-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

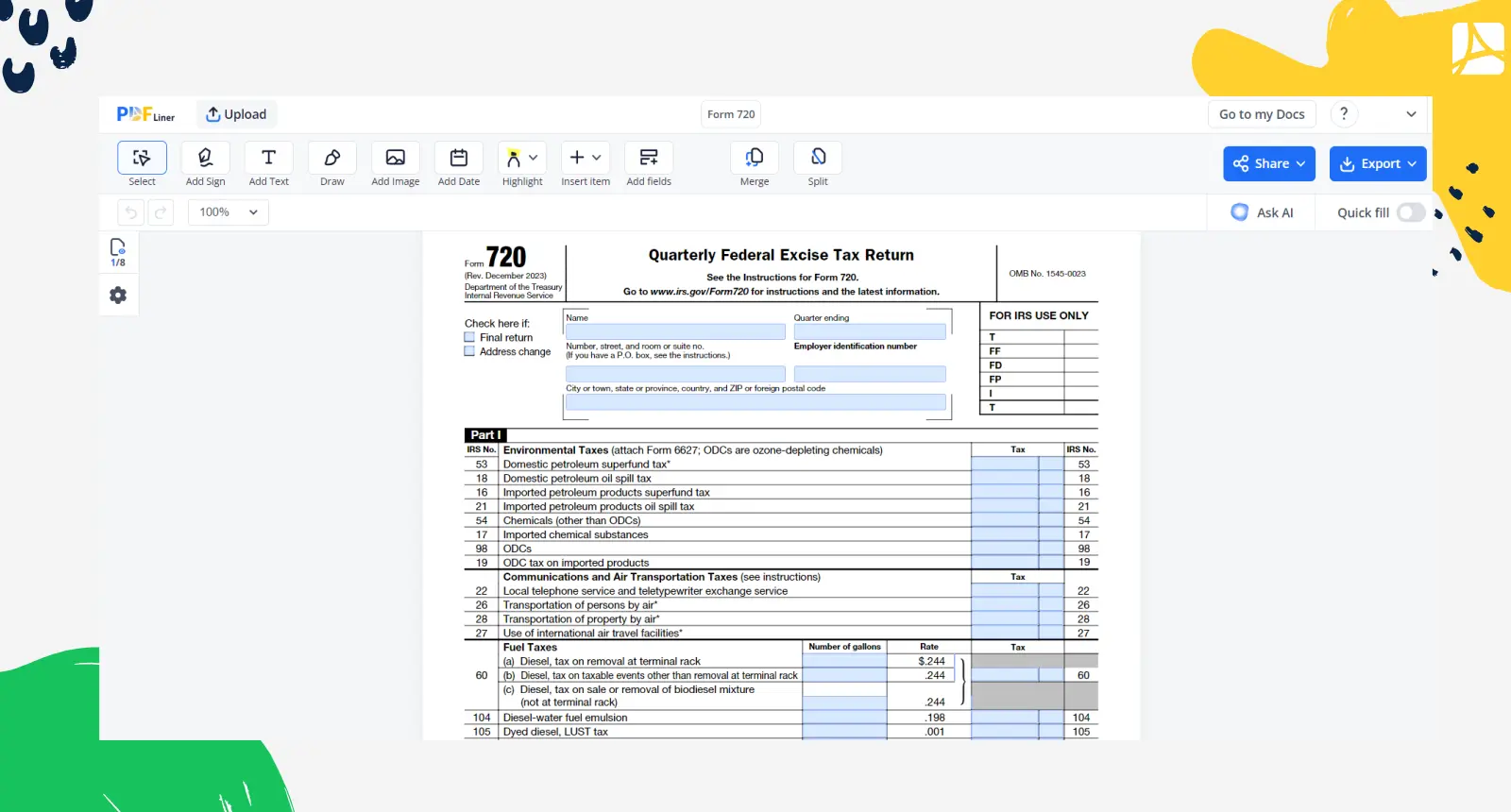

Form 720

Get your Form 720 in 3 easy steps

-

01 Fill and edit template

-

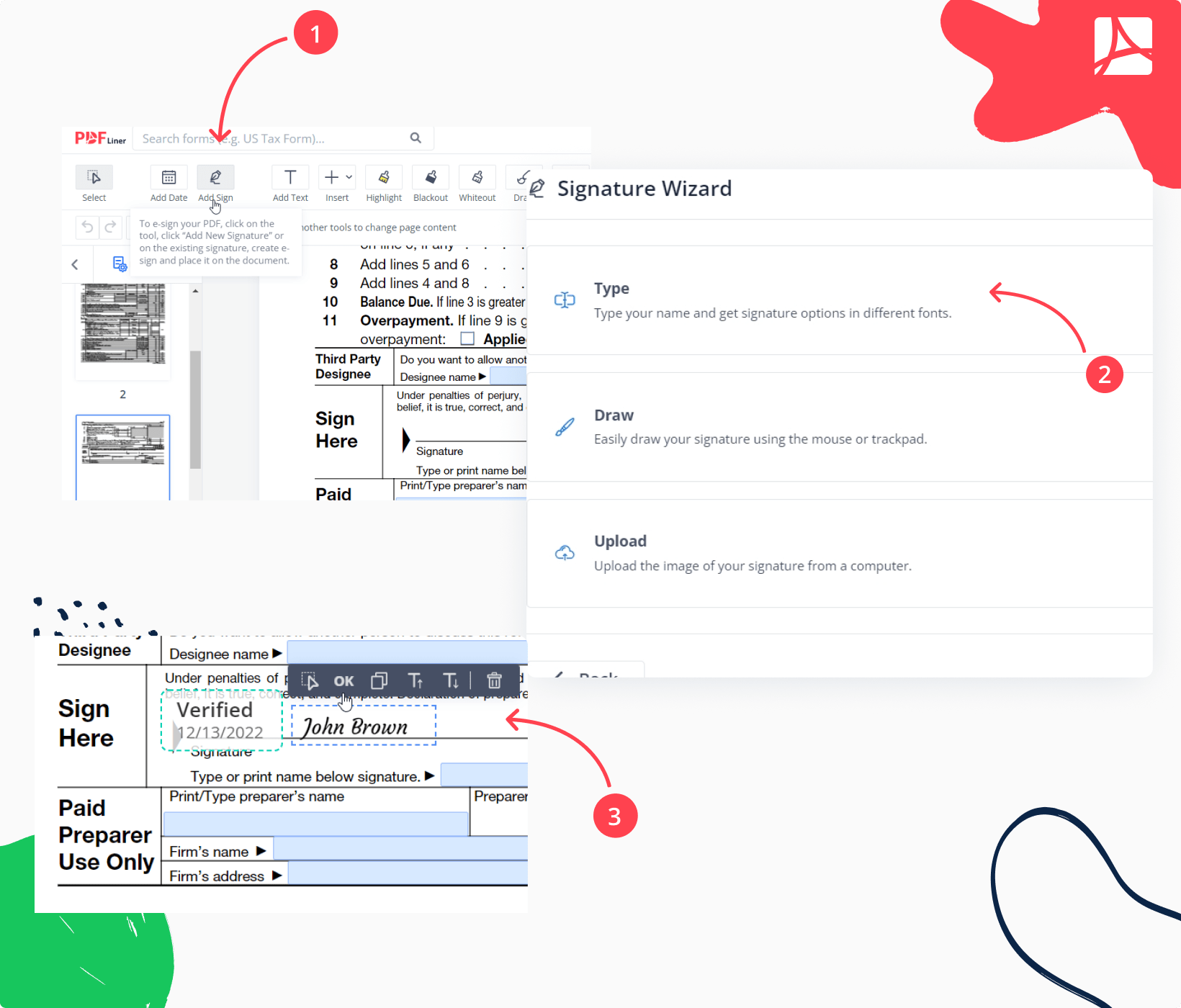

02 Sign it online

-

03 Export or print immediately

What Is Form 720?

The IRS 720 Form, or Quarterly Federal Excise Tax Return, is a document used each quarter to report and pay your federal excise tax. You have to file Form 720 if you run a small business subject to excise tax such as fishing equipment, gasoline, coal, transportation services, and the like.

What Do I Need the 720 Form For?

- To pay excise taxes on the income your company gets from offering products or services such as tires, vaccines, air transportation, indoor tanning services, etc.;

- Note that alcohol, firearms, and tobacco are not covered by this form, even though they are subject to excise taxes. If your organization sells these products, you can find the regulations from the Alcohol and Tobacco Tax and Trade Bureau.

Organizations That Work With Form 720

- The IRS.

Related to Form 720 Documents

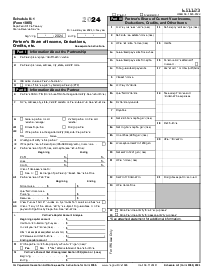

How to Fill Out Form 720?

- Press the blue button on this very page to get a Form 720 fillable blank.

- Enter your name, address, EIN, and end date of the required quarter in Part I.

- If your firm qualifies the details specified in Part I, use the appropriate rate in the “Rate” column to estimate your business taxes.

- If your company has any tax liability determined in Part I, you should additionally complete Schedule A of this form.

- If your business provides any items or services enlisted in Part II, calculate your total tax at the bottom of this part.

- Complete Schedules T and C in case your company deals with fuel.

- In box 3 of Part III, calculate your total business taxes by summing those from Parts I and II.

- Sign and date this IRS paper.

- Click on the Export button to download the fillable Form 720 in PDF format on your PC. Since the template is printable, you can print it out to use a paper copy.

Fillable online Form 720