-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

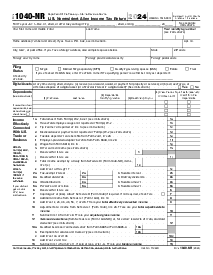

Fillable Schedule E Form 1040 (2021)

Get your Schedule E Form 1040 (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Schedule E Form 1040 2021

The Schedule E Form 1040 for 2021 is a crucial document for taxpayers who must report income and losses from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. This form allows individuals to itemize these specific earnings or losses, providing a clear breakdown of income sources that are not considered regular wages or salary. Understanding how to utilize this form effectively can significantly affect your tax filings, especially for those involved in multiple types of investments or passive income streams.

When to Use Form 1040 Schedule E 2021

Knowing exactly when to utilize the appropriate Schedule E Form 1040 2021 is essential. Here are the critical situations:

- If you own property that you rent to others and receive rental income, this is the form for you.

- Earned income from royalties, such as from a book you wrote or a product you patented, must be reported here.

- If you're part of a business partnership, your share of the income or loss from the partnership needs to be reported on Schedule E.

- Similar to partnerships, if you receive income from S corporations, it should be recorded on this form.

- Income received from estates and trusts is reported using Schedule E.

- This form will be necessary if you have residual interests in real estate mortgage investment contracts (REMICs).

How To Fill Out Schedule E Form 1040 For 2021

Filling out the IRS Form 1040 Schedule E 2021 correctly is crucial for accurate tax reporting. Follow these steps to ensure you complete it correctly:

Part I: Income or Loss from Rental Real Estate and Royalties

List all properties individually and provide the address and type of property.

Enter the rental income received and any expenses incurred, such as mortgage interest, repairs, and management fees.

Part II: Income or Loss From Partnerships and S Corporations

List each partnership or S corporation in which you have an interest. You'll need the Employer Identification Number (EIN) and your income or loss share.

Part III: Income or Loss from Estates and Trusts

Provide information about income or losses from estates and trusts, including the EIN and entity type.

Part IV: Summary

This section calculates your total income or loss reported on Schedule E, directly impacting your overall tax liability.

When to File 1040 Form 2021 Schedule E

The 1040 Form 2021 Schedule E should be filed alongside your regular Form 1040 tax return. The deadline generally falls on April 15th, following the tax year. If April 15th happens to be a weekend or holiday, the deadline is pushed to the next business day. For those who require more time, requesting an extension moves the deadline to October 15th. However, it's imperative to remember that an extension to file is not an extension to pay any taxes owed; estimated taxes should still be paid by the original due date to avoid penalties.

Navigating the nuances of tax reporting can be complex. Still, with a strategic approach to filling out and filing Schedule E Form 1040 for 2021, taxpayers can accurately represent their financial activities and potentially optimize their tax outcomes.

Fillable online Schedule E Form 1040 (2021)