-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Legal Forms

-

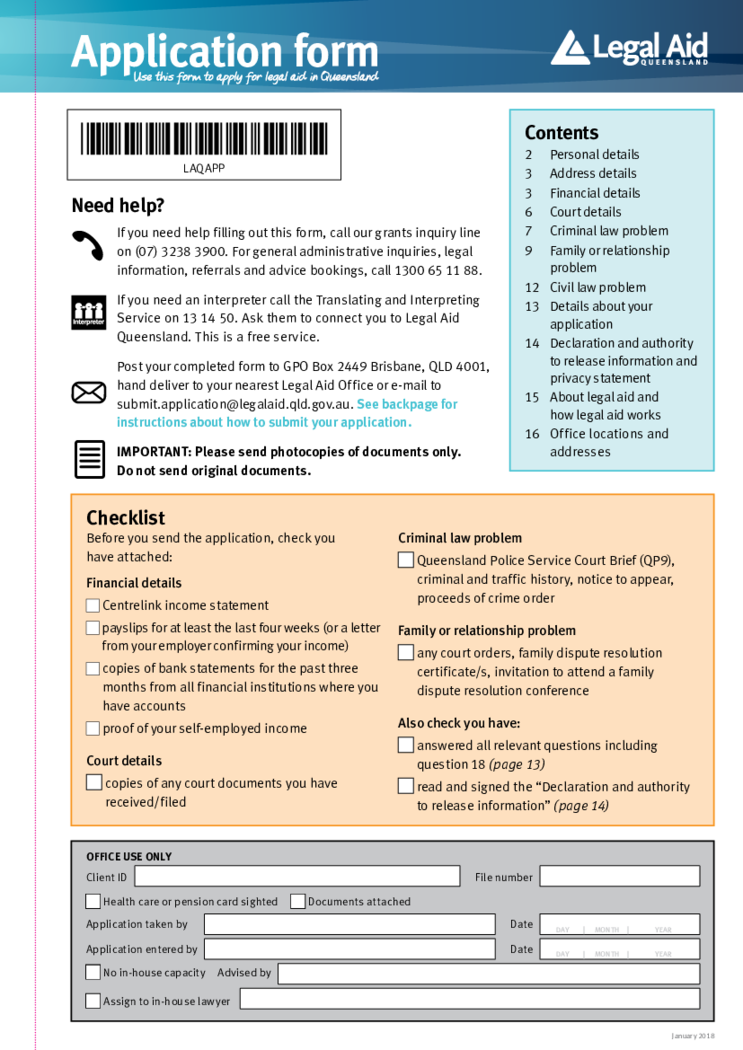

Legal Aid Queensland Application

What Is Legal Aid Queensland Application

The Legal Aid Queensland Application Form is a document used to request law-based assistance from Legal Aid Queensland, an organization that provides law-related services to eligible individuals in Queensland, Aust

Legal Aid Queensland Application

What Is Legal Aid Queensland Application

The Legal Aid Queensland Application Form is a document used to request law-based assistance from Legal Aid Queensland, an organization that provides law-related services to eligible individuals in Queensland, Aust

-

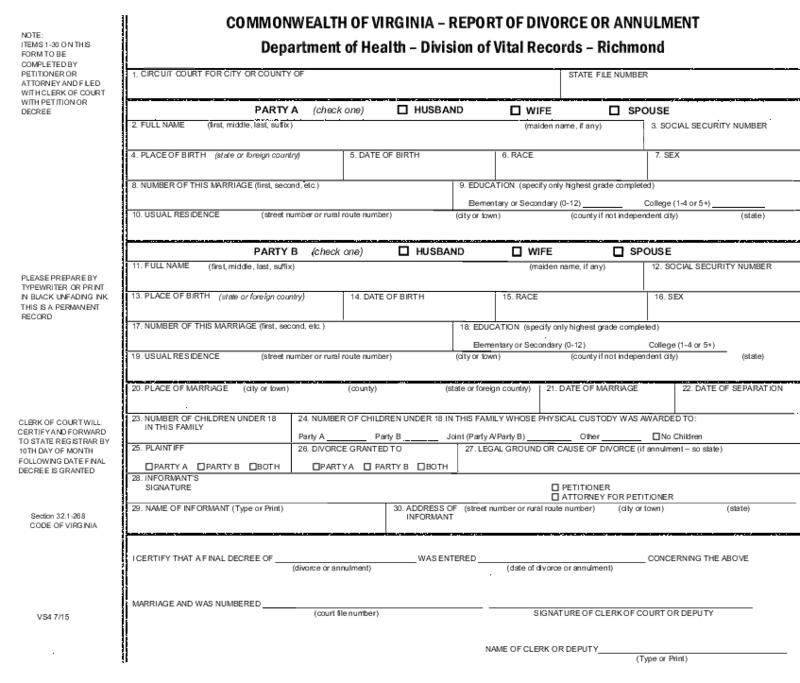

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Understanding the Virginia VS 4 Form

In the legal realm, divorce and annulment proceedings have essential paperwork needed to ensure that the process is properly recorded and maintained. The Virginia VS 4 form, also known as the Report of Divorce or Annul

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Understanding the Virginia VS 4 Form

In the legal realm, divorce and annulment proceedings have essential paperwork needed to ensure that the process is properly recorded and maintained. The Virginia VS 4 form, also known as the Report of Divorce or Annul

-

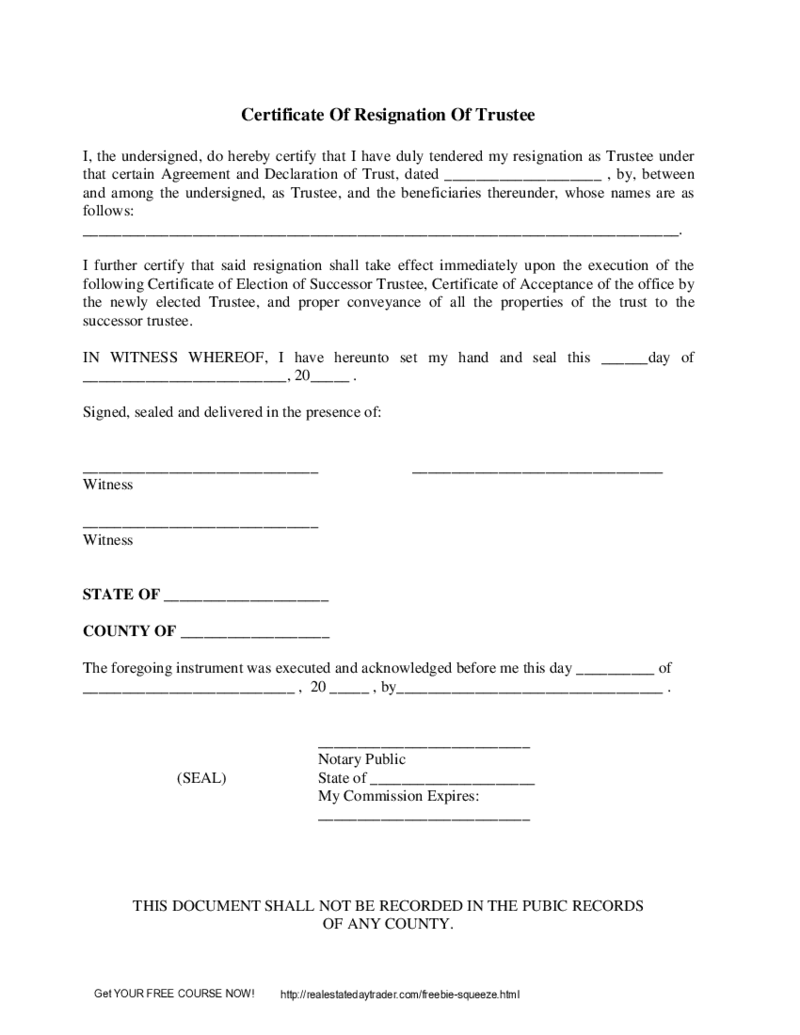

Trustee Resignation Form

What Is a Trustee Resignation Form?

It’s an official document utilized to resign as trustee of an organization. Whether you’re seeking this specific doc or need any other industry-specific template, our extensive database of pre-designed

Trustee Resignation Form

What Is a Trustee Resignation Form?

It’s an official document utilized to resign as trustee of an organization. Whether you’re seeking this specific doc or need any other industry-specific template, our extensive database of pre-designed

-

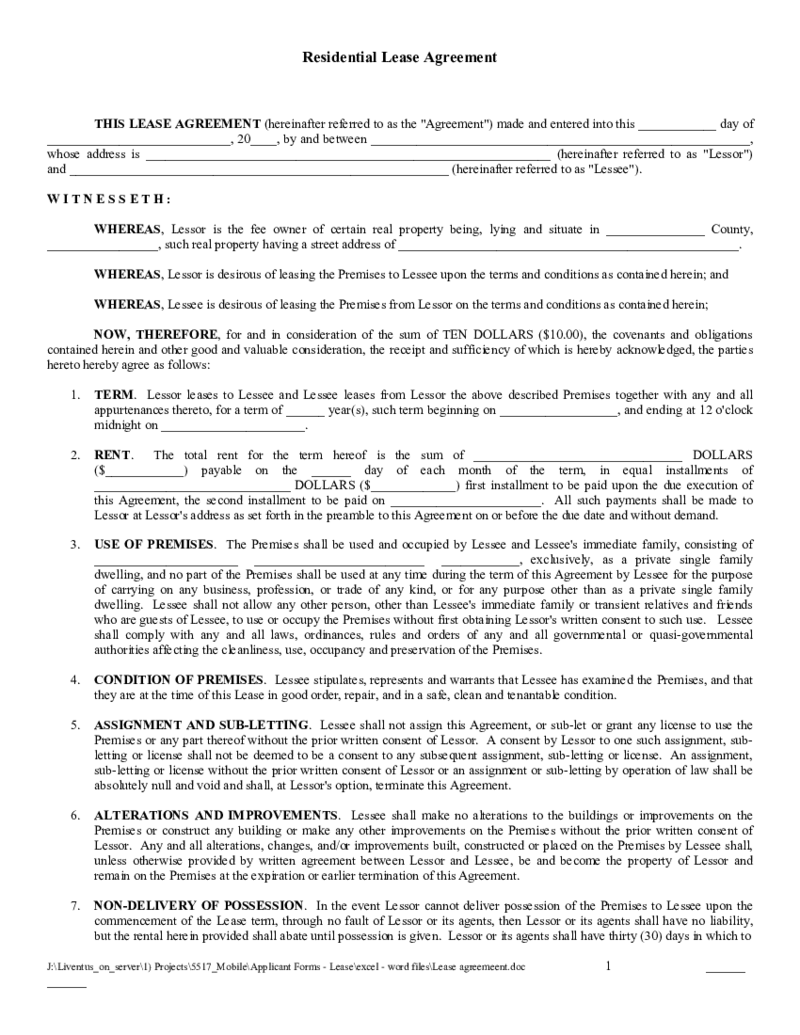

T 186 Lease Agreement Pdf

The T 186 Lease Agreement, also known as the Blumberg 186 Lease Agreement, is a crucial document for landlords, property managers, and individuals looking to rent out their property. This document outlines the terms and conditions of the rental agreement, providing l

T 186 Lease Agreement Pdf

The T 186 Lease Agreement, also known as the Blumberg 186 Lease Agreement, is a crucial document for landlords, property managers, and individuals looking to rent out their property. This document outlines the terms and conditions of the rental agreement, providing l

-

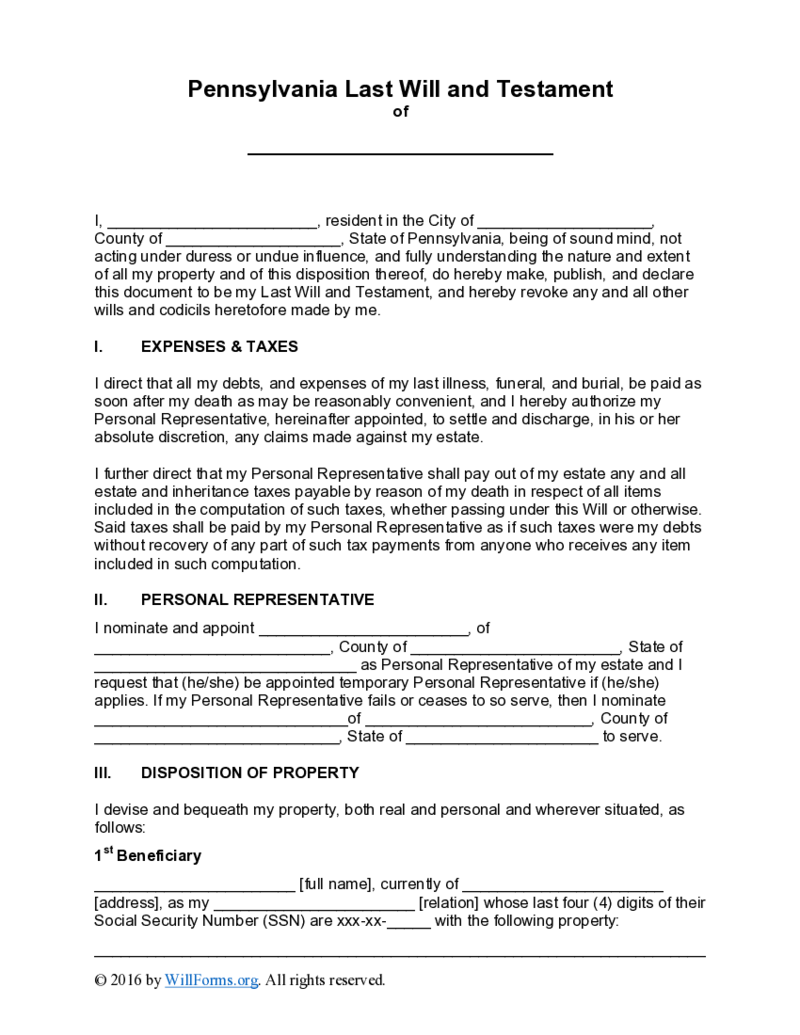

Pennsylvania Last Will and Testament Form

What Is a Pennsylvania Last Will and Testament?

The fillable Pennsylvania Last Will and Testament Form is a document that you can fill in order to declare your last will and distribute your assets (property, business, etc.) amongst your relatives or other

Pennsylvania Last Will and Testament Form

What Is a Pennsylvania Last Will and Testament?

The fillable Pennsylvania Last Will and Testament Form is a document that you can fill in order to declare your last will and distribute your assets (property, business, etc.) amongst your relatives or other

-

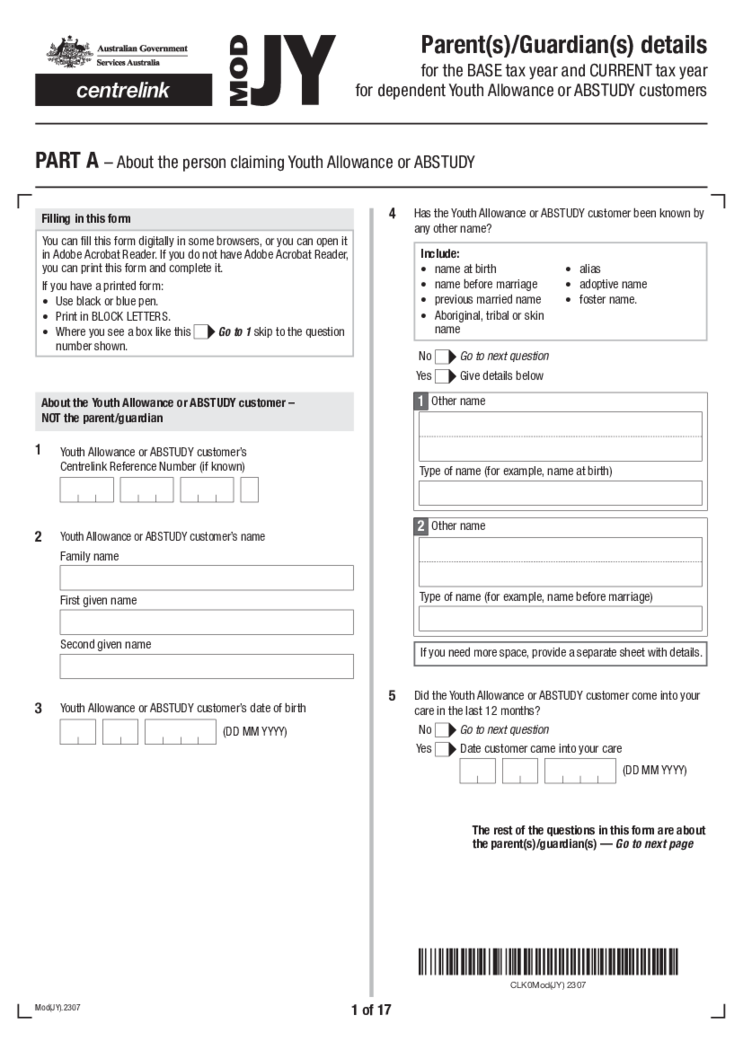

AU Mod(JY), Parent(s), Guardian(s) details

What Is a Modjy Form?

It’s a document utilized by dependents eligible for financial support in Australia, such as Youth Allowance and the like. If you’re currently on the prowl for this particular document template, the team behind PDFLi

AU Mod(JY), Parent(s), Guardian(s) details

What Is a Modjy Form?

It’s a document utilized by dependents eligible for financial support in Australia, such as Youth Allowance and the like. If you’re currently on the prowl for this particular document template, the team behind PDFLi

-

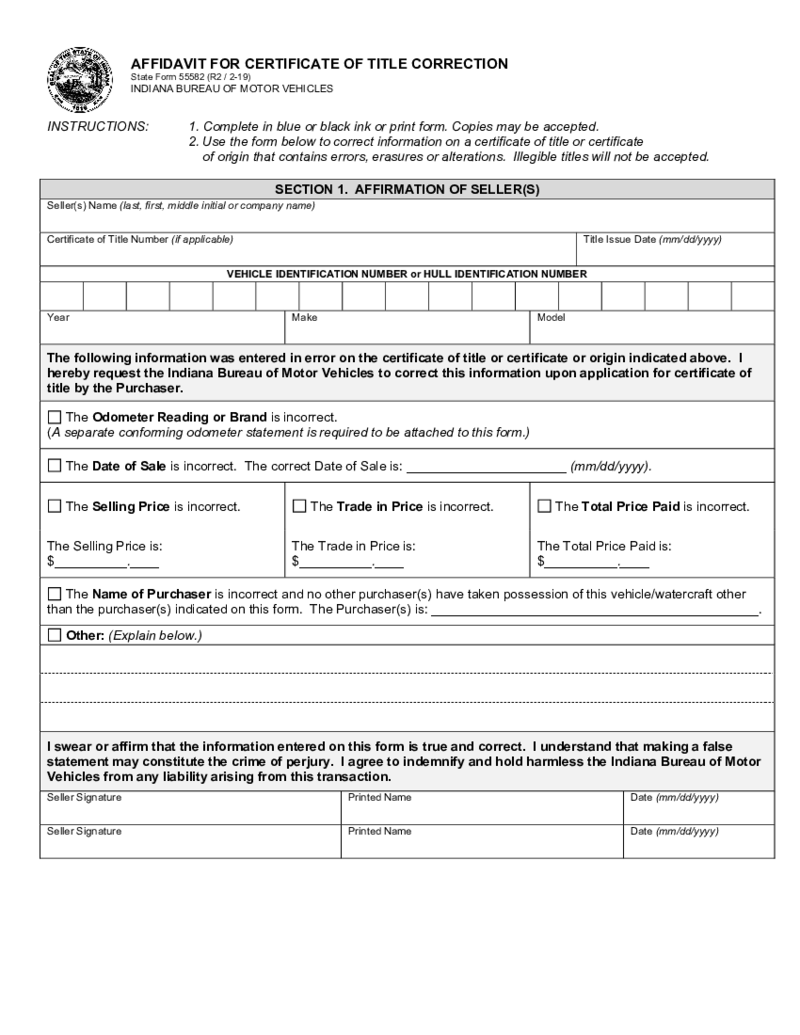

Indiana Affidavit of Correction

What is an Affidavit of Correction Indiana?

An Affidavit of Correction is a powerful tool, specifically an Indiana legal document, that facilitates the correction of errors discovered on previously filed records. This document is applicable in cases where

Indiana Affidavit of Correction

What is an Affidavit of Correction Indiana?

An Affidavit of Correction is a powerful tool, specifically an Indiana legal document, that facilitates the correction of errors discovered on previously filed records. This document is applicable in cases where

-

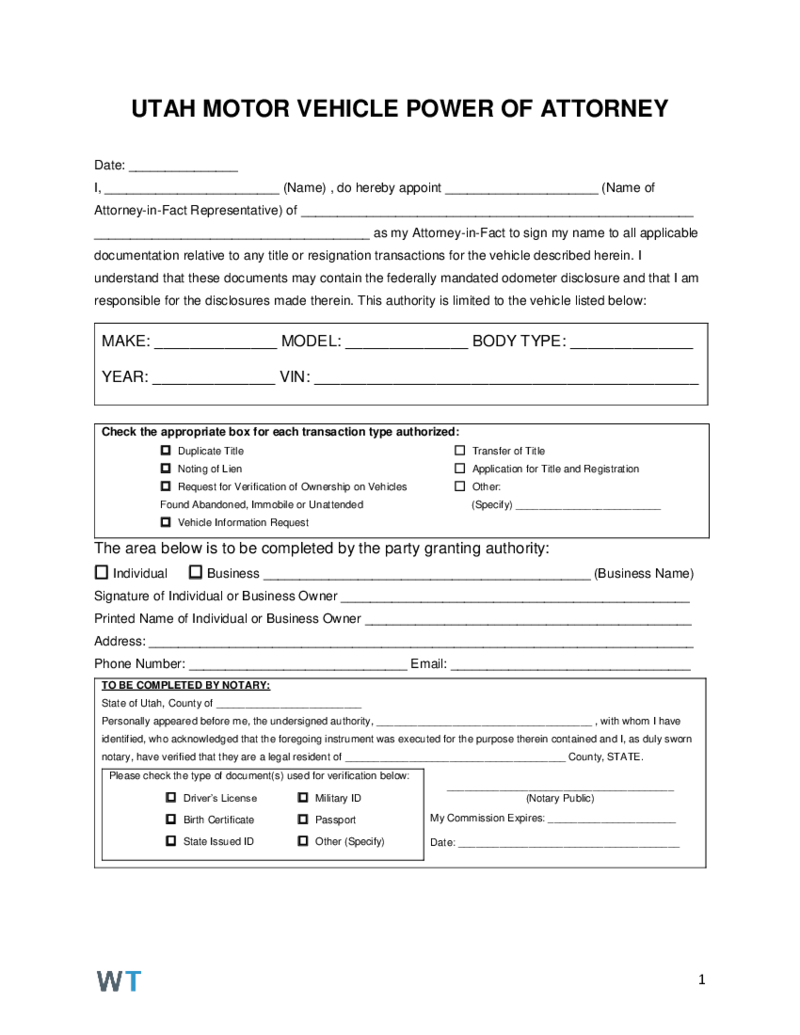

Utah Motor Vehicle Power of Attorney

What Is Utah Motor Vehicle Power Of Attorney

The Utah Motor Vehicle Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person or entity as their attorney-in-fact. This designated person is granted t

Utah Motor Vehicle Power of Attorney

What Is Utah Motor Vehicle Power Of Attorney

The Utah Motor Vehicle Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person or entity as their attorney-in-fact. This designated person is granted t

-

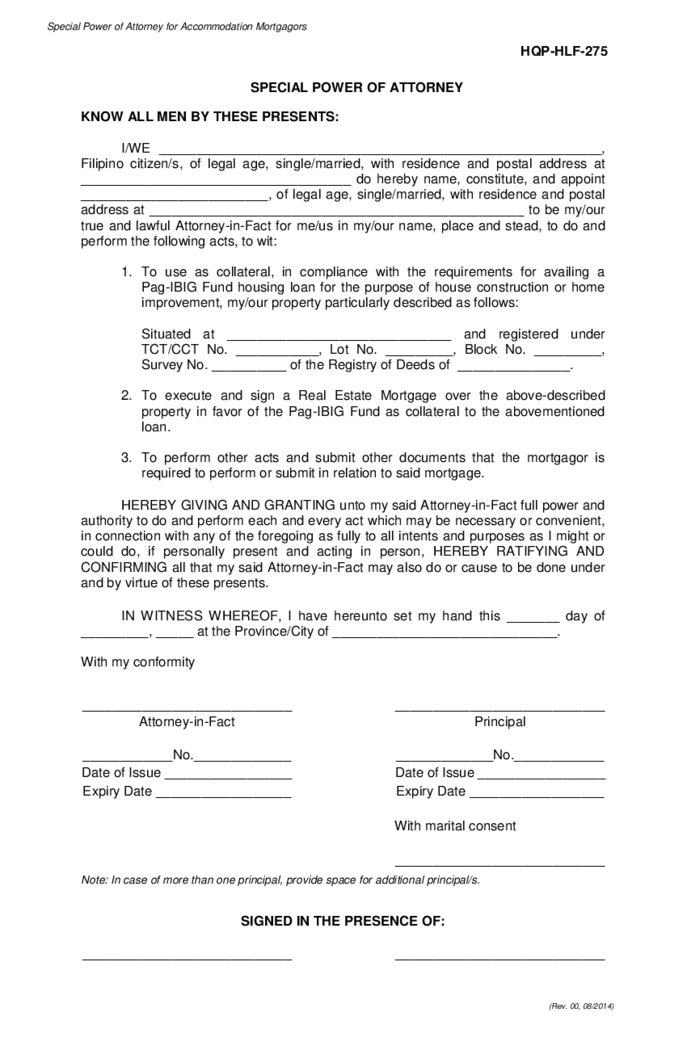

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

What Is the Pag IBIG Fund Special Power of Attorney Form?

A special power of attorney (SPA) form is a legal document that enables a person to appoint another individual to perform particular tasks on their behalf. In relation to Pag IBIG Fund, a Special P

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

What Is the Pag IBIG Fund Special Power of Attorney Form?

A special power of attorney (SPA) form is a legal document that enables a person to appoint another individual to perform particular tasks on their behalf. In relation to Pag IBIG Fund, a Special P

-

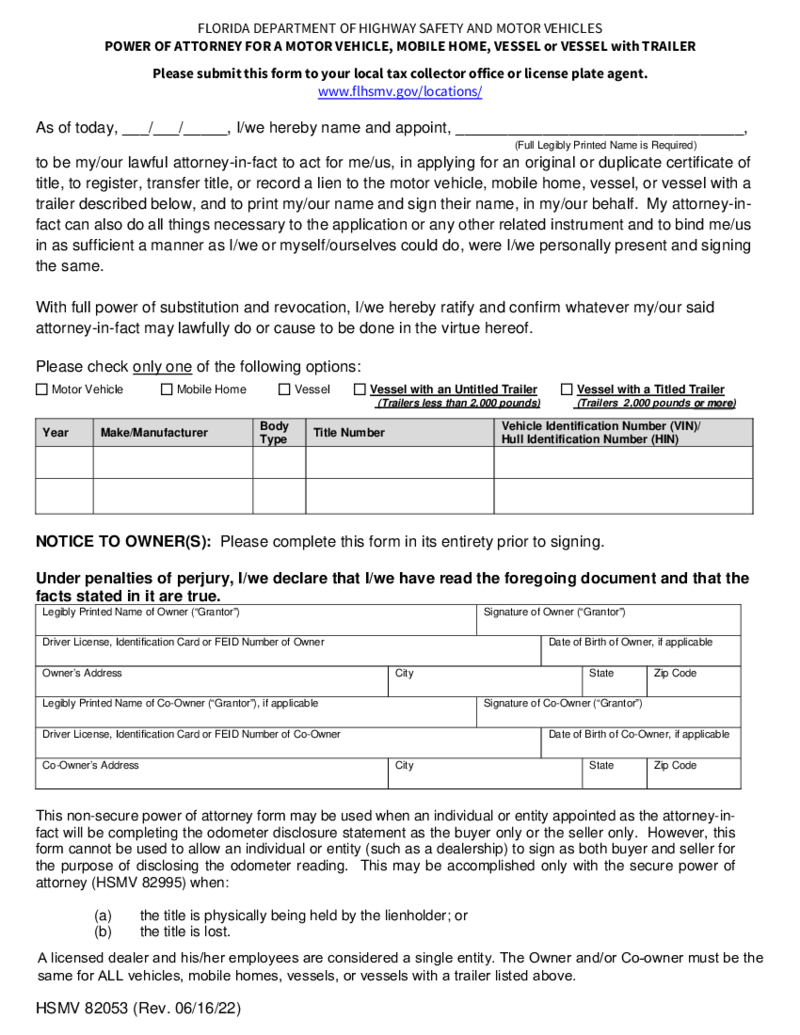

Florida Motor Vehicle Power of Attorney _ Form HSMV-82053

Introduction to Florida Department of Motor Vehicle Power of Attorney Form

The Florida department of motor vehicle power of attorney form, also known as the Form HSMV 82053, is a legal document that allows you to appoint a trusted person to handle title a

Florida Motor Vehicle Power of Attorney _ Form HSMV-82053

Introduction to Florida Department of Motor Vehicle Power of Attorney Form

The Florida department of motor vehicle power of attorney form, also known as the Form HSMV 82053, is a legal document that allows you to appoint a trusted person to handle title a

-

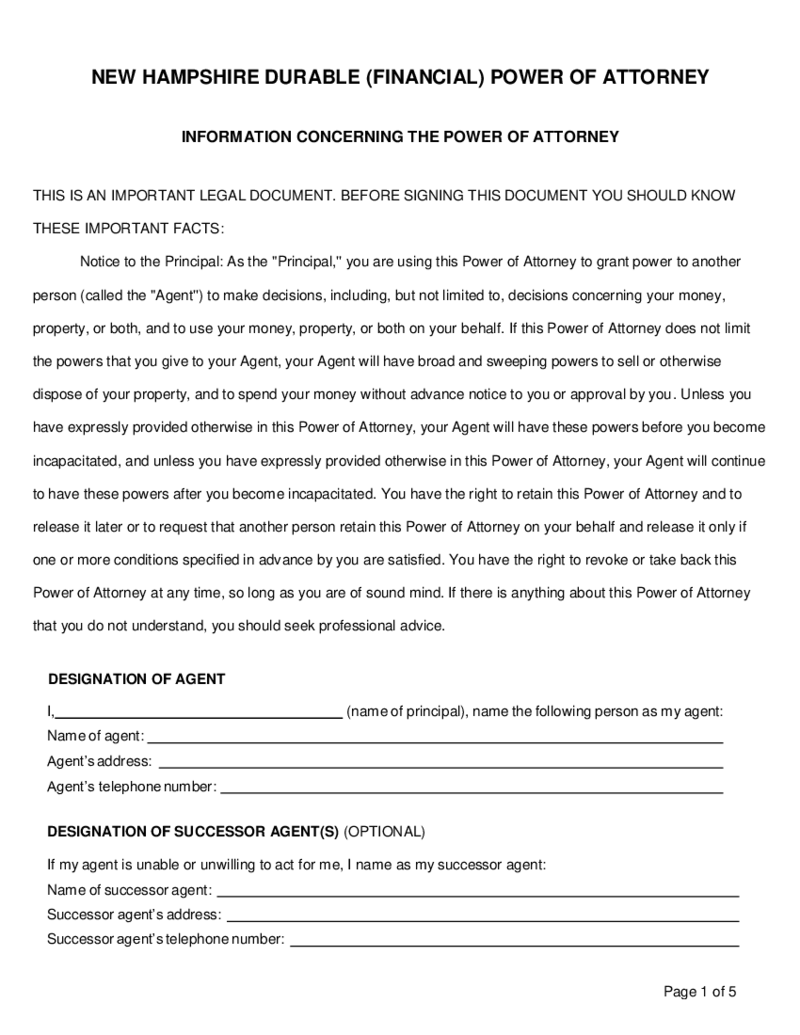

New Hampshire Durable Power of Attorney

The Vital Role of a New Hampshire Durable Power of Attorney

Understanding the implications of a New Hampshire durable power of attorney form is essential for anyone looking to ensure their financial affairs are managed effectively, particularly in unfores

New Hampshire Durable Power of Attorney

The Vital Role of a New Hampshire Durable Power of Attorney

Understanding the implications of a New Hampshire durable power of attorney form is essential for anyone looking to ensure their financial affairs are managed effectively, particularly in unfores

-

FS Form 1522

What Is FS Form 1522

Also known as "Special Form of Request for Payment of United States Savings and Retirement Securities Where Use of a Detached Request Is Authorized," FS Form 1522 is employed to request payment of various financial instrumen

FS Form 1522

What Is FS Form 1522

Also known as "Special Form of Request for Payment of United States Savings and Retirement Securities Where Use of a Detached Request Is Authorized," FS Form 1522 is employed to request payment of various financial instrumen

What Is Legal Form Template?

Legal Form Template is one of the most popular types of templates used by lawyers and law firms. You can use it to create any type of legal document, including contracts, leases, and wills. There are many different types of free downloadable legal form templates available on the PDFliner site, so you should be able to find one that suits your needs. They are used to help you create documents that are legally binding, and that can be used in court.

What Are the Legal Forms Templates Used For?

Nowadays, various legal form templates exist you can use for different purposes. Most often, these templates serve to create legal documents such as contracts, leases, and other agreements. However, there are many other uses for these templates, such as creating marketing materials, developing business plans, and even writing resumes.

Types of Legal Forms Templates

There are a variety of US legal forms. The most common use for these templates is to create documents for a variety of legal situations.

- Last Will and Testament Forms

A last will and testament is a legal document that dictates how a person's assets will be distributed after their death. This document can be created without the help of an attorney, but it is recommended that you seek legal counsel to ensure that your will is valid and correctly reflects your final wishes.

- Waivers and Consent Forms

This type of legal form template is freely used when an individual is waiving their rights to something or consenting to something. For example, a waiver and consent form may be used when an individual agrees to participate in a medical study.

- Divorce Forms

When a married couple decides to divorce, they must fill out a number of legal forms. These forms will vary depending on the couple's individual circumstances, but there are some forms that are required in all divorce cases.

- Assignment Agreements

An assignment agreement is a contract in which one party assigns (gives) its rights under a contract to another party. The assignment agreement will identify the rights being assigned and the party receiving the rights (the assignee). The agreement should also state whether the assignment is absolute or subject to conditions.

- Quit Claim Deed Forms

A quit claim deed is a legal document that is used to transfer ownership of real property from one person to another. The person who transfers the property is called the grantor, and the person who receives the property is called the grantee. The quit claim deed form is a simple document that does not require a lot of information from the grantor or the grantee.

- Non Disclosure Agreements

A non-disclosure agreement (NDA) is a legal contract between two parties, typically used to protect confidential information or trade secrets. The NDA creates a confidential relationship between the parties to share information. Confidential information is defined in the agreement, which is typically signed by both parties.

- Power of Attorney Forms

A power of attorney (POA) is a legal document that gives someone else the authority to act on your behalf. The person you name in your POA is called your “agent” or “attorney-in-fact.”

What Should Be Included in Legal Forms Templates?

If you are creating free legal template forms, certain elements should be included in the template. These elements will ensure that the form is legally binding and will protect your interests.

- Names and contact information of the parties involved. This should include the full name, mailing address, and telephone number of both the person creating the form and the person who will receive it.

- Description of the transaction. This should briefly describe what the form will be used for.

- Terms of the transaction. This is where you will list the specific terms of the agreement. Be sure to include any deadlines or timeframes that are relevant to the transaction.

- Signatures of the parties involved. This is probably the most important element of the form. Without the signatures of both parties, the form is not legally binding.

- Date of the transaction. This is the date both parties signed the form.

By including these elements in your free legal forms, you can be sure that the form will be legally binding and that your interests will be protected.

How to Create Legal Forms Templates: Step-By-Step

Here are some tips to help you in creating legal form templates:

- Your first step in creating legal forms template online is determining what document you need. There are many different types of legal documents, so it is important to choose the one that best suits your needs.

- Once you find the perfect template that matches your needs, you should begin to fill it out. It is important to read the instructions carefully so that you understand what information you need to include. Sometimes you may need to provide additional information, like your contact information or the names of witnesses.

- After you have filled out the legal form template, you can then take it to a lawyer to have it reviewed. This is an important step because a lawyer could help you ensure that the document is legally binding. If there are any questions or concerns, a lawyer can help you resolve them.