-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Social Security Administration Forms - page 2

-

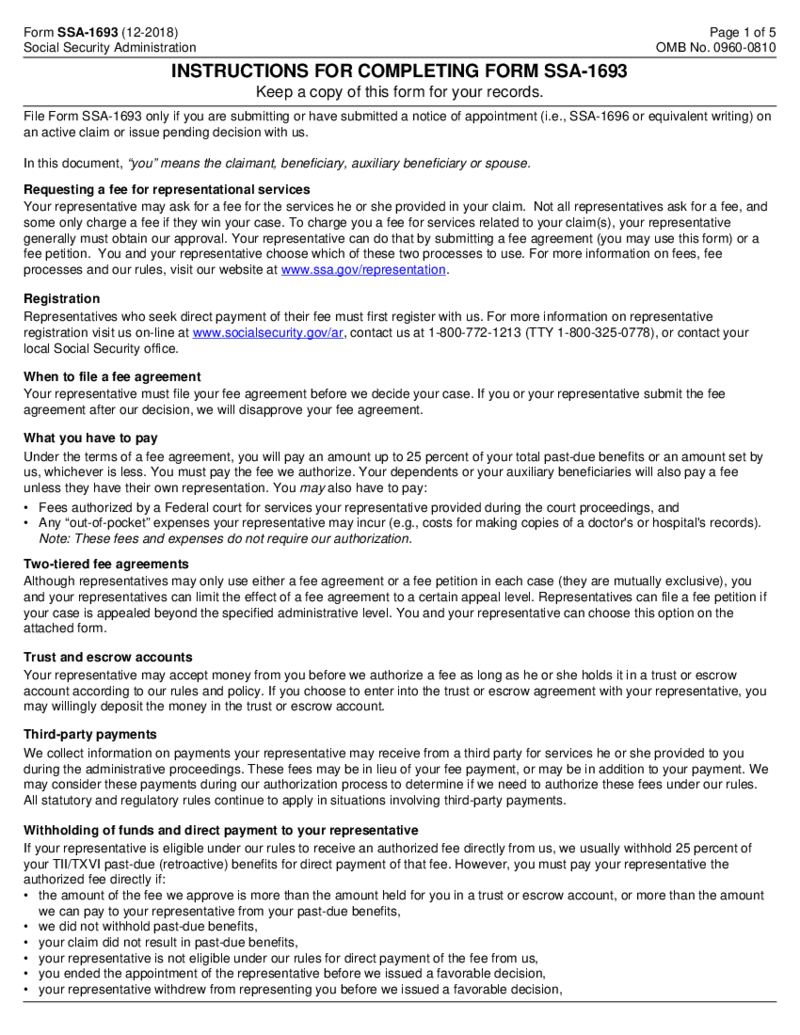

SSA-1693, Fee Agreement for Representation

SSA-1693 Fee Agreement Form

The SSA-1693 Fee Agreement Form is a legal document used by social security claimants to establish an agreement with their representatives regarding the fees for services rendered. It is crucial to promoting transparency and fa

SSA-1693, Fee Agreement for Representation

SSA-1693 Fee Agreement Form

The SSA-1693 Fee Agreement Form is a legal document used by social security claimants to establish an agreement with their representatives regarding the fees for services rendered. It is crucial to promoting transparency and fa

-

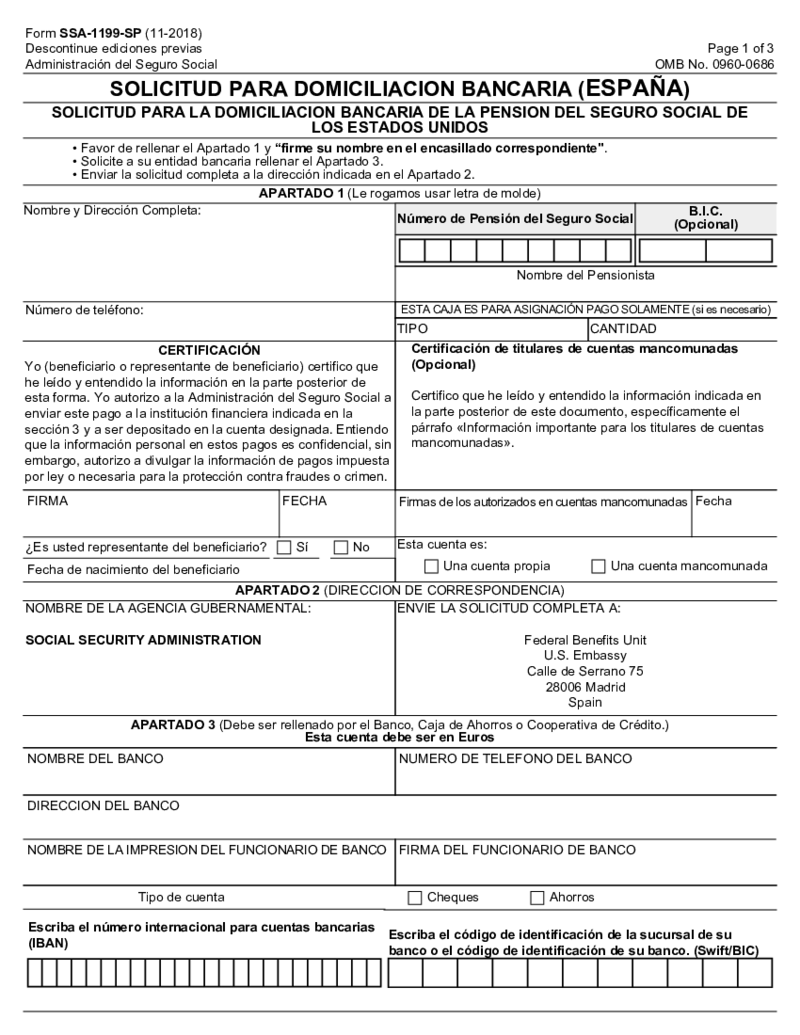

SSA-1199-SP, Direct Deposit Sign Up Form, Spanish

Understanding the SSA-1199-SP Form

The SSA-1199-SP is a Spanish version of the direct deposit sign up form typically available in English, specifically designed for Social Security beneficiaries. Its primary aim is to facilitate the direct deposit setup p

SSA-1199-SP, Direct Deposit Sign Up Form, Spanish

Understanding the SSA-1199-SP Form

The SSA-1199-SP is a Spanish version of the direct deposit sign up form typically available in English, specifically designed for Social Security beneficiaries. Its primary aim is to facilitate the direct deposit setup p

-

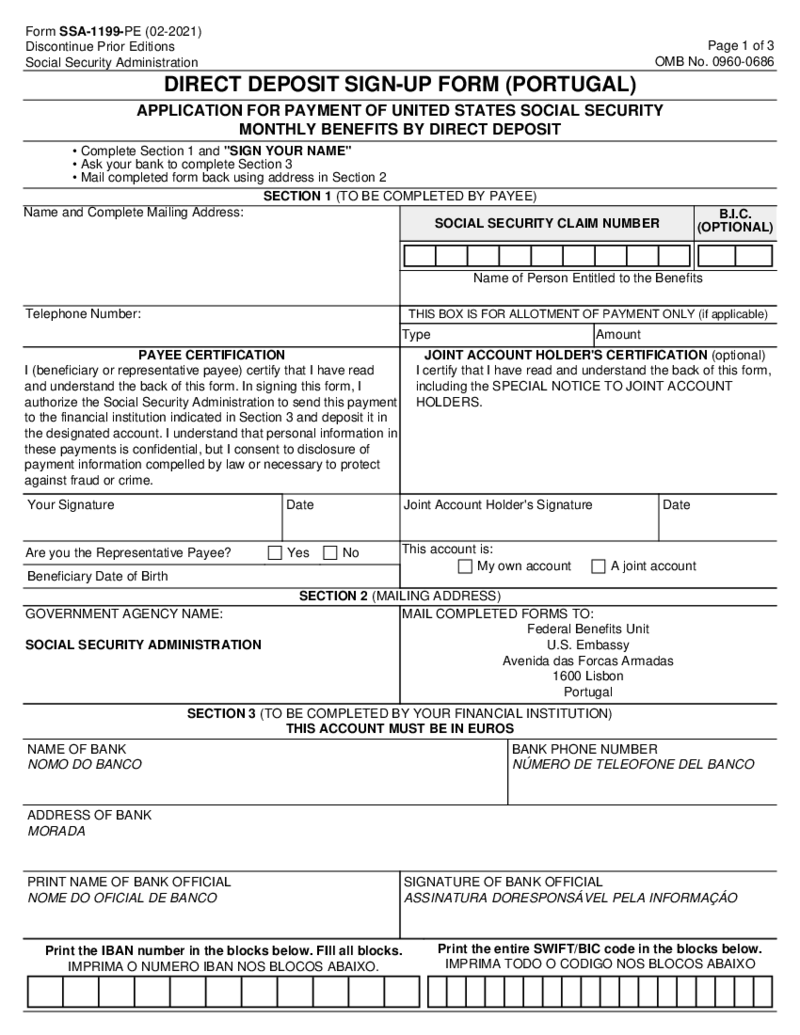

SSA-1199-PE, Direct Deposit Sign Up Form, Portugal

The SSA-1199-PE form is a crucial document for those residing in Portugal who are beneficiaries of U.S. Social Security. It enables you to set up a direct deposit system for your benefits, ensuring a seamless and secure transfer of funds into your bank account.

SSA-1199-PE, Direct Deposit Sign Up Form, Portugal

The SSA-1199-PE form is a crucial document for those residing in Portugal who are beneficiaries of U.S. Social Security. It enables you to set up a direct deposit system for your benefits, ensuring a seamless and secure transfer of funds into your bank account.

-

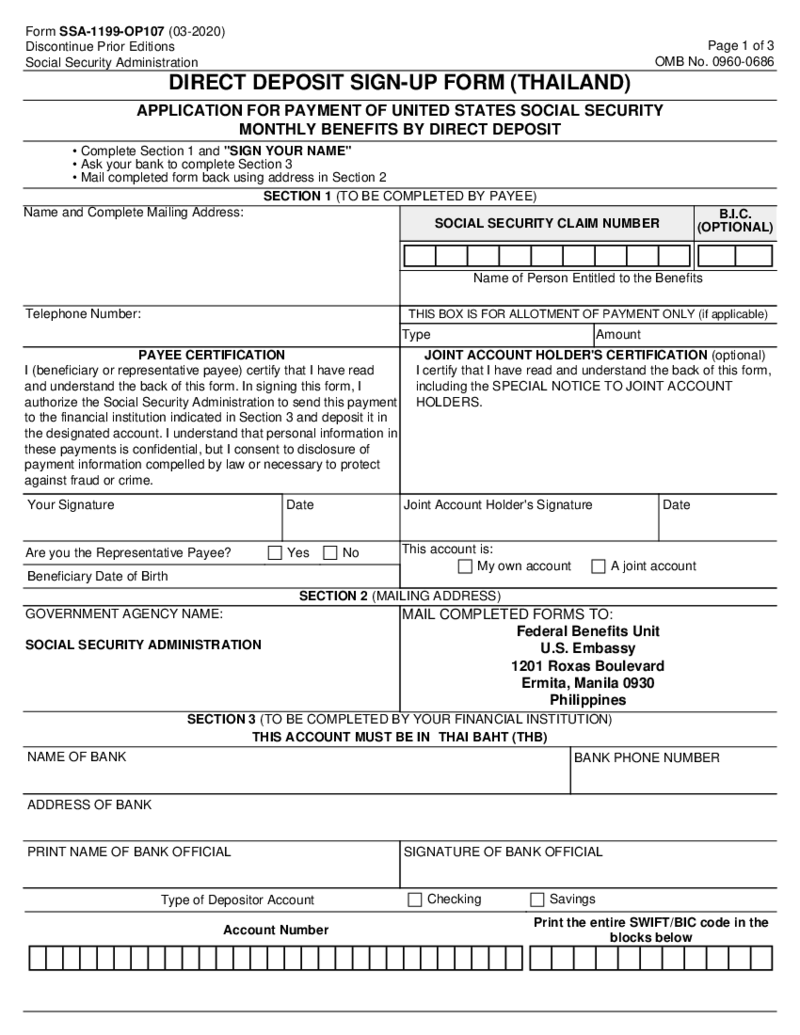

SSA-1199-OP107, Direct Deposit Sign Up Form, Thailand

Understanding the SSA-1199-OP107 Form

The SSA-1199-OP107 form is provided by the Social Security Administration in the United States. This form serves as an instrument for individuals residing in Thailand to initiate their direct deposit sign-up process f

SSA-1199-OP107, Direct Deposit Sign Up Form, Thailand

Understanding the SSA-1199-OP107 Form

The SSA-1199-OP107 form is provided by the Social Security Administration in the United States. This form serves as an instrument for individuals residing in Thailand to initiate their direct deposit sign-up process f

-

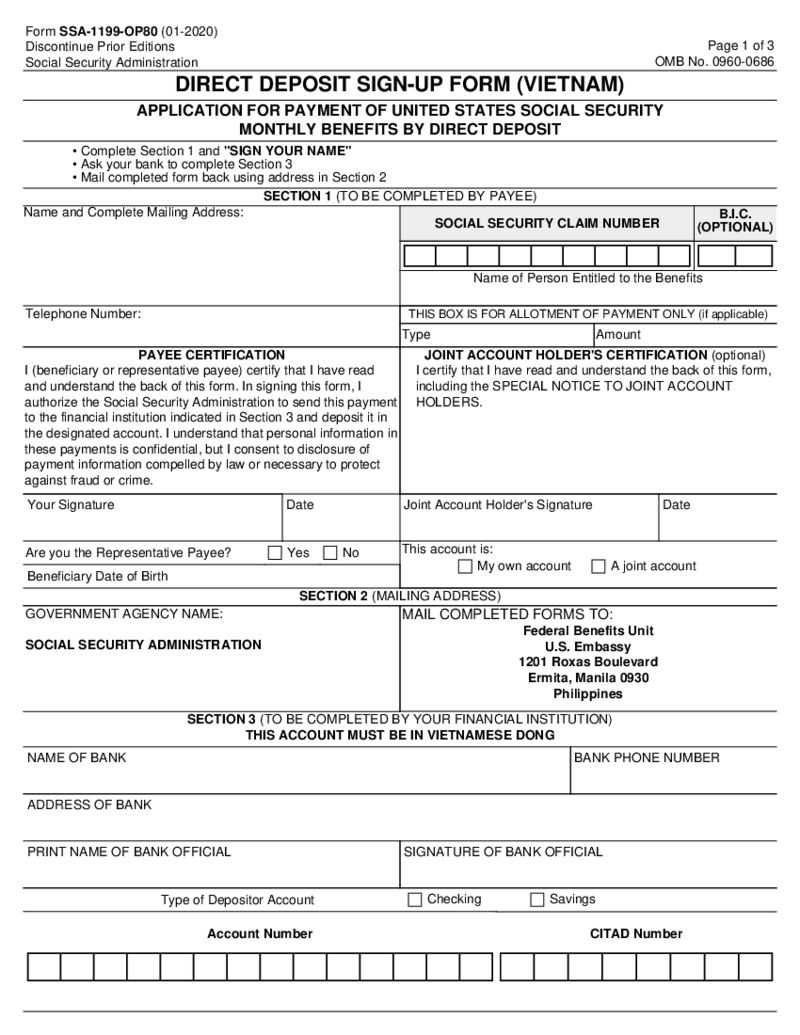

SSA-1199-OP80, Direct Deposit Sign Up Form, Vietnam

Banking and finance-related paperwork can be complex, especially when dealing with international transactions. Understanding each form thoroughly can

SSA-1199-OP80, Direct Deposit Sign Up Form, Vietnam

Banking and finance-related paperwork can be complex, especially when dealing with international transactions. Understanding each form thoroughly can

-

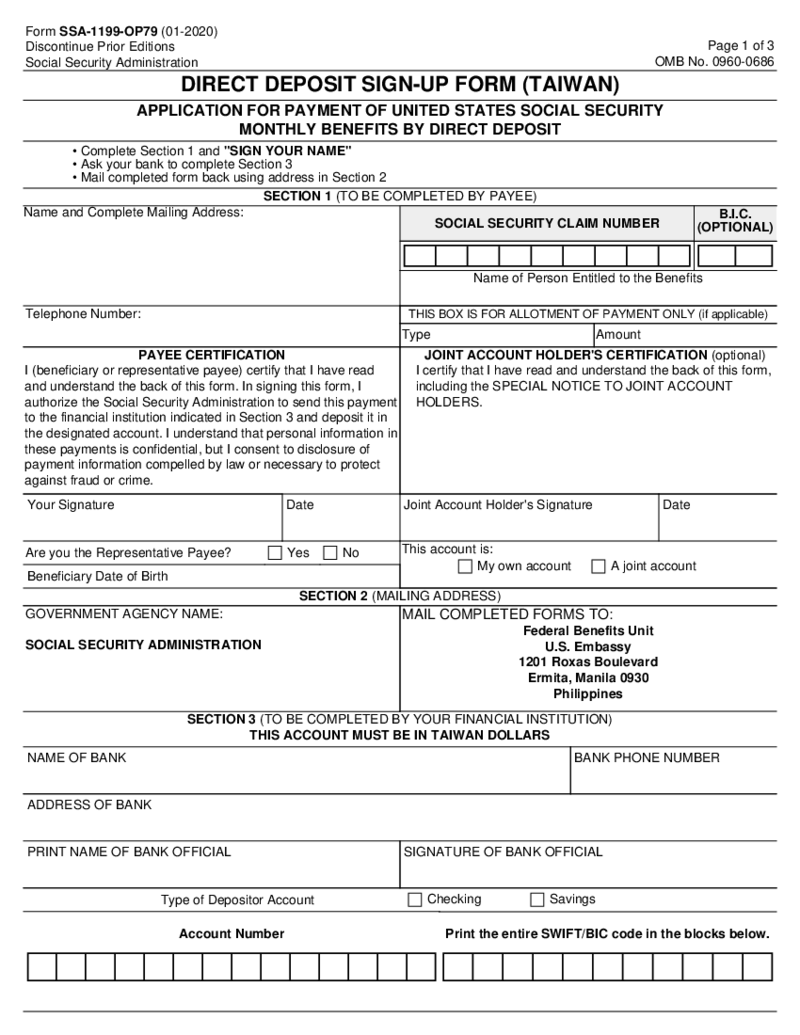

SSA-1199-OP79, Direct Deposit Sign Up Form, Taiwan

What is Form Direct Deposit Sign Up?

The direct deposit sign up form was created and provided by the Social Security Administration of the US. It is also known as the SSA-1199-OP79 template. The form is made as the application for the monthly payment from

SSA-1199-OP79, Direct Deposit Sign Up Form, Taiwan

What is Form Direct Deposit Sign Up?

The direct deposit sign up form was created and provided by the Social Security Administration of the US. It is also known as the SSA-1199-OP79 template. The form is made as the application for the monthly payment from

-

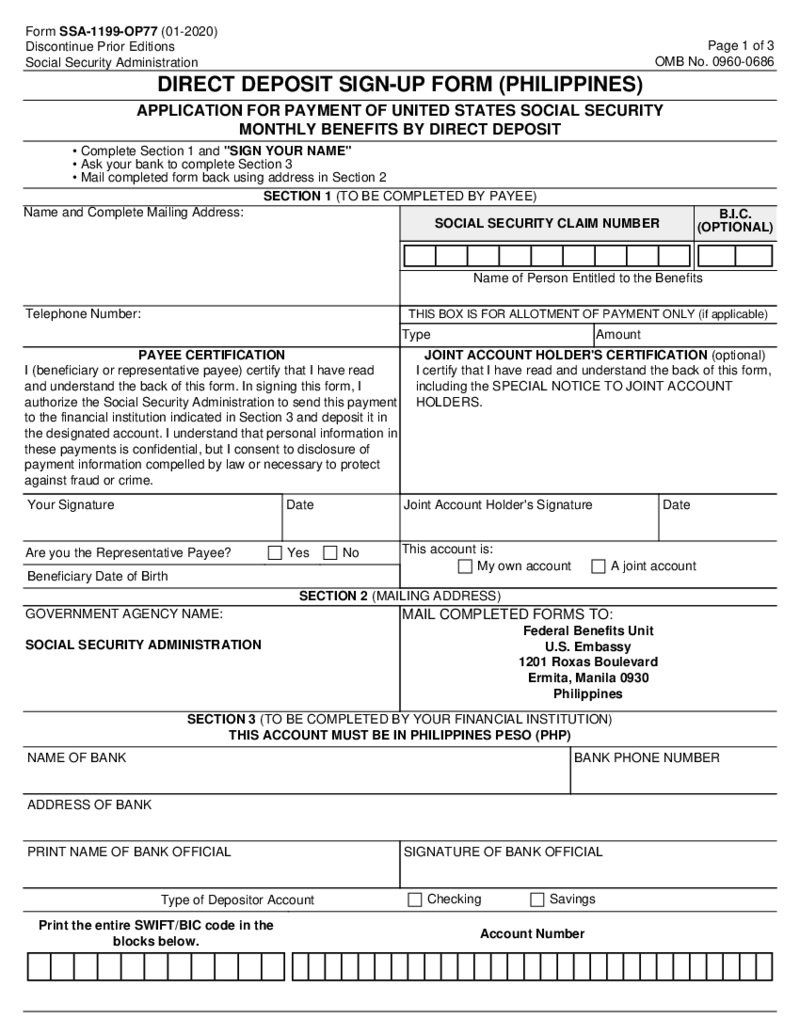

SSA-1199-OP77, Direct Deposit Sign Up Form, Philippines

What Is an SSA 1199 OP 77 Form?

An SSA 1199 form is also known as the Direct Deposit Sign-Up document. It is used in the Philippines. The paper is filed by the person to receive the payment of the US Social Security monthly benefits as a direct deposit. Y

SSA-1199-OP77, Direct Deposit Sign Up Form, Philippines

What Is an SSA 1199 OP 77 Form?

An SSA 1199 form is also known as the Direct Deposit Sign-Up document. It is used in the Philippines. The paper is filed by the person to receive the payment of the US Social Security monthly benefits as a direct deposit. Y

-

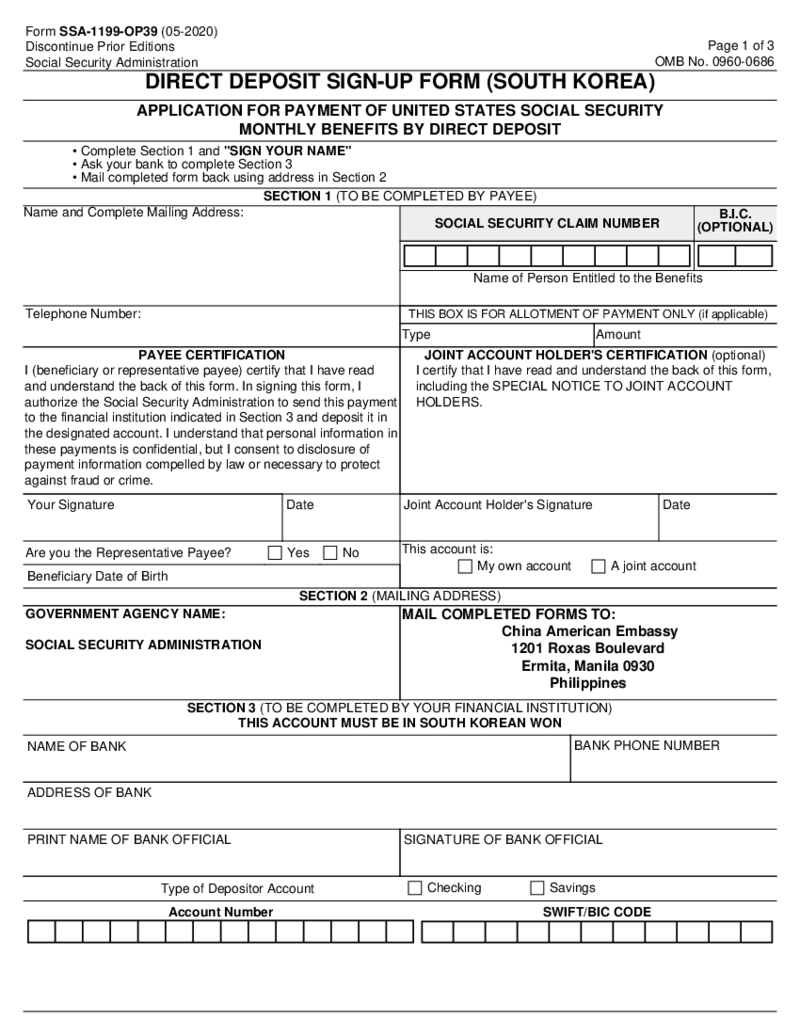

SSA-1199-OP39, Direct Deposit Sign Up Form, South Korea

Who Needs the SSA-1199-OP39 Form

This form is required by SSA beneficiaries residing in South Korea who wish to opt for direct deposit of their benefits. This includes retirees, disabled individuals, and other beneficiaries of SSA. It is especially benefi

SSA-1199-OP39, Direct Deposit Sign Up Form, South Korea

Who Needs the SSA-1199-OP39 Form

This form is required by SSA beneficiaries residing in South Korea who wish to opt for direct deposit of their benefits. This includes retirees, disabled individuals, and other beneficiaries of SSA. It is especially benefi

-

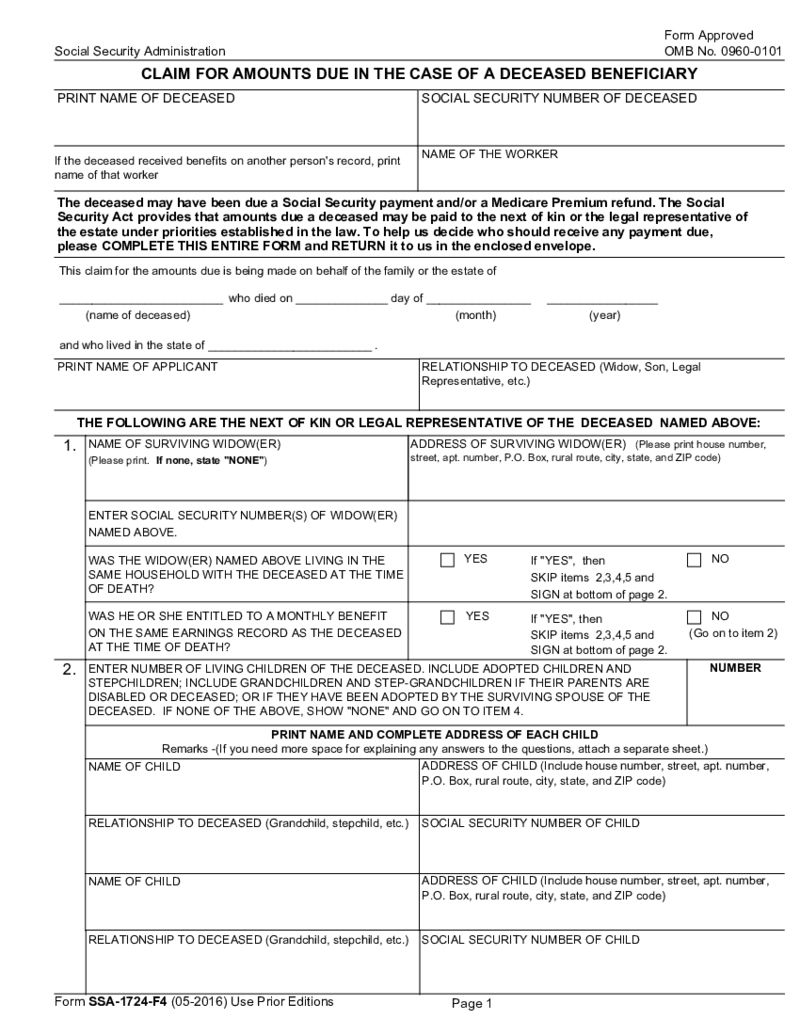

SSA-1724-F4, Claim for Amounts due in case of a Deceased Beneficiary

What Is SSA 1724 F4?

The SSA 1724 F4 fillable form is a two-page document that is filled out after the death of a relative. With its help, you, as a responsible person, can receive the due social benefits that the deceased did not get before passing away.

SSA-1724-F4, Claim for Amounts due in case of a Deceased Beneficiary

What Is SSA 1724 F4?

The SSA 1724 F4 fillable form is a two-page document that is filled out after the death of a relative. With its help, you, as a responsible person, can receive the due social benefits that the deceased did not get before passing away.

-

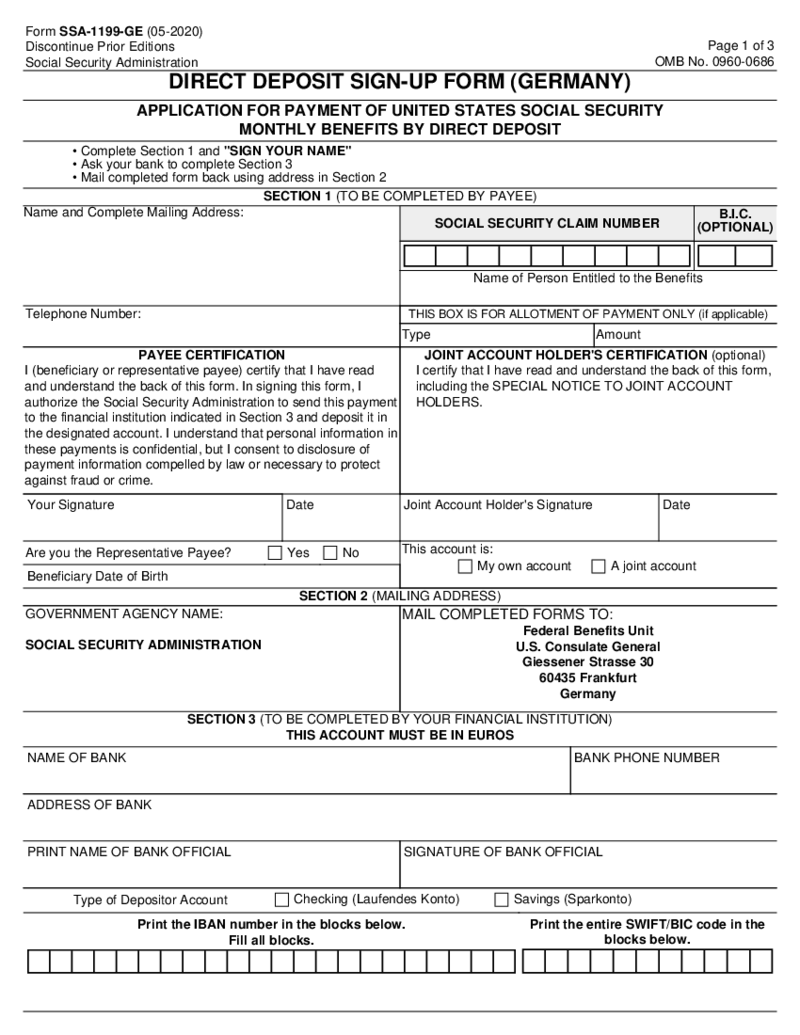

SSA-1199-GE, Direct Deposit Sign Up Form, Germany

What Is Direct Deposit Sign Up Form

The Direct Deposit Sign Up Form, officially known as SSA 1199 GE, is a document used to set up direct deposit for various types of payments. This form is crucial for individuals who want their Social Security payments,

SSA-1199-GE, Direct Deposit Sign Up Form, Germany

What Is Direct Deposit Sign Up Form

The Direct Deposit Sign Up Form, officially known as SSA 1199 GE, is a document used to set up direct deposit for various types of payments. This form is crucial for individuals who want their Social Security payments,

-

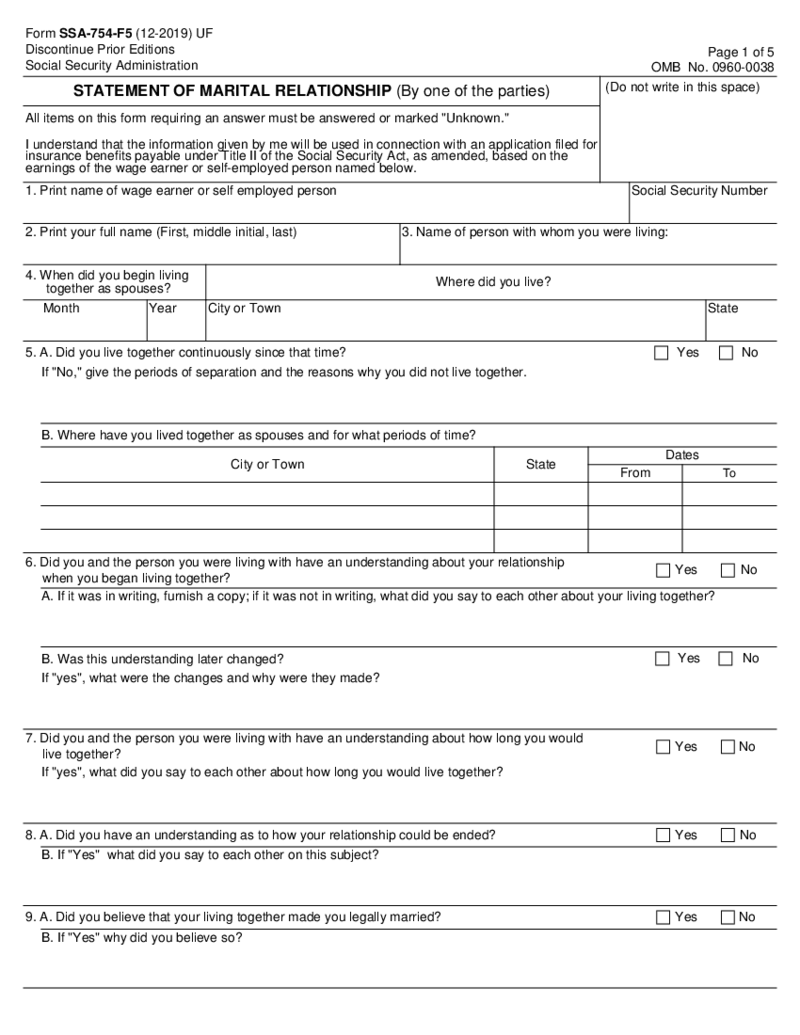

SSA-754-F5, Statement of Marital Relationship

The Social Security Administration (SSA) is a vast system that can seem complex and daunting. One critical element of this system is the SSA-754-F5 form, an essential document for certain individuals. This guide will provide an in-depth look at this form, its uses, a

SSA-754-F5, Statement of Marital Relationship

The Social Security Administration (SSA) is a vast system that can seem complex and daunting. One critical element of this system is the SSA-754-F5 form, an essential document for certain individuals. This guide will provide an in-depth look at this form, its uses, a

-

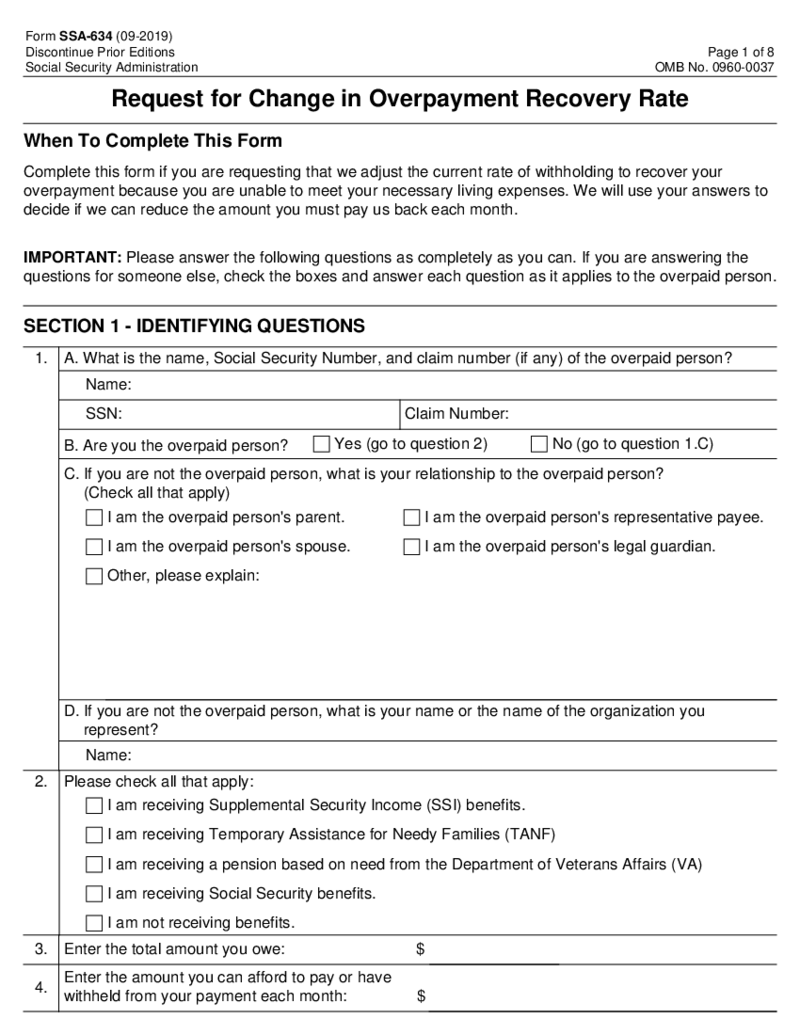

SSA-634, Request for Change in Overpayment Recovery Rate

What is SSA-634 Form?

The SSA 634 template is widely known as a request for waiver of overpayment recovery or change in repayment rate. This form was made by the United States Social Security Administration. It is spread and used around the country by tax

SSA-634, Request for Change in Overpayment Recovery Rate

What is SSA-634 Form?

The SSA 634 template is widely known as a request for waiver of overpayment recovery or change in repayment rate. This form was made by the United States Social Security Administration. It is spread and used around the country by tax