-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Power of Attorney Forms

-

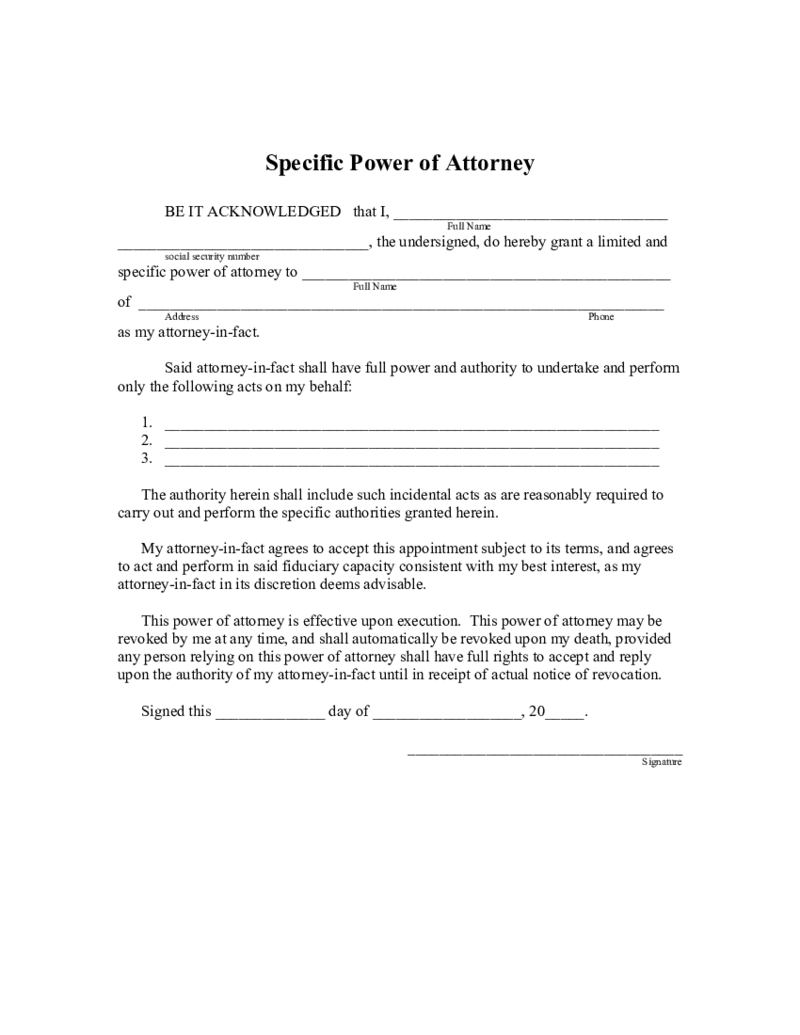

Specific Power of Attorney

Specific Power of Attorney Form: What Is It?

A limited power of attorney (POA), which is also referred to as a specific power of attorney or special power of attorney, is a legal document that authorizes a trusted person (‘grantee’, ‘age

Specific Power of Attorney

Specific Power of Attorney Form: What Is It?

A limited power of attorney (POA), which is also referred to as a specific power of attorney or special power of attorney, is a legal document that authorizes a trusted person (‘grantee’, ‘age

-

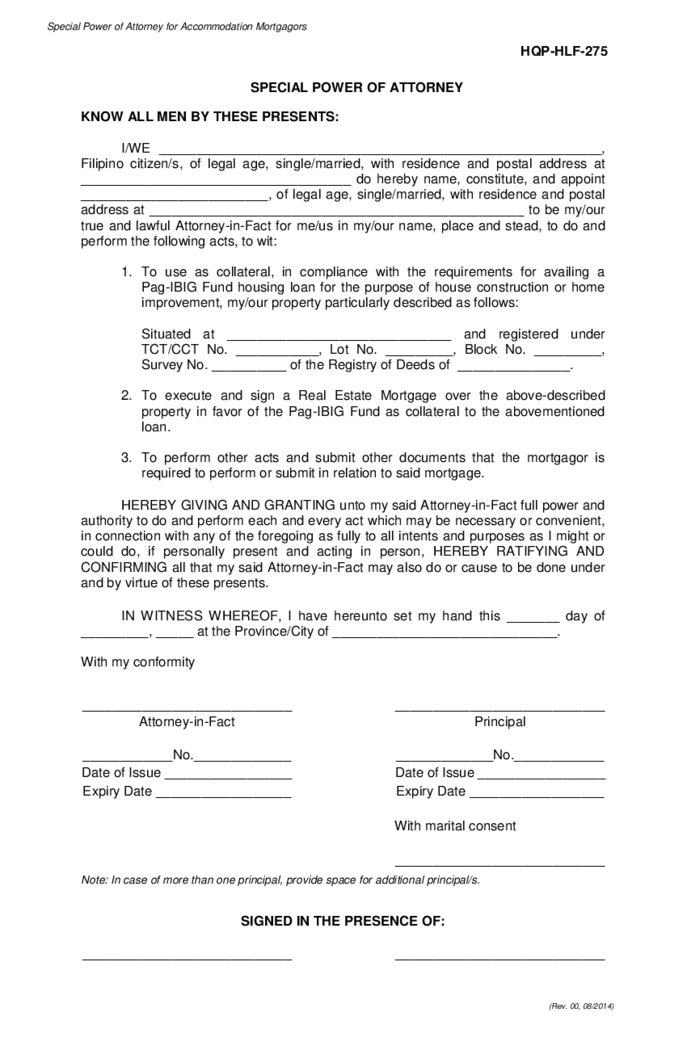

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

What Is the Pag IBIG Fund Special Power of Attorney Form?

A special power of attorney (SPA) form is a legal document that enables a person to appoint another individual to perform particular tasks on their behalf. In relation to Pag IBIG Fund, a Special P

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

What Is the Pag IBIG Fund Special Power of Attorney Form?

A special power of attorney (SPA) form is a legal document that enables a person to appoint another individual to perform particular tasks on their behalf. In relation to Pag IBIG Fund, a Special P

-

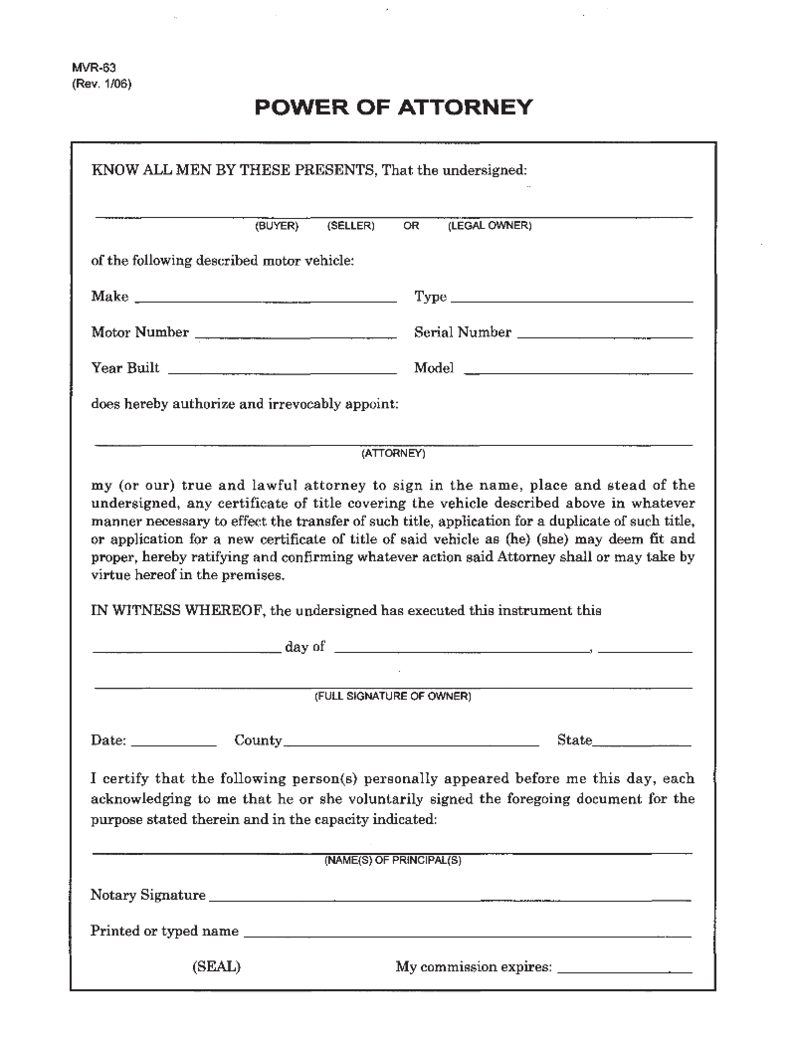

North Carolina Motor Vehicle Power of Attorney (Form MVR-63)

What is Form MVR-63?

The MVR 63 form is also called the North Carolina Motor Vehicle Power of Attorney. The document was created for specific cases. It must be used by the person who wants to appoint an attorney to take care of the problems that are relat

North Carolina Motor Vehicle Power of Attorney (Form MVR-63)

What is Form MVR-63?

The MVR 63 form is also called the North Carolina Motor Vehicle Power of Attorney. The document was created for specific cases. It must be used by the person who wants to appoint an attorney to take care of the problems that are relat

-

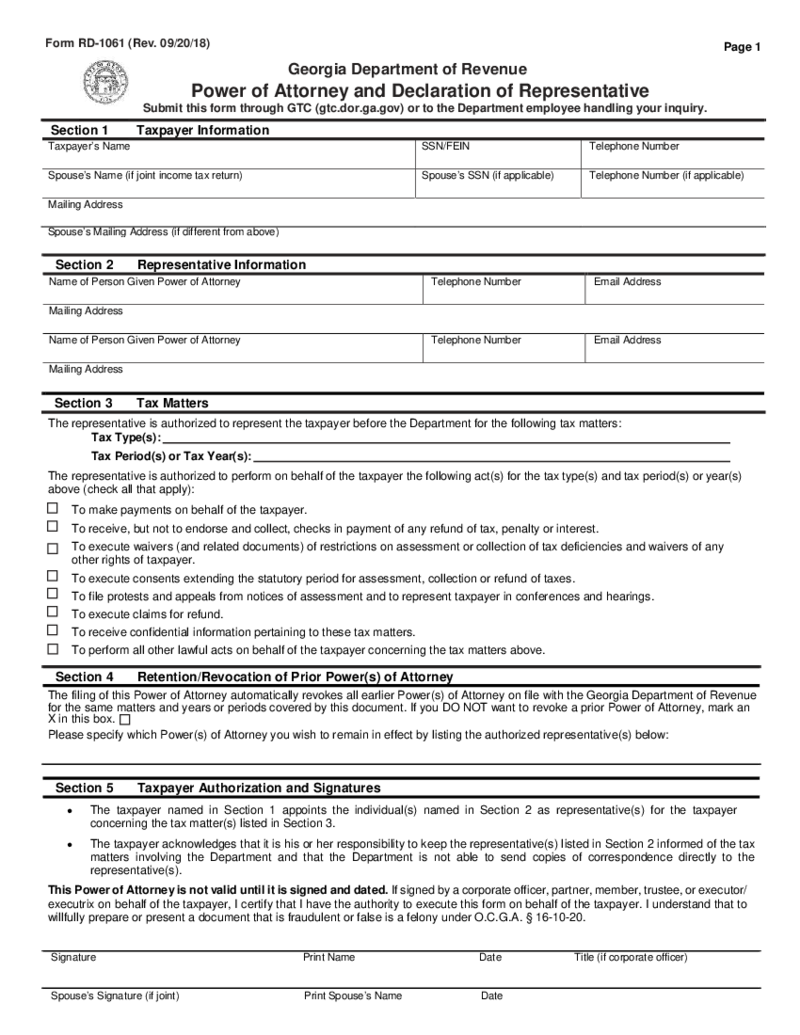

Georgia Tax Power of Attorney (Form RD-1061)

What Is a Georgia Tax Power of Attorney?

A Georgia Tax Power of Attorney (Form RD-1061) is a legal document that allows a person or entity to appoint an agent or representative to act on their behalf regarding tax matters with the Georgia Department of Re

Georgia Tax Power of Attorney (Form RD-1061)

What Is a Georgia Tax Power of Attorney?

A Georgia Tax Power of Attorney (Form RD-1061) is a legal document that allows a person or entity to appoint an agent or representative to act on their behalf regarding tax matters with the Georgia Department of Re

-

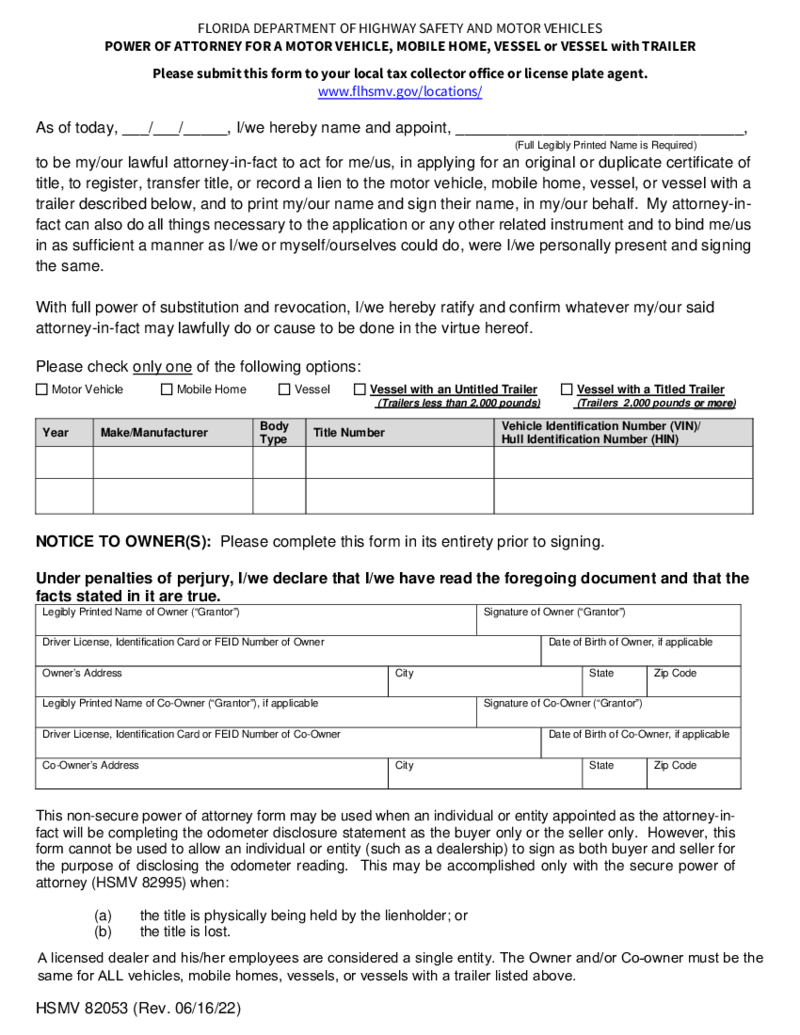

Florida Motor Vehicle Power of Attorney _ Form HSMV-82053

Introduction to Florida Department of Motor Vehicle Power of Attorney Form

The Florida department of motor vehicle power of attorney form, also known as the Form HSMV 82053, is a legal document that allows you to appoint a trusted person to handle title a

Florida Motor Vehicle Power of Attorney _ Form HSMV-82053

Introduction to Florida Department of Motor Vehicle Power of Attorney Form

The Florida department of motor vehicle power of attorney form, also known as the Form HSMV 82053, is a legal document that allows you to appoint a trusted person to handle title a

-

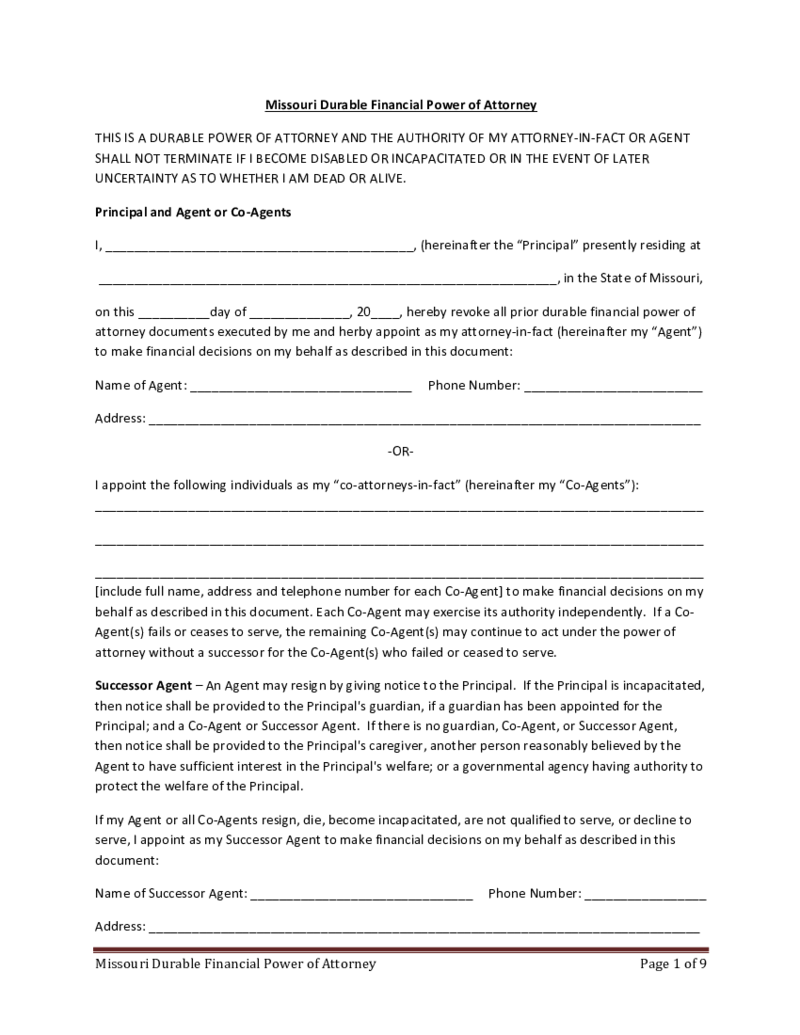

Missouri Power of Attorney Form

The fillable Missouri Power of Attorney form is required if you want to give your Agent(s) the authority to make decisions while you are away, sign documents for you, or otherwise manage your legal and financial matters.

What I need the Missouri Power of A

Missouri Power of Attorney Form

The fillable Missouri Power of Attorney form is required if you want to give your Agent(s) the authority to make decisions while you are away, sign documents for you, or otherwise manage your legal and financial matters.

What I need the Missouri Power of A

-

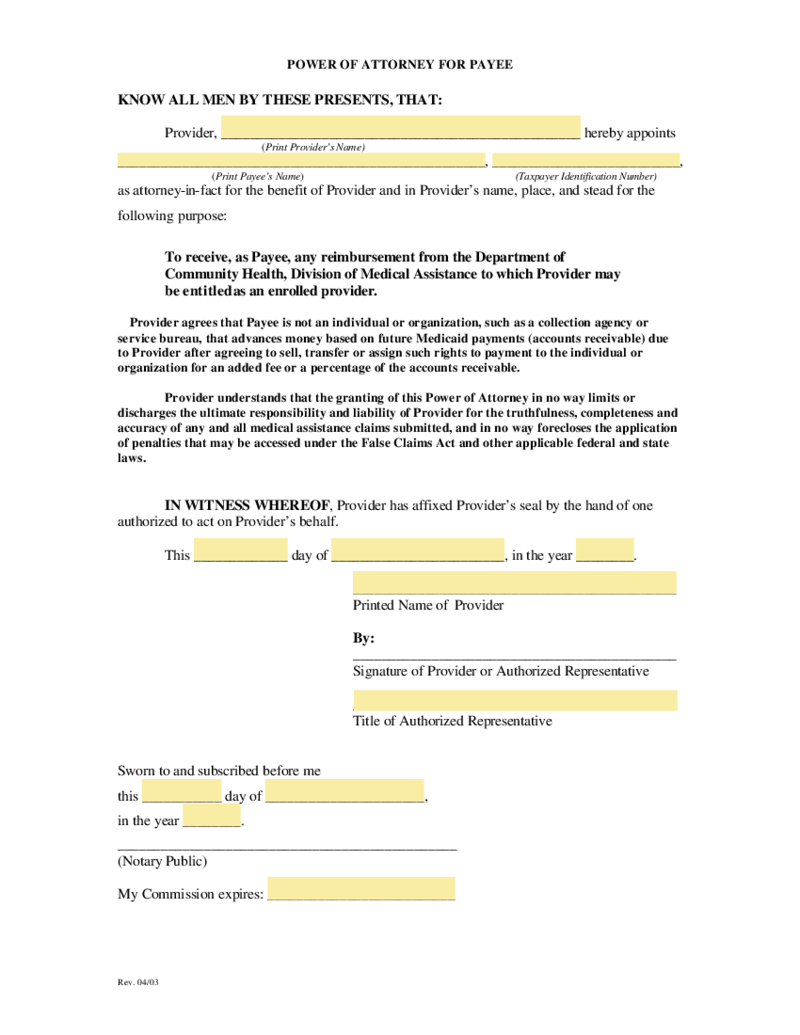

Power of Attorney For Payee - Georgia

Understanding the Power of Attorney for Payee Form

The power of attorney for payee form refers to a legal document that gives the person or organization mentioned in the document the right to handle your financial affairs. This individual, also known as t

Power of Attorney For Payee - Georgia

Understanding the Power of Attorney for Payee Form

The power of attorney for payee form refers to a legal document that gives the person or organization mentioned in the document the right to handle your financial affairs. This individual, also known as t

-

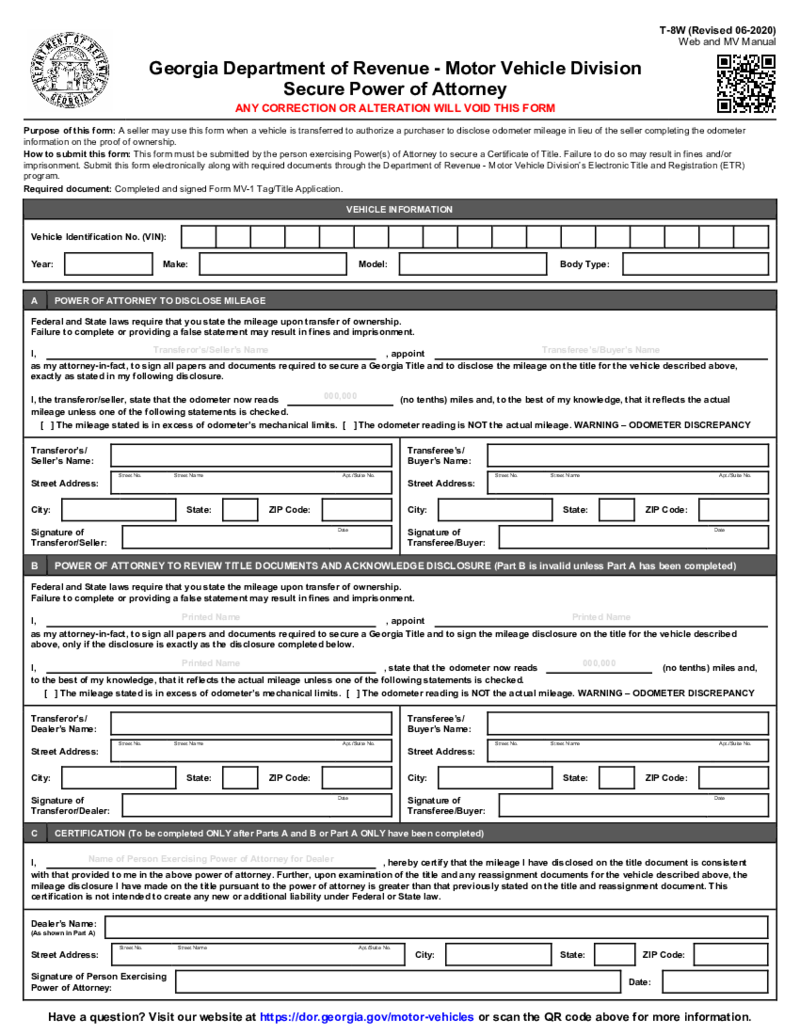

Form T-8W, Motor Vehicle Division Secure Power of Attorney - Georgia

What is Form T-8W?

The fillable and printable Georgia Secure Power of Attorney online PDF form is a valid-for-12-months document that allows you to choose someone to represent and/or register a vehicle on your behalf.

What I need the Vehicle Po

Form T-8W, Motor Vehicle Division Secure Power of Attorney - Georgia

What is Form T-8W?

The fillable and printable Georgia Secure Power of Attorney online PDF form is a valid-for-12-months document that allows you to choose someone to represent and/or register a vehicle on your behalf.

What I need the Vehicle Po

-

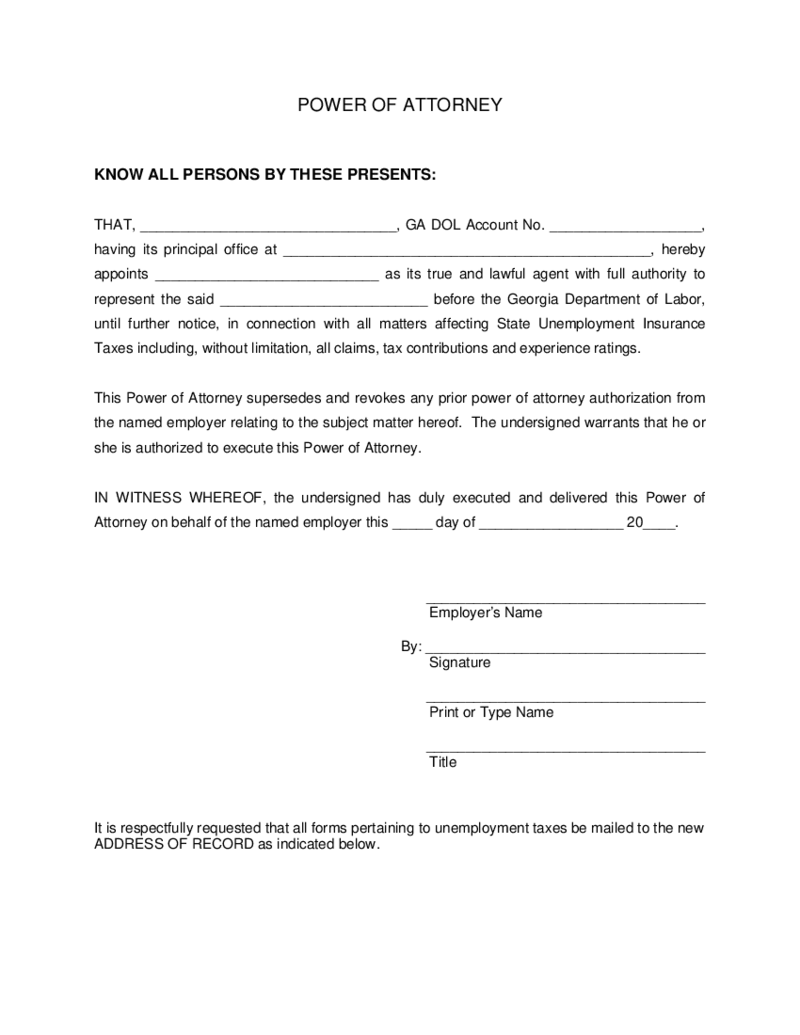

Power of Attorney - Georgia Department of Labor

Understanding When a Power of Attorney is Needed for the Georgia DOL

When dealing with matters concerning the Georgia Department of Labor (DOL), understanding when a power of attorney is needed can be crucial in ensuring a smooth and efficient process. A

Power of Attorney - Georgia Department of Labor

Understanding When a Power of Attorney is Needed for the Georgia DOL

When dealing with matters concerning the Georgia Department of Labor (DOL), understanding when a power of attorney is needed can be crucial in ensuring a smooth and efficient process. A

-

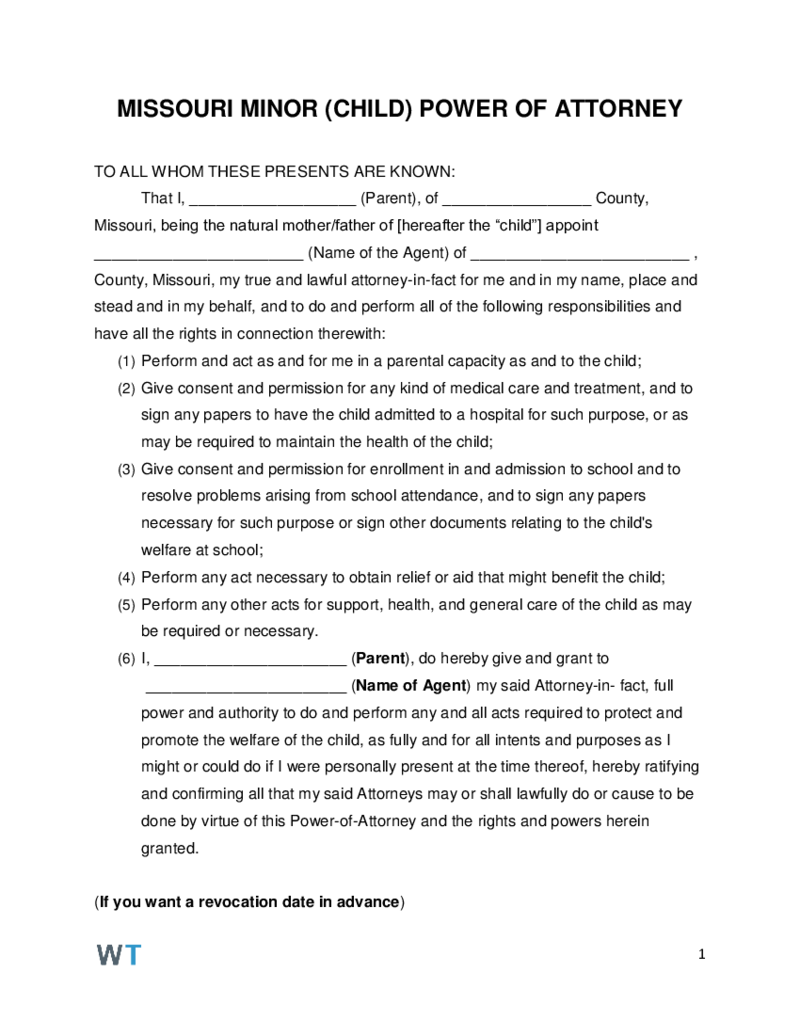

Missouri Minor Child Power of Attorney

What Is a Missouri Minor Child Power of Attorney Form?

A Missouri minor child power of attorney form is the official permission of a parent or guardian to temporarily transfer some or all of the responsibility for caring for a little child to another pers

Missouri Minor Child Power of Attorney

What Is a Missouri Minor Child Power of Attorney Form?

A Missouri minor child power of attorney form is the official permission of a parent or guardian to temporarily transfer some or all of the responsibility for caring for a little child to another pers

-

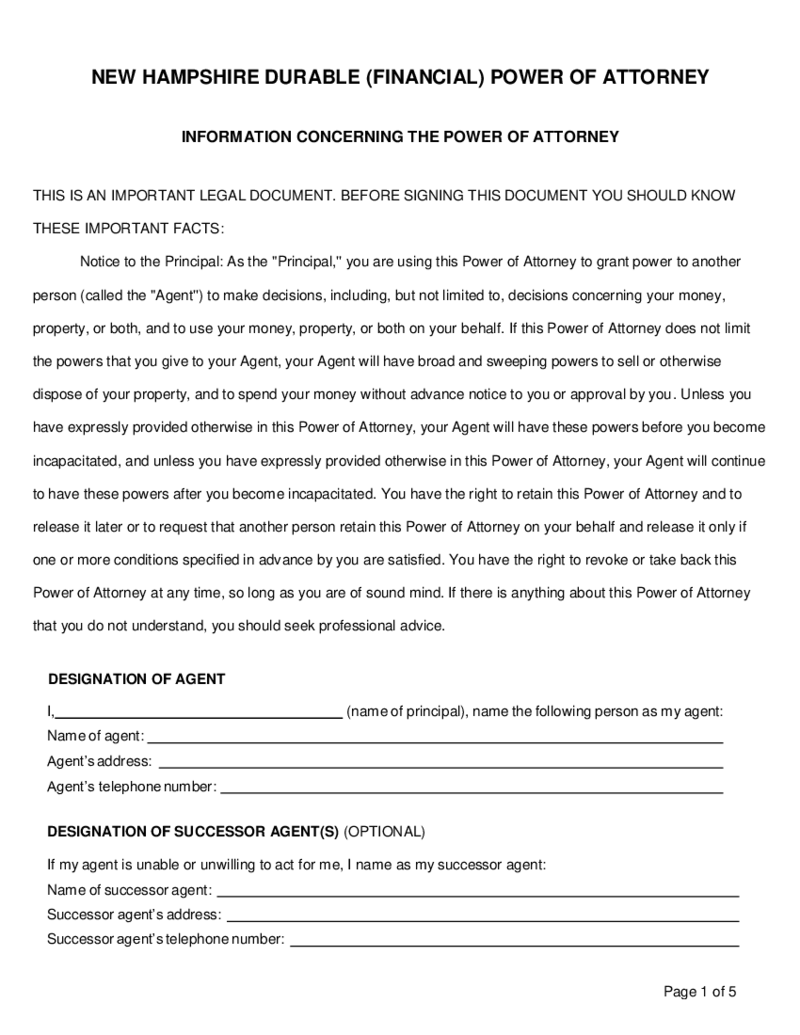

New Hampshire Durable Power of Attorney

The Vital Role of a New Hampshire Durable Power of Attorney

Understanding the implications of a New Hampshire durable power of attorney form is essential for anyone looking to ensure their financial affairs are managed effectively, particularly in unfores

New Hampshire Durable Power of Attorney

The Vital Role of a New Hampshire Durable Power of Attorney

Understanding the implications of a New Hampshire durable power of attorney form is essential for anyone looking to ensure their financial affairs are managed effectively, particularly in unfores

-

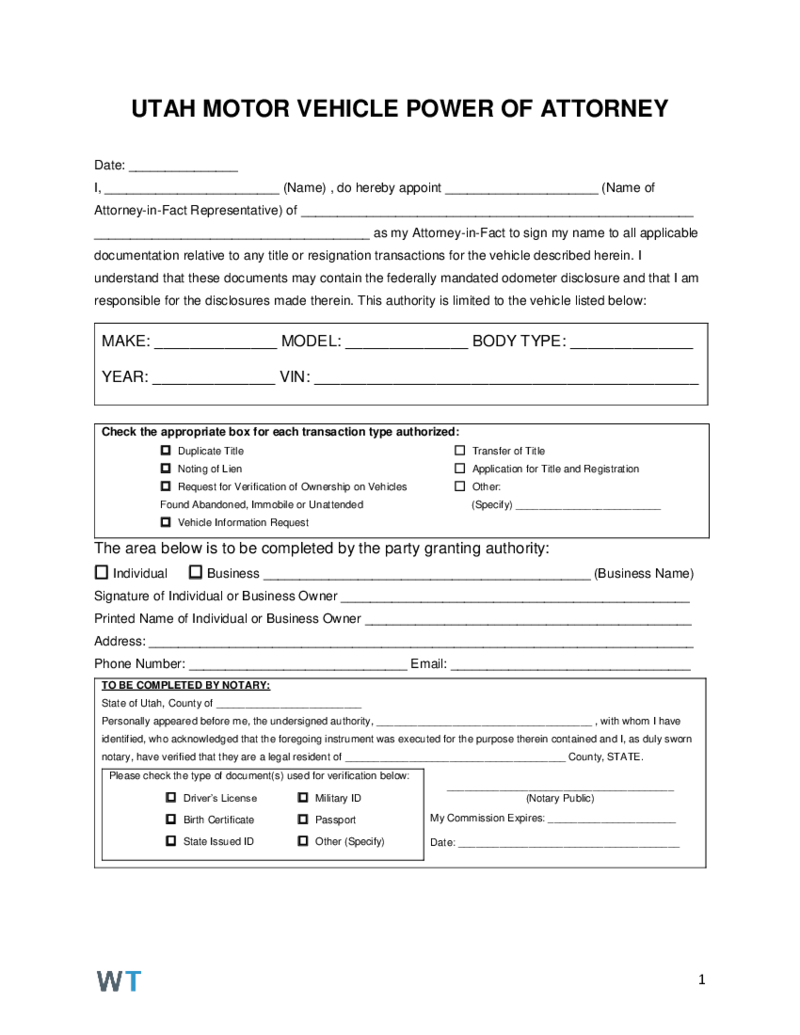

Utah Motor Vehicle Power of Attorney

What Is Utah Motor Vehicle Power Of Attorney

The Utah Motor Vehicle Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person or entity as their attorney-in-fact. This designated person is granted t

Utah Motor Vehicle Power of Attorney

What Is Utah Motor Vehicle Power Of Attorney

The Utah Motor Vehicle Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person or entity as their attorney-in-fact. This designated person is granted t

When to Use Power of Attorney Forms?

No matter whether you use power of attorney forms online or offline, these documents were made to simplify the life of one person and share responsibilities with a professional attorney who may act on their behalf. You can pick any trustable representative for your affairs. This person will handle your business on your behalf the way you wish it to, expressing your thoughts and opinions. The agent that the person names as a personal attorney deal with different tasks, including those that are tax-related, guardianship, medical, and financial.

The document grants the powers to the attorney to act on a person’s behalf. If you can’t deal with legal documents and need a representative, this is the form you need. Sometimes, the document is used to delegate taking medical decisions on behalf of patients who can no longer express these decisions themselves.

Types of Online Power of Attorney Forms

There are several types of the same document you can use. It is made for users’ comfort. You don’t need to fill any template if you have specific needs. It speeds up the whole process. Here is the special power of attorney forms that are the most widely used among taxpayers across the country. You will find all of these types on PDFLiner whenever you need them, and they will serve you on different occasions. Make sure you get familiar with each type before you fill any document:

- General or non-durable type. It provides financial powers to the attorney that is hired. You trust this person to make decisions on your behalf, mainly when it comes to business or its legal sides. However, this form has its limitations. It becomes ineffective in the case of mentally disabled people or incapacitated clients;

- Durable or financial type. This is the most used form by Americans. It gives the right to the person who signs the document to delegate the task to the attorney to handle the financial transaction on this person’s behalf. A power of attorney, according to the document is unrestricted till it matches the major wishes of the principal;

- Limited or Special type. It grants the right for the attorney to act on the principal’s behalf in a specific period of time. This document has a deadline. If the principal wants to provide the freedom to the attorney to act on his behalf during special occasions, instead of a time limit, there can be specific the occasion in the document;

- Real Estate POA. It is mainly used by the buyers and sellers of real estate. The form grants the right to the attorney to deal with negotiation and even financial transactions if the principal requires it on behalf of this person. An attorney can start negotiations about the real estate. Yet, the final decision must still be taken by the principal;

- Tax POA or IRS POA. This document is also known as form 2848. It was released back in 2015, and you can find an updated version nowadays. It grants the rights to an attorney to file the taxes on behalf of the individual or the company. This form must be supported by other documents as attachments and signatures of several witnesses;

- Health Care or medical type. This form is originally used by the person who wants to choose the representative to make health care decisions. If the person becomes unable to express their own wishes about health care, the attorney can make these decisions based on the form filled out by the person. The document must be signed by witnesses as well;

- Vehicle type was made by the Department of Motor Vehicles. It solves the problem of registering, selling, or buying a car. If the person requires the legal representative to buy, sell, and fill the forms to receive titles or registration, this document must be submitted to the DMV in the first place;

- Revocation. If you don’t need the services of an attorney anymore, you can fill out this document. It cancels the previous agreement, no matter the type. Make sure you fill it out in advance.

How to Write a Power of Attorney Letter Sample

You can easily find blank power of attorney forms on the Internet. Based on the type of template you need, you can find it on the official websites. All the types are gathered on PDFLiner as well. Once you open it, you will see the document with empty sections you have to fill in front of you. Not all of them are similar. Some of them require specific information. Some of them may differ from state to state. Yet, when it comes to the general procedure, you have to provide personal data on you and the other party. Here are the step-by-step instructions on how to fill out a standard power of attorney form:

- Read the statement that is revealed in the form in the first place. If it does not match your interests, go and search for another template. Even one slightest difference may be crucial once you sign the document;

- Fill in the sections about you. Include your full name there, your phone, address, and email. Make sure that your phone is correct and the email is checked by you frequently. If you are changing the address, it is better to provide the one you can be connected at;

- Provide the information about the agent and the person who can become the successor of the agent. You have to include the data on the agent’s full name, address, phone, and email. The same goes for the successor. You don’t need to name the successor of the agent if you don’t want to. Yet, it might be helpful whenever the agent is not available, and the decision must be made immediately. If the problem is vital, and you are worried that the agent and successor will be absent, you may name the third person who will take responsibility on your behalf. Don’t worry, there is enough space in the document to do it, and you will feel more secure after;

- Read the blocks with propositions to grant a wide range of rights to the attorney and pick only those that you want. You don’t need to put ticks in each section. You can limit the power you offer to the professional that you’ve hired. Based on the type of form, you can choose the type of access this person receives to your business;

- Grant access to the information and to the actions that may be performed on your behalf. You can limit not only the type of power the attorney receives but also the actions. If you don’t want to give access to the business entirely, you can pick the appropriate options in the document or name them in specific sections;

- Provide limitations to the authority of the attorney that represents you. You can underline those powers that must be kept untouched by the agent. Include them in the form;

- Provide extra instructions to be followed by an attorney. Your attorney can act on your behalf by using a specific approach if you want. In this case, write down step-by-step instructions;

- Name the deadline for the attorney’s work if you want;

- Sign the document. Ask the agent to sign it. Gather two witnesses and ask them to sign the document as well.

Where to Get Power of Attorney Forms

Almost all online power of attorney forms can be found either on the official government websites based on their types or on PDFLiner. PDFLiner also offers quick access to the document and the ability to fill it on your device without the need to download it in the first place. You can read the description for every form there and enter the one you need. Use the tools you see on the upper panel, including the tool that allows you to create an e-signature to fill the document. Don’t forget to save the copy on your device and send documents to the other party.

FAQ:

-

What power of attorney form covers everything?

There are no universal forms of POA that can cover all the issues. Yet, the closest to the universal is the general form. However, it is not financial and still can be limited in time. You have to think about which type of form you need the most and which responsibilities you want to delegate to the attorney. Once you understand the details, use PDFLiner with over 200 different templates related to a power of attorney.

-

Does a power of attorney form need to be notarized?

Yes, it needs to be notarized since it is a legal document. You delegate your work to another person, meaning that the person becomes your voice. You have to prove that you are in your own mind by asking two witnesses to sign the document and the notary public to recognize your contract officially. Sometimes your attorney may be enough if the document is signed in the presence of witnesses. Yet, not all of the types can be equally recognized in the court or by officials, especially if they allow attorneys to make life-changing decisions on your behalf.

-

How to terminate the power of attorney forms?

There is a specific type of form that is called Revocation. You can use this template to stop the action of the original form. Moreover, you can put the deadline of the attorney’s actions in the document you sign in the first place. This way, the attorney will be limited by time. You can take the Limited type of form to grant limited access to the attorney to your business. After the deadline, the attorney is no longer able to make decisions on your behalf. You can also limit the tasks you are allowed to perform.

-

Who signs a power of attorney forms?

Several people have to sign the form. Based on the type of the form, the list may change. However, the most popular types include the signatures of the person who fill the form, the attorney, and two witnesses. If you want to appoint several successors to the attorney, they also have to sign the document. If the document contains information about health care decisions, it also must be signed by the notary public.