-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Tax Forms - page 73

-

File Fillable Forms Users Guide

What is Fillable Forms FAQs & Limitations Guide?

Free Fillable Forms FAQs & Limitations Guide is a non-fillable program designed to provide free assistance with fillable federal forms. It includes comprehensive guidelines for filling out fede

File Fillable Forms Users Guide

What is Fillable Forms FAQs & Limitations Guide?

Free Fillable Forms FAQs & Limitations Guide is a non-fillable program designed to provide free assistance with fillable federal forms. It includes comprehensive guidelines for filling out fede

-

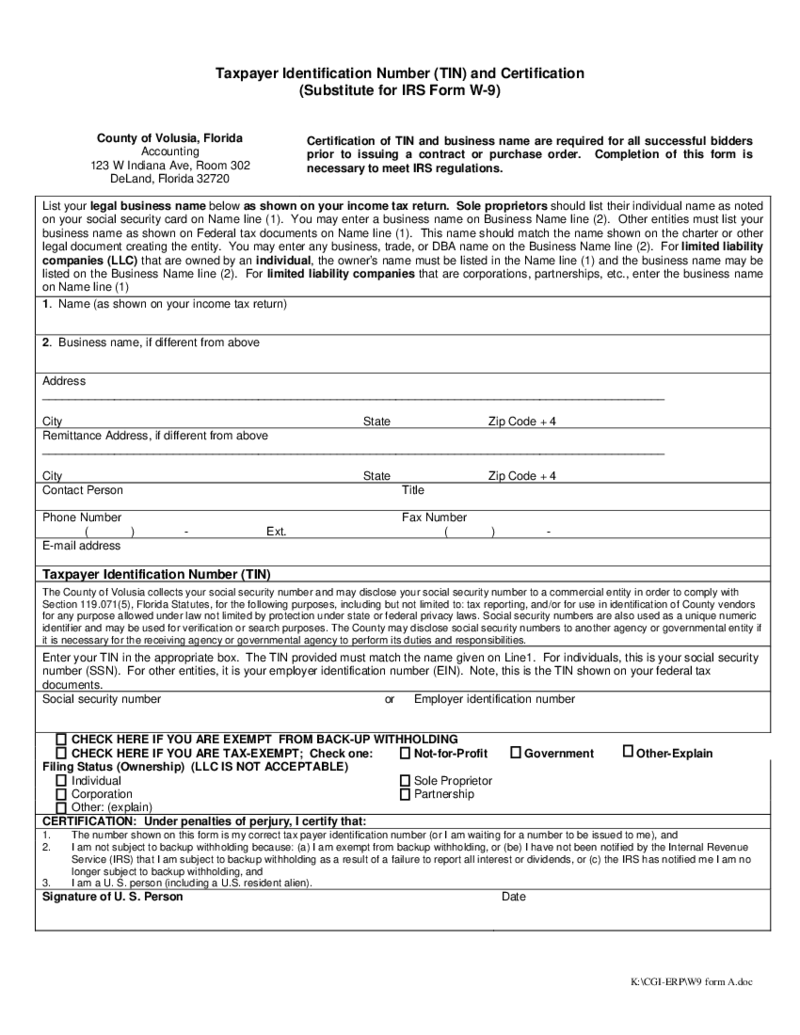

Taxpayer Identification and Certification

What is the IRS W-9 Form?

The IRS W-9 Form or presently a Taxpayer Identification (TIN) and Certification Form is a federal document required for businesses to meet Internal Revenue Service (IRS) regulations of the US. It is necessary to fill the form pri

Taxpayer Identification and Certification

What is the IRS W-9 Form?

The IRS W-9 Form or presently a Taxpayer Identification (TIN) and Certification Form is a federal document required for businesses to meet Internal Revenue Service (IRS) regulations of the US. It is necessary to fill the form pri

-

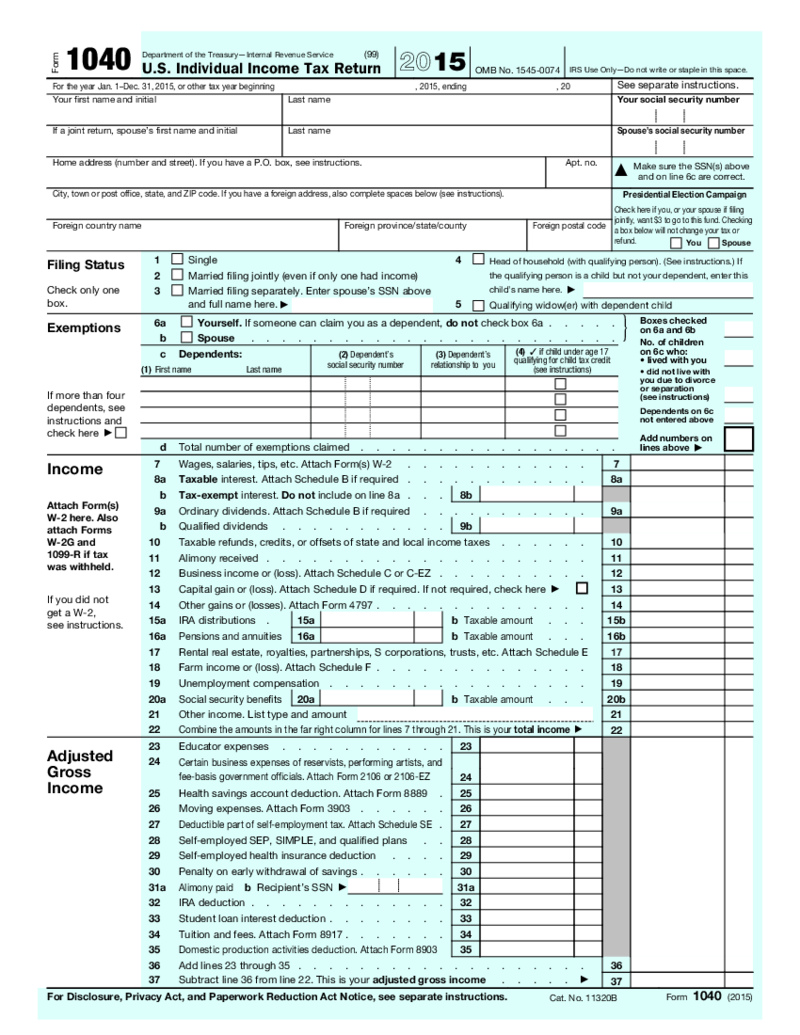

Form 1040 (2015)

What Is Form 2015 1040

Form 2015 1040, officially known as the U.S. Individual Income Tax Return, is the standard federal income tax form used to report an individual's gross income. This includes earnings from work, dividends, interest, and capital g

Form 1040 (2015)

What Is Form 2015 1040

Form 2015 1040, officially known as the U.S. Individual Income Tax Return, is the standard federal income tax form used to report an individual's gross income. This includes earnings from work, dividends, interest, and capital g

-

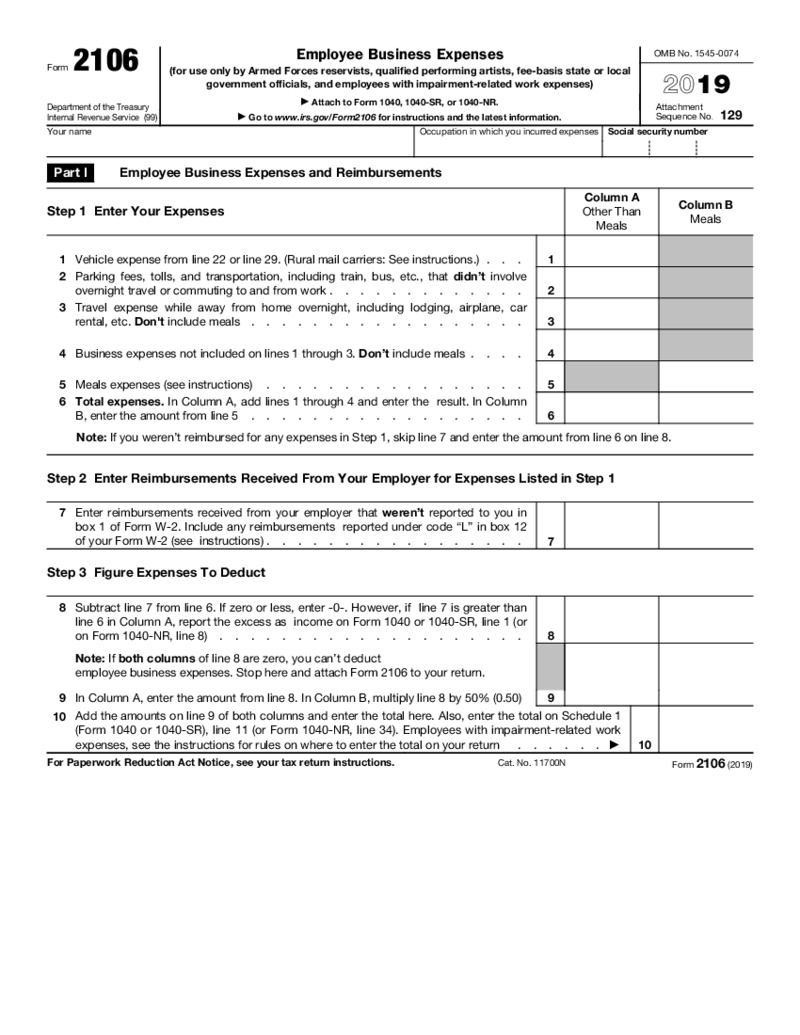

Form 2106

What Is a Form 2106

Understanding Form 2106 is critical for employees who incur job-related expenses not reimbursed by their employer. The IRS provides the Employee Business Expenses form for taxpayers to calculate allow

Form 2106

What Is a Form 2106

Understanding Form 2106 is critical for employees who incur job-related expenses not reimbursed by their employer. The IRS provides the Employee Business Expenses form for taxpayers to calculate allow

-

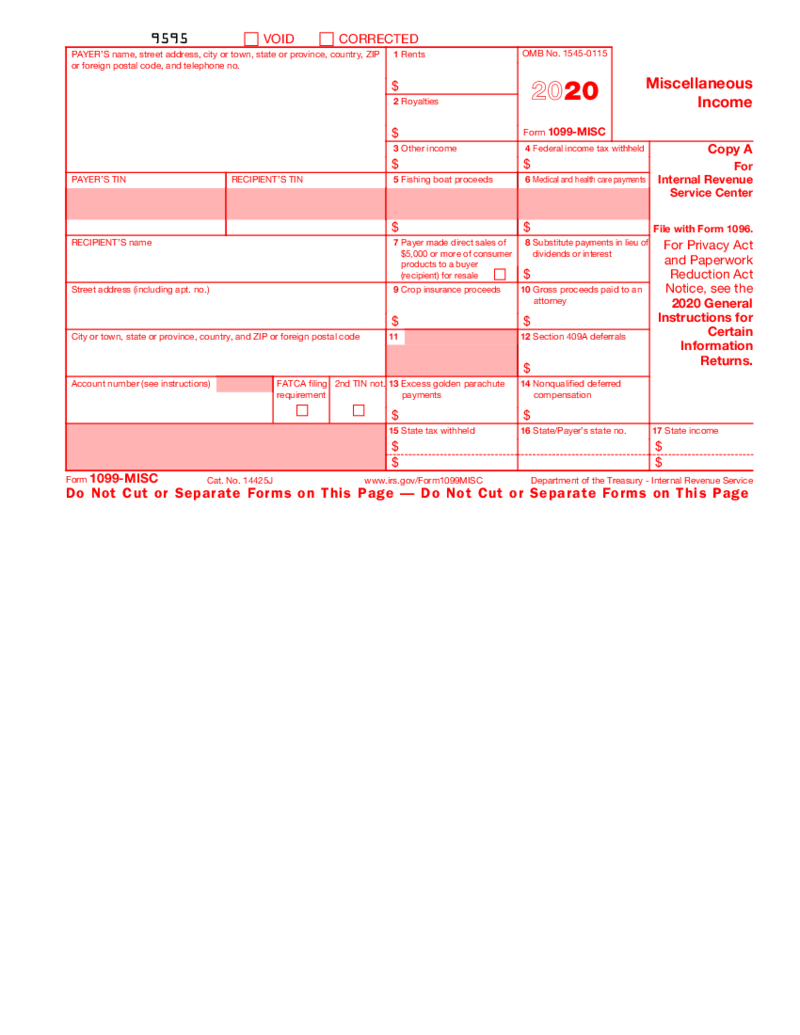

1099-MISC Form (2020)

What is 1099-MISC 2020 form?

The 1099-MISC form for 2020 is one of the types of forms that were created for US citizens to report about the incomes and expenses. It is necessary to define the level of taxes the individuals have to pay.

Wh

1099-MISC Form (2020)

What is 1099-MISC 2020 form?

The 1099-MISC form for 2020 is one of the types of forms that were created for US citizens to report about the incomes and expenses. It is necessary to define the level of taxes the individuals have to pay.

Wh

-

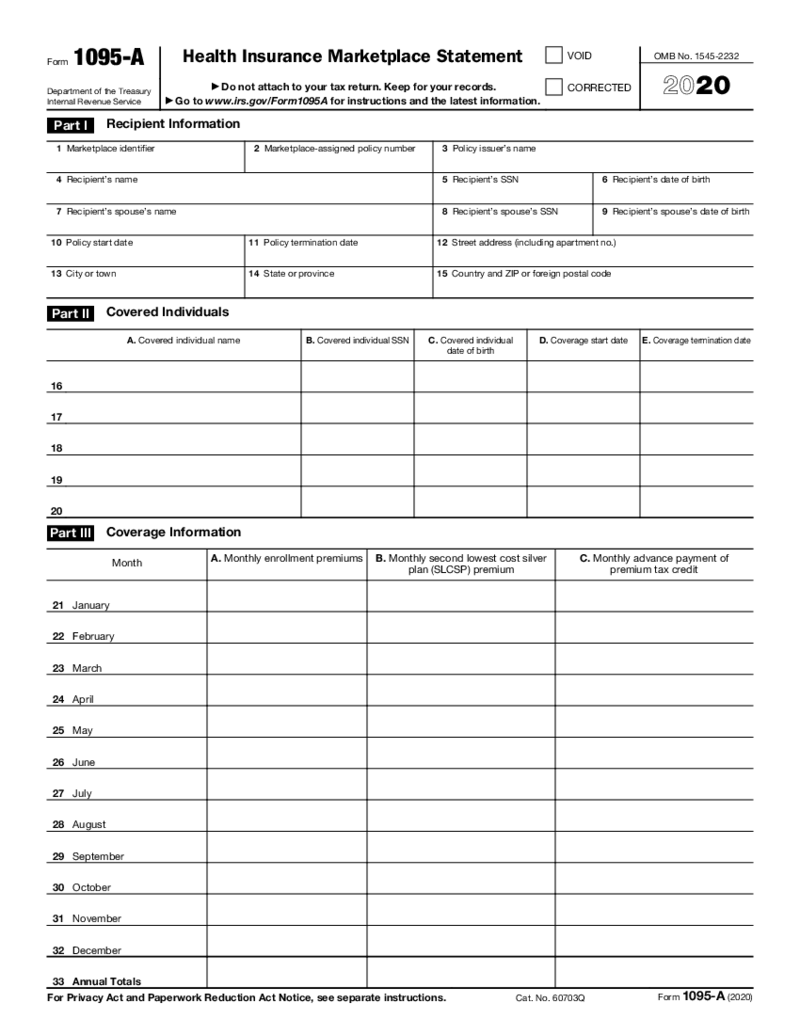

Form 1095-A (2020)

What Is a 1095 A Tax Form 2020

The 1095 A Tax Form 2020 is a crucial document for anyone who has received health insurance through the Health Insurance Marketplace. This form provides essential information about the insurance coverage, such as the monthly

Form 1095-A (2020)

What Is a 1095 A Tax Form 2020

The 1095 A Tax Form 2020 is a crucial document for anyone who has received health insurance through the Health Insurance Marketplace. This form provides essential information about the insurance coverage, such as the monthly

-

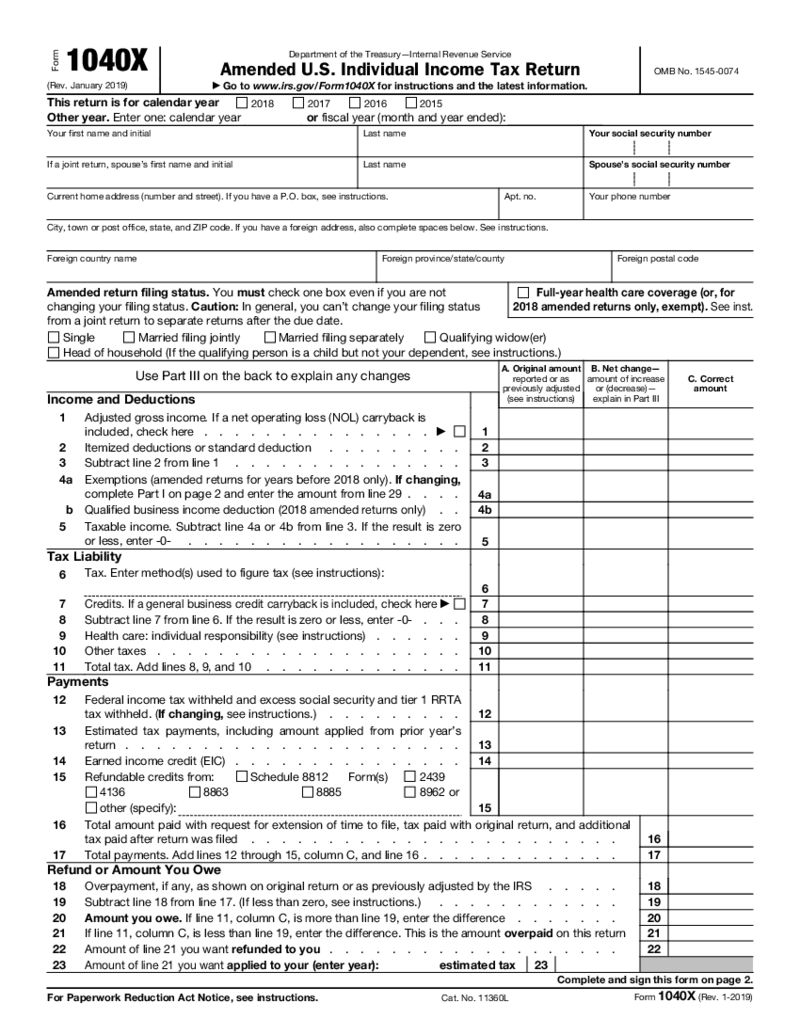

Form 1040X (2019)

What is 1040x 2019 form?

1040x form is used to correct the information in 1040, 1040A, 1040EZ, 1040NR and 1040 NR-EZ forms. These changes may include filing status, income and deductions, number of exemptions, and so on.

What I

Form 1040X (2019)

What is 1040x 2019 form?

1040x form is used to correct the information in 1040, 1040A, 1040EZ, 1040NR and 1040 NR-EZ forms. These changes may include filing status, income and deductions, number of exemptions, and so on.

What I

-

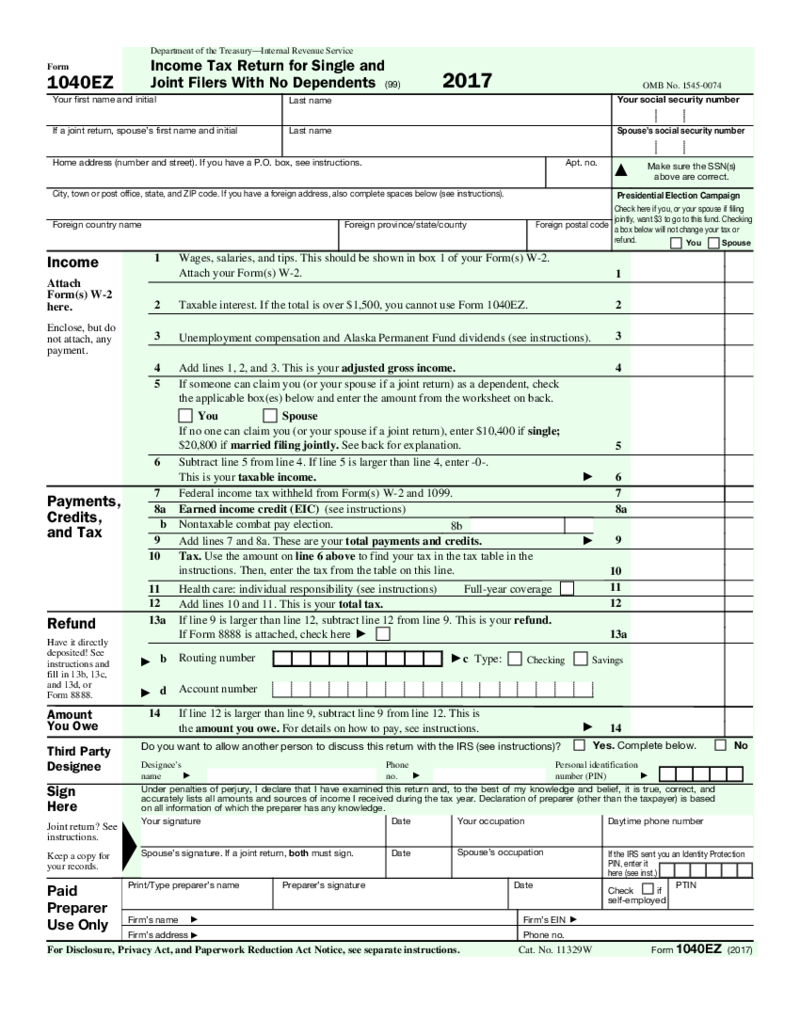

IRS Form 1040EZ

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayer

IRS Form 1040EZ

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayer

-

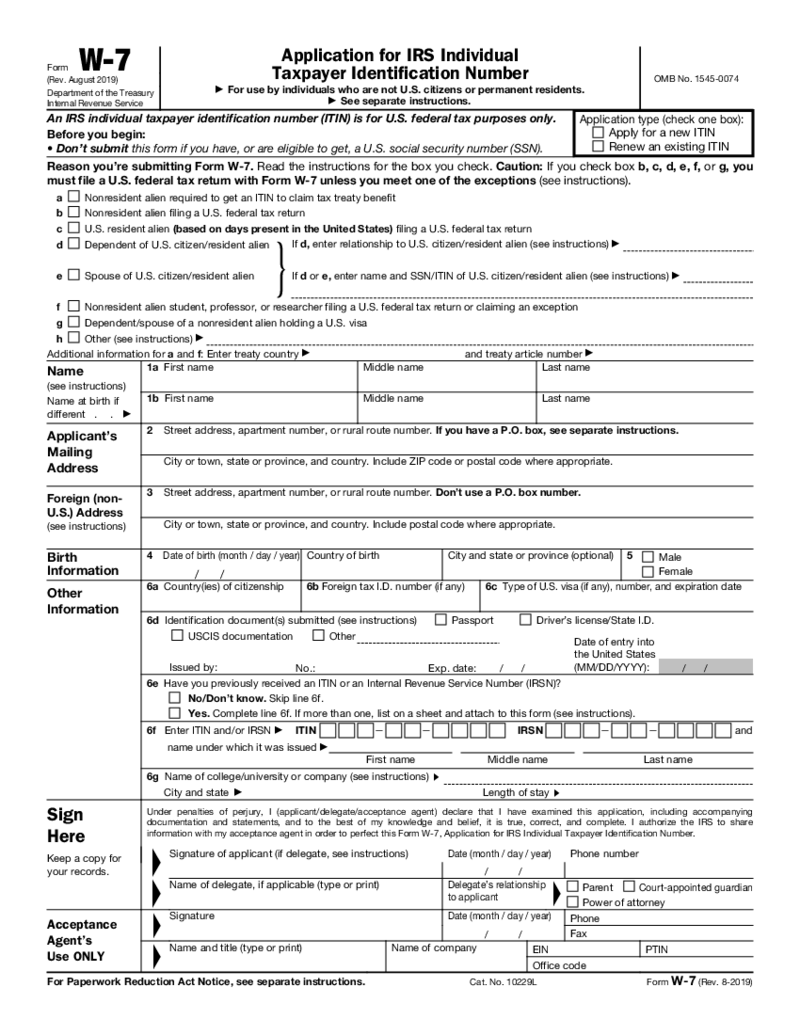

Form W-7

What is a W7 Form?

Form W-7 is an application for IRS individual taxpayer identification number or simply ITIN. ITIN is an 9-digits number that IRS grants to people who can't receive an SSN for some reason and uses is to identify a tax payer.&nbs

Form W-7

What is a W7 Form?

Form W-7 is an application for IRS individual taxpayer identification number or simply ITIN. ITIN is an 9-digits number that IRS grants to people who can't receive an SSN for some reason and uses is to identify a tax payer.&nbs

-

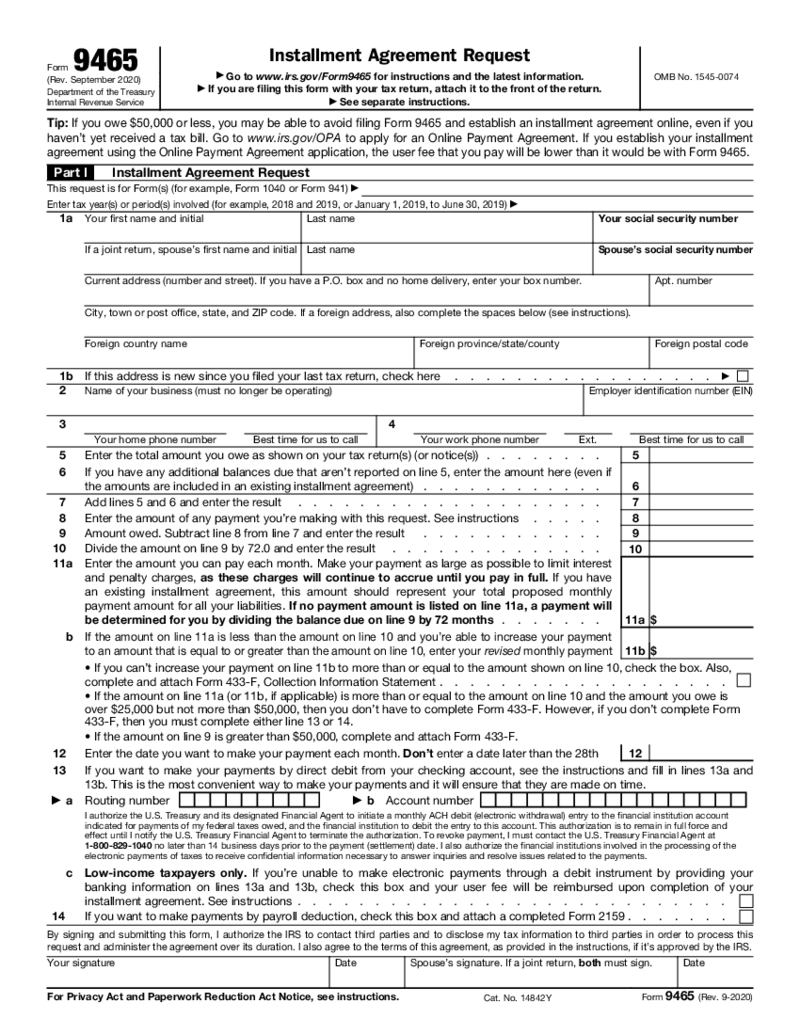

Form 9465

What is Form 9465?

Form 9465 is used to request a monthly installment plan (payment plan) if you cannot pay the full amount indicated in the tax return (or in the notice we sent you). The maximum term for a simplified agreement is 72 months. In certain ci

Form 9465

What is Form 9465?

Form 9465 is used to request a monthly installment plan (payment plan) if you cannot pay the full amount indicated in the tax return (or in the notice we sent you). The maximum term for a simplified agreement is 72 months. In certain ci

-

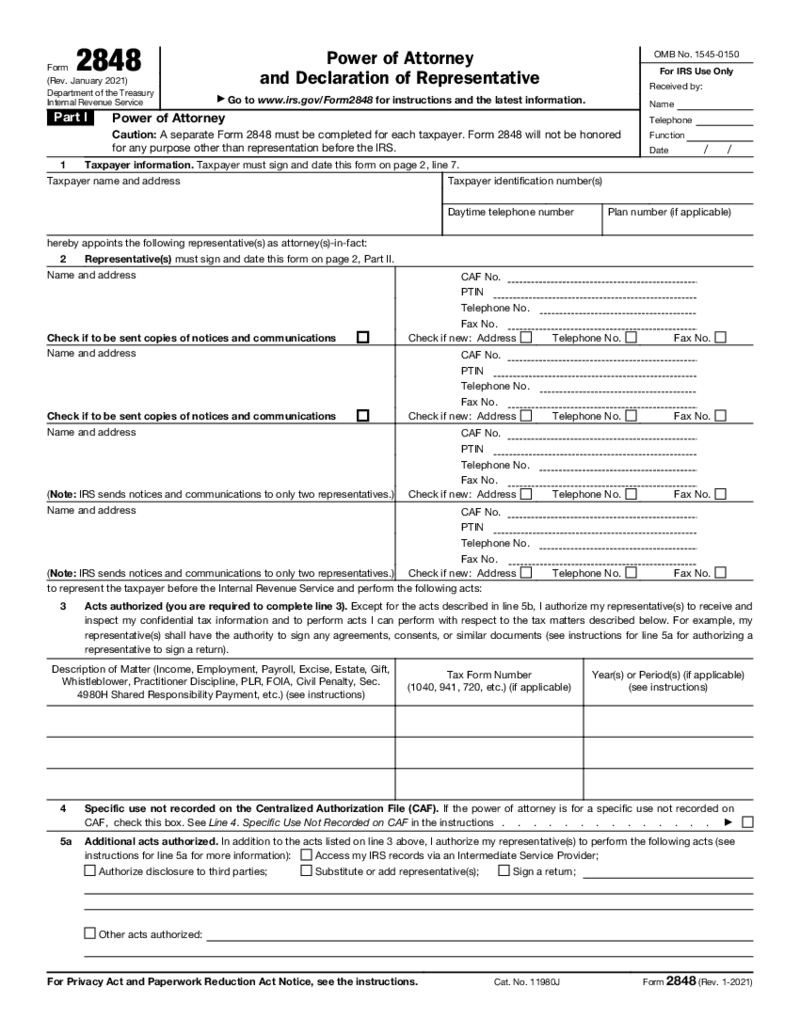

POA Form 2848

What is IRS Form 2848?

IRS 2848 is the tax form used to give a taxpayer power of attorney. A power of attorney allows a representative to register taxes and appear on behalf of another person in an IRS proceeding. The form provides a standard definition o

POA Form 2848

What is IRS Form 2848?

IRS 2848 is the tax form used to give a taxpayer power of attorney. A power of attorney allows a representative to register taxes and appear on behalf of another person in an IRS proceeding. The form provides a standard definition o

-

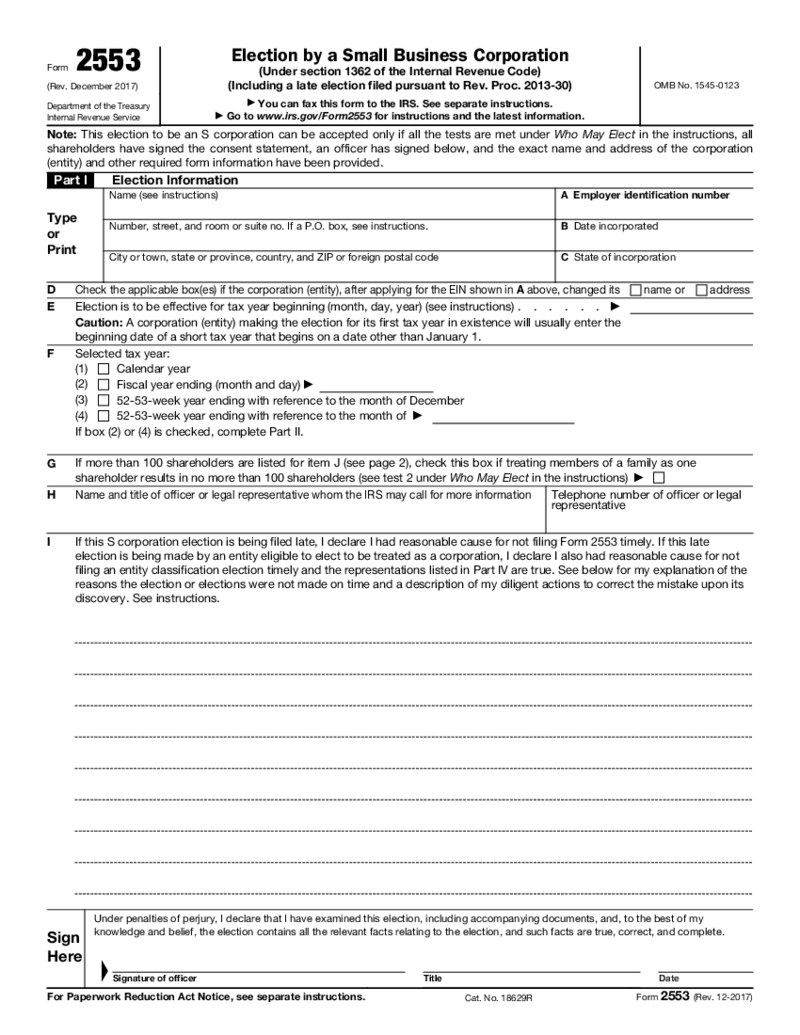

Form 2553

What is the IRS 2553?

If you have a business that is a corporation C type, but you want to switch and file taxes as a corporation S, you need to notify the IRS in advance by submitting the relevant document IRS 2553 Form. Election by a Small Business Corp

Form 2553

What is the IRS 2553?

If you have a business that is a corporation C type, but you want to switch and file taxes as a corporation S, you need to notify the IRS in advance by submitting the relevant document IRS 2553 Form. Election by a Small Business Corp

Search by State

FAQ

-

When will the IRS finalize forms for 2023-2024?

April 18, 2024, is the last day for submitting your returns. Go the extra mile if necessary to file the needed forms in a timely manner if you want to avoid penalties and preserve peace of mind as this upcoming tax year is finalized.

-

How to mail tax forms to the IRS?

You can use your usual email account to send your online IRS tax forms to your assigned IRS employee at their email address. Not feeling comfortable emailing your sensitive files? Send the docs with eFax or via regular mail.

-

Where to find IRS tax forms?

You can find the templates on their official website. As a fine alternative, find the necessary templates on PDFLiner and fill them out online. Our platform offers super handy tools for adjusting any PDF file to suit your most intricate needs.

-

How to request tax forms from the IRS?

In the majority of cases, you won’t have to request those forms. Most of them are available for free on their official site. They’re not as convenient as PDF templates offered here, though. Simply because our templates are fully fillable and modifiable in the digital format. That’s what we call convenience.

-

How to check if the IRS received tax forms?

There are several methods of doing it. First, you can utilize their application called Where’s My Refund. Second, you can check your IRS account details. Third, you can call them by phone. Ultimately, you can check out updates within the e-filing service of your choice. Simple as that.