-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

IRS Tax Forms - page 46

-

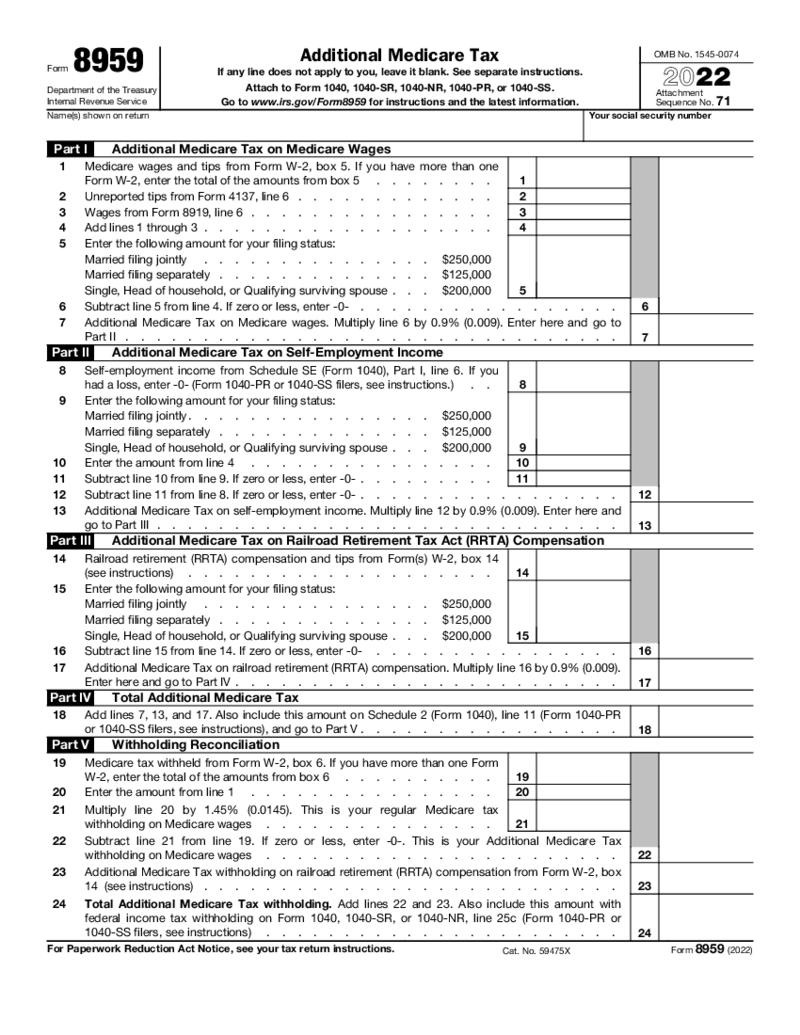

Form 8959

What is Form 8959?

The 8959 Form is an application that is used to calculate additional medicare tax. It needs to be completed only by those whose medicare wages are over the established threshold. This document is an addition to your main tax return.

Form 8959

What is Form 8959?

The 8959 Form is an application that is used to calculate additional medicare tax. It needs to be completed only by those whose medicare wages are over the established threshold. This document is an addition to your main tax return.

-

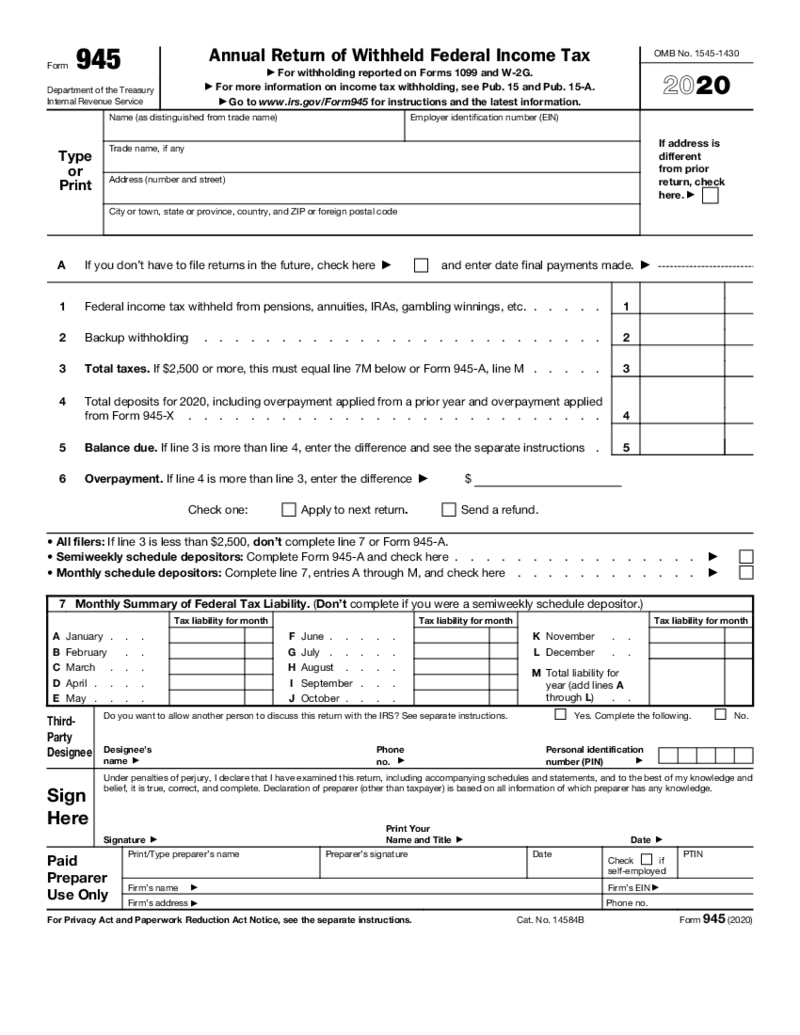

Form 945 (2020)

What Is 2020 Form 945?

Form 945 is a tax document utilized by the Internal Revenue Service (IRS) to report on federal income tax withheld from non-payroll payments. This includes a variety of payment types, such as pension distributions, gambling winnings

Form 945 (2020)

What Is 2020 Form 945?

Form 945 is a tax document utilized by the Internal Revenue Service (IRS) to report on federal income tax withheld from non-payroll payments. This includes a variety of payment types, such as pension distributions, gambling winnings

-

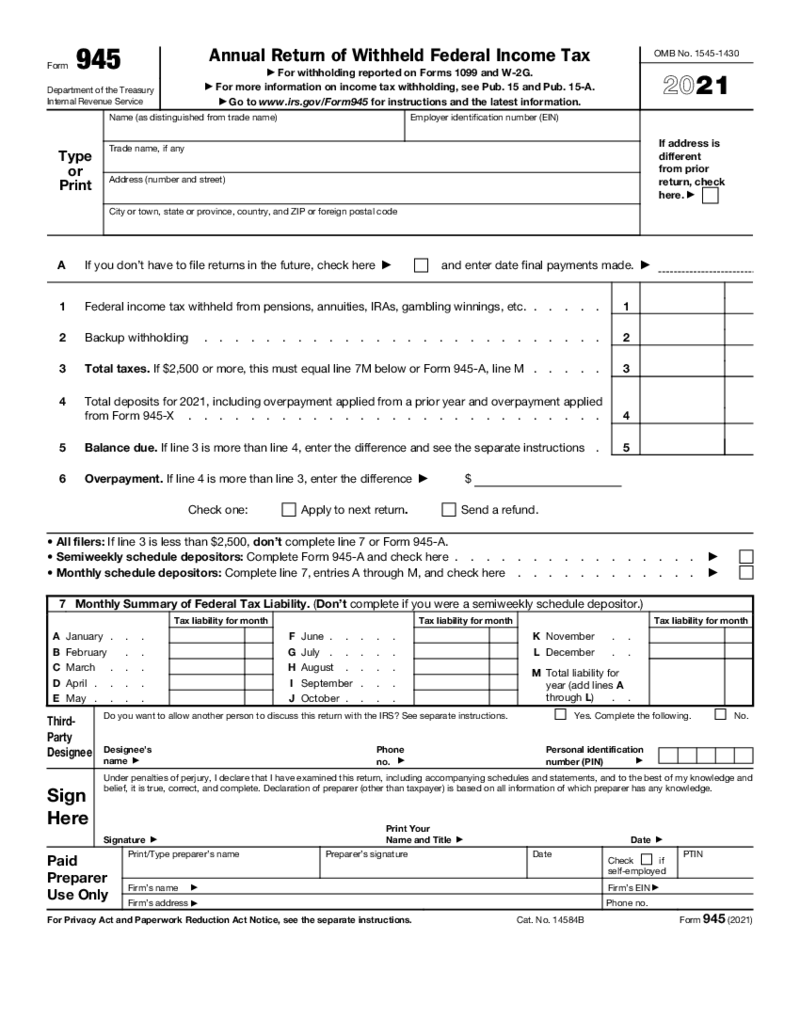

Form 945 (2021)

What Is Form 945 2021?

Form 945 for the year 2021 is an essential IRS document that businesses and other payers utilize to report federal income tax withheld from non-payroll payments. It's a crucial form that ensures taxes on certain income are colle

Form 945 (2021)

What Is Form 945 2021?

Form 945 for the year 2021 is an essential IRS document that businesses and other payers utilize to report federal income tax withheld from non-payroll payments. It's a crucial form that ensures taxes on certain income are colle

-

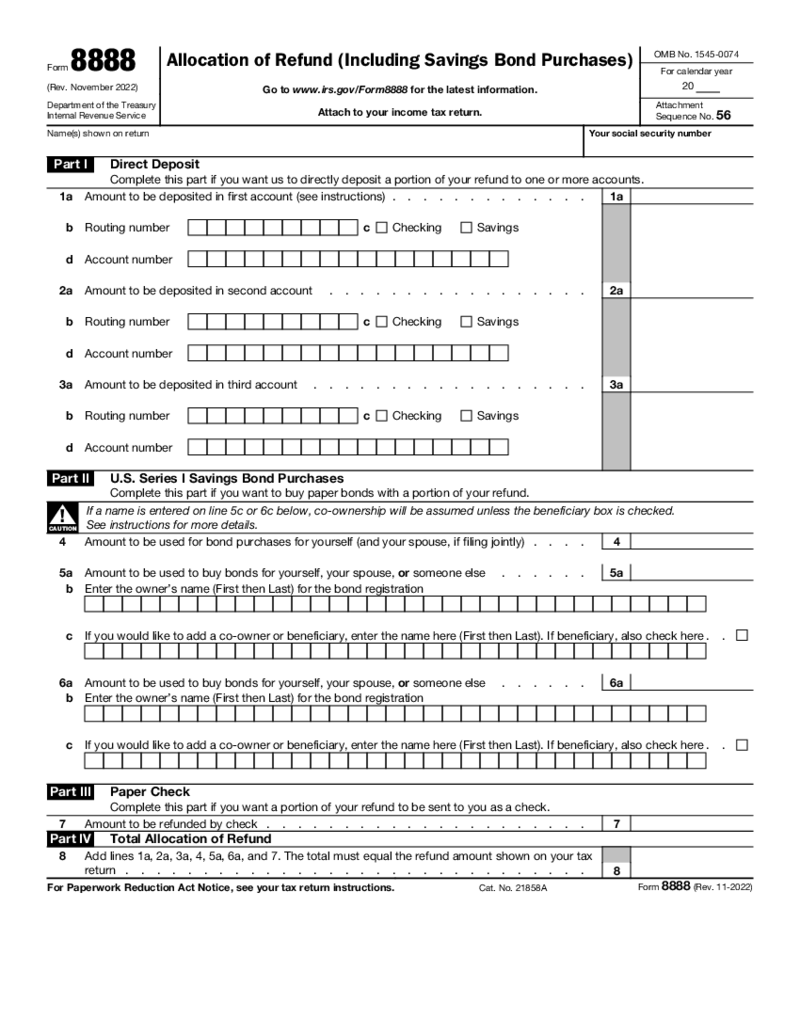

Form 8888

What is Form 8888?

The 8888 tax form is a one-page application to distribute the refunds you receive to different bank accounts or funds or to purchase bonds. That is, instead of receiving funds and allocating them on your own, you can arrange a direct tr

Form 8888

What is Form 8888?

The 8888 tax form is a one-page application to distribute the refunds you receive to different bank accounts or funds or to purchase bonds. That is, instead of receiving funds and allocating them on your own, you can arrange a direct tr

-

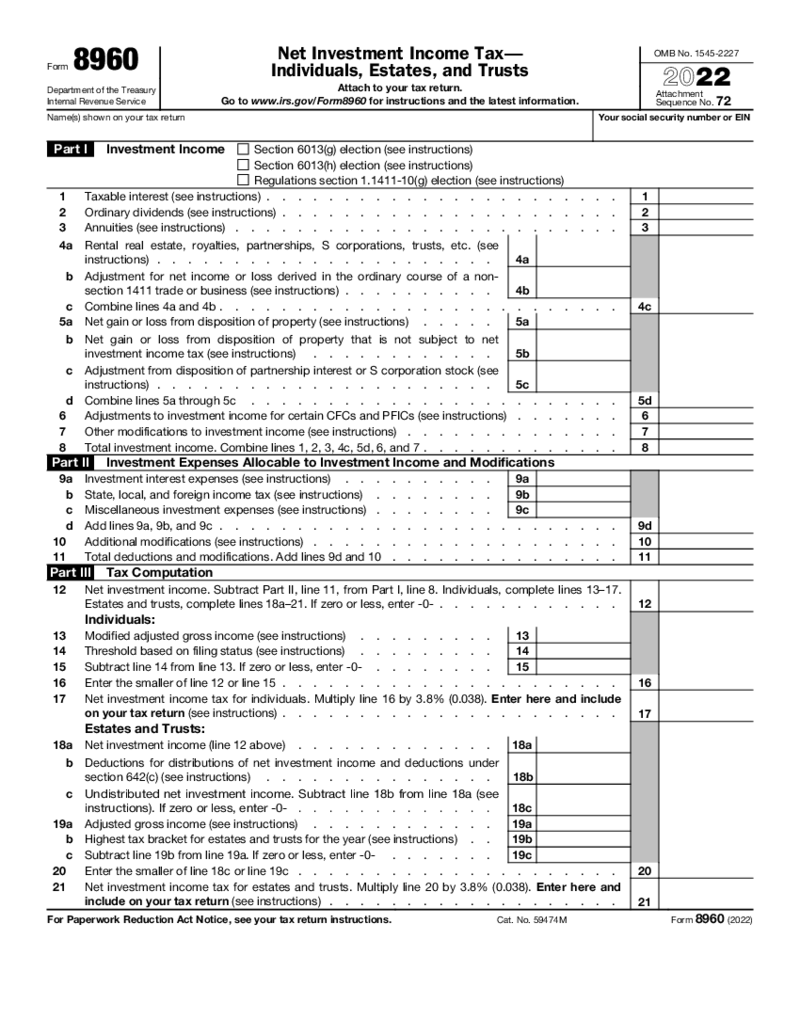

Form 8960

What is an 8960 Form?

The tax form 8960 is an application for calculating taxes on your income from interest, dividends, annuities, and so on. Depending on the size of your gross income (MAGI), you might need to complete this document with your return for

Form 8960

What is an 8960 Form?

The tax form 8960 is an application for calculating taxes on your income from interest, dividends, annuities, and so on. Depending on the size of your gross income (MAGI), you might need to complete this document with your return for

-

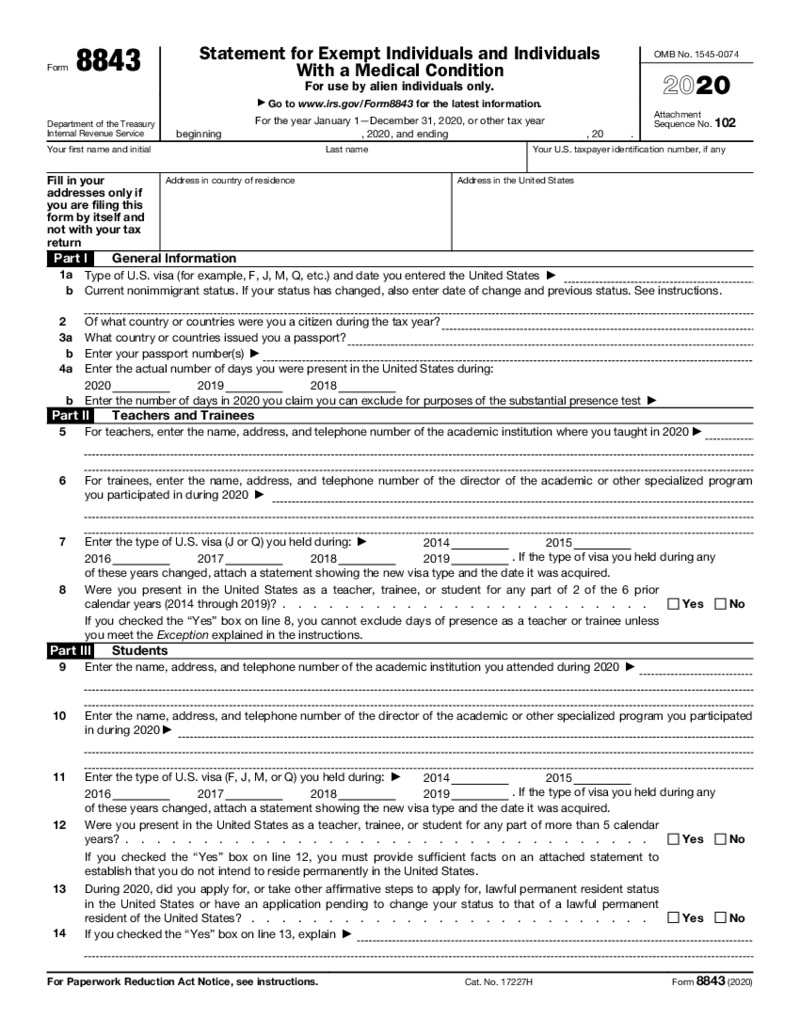

Form 8843 (2020)

Where to Get Fillable Form 8843 Example?

The form is ready to be filled and can be found in PDFLiner catalog. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

Enter y

Form 8843 (2020)

Where to Get Fillable Form 8843 Example?

The form is ready to be filled and can be found in PDFLiner catalog. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

Enter y

-

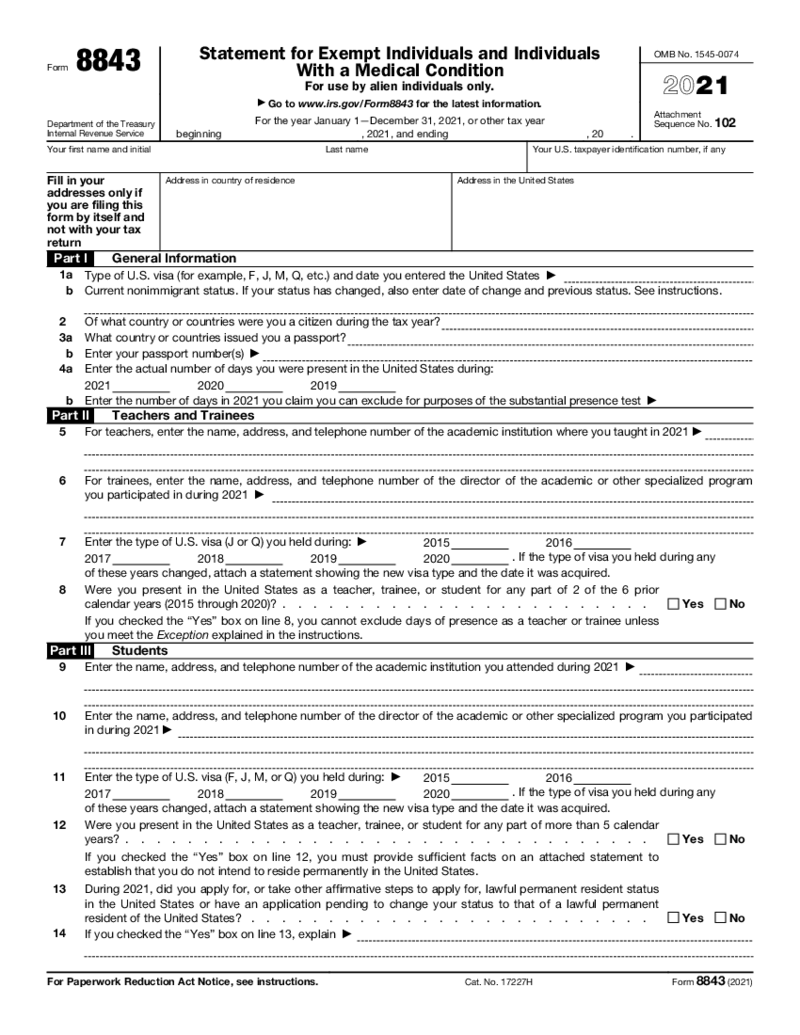

Form 8843 (2021)

What Is Form 8843 2021

Form 8843 for 2021 is a tax form specifically designed for certain nonresident alien individuals in the United States, including those with F, J, M, or Q visas. Its primary purpose is to explain the nature of their presence in the U

Form 8843 (2021)

What Is Form 8843 2021

Form 8843 for 2021 is a tax form specifically designed for certain nonresident alien individuals in the United States, including those with F, J, M, or Q visas. Its primary purpose is to explain the nature of their presence in the U

-

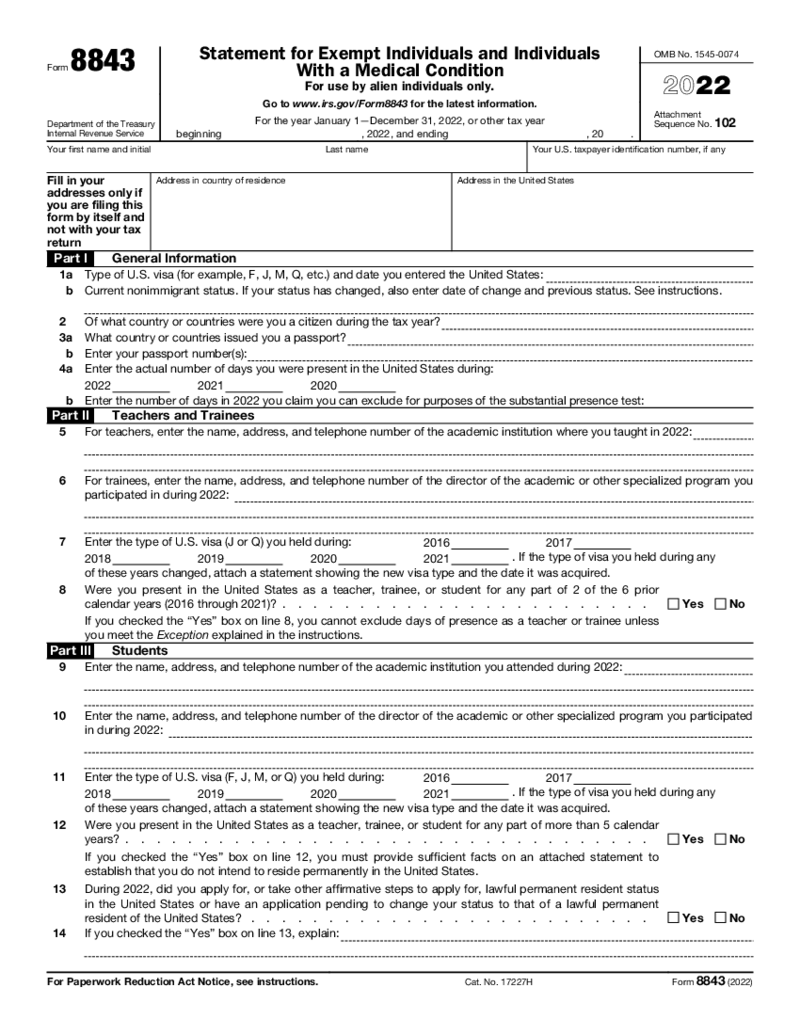

Form 8843 (2022)

What is Form 8843?

The IRS 8843 Form is a two-page document filled in by non-residents/alien individuals to document periods spent outside the US. This information is necessary for the tax service to calculate the tax liability of such payers. Depending o

Form 8843 (2022)

What is Form 8843?

The IRS 8843 Form is a two-page document filled in by non-residents/alien individuals to document periods spent outside the US. This information is necessary for the tax service to calculate the tax liability of such payers. Depending o

-

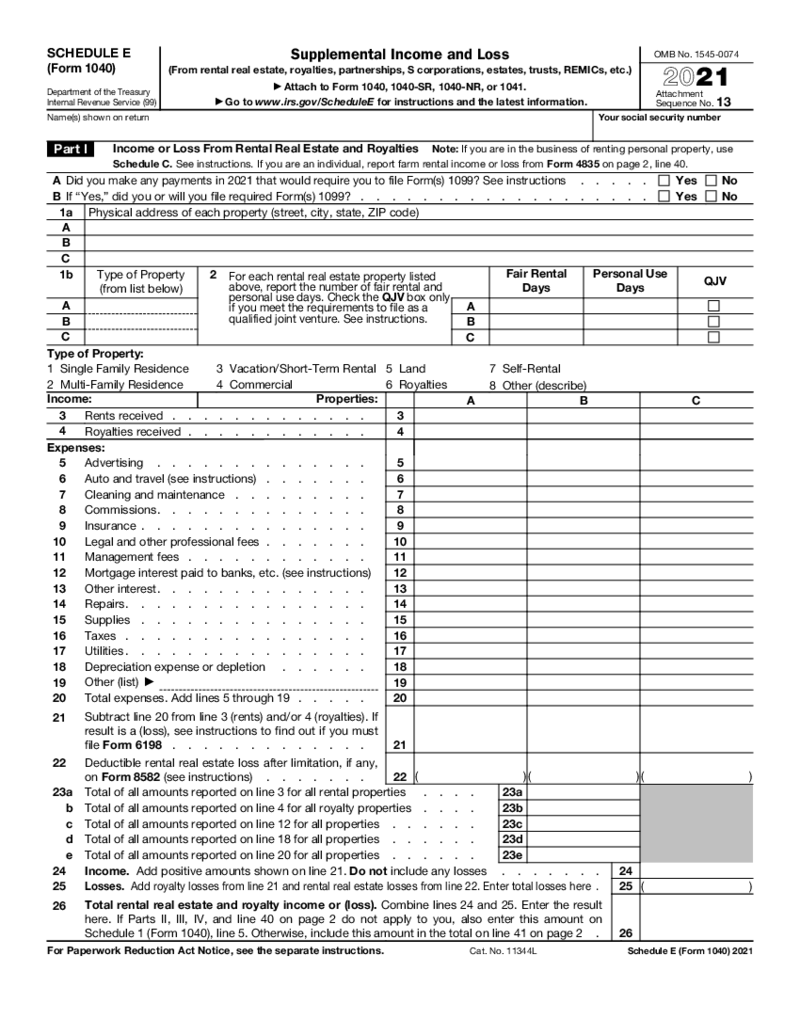

Schedule E Form 1040 (2021)

What Is a Schedule E Form 1040 2021

The Schedule E Form 1040 for 2021 is a crucial document for taxpayers who must report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs

Schedule E Form 1040 (2021)

What Is a Schedule E Form 1040 2021

The Schedule E Form 1040 for 2021 is a crucial document for taxpayers who must report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs

-

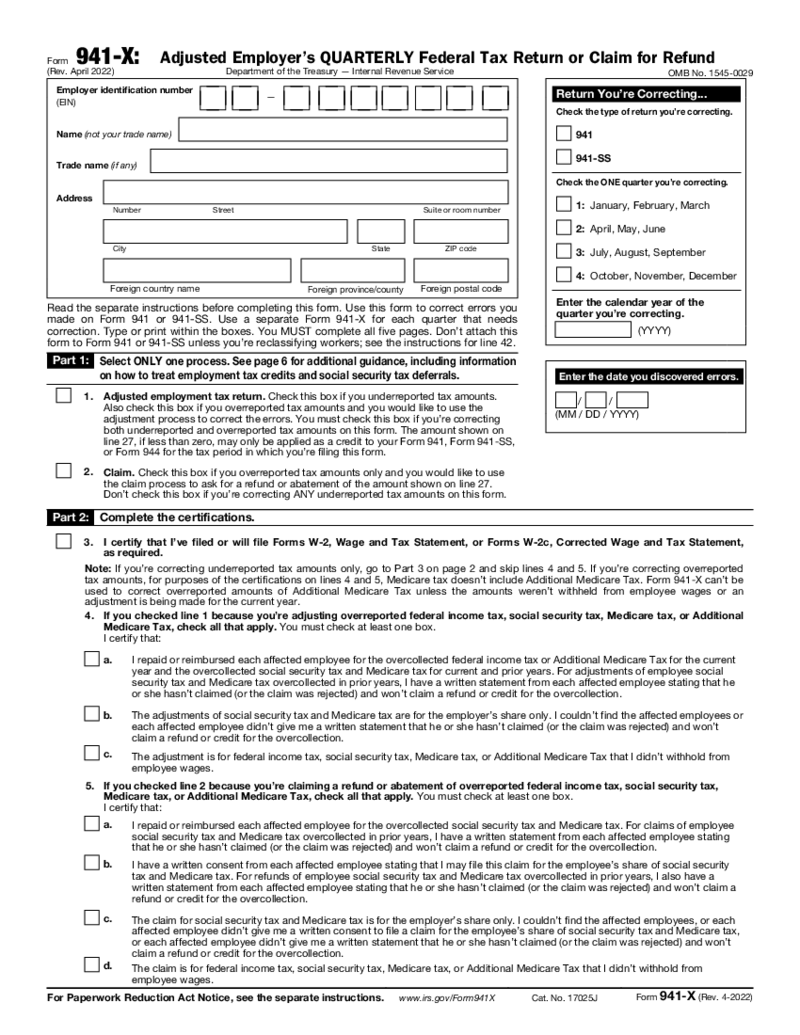

Form 941-X

What Is Form 941 X 2020?

Want to know the basics about this form? We’ve got you covered. Let’s start with the definition. It’s a document utilized for correcting errors you’ve made on your 941 tax return. Keep reading for mor

Form 941-X

What Is Form 941 X 2020?

Want to know the basics about this form? We’ve got you covered. Let’s start with the definition. It’s a document utilized for correcting errors you’ve made on your 941 tax return. Keep reading for mor

-

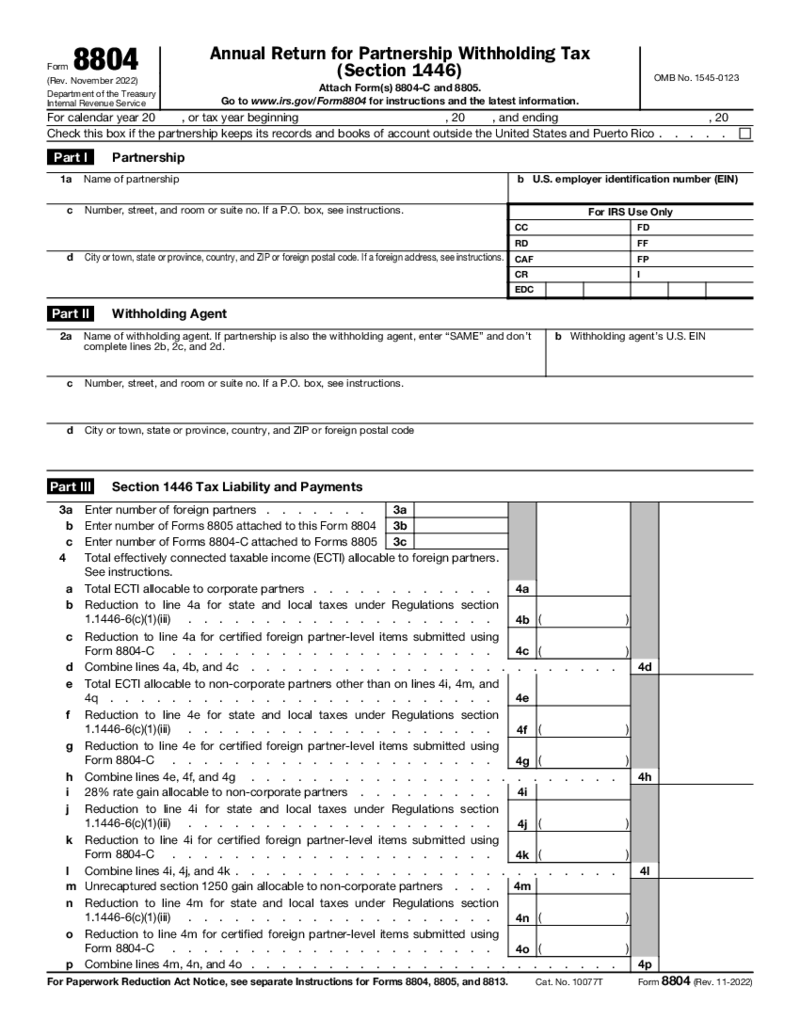

Form 8804

What Is Form 8804?

The 8804 form is also known as Annual Return for Partnership Withholding Tax. It is covered by Section 1446 Internal Revenue Code, created by the Department of the Treasury Internal Revenue Service. It comes with attachments like form 8

Form 8804

What Is Form 8804?

The 8804 form is also known as Annual Return for Partnership Withholding Tax. It is covered by Section 1446 Internal Revenue Code, created by the Department of the Treasury Internal Revenue Service. It comes with attachments like form 8

-

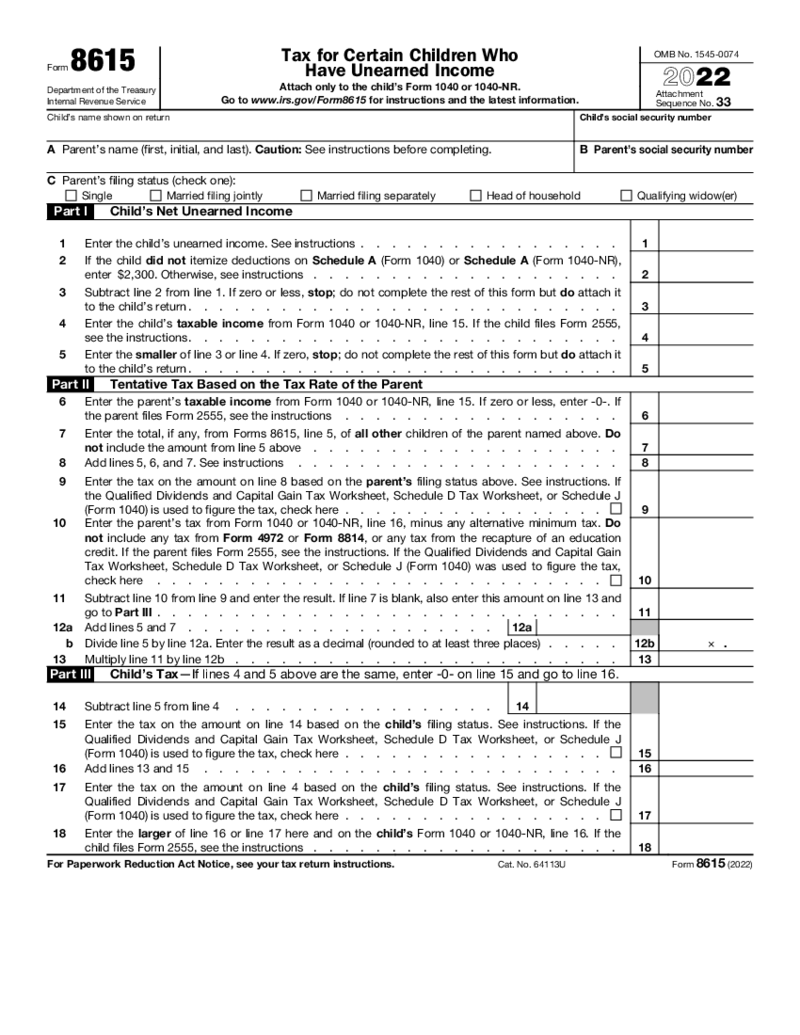

Form 8615

What Is Form 8615?

If you are looking for what is tax form 8615, you have come to the right place. This form is called Tax for Certain Children Who Have Unearned Income. It is used only with the 1040NR or 1040 form for the child. The 8615 form was created

Form 8615

What Is Form 8615?

If you are looking for what is tax form 8615, you have come to the right place. This form is called Tax for Certain Children Who Have Unearned Income. It is used only with the 1040NR or 1040 form for the child. The 8615 form was created

Search by State

FAQ

-

When will the IRS finalize forms for 2023-2024?

April 18, 2024, is the last day for submitting your returns. Go the extra mile if necessary to file the needed forms in a timely manner if you want to avoid penalties and preserve peace of mind as this upcoming tax year is finalized.

-

How to mail tax forms to the IRS?

You can use your usual email account to send your online IRS tax forms to your assigned IRS employee at their email address. Not feeling comfortable emailing your sensitive files? Send the docs with eFax or via regular mail.

-

Where to find IRS tax forms?

You can find the templates on their official website. As a fine alternative, find the necessary templates on PDFLiner and fill them out online. Our platform offers super handy tools for adjusting any PDF file to suit your most intricate needs.

-

How to request tax forms from the IRS?

In the majority of cases, you won’t have to request those forms. Most of them are available for free on their official site. They’re not as convenient as PDF templates offered here, though. Simply because our templates are fully fillable and modifiable in the digital format. That’s what we call convenience.

-

How to check if the IRS received tax forms?

There are several methods of doing it. First, you can utilize their application called Where’s My Refund. Second, you can check your IRS account details. Third, you can call them by phone. Ultimately, you can check out updates within the e-filing service of your choice. Simple as that.