-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

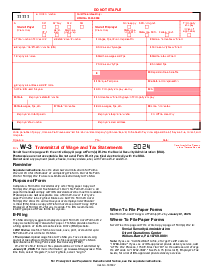

Form 1099-DIV (2020)

Get your Form 1099-DIV (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is 2020 Form 1099 DIV?

Form 1099-DIV is an IRS form issued to investors who have received dividends and other distributions from any type of investment during the year. The form includes information on the total dividends received, capital gains distributions, non-taxable distributions, and federal income tax withheld. For the 2020 tax year, recipients of such income must report it on their tax returns using the information provided on the 1099-DIV form 2020.

Who needs to file form 1099 DIV 2020?

Any individual or entity that receives dividends or distributions totaling $10 or more during the calendar year must typically receive a Form 1099-DIV. This includes shareholders in mutual funds, individuals with stock portfolios, or anyone who has earned income from dividends. Payers, such as businesses or financial institutions, must issue the form to both the recipient and the IRS if the income meets or exceeds the reporting threshold.

How to Fill Out the 1099 DIV Form 2020 PDF

Learning how to complete this DIV form template can save taxpayers from potential errors that could delay tax processing or result in fines. The process is straightforward but requires attention to detail:

- Begin by entering the payer’s information in the top left area of the form, which includes the payer's name, street address, city, state, ZIP code, and telephone number.

- Include the payer's Taxpayer Identification Number (TIN) in the designated box.

- Proceed to the top right area to fill in the recipient’s information, such as the recipient's name, street address (including apt. no.), city or town, state, country, ZIP or foreign postal code, and account number(s) if available.

- Below the recipient’s area, provide the recipient’s TIN.

- In the main section of the form, report the total amount of ordinary dividends in Box 1a. This figure represents the total dividends paid to the recipient that are taxable.

- If applicable, enter the total amount of qualified dividends in Box 1b. These are dividends that are eligible for a lower tax rate.

- In Box 2a, report the total capital gain distribution - often coming from a mutual fund or other regulated investment company - that are long-term capital gains.

- For Box 2b, specify any unrecaptured section 1250 gain from certain depreciable real property.

- Enter the section 1202 gain amount in Box 2c, which relates to specific small business stock ownership.

- In Box 2d, fill in any gains from collectibles (28% rate gain).

- If the recipient received any non-dividend distributions, record the total amount in Box 3.

- Report any federal income tax withheld, often due to backup withholding, in Box 4.

- Include the investment expenses the recipient is entitled to write off in Box 5.

- Enter the foreign tax paid and the foreign country or U.S. possession to which it relates in Boxes 6 and 7, respectively.

- In Box 8, record the total cash liquidation distributions, and in Box 9, specify noncash liquidation distributions.

- If the recipient received exempt-interest dividends from a mutual fund or other investment company, enter that amount in Box 10.

- Report specified private activity bond interest dividends in Box 11.

- Carefully review all the information entered to ensure accuracy. Once confirmed, the IRS 1099 DIV form 2020 is ready to either be printed and sent to the IRS and the recipient or submitted electronically if you are set up to e-file.

Ensuring correctness and compliance

Accuracy can't be overstated in the realm of tax reporting. Misreporting can lead to audits and penalties, making meticulous attention to detail a necessity when filing the 1099 DIV form 2020. Additionally, it is important to note that the information you provide on this form should align with other components of your tax return. Cross-reference amounts reported on the 1099-DIV with your personal financial records for a consistent and truthful tax report.

Current Version

Fillable online Form 1099-DIV (2020)