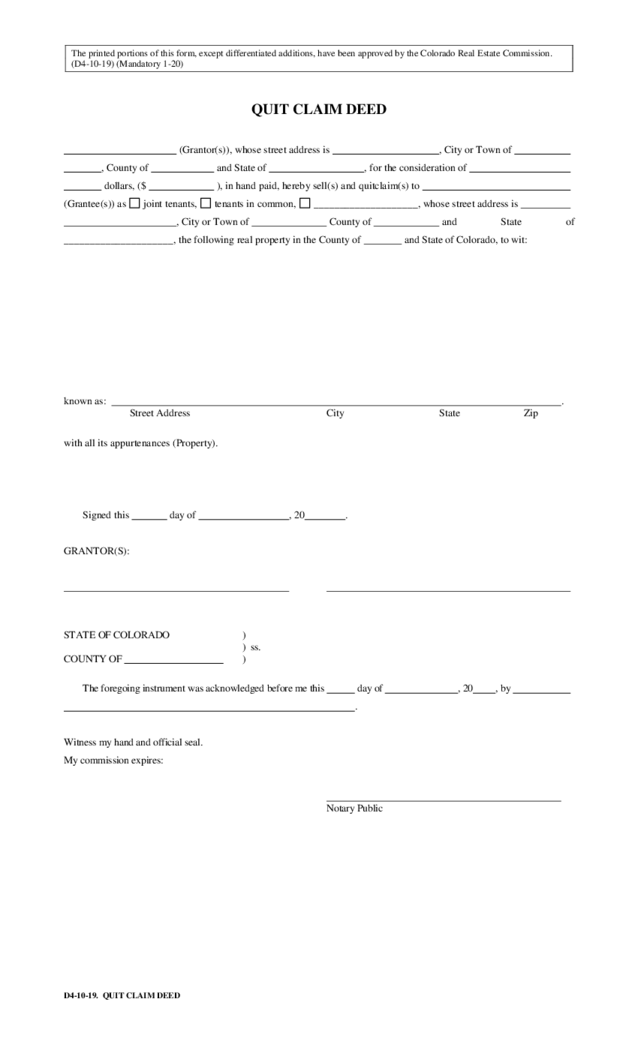

Colorado DORA Quit Claim Deed

Colorado Quit Claim Deed Template Explained

Are you on the prowl for a free quit claim deed Colorado? We’ve got you covered here on PDFLiner. In this piece, you’ll get the gist of the notion of this file, lay your fingertips on the templ

Colorado DORA Quit Claim Deed

Colorado Quit Claim Deed Template Explained

Are you on the prowl for a free quit claim deed Colorado? We’ve got you covered here on PDFLiner. In this piece, you’ll get the gist of the notion of this file, lay your fingertips on the templ

-

Mississippi Quit Claim Deed

Mississippi Quit Claim DeedWhat is the blank Mississippi Quit Claim Deed?

The fillable blank Mississippi Quit Claim Deed is a document used to legally transfer property rights in the state of Mississippi. In order for the document to become effective, it

Mississippi Quit Claim Deed

Mississippi Quit Claim DeedWhat is the blank Mississippi Quit Claim Deed?

The fillable blank Mississippi Quit Claim Deed is a document used to legally transfer property rights in the state of Mississippi. In order for the document to become effective, it

-

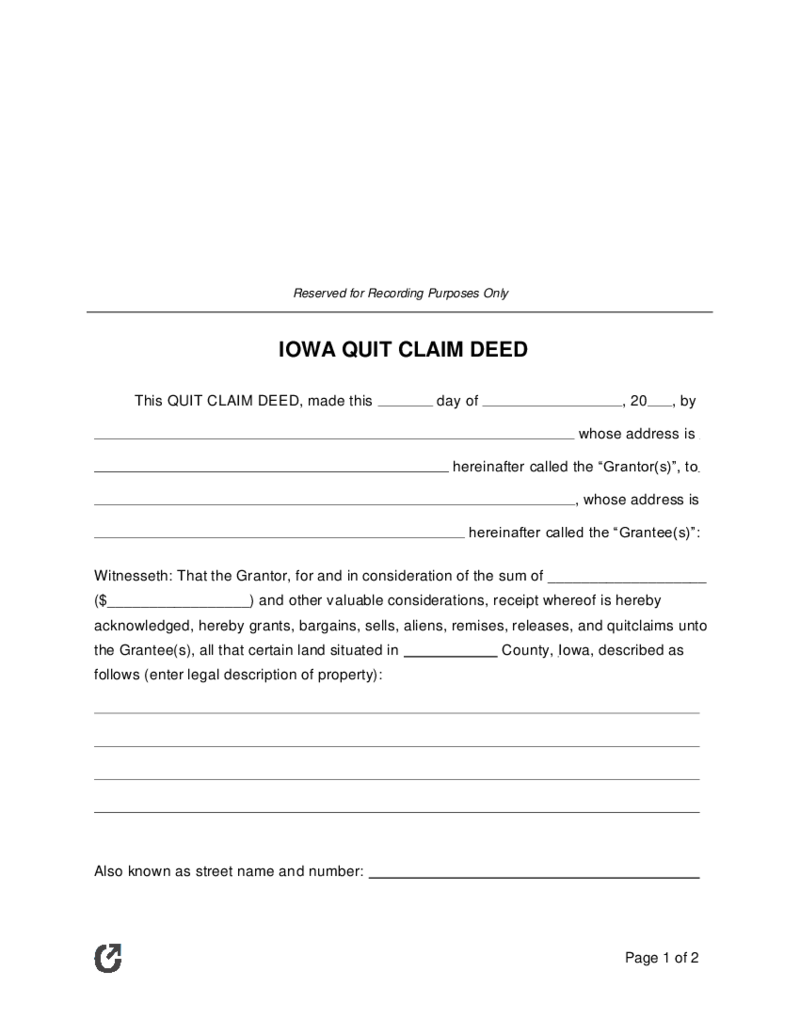

Iowa Quit Claim Deed

What is the Fillable Iowa Quit Claim Deed?

Fillable Iowa Quit Claim Deed is a document that allows you to transfer the premises from one person to another. The amount of dollars in exchange for the transferred property should be specified.

What

Iowa Quit Claim Deed

What is the Fillable Iowa Quit Claim Deed?

Fillable Iowa Quit Claim Deed is a document that allows you to transfer the premises from one person to another. The amount of dollars in exchange for the transferred property should be specified.

What

-

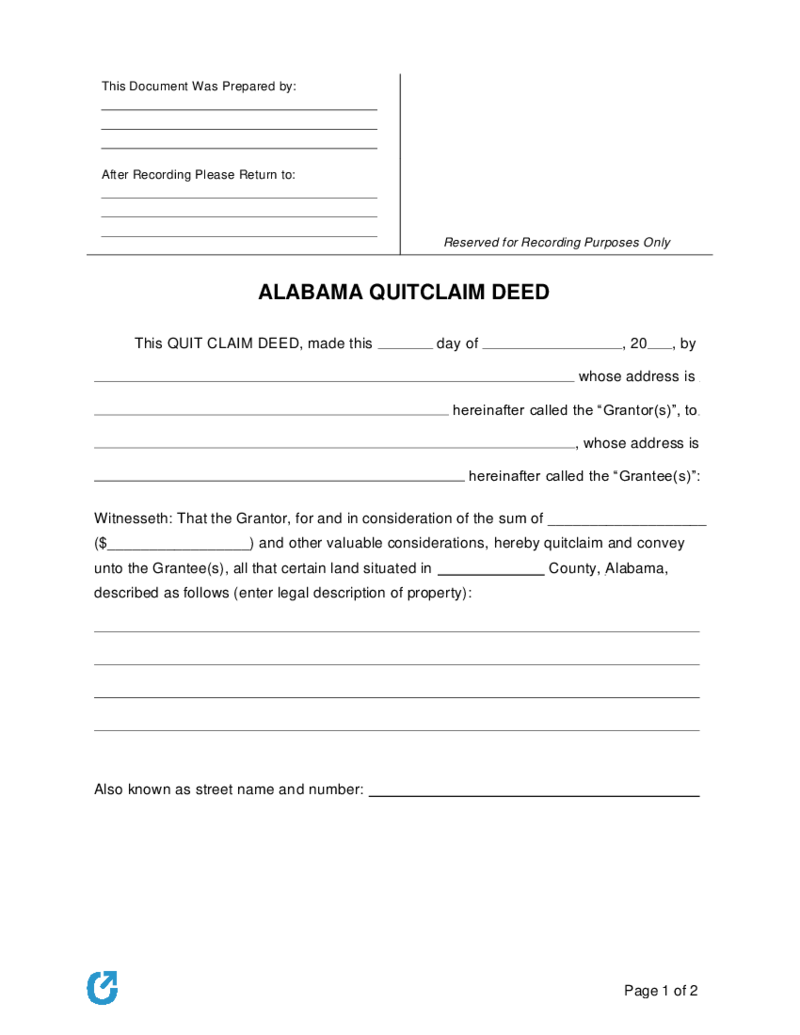

Alabama Quit Claim Deed Form

What is the blank Alabama Quit Claim Deed Form?

The fillable blank Alabama Quit Claim Deed Form is a document used to transfer property ownership rights from the grantor to the grantee(s) in the state of Alabama. The form contains information about both p

Alabama Quit Claim Deed Form

What is the blank Alabama Quit Claim Deed Form?

The fillable blank Alabama Quit Claim Deed Form is a document used to transfer property ownership rights from the grantor to the grantee(s) in the state of Alabama. The form contains information about both p

-

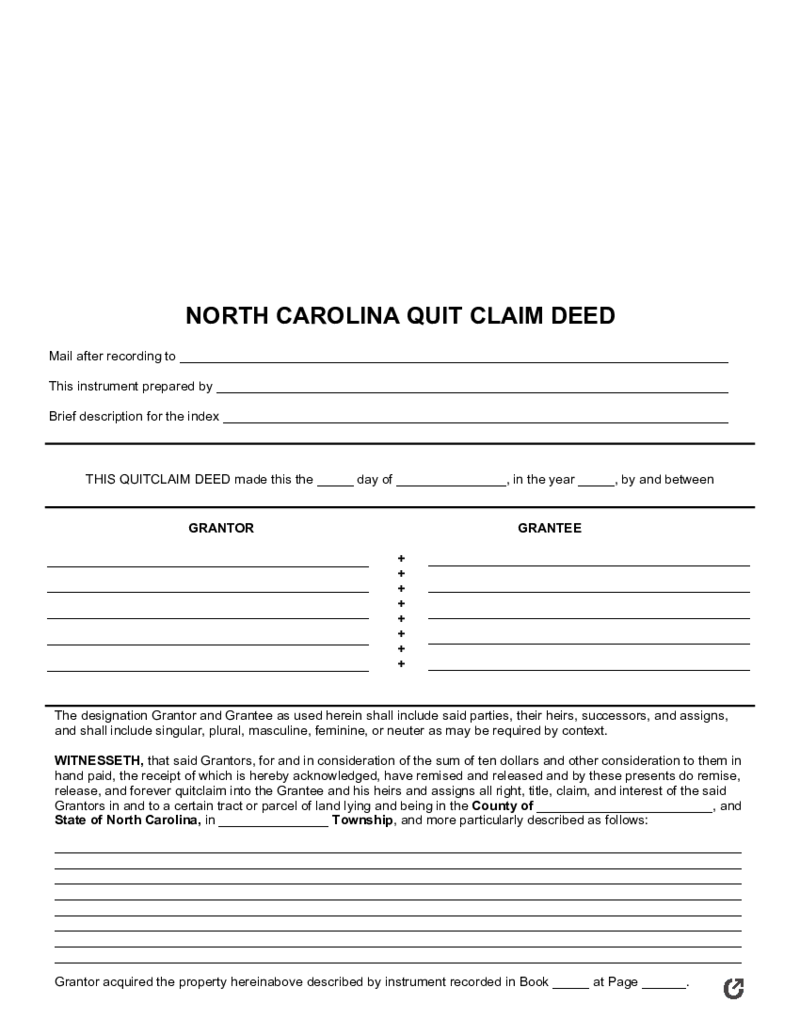

North Carolina Quit Claim Deed Form

What Is North Carolina Quit Claim Deed Form?

The fillable North Carolina Quit Claim Deed Form is a legal document, which allows you to transfer ownership of a certain property to another person. The recipient gets the full hold and interest of the sa

North Carolina Quit Claim Deed Form

What Is North Carolina Quit Claim Deed Form?

The fillable North Carolina Quit Claim Deed Form is a legal document, which allows you to transfer ownership of a certain property to another person. The recipient gets the full hold and interest of the sa

-

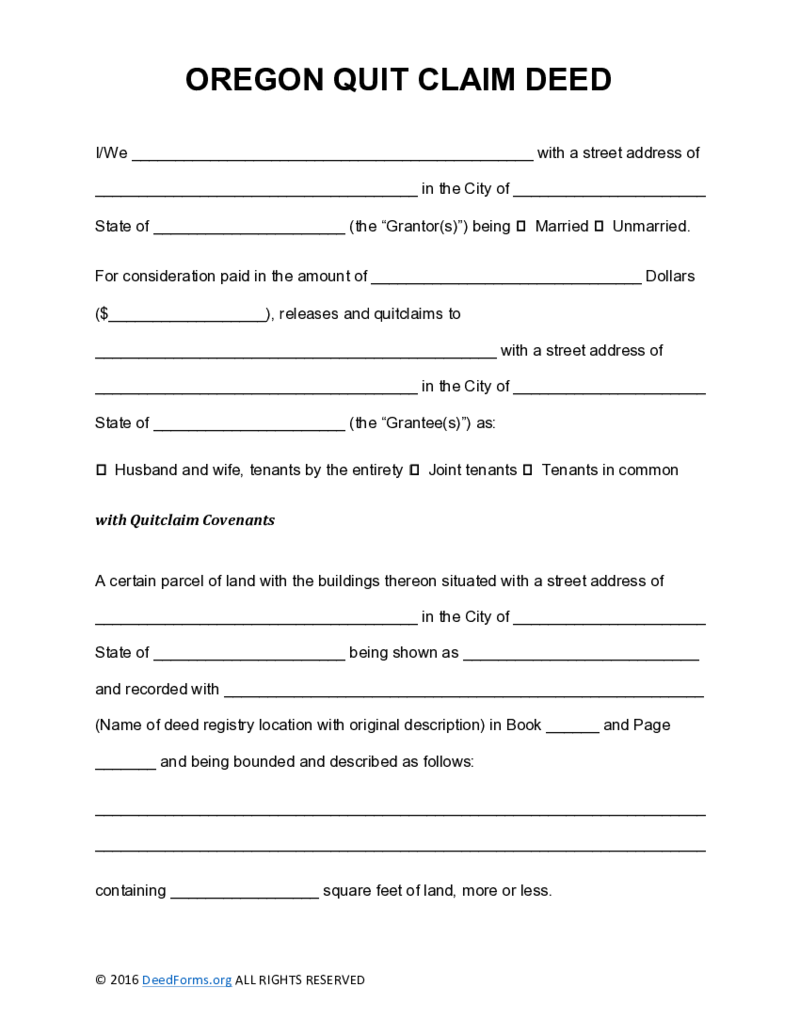

Oregon Quit Claim Deed

What is an Oregon Quit Claim Deed form?

Oregon Quit Claim Deed is an official paper by which you, as a grantor (seller), can transfer your property or a part of it to another person or company (buyer/grantee). Although this PDF form is an official documen

Oregon Quit Claim Deed

What is an Oregon Quit Claim Deed form?

Oregon Quit Claim Deed is an official paper by which you, as a grantor (seller), can transfer your property or a part of it to another person or company (buyer/grantee). Although this PDF form is an official documen

Search by State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Delaware

- Florida

- Georgia

- Hawaii

- Illinois

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Mississippi

- Missouri

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- South Carolina

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

What Is a Quit Claim Deed Form?

Quit claim deed forms are specialized legal documents through which you can transfer your share of real estate to another person or change the title. By filling out and signing this type of paper, you waive claims to the described object. An alternative name for such forms is “non-warranty deeds” because the existence of a document does not mean that the person who issued it actually had rights to the property in question.

That is why they are usually used to formalize relationships between close people who trust each other. This format greatly simplifies the process of transferring or exchanging property, but it is regulated differently in diverse states.

When to Use Quit Claim Deed

Despite the seemingly narrow focus, free quit claim deed forms may be used in various situations. Here is a complete list of such cases.

Transfer of property to a family member

It is the most common case when a quit claim deed is used. You can transfer what you own to any family member by waiving your right to it. Typically, this format is used when parents decide to gift their children real estate. A trusting relationship between the grantor and the grantee makes it possible to avoid using other complex documents and arranging checks.

Add/remove a spouse

There are times when you need to add or remove a spouse from a property’s title. In this case, after marriage or divorce, you need to fill out a quit claim deed. It is especially important in states where there are so-called homestead rights; that is, when selling property, you need your spouse’s consent. The same method can be used to add or remove the names of any other individuals.

Change of an owner

If the property is owned by a company, LLC, or other business forms, a change of ownership in the title is common. To avoid the hassle of transferring ownership documents, you can use the free printable quit claim deed forms to change the name of the entity that shows in the title.

Transfer of ownership in a living trust

If you choose to pre-dispose of your assets, you can specify the directions where they should go after your death. You should appoint beneficiaries and trustees who will dispose of the property following your instructions. Do not confuse this process with making a will since the latter is somewhat more complicated from a legal point of view.

Correction of errors in the title

Unlike many legal forms, quit claim deed variations can also be used simply to correct errors and defects that were made when writing the title. You can fix typos, spelling errors, and factual mistakes that create ambiguity. In the latter case, providing other documents confirming your unambiguous ownership of the property is essential. Despite it, a quit claim deed is much easier than any other legal proceedings regarding rights.

As you can see, the main task of this type of form is to simplify the solution of complex legal issues. In many situations, they can legally replace many other documents.

Where to Get Quit Claim Deed Forms

We have collected downloadable quit claim deed forms from different states in one directory so that you do not waste time looking for the right templates. Moreover, you can not only download the appropriate file but also fill it out right on the spot. Explore our collection, select the option that suits you, and click on it to read our instructions and start filling it out. Keep in mind that the specifics of using this document format may vary by state, so find out the details before entering information. You can contact your local recording office for official clarification.

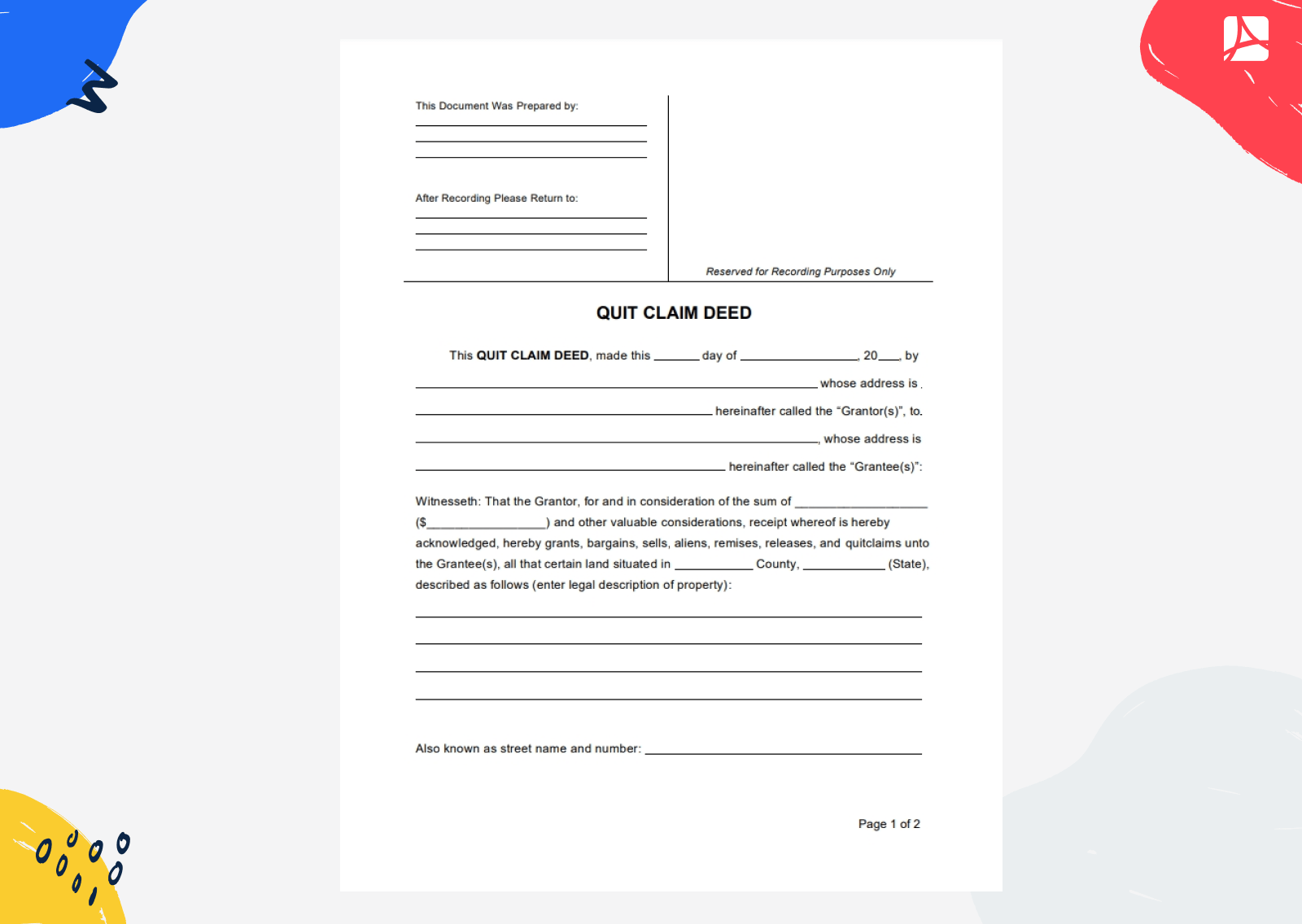

How to Fill Out Quit Claim Deed PDF Forms

A quit claim deed is a fairly simple document. Depending on your state, the nuances of the form, and the process of registering a new owner, it might slightly differ. However, in general, your steps in filling out the quit claim deed will be as follows:

- Enter general information about this transaction: date, names of participants, and addresses and contact details of the grantor and grantee.

- Specify the transaction price. In the quit claim deed PDF forms, it is called “consideration.” In some states, you are required to state the value, even if you donate property, without asking for payment. In such situations, you can simply enter a nominal amount, for instance, $10.

- Give up ownership. Usually, such a disclaimer is pre-written in the template, so you just need to read what exactly it implies. From the law point of view, it is considered that you transfer the rights to real estate in exchange for the amount indicated above.

- Give a detailed description of the property. Usually, it includes not only the exact address and description from tax records but also the so-called legal land description with lots and blocks or metes and bounds.

- Enter the data of witnesses. In this case, witnesses are needed to confirm that the transfer of ownership is legal and voluntary. Include the names and contact details of two uninterested people present at the transaction’s time.

- Notarize the document. The legislation of almost all states requires the paper to be filled out and signed in the presence of a notary and certified by them. Only in this case, the contract will be considered valid.

Remember that transferring ownership only means transferring your share to another person. If you are paying off the mortgage at the time of this transaction, you will still be responsible for it.

How to File Quit Claim Deed Forms

Before completing and submitting the form, you should make sure that you really want to transfer ownership to another person. The fact is that from a legal point of view, you cannot nullify this document and refuse your application. The only possible option is to draw up a quit claim deed on behalf of the new owner. However, there is a chance that they will not want to do it, so think carefully about this question. Consulting with an attorney who deals with such matters is never superfluous, especially if you transfer property for a fee. Specialists will ensure that all negotiations are carried out in accordance with the state’s laws.

If your decision is final, here’s what you need to do to file this form:

- Enter all required information about the grantor, the grantee, the property, and the witnesses. Follow our instructions above. Before filling it out, check local legal requirements to ensure that the data is presented in the correct form. Usually, other documents, such as the purchase of the property in question, are not required.

- All participants in the process must sign the document in the presence of a notary who certifies it with their seal upon completion. You can ask for help from any notary at, for example, a county recording office or bank (even if you are not a client).

- The finished paper needs to be registered with the local recording office. This step is mandatory so that other services and organizations are aware of the change of ownership. It is crucial, for example, if the new owner decides to get a mortgage on this property.

Addresses for submitting completed forms vary by state. You can find the complete list of addresses in the table below.

Quit Claim Deed vs. Warranty Deed

You can guess the difference between these two kinds of deeds by their names.

Quit Claim Deeds

The fact is that quit claim deeds do not guarantee that the grantor really has ownership of the property they intend to transfer to another person. This type of paperwork requires a minimum amount of information, which is why the grantee does not have sufficient protection as a buyer. It’s the reason why such forms are usually used in close family relationships for the transfer or exchange of property.

Pros

- Easy to fill out;

- Do not require supporting documents;

- Consideration price can be symbolic.

Cons

- Do not guarantee the grantor’s ownership rights;

- Provide no insurance.

Warranty Deeds

On the contrary, warranty deeds are not easy to draw up and require documents from the owner confirming their right to own real estate. Such forms are used in transactions for property sales, as they are more reliable. They can include guarantees of ownership, insurance, papers protecting the buyer’s rights, etc.

Pros

- Confirm the grantor’s ownership;

- Protect the owner from all defects;

- Provide insurance.

Cons

- Complex to fill out;

- Require additional paperwork.

FAQ

-

Can I file my own quit claim deed?

The law allows you to complete (provided that you do it in front of witnesses and have it notarized) and submit the form on your own. Contacting an attorney or lawyer is unnecessary, but consultation is still recommended.

-

Does a quitclaim need to be notarized?

Yes, it is a prerequisite for the transaction to be recognized as valid. In this way, the state can avoid property fraud and minimize the mistakes and misunderstandings that might arise between the old and new owners.

-

Is a quit claim deed legally binding?

After being signed by both parties and witnesses and notarized by a notary, the document comes into force and is considered legally binding. From that moment on, the grantor is no longer the owner of the property in question. It is impossible to revoke or cancel it.