-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other Templates

-

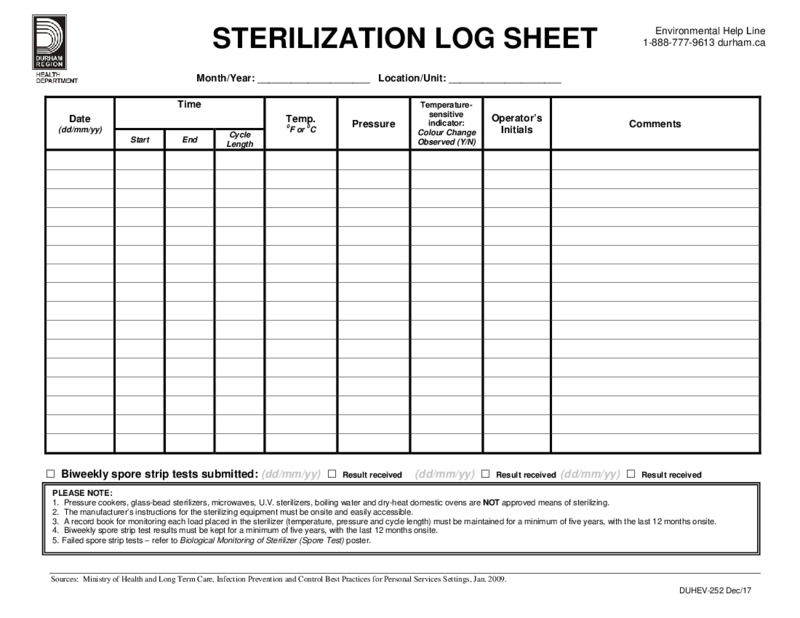

Sterilization Log Sheet

What Is Sterilization Log Sheet

A Sterilization Log Sheet is a critical document used to record the details of sterilization processes. This sheet helps ensure all equipment and instruments undergo thorough sterilization, meeting safety and regulatory sta

Sterilization Log Sheet

What Is Sterilization Log Sheet

A Sterilization Log Sheet is a critical document used to record the details of sterilization processes. This sheet helps ensure all equipment and instruments undergo thorough sterilization, meeting safety and regulatory sta

-

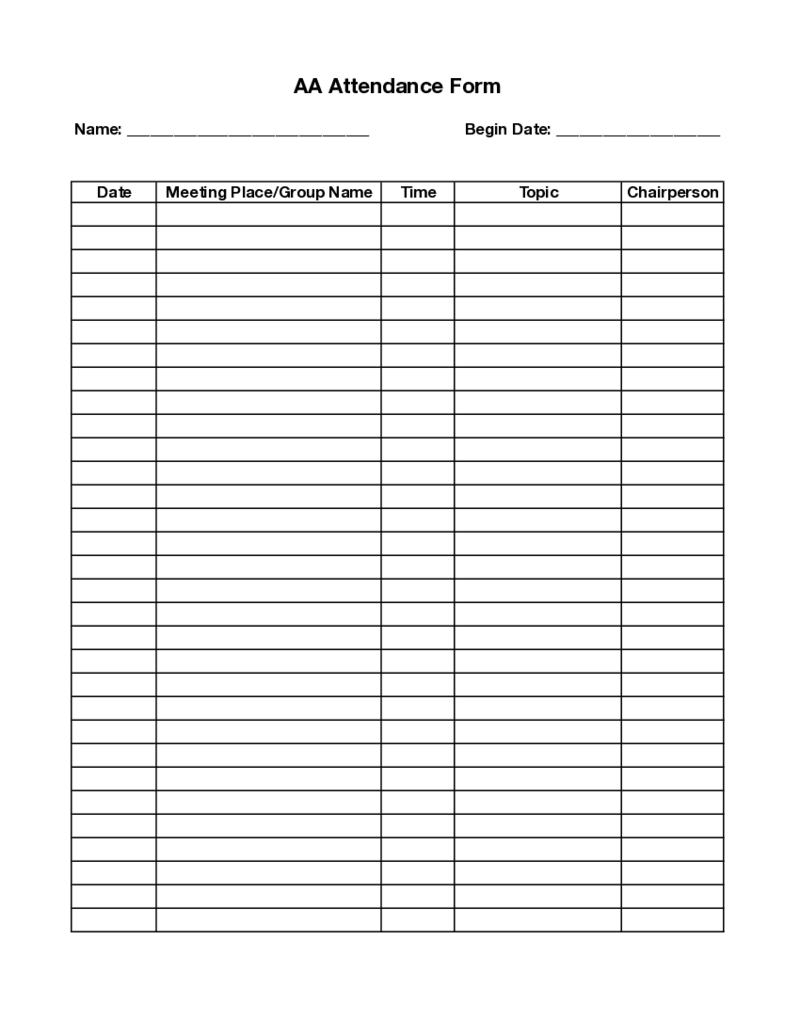

AA Attendance Form

What Is an AA Meeting Court Card Form?

An AA Court Card is a form used by individuals who have been charged with a driving under the influence (DUI) offense and are required to attend Alcoholics Anonymous (AA) meetings as part of their court-mandated sent

AA Attendance Form

What Is an AA Meeting Court Card Form?

An AA Court Card is a form used by individuals who have been charged with a driving under the influence (DUI) offense and are required to attend Alcoholics Anonymous (AA) meetings as part of their court-mandated sent

-

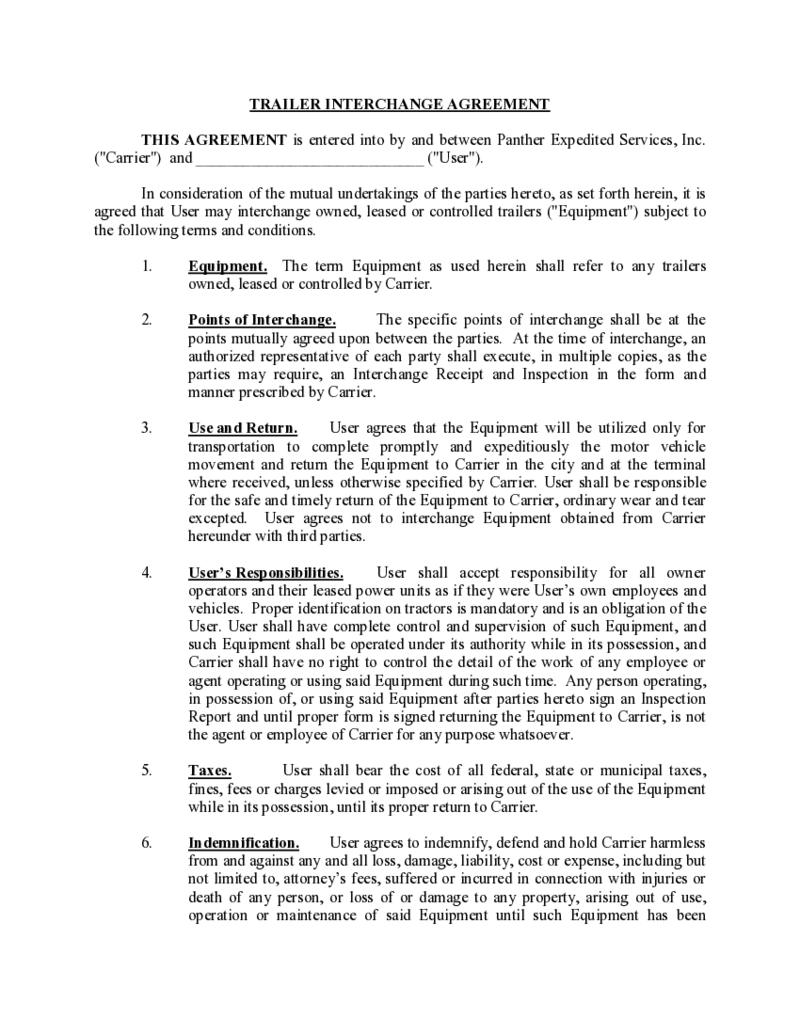

Trailer Interchange Agreement Template

In the transportation industry, managing legal agreements is a crucial aspect of smooth operations. One such crucial agreement is the Trailer Interchange Agreement. This guide provides an in-depth look at the Trailer Interchange Agreement, its importance, and how to

Trailer Interchange Agreement Template

In the transportation industry, managing legal agreements is a crucial aspect of smooth operations. One such crucial agreement is the Trailer Interchange Agreement. This guide provides an in-depth look at the Trailer Interchange Agreement, its importance, and how to

-

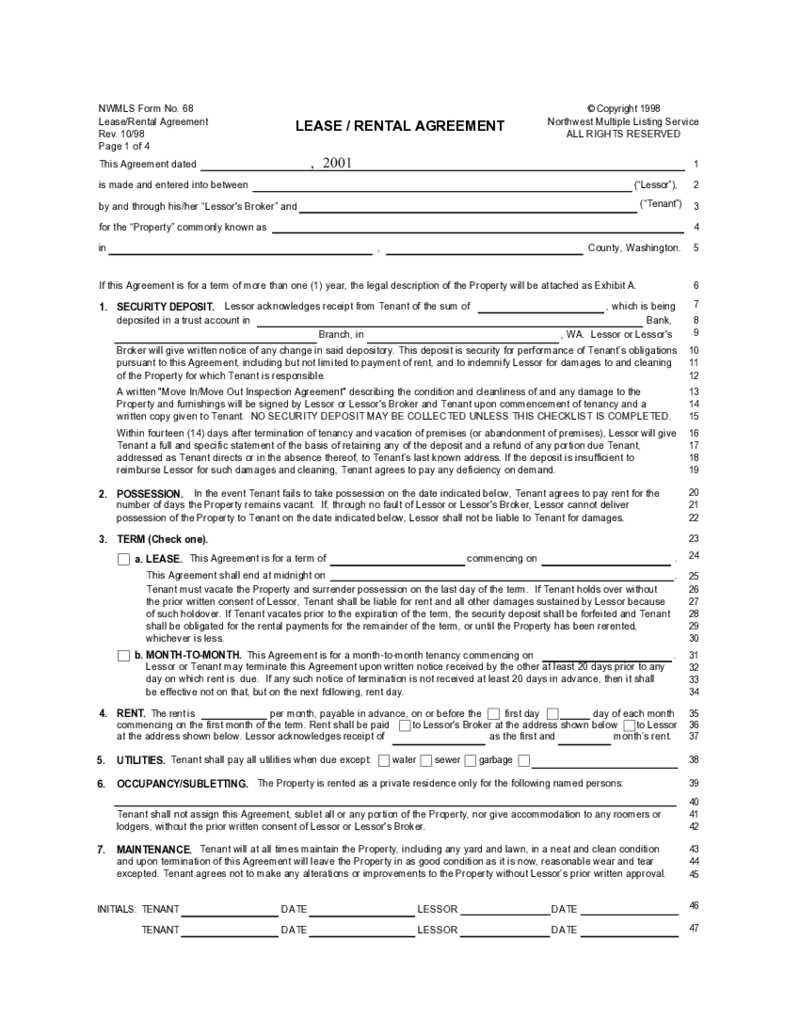

Form 68 Lease Rental Agreement

Form 68 Lease Rental Agreement: Fill Out PDF

In today's fast-paced world, efficiency and accuracy are paramount, even in the world of leasing real estate. The Form 68 lease/rental agreement PDF is a powerful tool that streamlines the rental process, e

Form 68 Lease Rental Agreement

Form 68 Lease Rental Agreement: Fill Out PDF

In today's fast-paced world, efficiency and accuracy are paramount, even in the world of leasing real estate. The Form 68 lease/rental agreement PDF is a powerful tool that streamlines the rental process, e

-

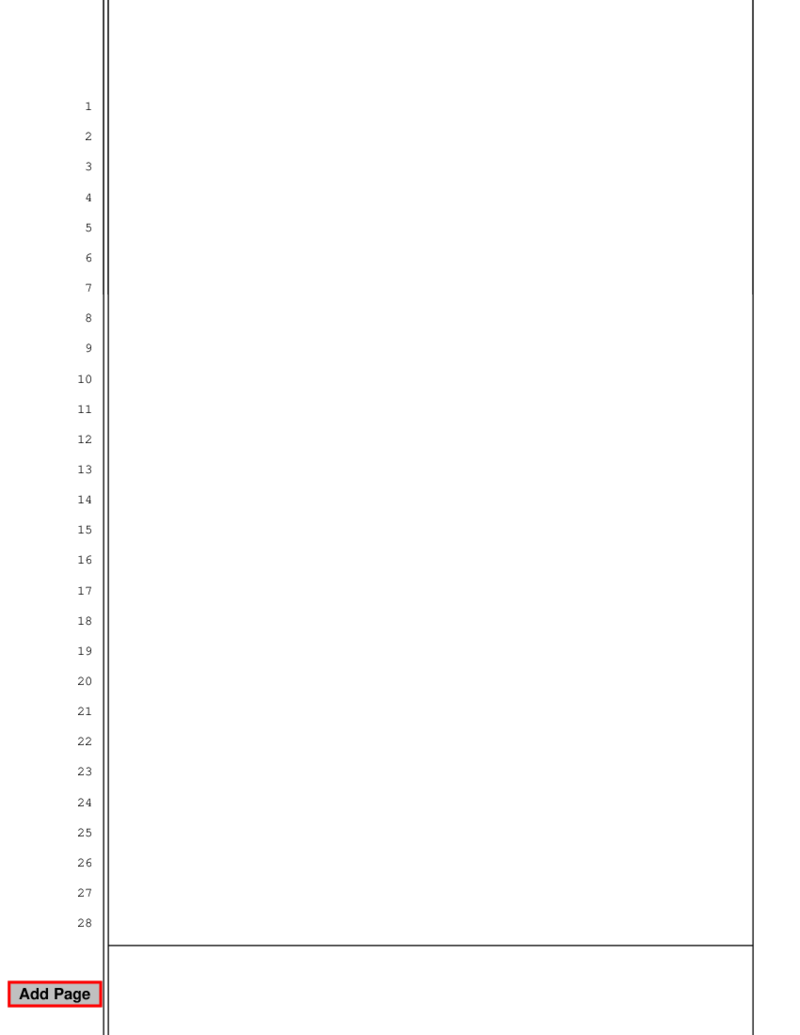

Blank Pleading Template

What Is a Blank Pleading Template Form?

A blank pleading form template is a legal document that outlines the facts and arguments a party presents to a court in a legal dispute. A blank pleading template form is a pre-formatted document that allows individ

Blank Pleading Template

What Is a Blank Pleading Template Form?

A blank pleading form template is a legal document that outlines the facts and arguments a party presents to a court in a legal dispute. A blank pleading template form is a pre-formatted document that allows individ

-

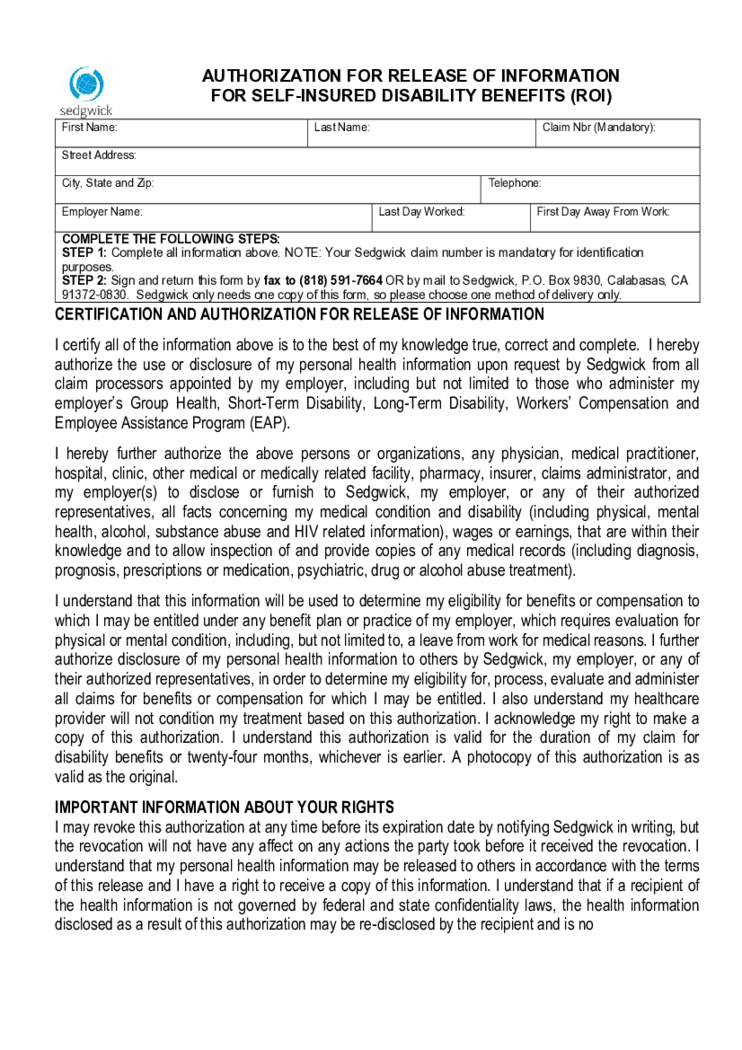

Sedgwick Authorization for Resale of Information

Sedgwick Family and Medical Leave Act (FMLA) forms are necessary tools that allow employees to apply for leave and absences from work due to medical and family issues. Understanding these forms is crucial for both employees and employers to ensure smooth processing o

Sedgwick Authorization for Resale of Information

Sedgwick Family and Medical Leave Act (FMLA) forms are necessary tools that allow employees to apply for leave and absences from work due to medical and family issues. Understanding these forms is crucial for both employees and employers to ensure smooth processing o

-

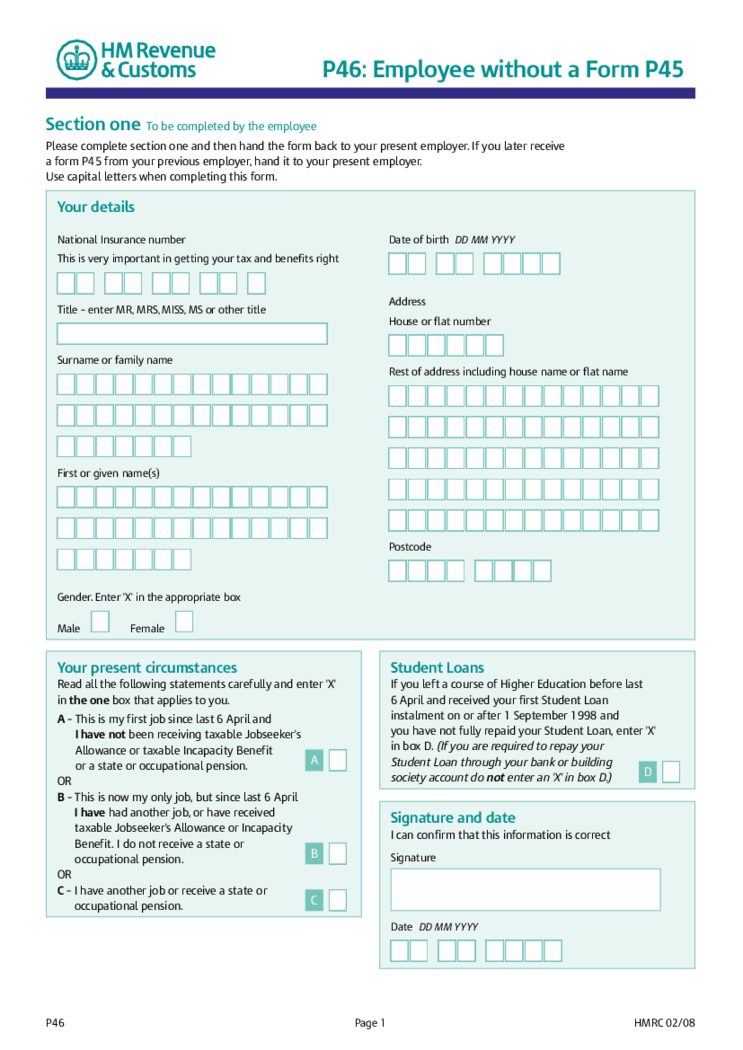

P46 Employee Without A Form P45

What is P46 Form?

The P46 form is called Employee without a Form P45. This template is required by any new employee who has the P45 unavailable and just began work in another company. The P46 tax form was created by HM Revenue and Customs, the UK. It is r

P46 Employee Without A Form P45

What is P46 Form?

The P46 form is called Employee without a Form P45. This template is required by any new employee who has the P45 unavailable and just began work in another company. The P46 tax form was created by HM Revenue and Customs, the UK. It is r

-

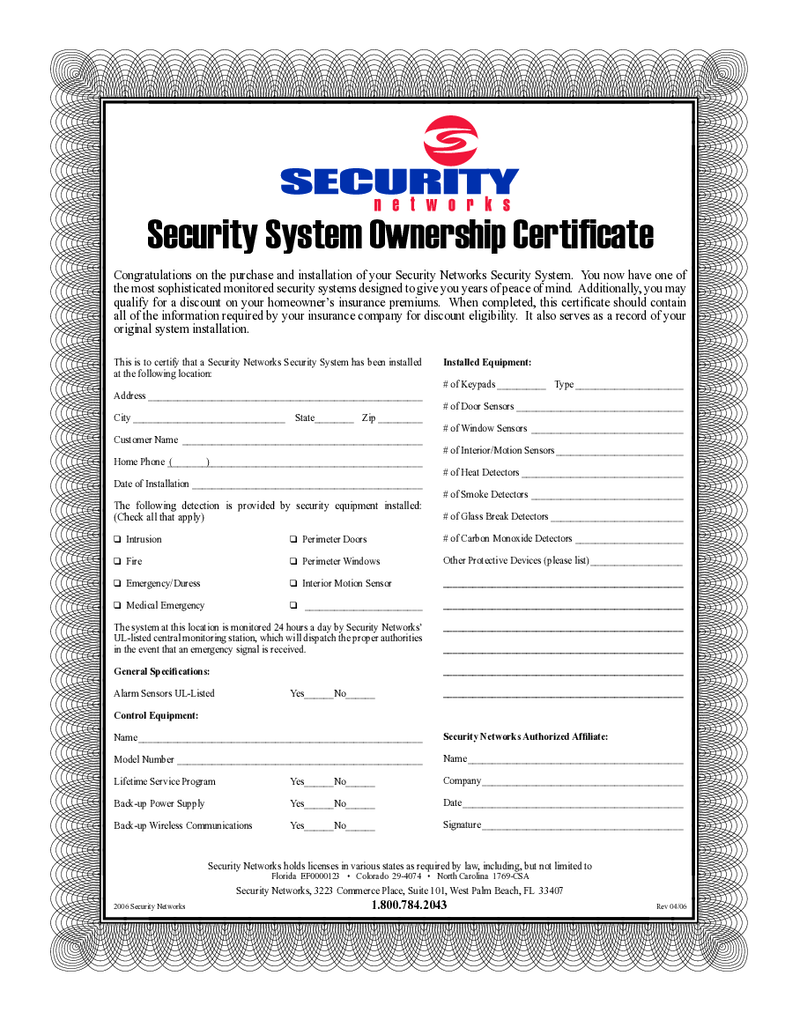

Adt Alarm Certificate For Insurance Pdf

The ADT Alarm Certificate for Insurance is a crucial document for every homeowner with an ADT alarm system installed. This certificate serves as proof that you have a monitored security system in place, which can significantly reduce your home insurance premiums.

Adt Alarm Certificate For Insurance Pdf

The ADT Alarm Certificate for Insurance is a crucial document for every homeowner with an ADT alarm system installed. This certificate serves as proof that you have a monitored security system in place, which can significantly reduce your home insurance premiums.

-

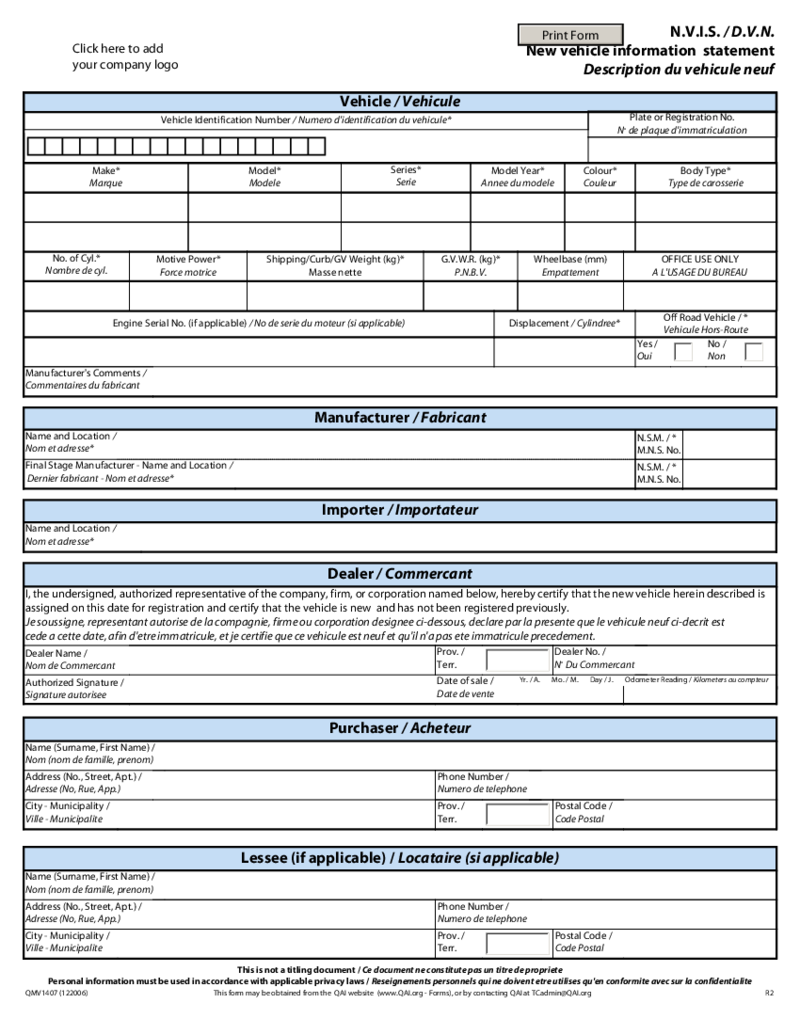

Nvis

Understanding the NVIS Form and Its Importance

The New Vehicle Information Statement (NVIS) is a document provided by vehicle manufacturers that contains important details about a new vehicle. This information is crucial for registration purposes and to e

Nvis

Understanding the NVIS Form and Its Importance

The New Vehicle Information Statement (NVIS) is a document provided by vehicle manufacturers that contains important details about a new vehicle. This information is crucial for registration purposes and to e

-

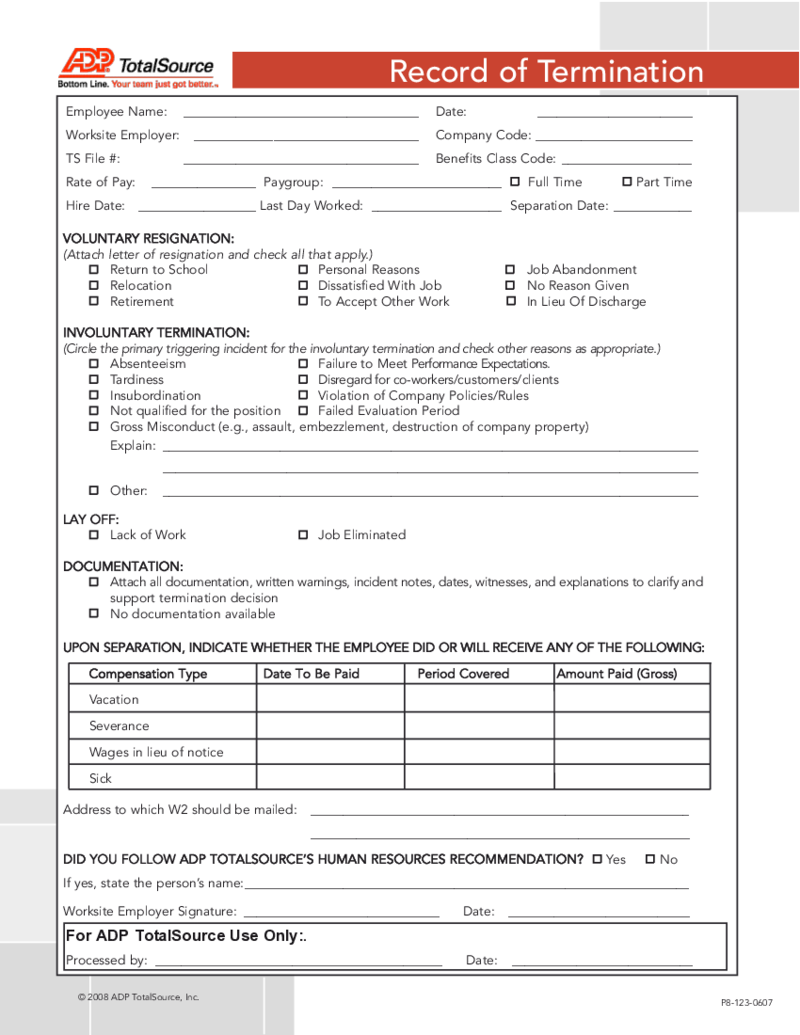

ADP Termination Form

ADP Termination Form: A Guide to Editing and Filing

The ADP Termination Form is a critical document used by businesses when terminating an employee's services. It simplifies the process of documenting the termination, ensuring all necessary informatio

ADP Termination Form

ADP Termination Form: A Guide to Editing and Filing

The ADP Termination Form is a critical document used by businesses when terminating an employee's services. It simplifies the process of documenting the termination, ensuring all necessary informatio

-

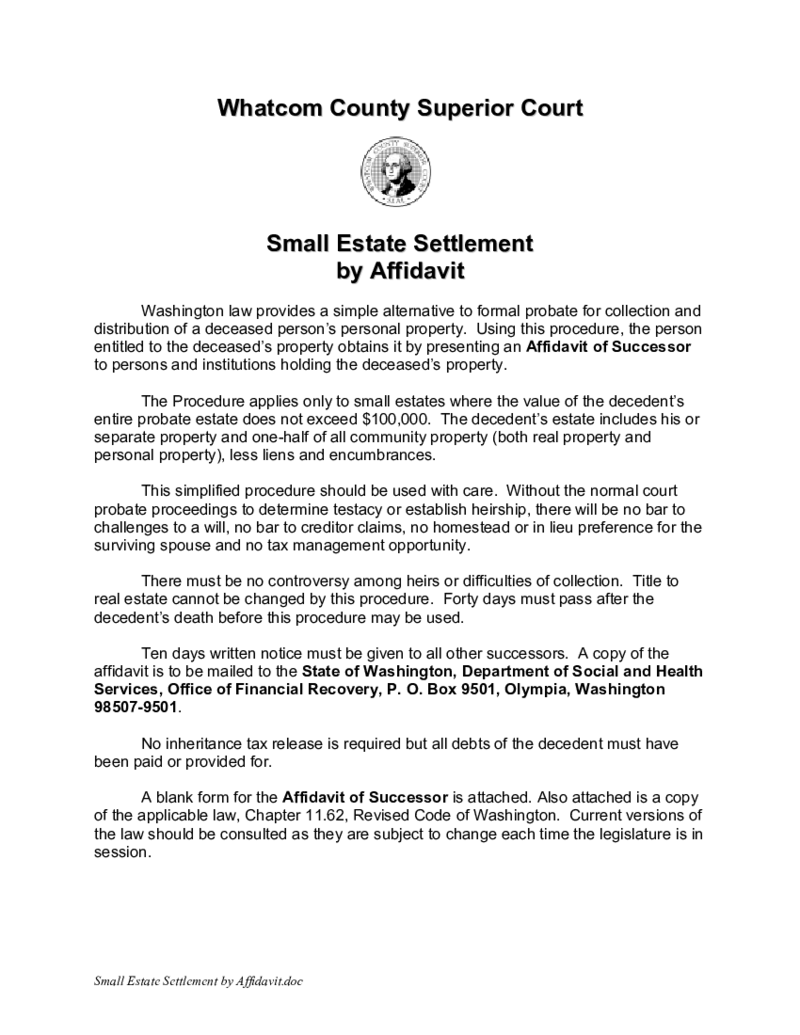

Washington State Transfer On Death Deed

Managing one's estate is an essential task that requires careful consideration and planning. One such tool used for this purpose is the Transfer on Death Deed (TOD Deed). In this article, we delve into the specifics of a TOD Deed, its workings in Washington State

Washington State Transfer On Death Deed

Managing one's estate is an essential task that requires careful consideration and planning. One such tool used for this purpose is the Transfer on Death Deed (TOD Deed). In this article, we delve into the specifics of a TOD Deed, its workings in Washington State

-

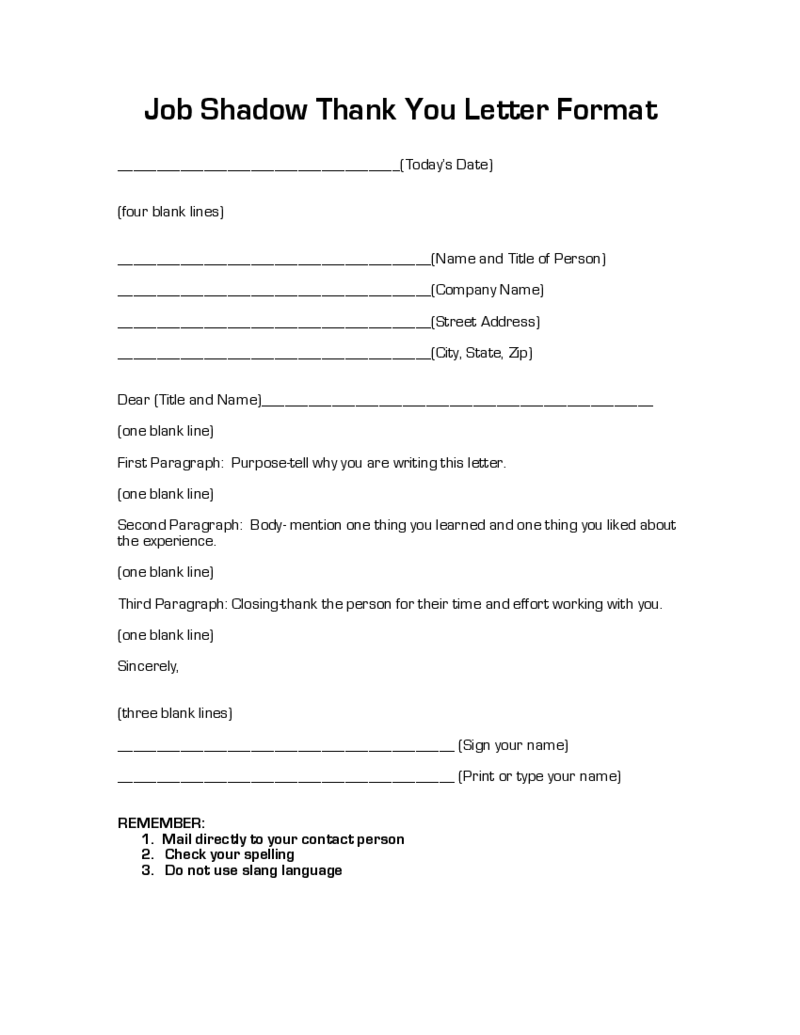

Job Shadow Thank You Letter

What Is a Job Shadow Thank You Letter Form?

A job shadow thank you letter is a document that is sent to an individual or organization after you have completed a job shadow experience. The purpose of this letter is to express gratitude and appreciation for

Job Shadow Thank You Letter

What Is a Job Shadow Thank You Letter Form?

A job shadow thank you letter is a document that is sent to an individual or organization after you have completed a job shadow experience. The purpose of this letter is to express gratitude and appreciation for