-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Entity Returns

-

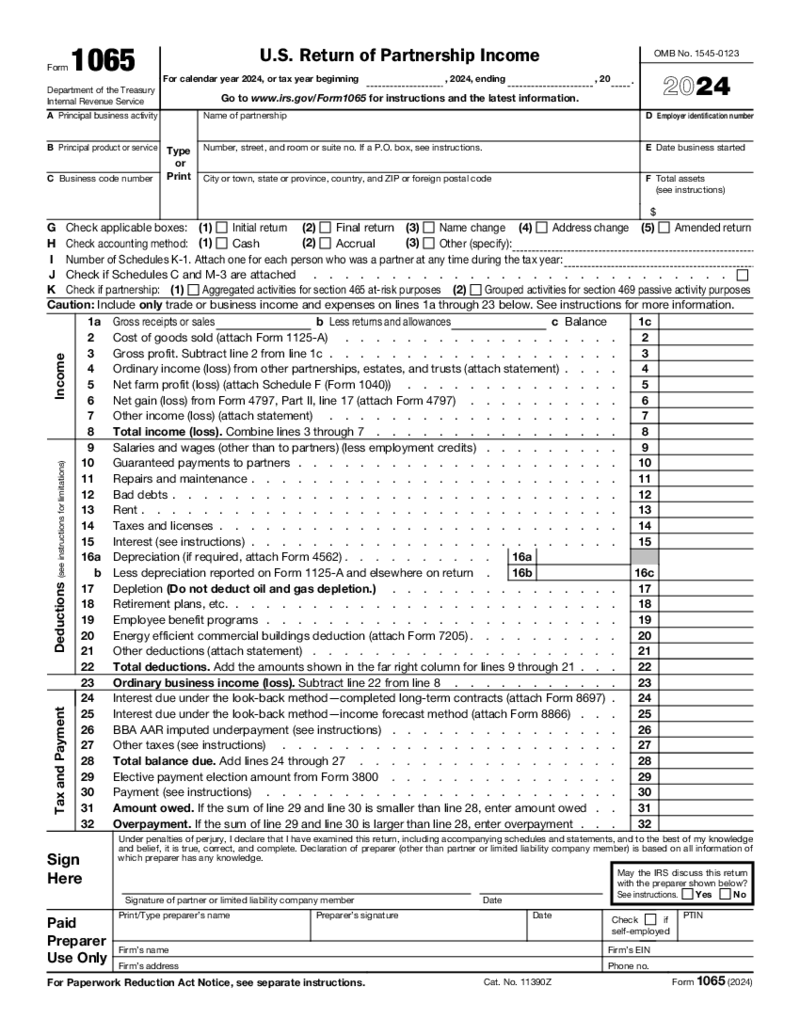

IRS 1065 Form (2024)

What Is IRS 1065 2024?

IRS Form 1065 PDF is an official form required by taxpayers who formed a partnership with each other. IRS 1065 is also known as the US Return of Partnership Income. It must be filled fo

IRS 1065 Form (2024)

What Is IRS 1065 2024?

IRS Form 1065 PDF is an official form required by taxpayers who formed a partnership with each other. IRS 1065 is also known as the US Return of Partnership Income. It must be filled fo

-

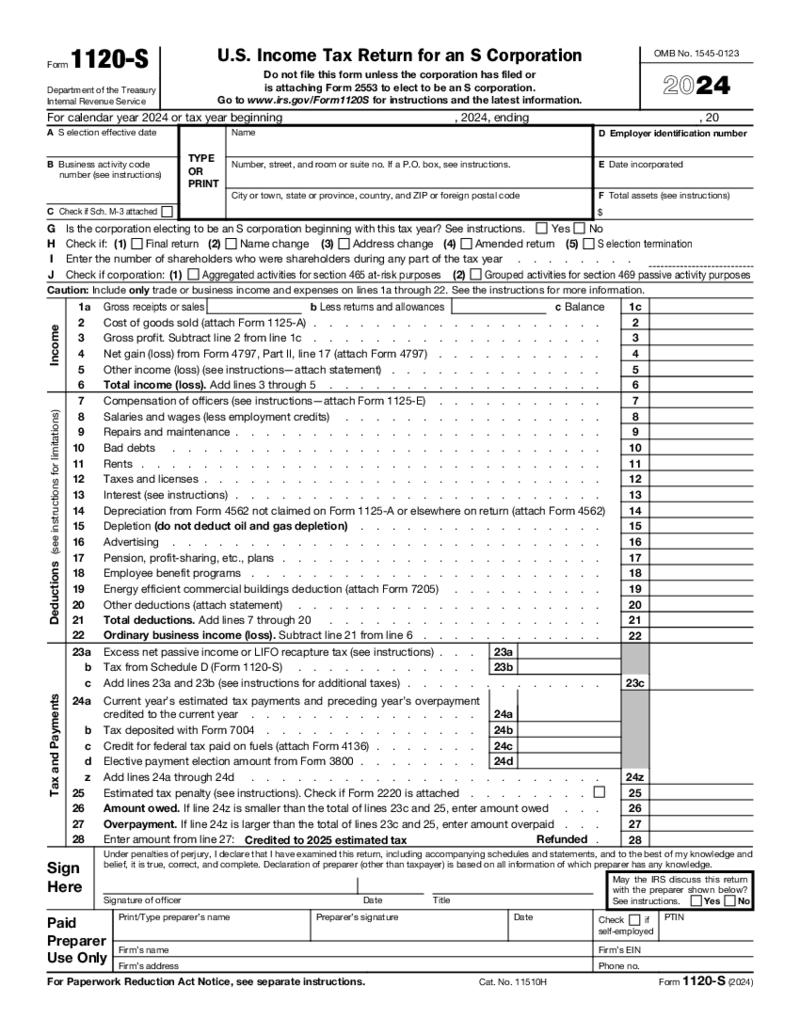

Form 1120-S (2024)

What is IRS Form 1120S?

IRS 1120S is the form created by the Internal Revenue Service for S corporations as an income tax return yearly report. S corporations are business structures that were made the way their owners can avoid double taxation. Each shar

Form 1120-S (2024)

What is IRS Form 1120S?

IRS 1120S is the form created by the Internal Revenue Service for S corporations as an income tax return yearly report. S corporations are business structures that were made the way their owners can avoid double taxation. Each shar

-

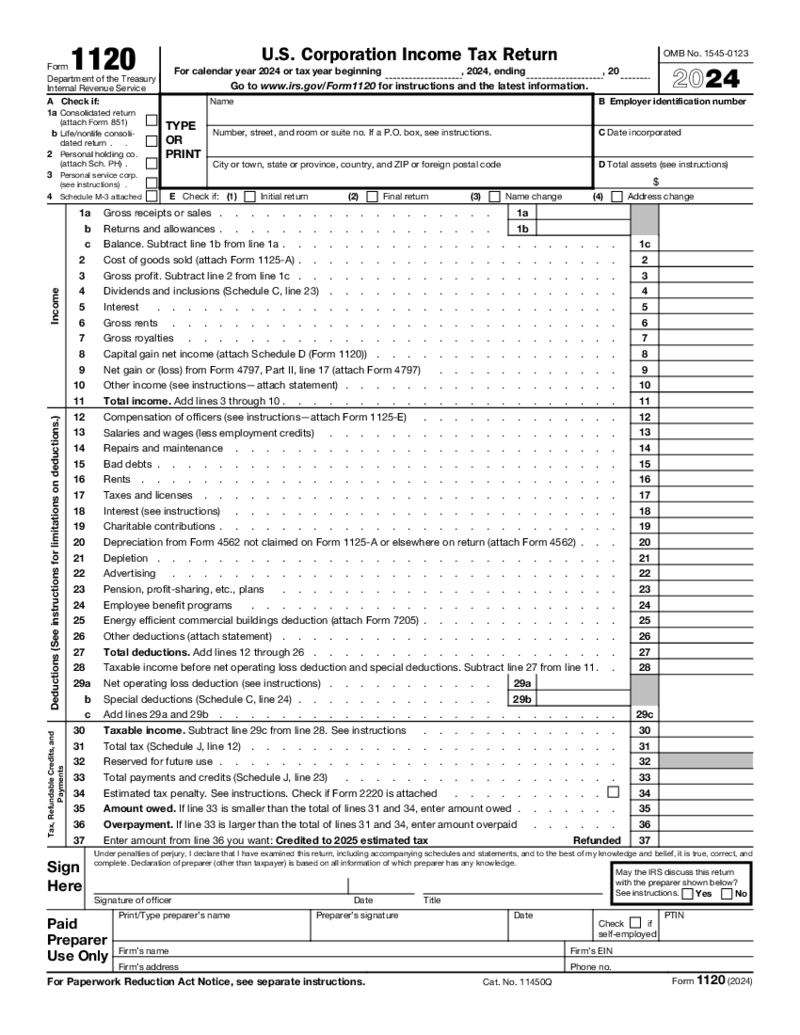

Form 1120 (2024)

What is Fillable Form 1120 - Corporation Income Tax Return?

Fillable Form 1120 2024 - Corporation Income Tax Return is a form that helps US domestic corporations to fill out their income and losses. The 1120 tax form is issued by the IRS and should b

Form 1120 (2024)

What is Fillable Form 1120 - Corporation Income Tax Return?

Fillable Form 1120 2024 - Corporation Income Tax Return is a form that helps US domestic corporations to fill out their income and losses. The 1120 tax form is issued by the IRS and should b

-

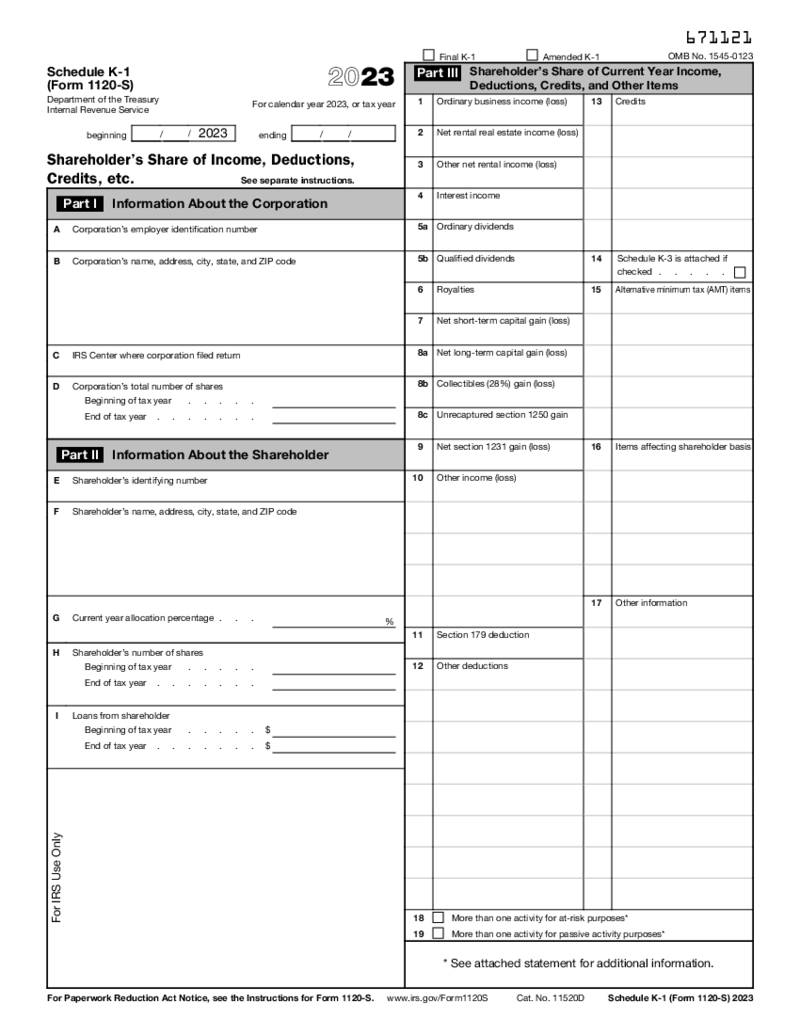

Schedule K-1 (Form 1120-S)

What is an 1120-S Form 2023 - 2024

Income Tax Return for an S Corporation (shortly Form 1120-S) is a federal tax form by the IRS that is used for reporting your S corporation income, deductions, gains, losses, credits, and other financial facts of the bus

Schedule K-1 (Form 1120-S)

What is an 1120-S Form 2023 - 2024

Income Tax Return for an S Corporation (shortly Form 1120-S) is a federal tax form by the IRS that is used for reporting your S corporation income, deductions, gains, losses, credits, and other financial facts of the bus

-

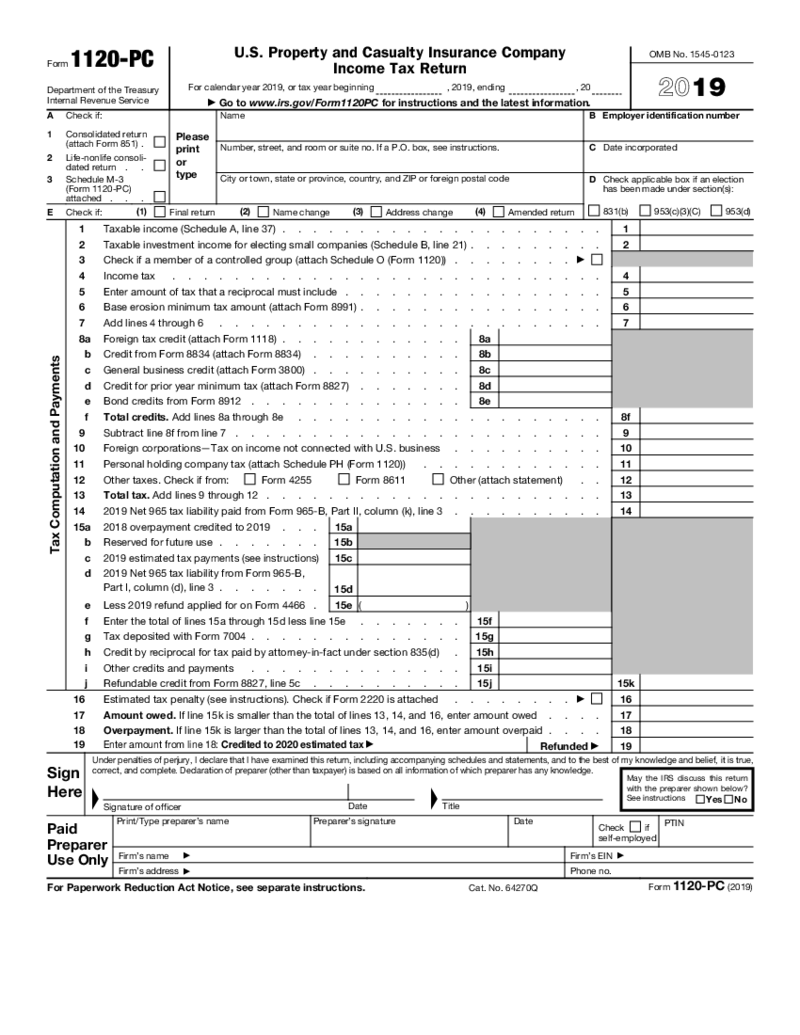

Form 1120-PC (2019)

What Is A Form 1120-PC

Form 1120-PC holds significance for specific entities within the corporate world, particularly those in the insurance industry. This specialized form, designated for U.S. Property and Casualty Insurance Companies, a

Form 1120-PC (2019)

What Is A Form 1120-PC

Form 1120-PC holds significance for specific entities within the corporate world, particularly those in the insurance industry. This specialized form, designated for U.S. Property and Casualty Insurance Companies, a

-

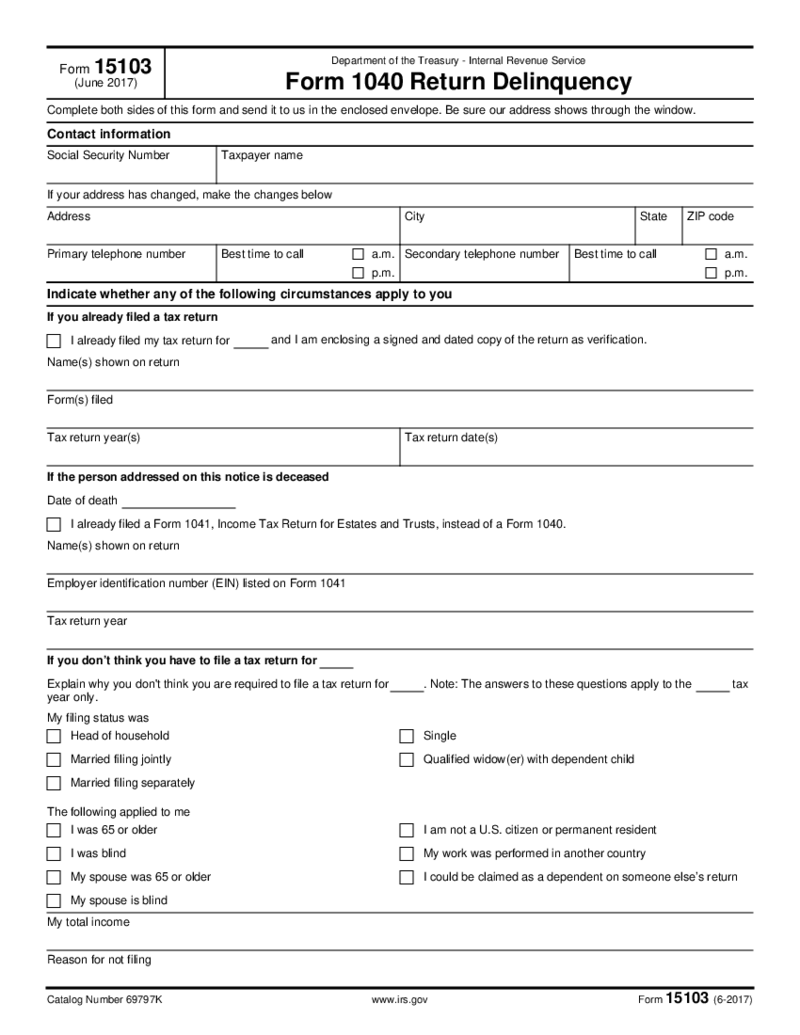

Form 15103 Return Delinquency

What Is Form 15103

Form 15103, commonly known as the Return Delinquency Form, is issued by the Internal Revenue Service (IRS) when they

Form 15103 Return Delinquency

What Is Form 15103

Form 15103, commonly known as the Return Delinquency Form, is issued by the Internal Revenue Service (IRS) when they

-

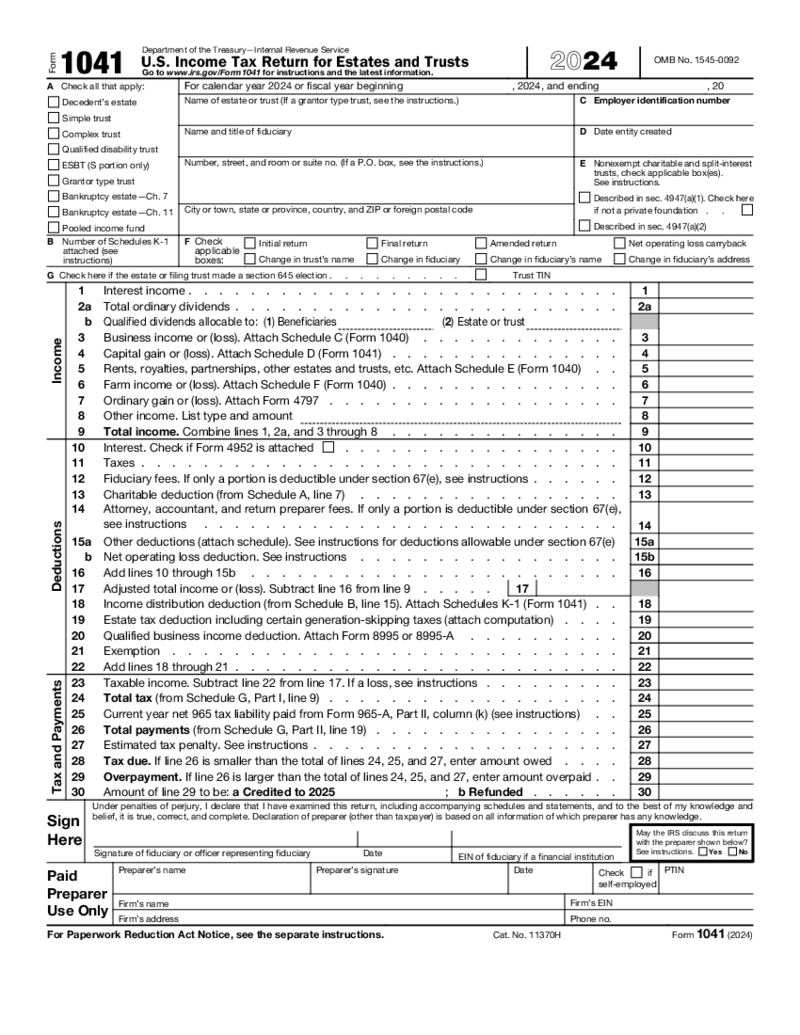

Form 1041

What is IRS Form 1041 2024 - 2025?

IRS 1041 is an official form of tax return that can be used by trusts and estates. This form may be familiar to you as the American Income Tax Return for Estates and Trusts. If a trust or estate reports the expenses and

Form 1041

What is IRS Form 1041 2024 - 2025?

IRS 1041 is an official form of tax return that can be used by trusts and estates. This form may be familiar to you as the American Income Tax Return for Estates and Trusts. If a trust or estate reports the expenses and

-

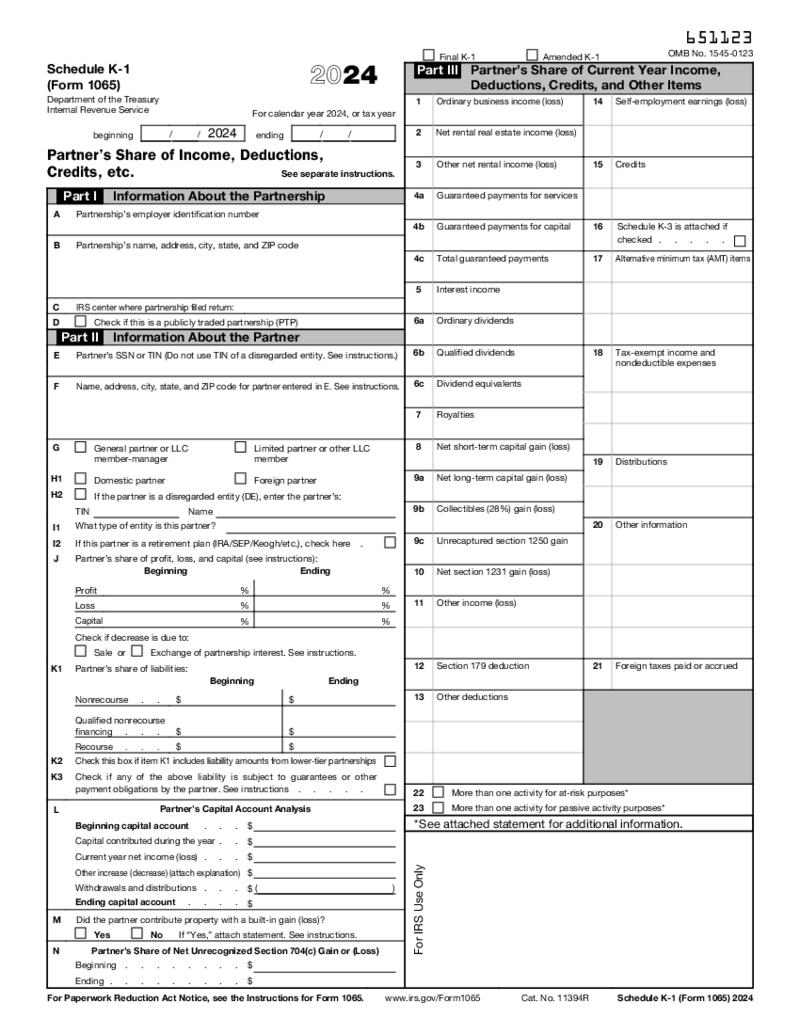

Schedule K-1 Form 1065 (2024)

What Is IRS Schedule K-1 (Form 1065) 2024

Schedule K-1 Tax Form 1065 is an IRS tax form issued annually for the purpose of documenting the revenue, profits, losses, and credits of each partner within a business entity, as well as other IRS-focused financi

Schedule K-1 Form 1065 (2024)

What Is IRS Schedule K-1 (Form 1065) 2024

Schedule K-1 Tax Form 1065 is an IRS tax form issued annually for the purpose of documenting the revenue, profits, losses, and credits of each partner within a business entity, as well as other IRS-focused financi

-

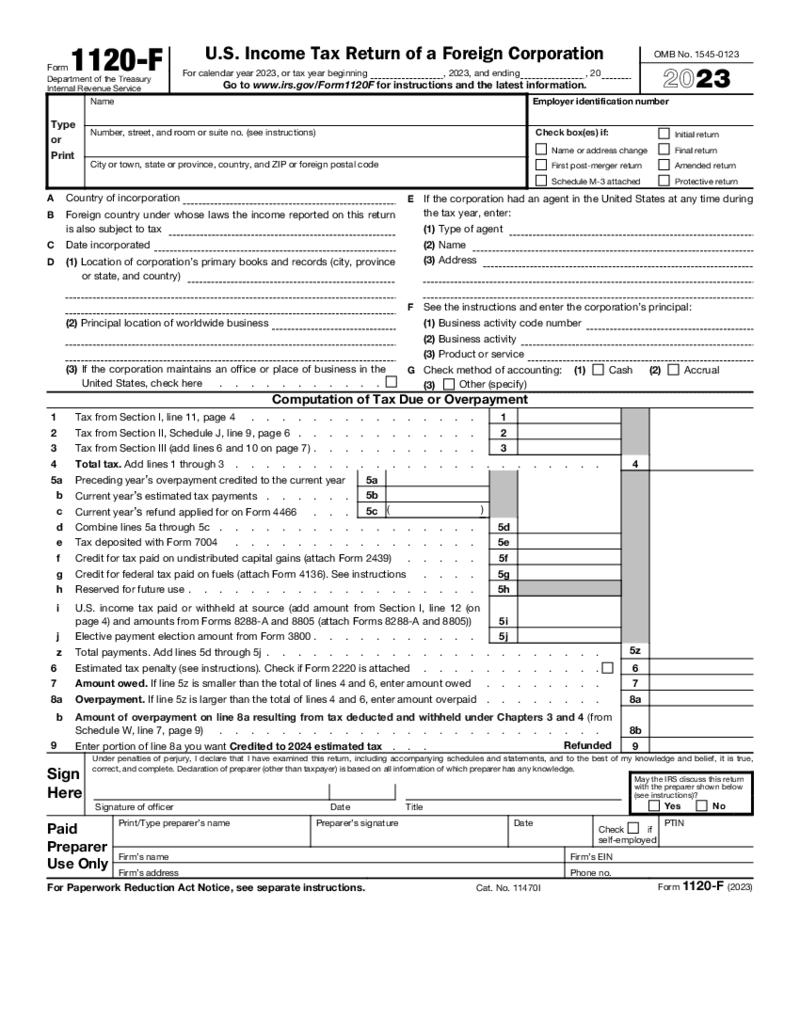

Form 1120-F (2023)

What is Form 1120-F?

Form 1120-F, namely U.S. Income Tax Return of a Foreign Corporation, is a tax document used by foreign corporations to report their U.S. income, profits, losses, credits, and deductions. It also serves to assess their U.S. incom

Form 1120-F (2023)

What is Form 1120-F?

Form 1120-F, namely U.S. Income Tax Return of a Foreign Corporation, is a tax document used by foreign corporations to report their U.S. income, profits, losses, credits, and deductions. It also serves to assess their U.S. incom

-

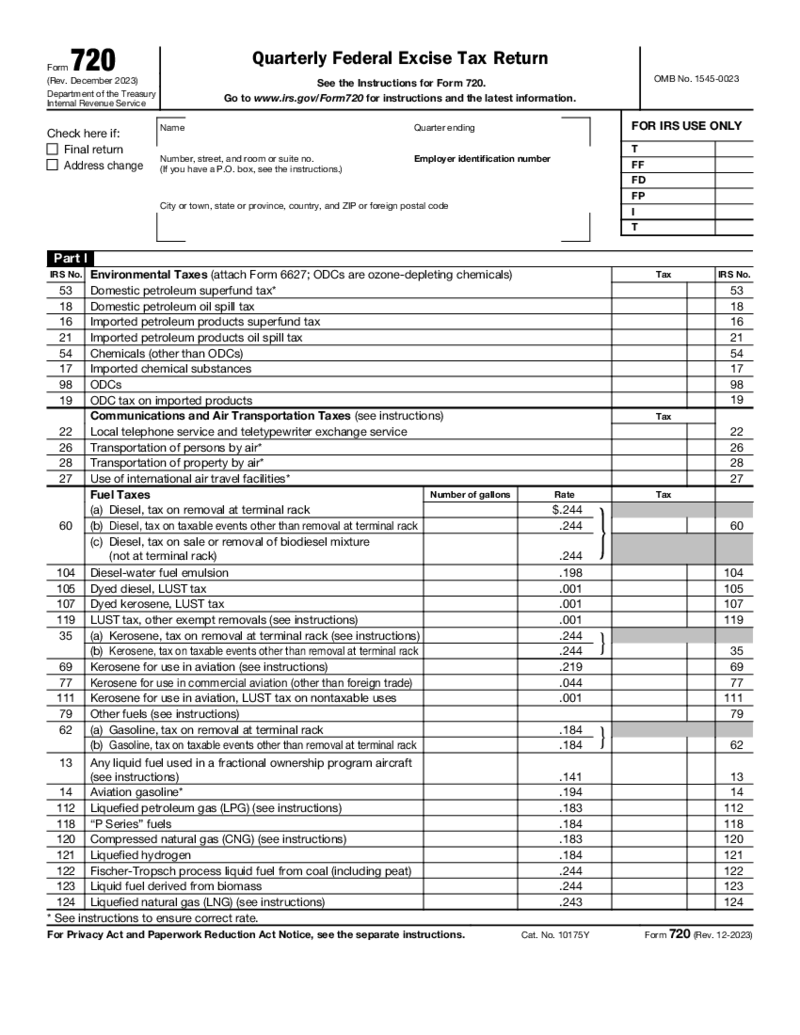

Form 720

What Is Form 720?

The IRS 720 Form, or Quarterly Federal Excise Tax Return, is a document used each quarter to report and pay your federal excise tax. You have to file Form 720 if you run a small business subject to excise tax such as fishing equipment, g

Form 720

What Is Form 720?

The IRS 720 Form, or Quarterly Federal Excise Tax Return, is a document used each quarter to report and pay your federal excise tax. You have to file Form 720 if you run a small business subject to excise tax such as fishing equipment, g

-

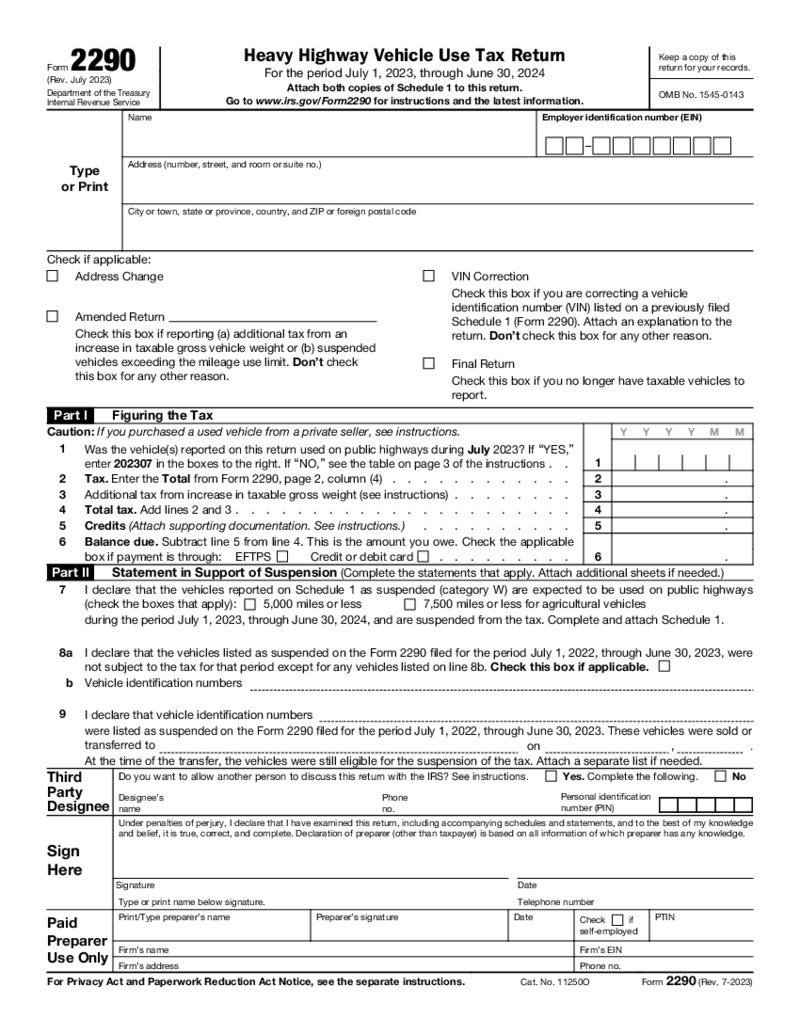

Form 2290

What Is a 2290 Form?

The fillable Form 2290 (2023) (Heavy Highway Vehicle Use Tax Return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. The form collects the information about all the vehicl

Form 2290

What Is a 2290 Form?

The fillable Form 2290 (2023) (Heavy Highway Vehicle Use Tax Return) lets you calculate and pay the tax if you have a highway motor vehicle that weighs 55,000 pounds or more. The form collects the information about all the vehicl

-

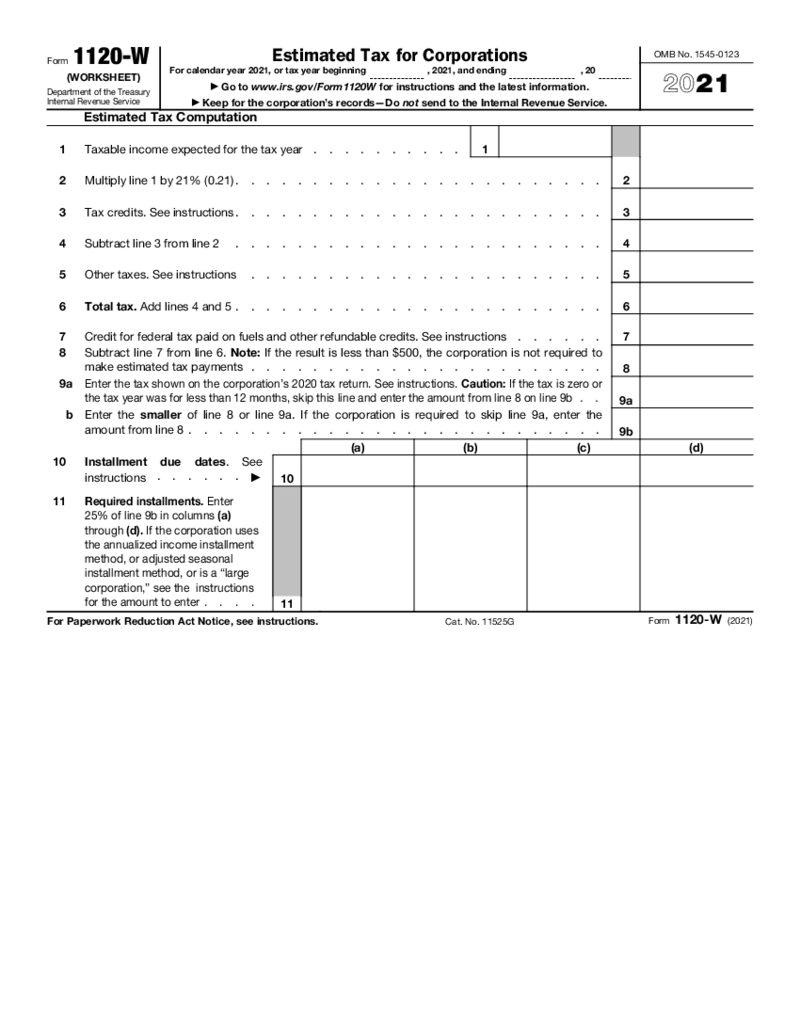

Form 1120-W (2021)

What Is a Form 1120 W 2021

Form 1120 W 2021 is an essential document for corporations in the United States, specifically designed for calculating and paying estimated taxes on a corporation’s taxable income. This form guides corporations in estimati

Form 1120-W (2021)

What Is a Form 1120 W 2021

Form 1120 W 2021 is an essential document for corporations in the United States, specifically designed for calculating and paying estimated taxes on a corporation’s taxable income. This form guides corporations in estimati

What Are Entity Tax Returns?

Let’s start with an undeniable fact: your business structure influences an array of aspects, including your tax responsibilities. With that said, opting for the right structure of your operation determines whether your taxes will be extremely complex and a rip-off or easily-dealt-with and affordable. Now, when it comes to entity tax, it’s a broad notion that covers any tax in accordance with which the company or any of the company’s subsidiaries is liable to tax. Therefore, entity tax returns are forms utilized for reporting this tax. On paper, it’s pretty straightforward. But when it comes to any tax issue, the topic deserves deeper coverage.

Most Popular IRS Entity Tax Returns

If you’re currently interested in taxation for business entities, the following widely used forms are probably among your focal points, as well.

- Form 2290. Also referred to as Heavy Highway Vehicle Use Tax Return, this document is utilized for calculating and paying the annual tax for a highway motor vehicle weighing 55,000 or more. The file gathers data about all vehicles within this class in your possession.

- Form 1120-S. Designed and issued by the IRS for S-corporations, this document is utilized for reporting your corp’s annual revenue. As you’re probably aware, S-corporations are the best-suiting business structures to aid you in avoiding double taxation.

- Schedule K-1 Form 1065. Filed as part of your 1065 Form (also known as Partnership Tax Return), this doc is a must-complete when it comes to recording your business’s total net revenue. The purpose of this form is to document the earnings, losses, and credits of each partner of a business organization, along with other tax-related financial data in relation to business partnerships. The file should be assessed by each partner in a business entity. The form contains sensitive financial information, so go the extra mile if you want it to stay properly protected.

- Form 1120. Also referred to as Corporation Income Tax Return, this document is utilized to aid US corps in pinpointing and reporting their earnings and spendings. Issued by the tax authorities, the document must be assessed by the fourth month after the corp’s tax year resumes. You’re welcome to fill out this form online while making the most of our useful editing functionality. All the templates offered by PDFLiner are effortlessly modifiable.

- Form 7004. Does your business need to prolong the date of the tax return? Then this form is your best choice. Sort out this form and get an automatic extension. So, whether you missed the deadline or have other reasons for extending the time given to file your tax return, Form 7004 is exactly what you need. And it’s up for grabs right here and right now on PDFLiner. Bear in mind that the document suits your situation only if you operate as a partnership, S corporation, or any corporation. Also, remember that the form will not help you delay your tax payments. Paying on time is a must.

Last but not least, if you want your tax affairs to be in order, consider how you legally organize your business. Study the classification of business structures, analyze business entity comparison charts, and get the full picture of tax responsibilities for each type of business. That way, you are guaranteed to succeed in taking your tax tasks to the next level.

Where to Get Entity Tax Return Forms

The fastest and easiest way to lay your hands on these forms is by finding the right one in our vast library of templates. Absolutely, you can find the necessary template on the IRS official site, but there, you won’t be granted the outstanding possibility to complete the form online and modify it to suit your most complex needs.

In case any of the forms is too complicated for you to fill out, don’t hesitate to consult a reliable bookkeeper or ask them to deal with all the complicated stuff for you. This not-so-money-saving strategy is sure to pay off very soon. With all that said, knowing what you need and where to look for it is among the key success strategies in dealing with your entity tax return submission. And the best answer to all this is here on PDFLiner.