-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

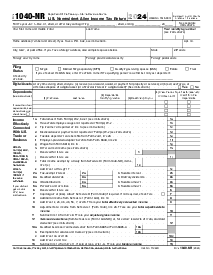

Form 1040 (2015)

Get your Form 1040 (2015) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 2015 1040

Form 2015 1040, officially known as the U.S. Individual Income Tax Return, is the standard federal income tax form used to report an individual's gross income. This includes earnings from work, dividends, interest, and capital gains. It's designed by the Internal Revenue Service (IRS) for taxpayers to calculate their tax refund or the amount they owe the federal government for the year 2015. The form gathers information about the taxpayer's income, deductions, credits, and other necessary financial details to determine the tax liability.

When to Use Form 1040 For 2015

Listing the situations when an individual should use this form includes multiple scenarios:

- If your total income for the year exceeds the standard deduction plus one exemption and is not subject to Form 1040EZ or Form 1040A requirements.

- Opting to itemize deductions instead of taking the standard deduction.

- Reporting earnings from self-employment of $400 or more.

- Those who have earned income from sources outside the United States.

- If you're going to report income from the sale of property, alimony, business income, and other similar sources.

These circumstances represent just a selection of occasions when Form 1040 for 2015 is pertinent, catering to a wide range of financial situations to ensure appropriate tax calculation.

How To Fill Out Form 1040 For 2015 Instructions

Filling out your Tax 1040 Form 2015 can be a straightforward process if approached methodically:

Personal Information:

Provide your full name, Social Security Number, address, and filing status.

Income Section:

Enter all sources of income — wages, salaries, tips, interest earned, dividends, and any other income.

Adjusted Gross Income:

This includes deductions such as educator expenses, health savings account deductions, and moving expenses.

Tax and Credits:

Calculate the total tax owed by considering various tax credits and deductions that apply to your situation.

Other Taxes:

Include any additional taxes such as self-employment tax or AMT (Alternative Minimum Tax) if applicable.

Payments:

Detail any tax payments you've made during the year, including withholding and estimated tax payments.

Refund or Amount Owed:

Conclude by calculating whether you are due a refund or owe additional taxes to the IRS. Ensure to provide your bank details if you expect a refund for direct deposit.

Following these steps will help you accurately complete your form, ensuring compliance with tax obligations.

When to File Tax 1040 Form 2015

The deadline to file your 2015 tax return was April 15, 2016. However, for those who requested an extension, the final deadline was October 15, 2016. It's crucial to note that even if you missed these deadlines, it's advisable to file your tax return as soon as possible to minimize potential penalties or claim a refund if you're due. The IRS typically allows taxpayers to file past returns to rectify their tax records and possibly reclaim overpaid taxes.

Employing these steps when dealing with Form 1040 for 2015 can streamline the process, ensuring accurate and timely submission of tax information. Whether you're navigating through your first tax filing or a seasoned taxpayer, understanding the essence and requirements of this form demystifies the tax filing process, setting you on the right path toward compliance and financial stability.

Fillable online Form 1040 (2015)