-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Accounting

-

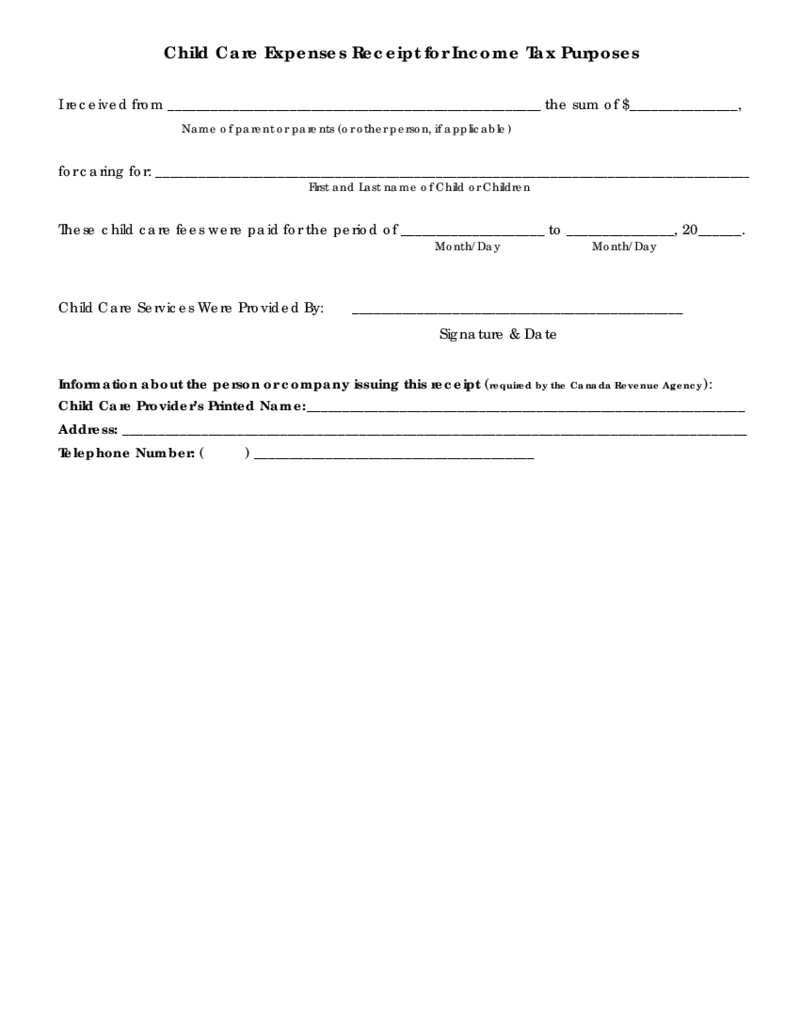

Child Care Receipt for Tax Purposes

What Is a Child Care Tax Receipt Template?

A Child Care Expenses Receipt/Affidavit for Income Tax Purposes Form is a document used to claim child care expenses on your income tax return. If you paid someone to take care of your child while you were workin

Child Care Receipt for Tax Purposes

What Is a Child Care Tax Receipt Template?

A Child Care Expenses Receipt/Affidavit for Income Tax Purposes Form is a document used to claim child care expenses on your income tax return. If you paid someone to take care of your child while you were workin

-

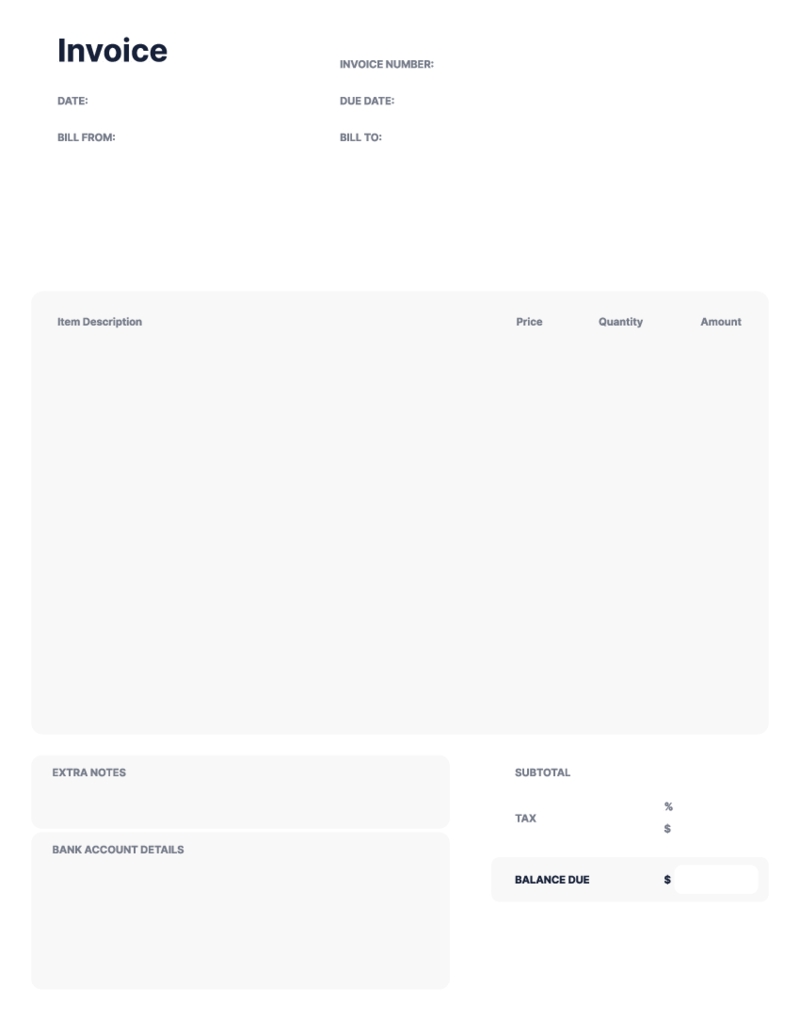

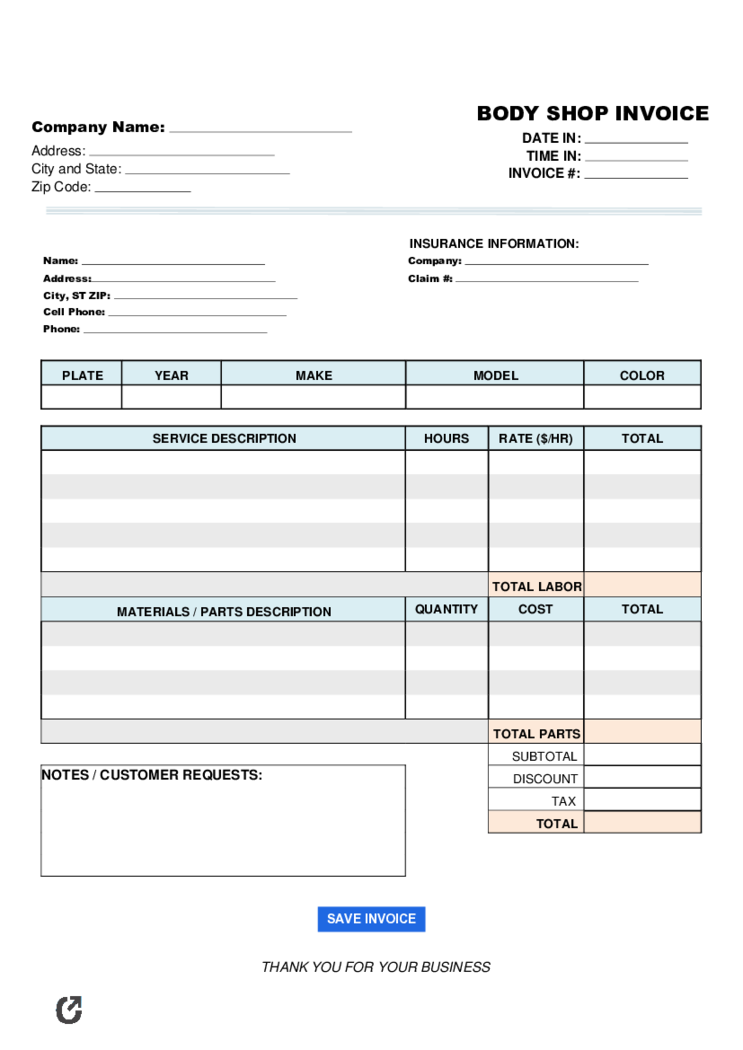

Body Shop Invoice

What Is a Body Shop Invoice

A body shop invoice is a detailed document provided by an automotive repair or collision center to a customer. It establishes the cost of services rendered, parts replaced, and labor performed during the vehicle's repair or

Body Shop Invoice

What Is a Body Shop Invoice

A body shop invoice is a detailed document provided by an automotive repair or collision center to a customer. It establishes the cost of services rendered, parts replaced, and labor performed during the vehicle's repair or

-

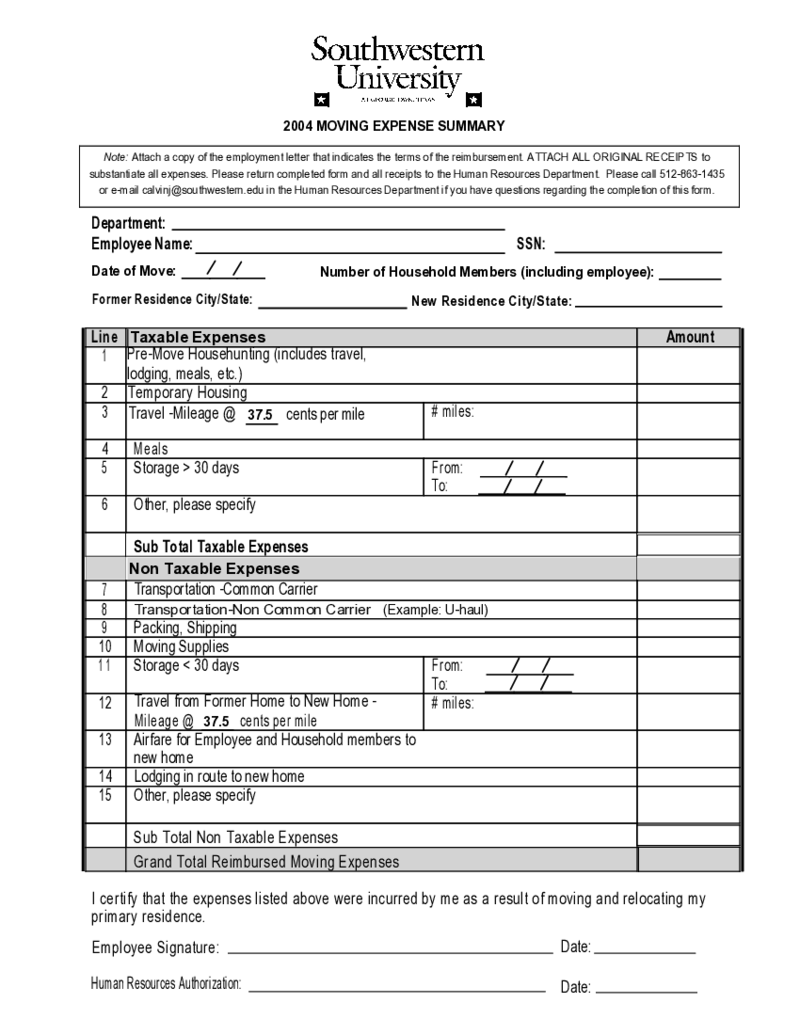

U Haul Receipt

What Is the U Haul Receipt?

The U Haul receipt is a bill of service given upon completion of a transaction with U-Haul. It details all administered services, their respective costs, and transaction date. This receipt is also useful for future reference or

U Haul Receipt

What Is the U Haul Receipt?

The U Haul receipt is a bill of service given upon completion of a transaction with U-Haul. It details all administered services, their respective costs, and transaction date. This receipt is also useful for future reference or

-

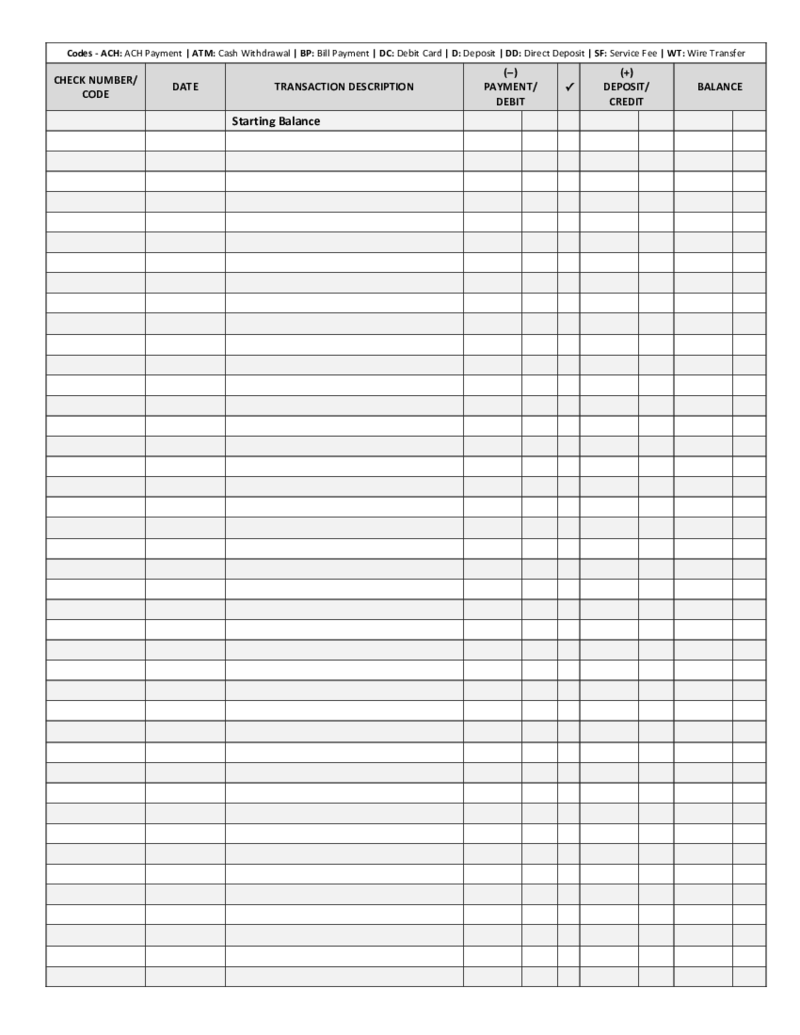

Checkbook Register Template

What Is Checkbook Register Template?

The checkbook register template is a must-have for everyone who pays with checks and has to keep records of transactions. Even if you don’t need to do it, it is better to keep up with the checks you sign and orga

Checkbook Register Template

What Is Checkbook Register Template?

The checkbook register template is a must-have for everyone who pays with checks and has to keep records of transactions. Even if you don’t need to do it, it is better to keep up with the checks you sign and orga

-

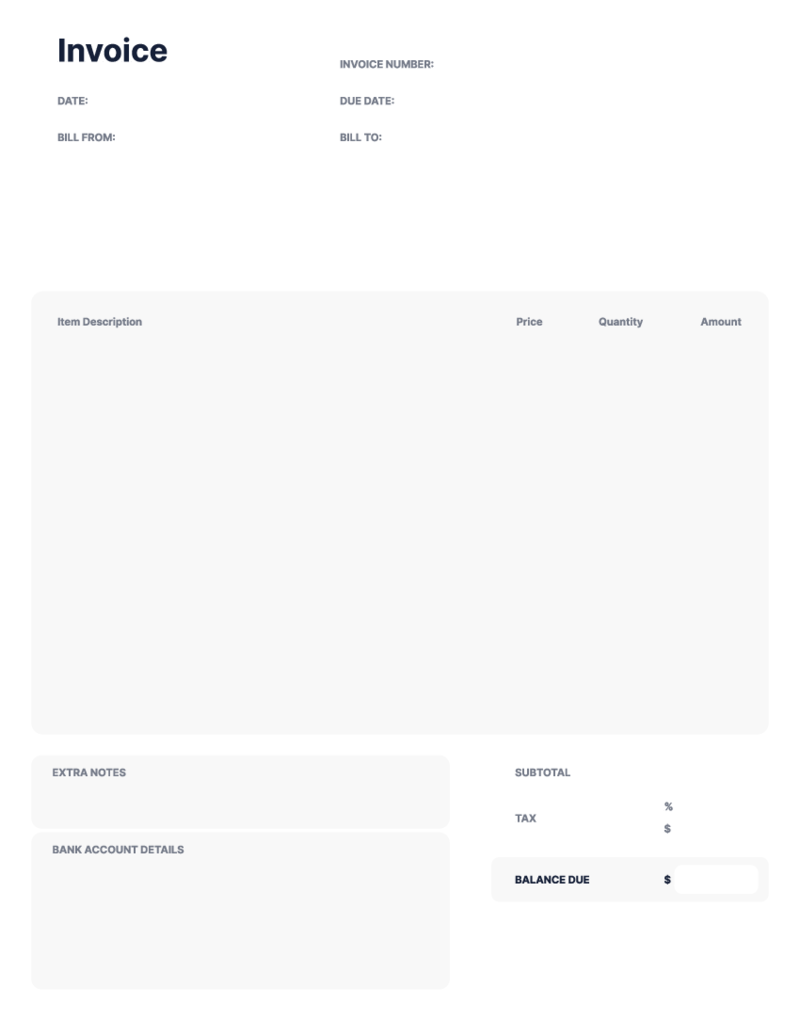

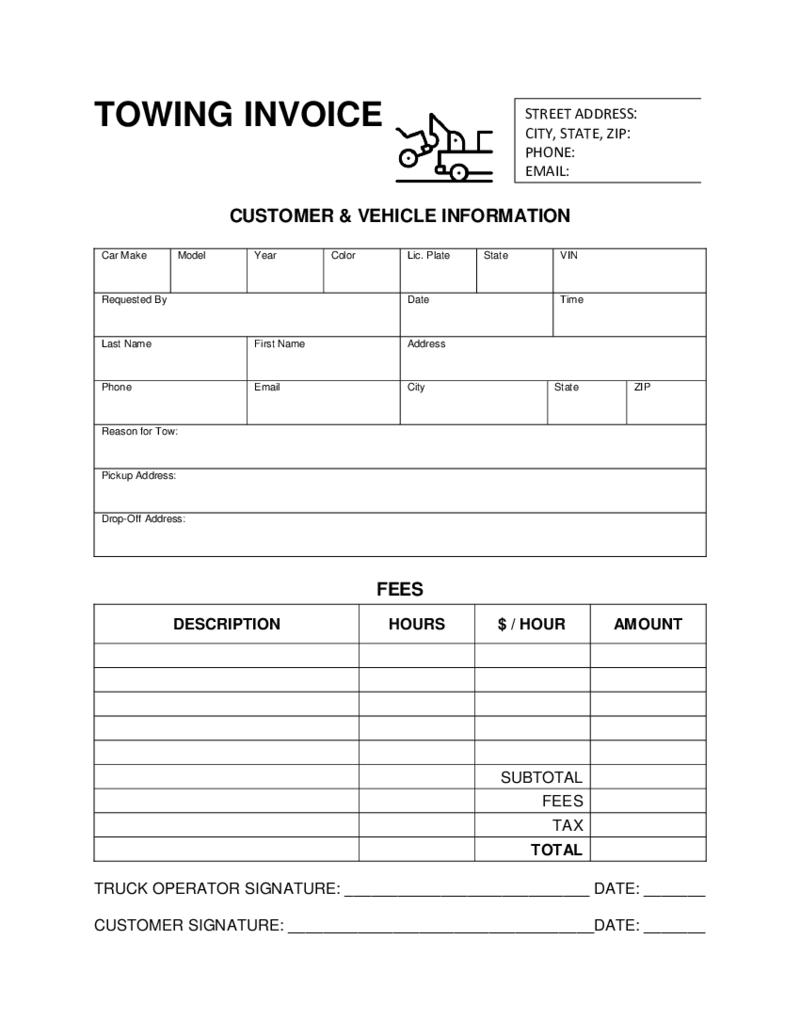

Towing Invoice

What Is a Towing Invoice?

Towing Invoice form is a specific document that arranges the business between towing companies or private persons and customers. It can be used as a bill for the provided services. Towing Invoice template must be filled by the co

Towing Invoice

What Is a Towing Invoice?

Towing Invoice form is a specific document that arranges the business between towing companies or private persons and customers. It can be used as a bill for the provided services. Towing Invoice template must be filled by the co

-

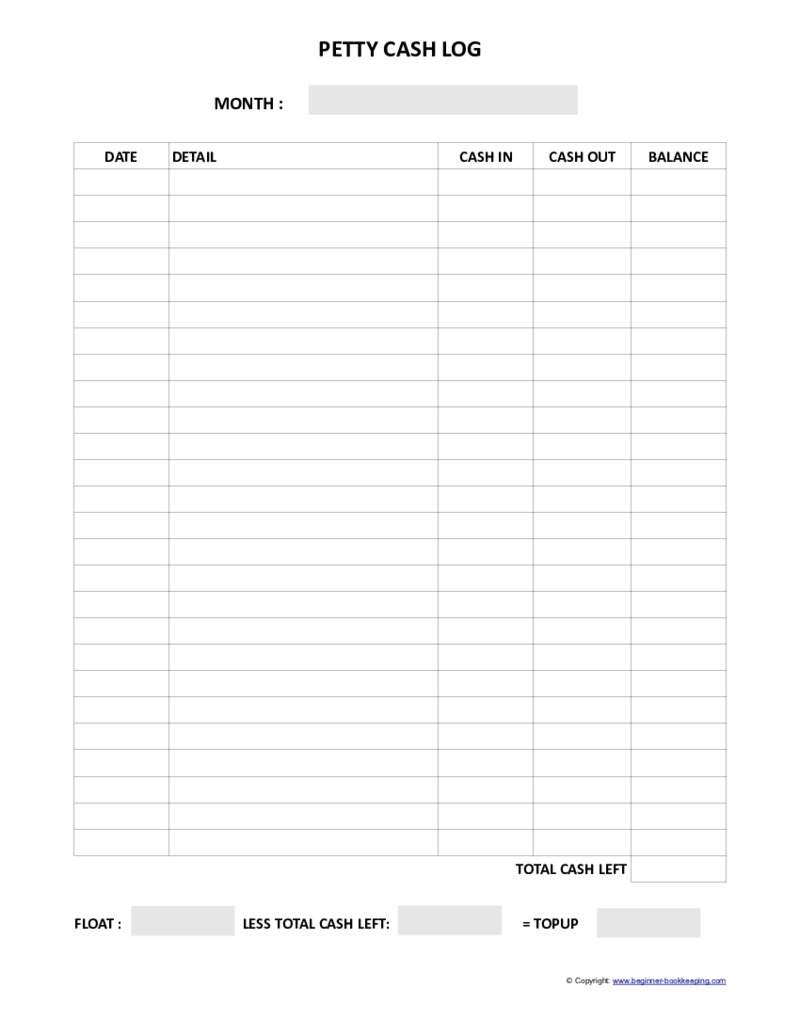

Petty Cash Log

What Is a Petty Cash Log Template?

A Petty Cash Log Sheet template is an important document for anyone who needs to record their financial information. It is widely used in business when you need to track the money paid for some small services or goods. Y

Petty Cash Log

What Is a Petty Cash Log Template?

A Petty Cash Log Sheet template is an important document for anyone who needs to record their financial information. It is widely used in business when you need to track the money paid for some small services or goods. Y

-

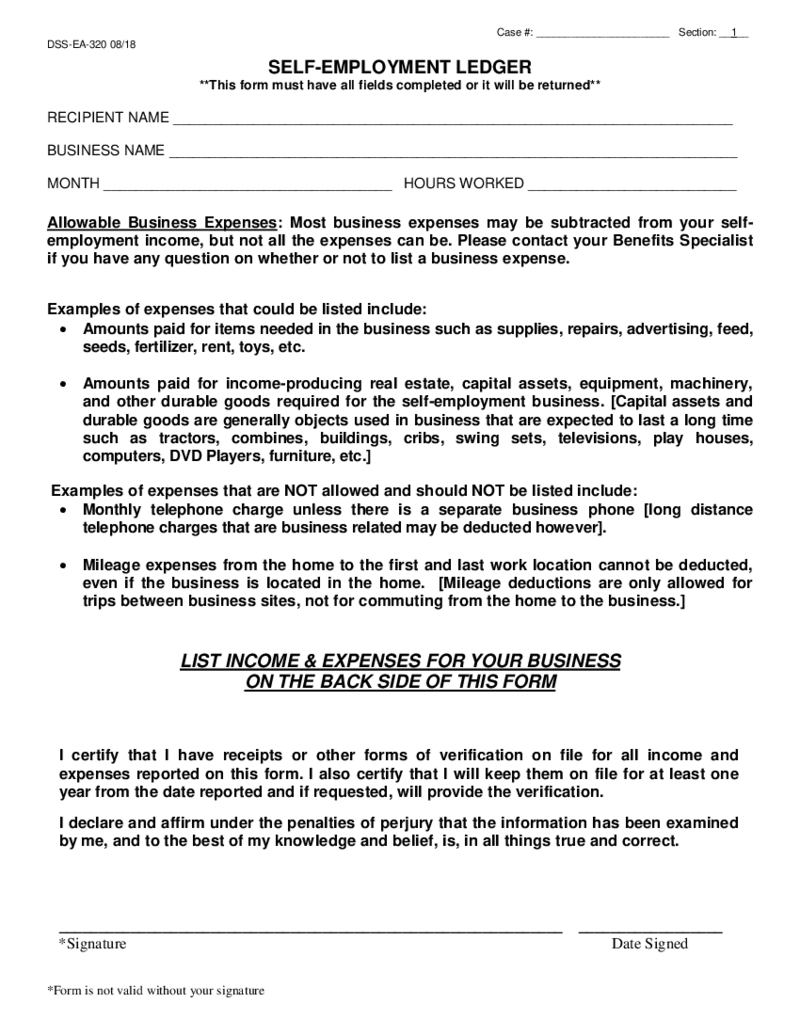

Self Employment Ledger Template

What Is a Self-Employed Ledger

A Self-Employed Ledger Form is a financial document utilized by self-employed individuals to track income and expenses related to their business activities. Its fundamental purpose is to maintain a detailed record of earning

Self Employment Ledger Template

What Is a Self-Employed Ledger

A Self-Employed Ledger Form is a financial document utilized by self-employed individuals to track income and expenses related to their business activities. Its fundamental purpose is to maintain a detailed record of earning

-

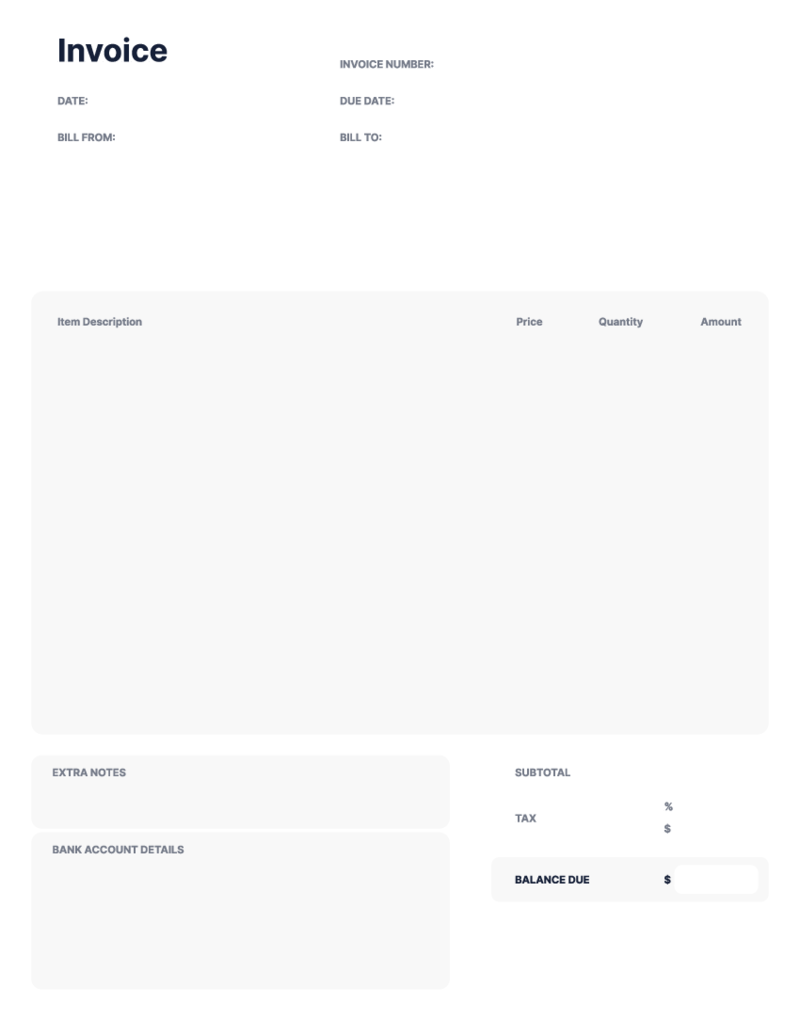

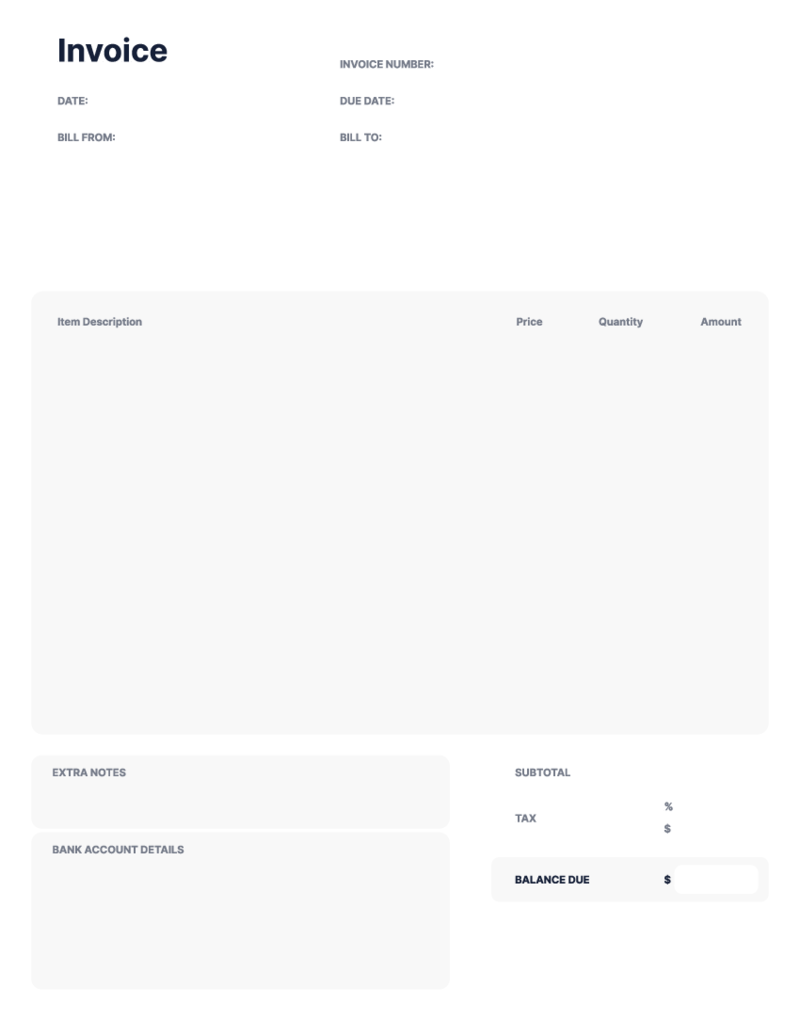

Free Pharmacy Invoice Template

What Is a Pharmacy Invoice?

A pharmacy invoice is a crucial document that outlines the medical products and services provided to a patient by a pharmacy. It comprehensively tallies the cost associated with your treatment, serving as a transparent medium b

Free Pharmacy Invoice Template

What Is a Pharmacy Invoice?

A pharmacy invoice is a crucial document that outlines the medical products and services provided to a patient by a pharmacy. It comprehensively tallies the cost associated with your treatment, serving as a transparent medium b

-

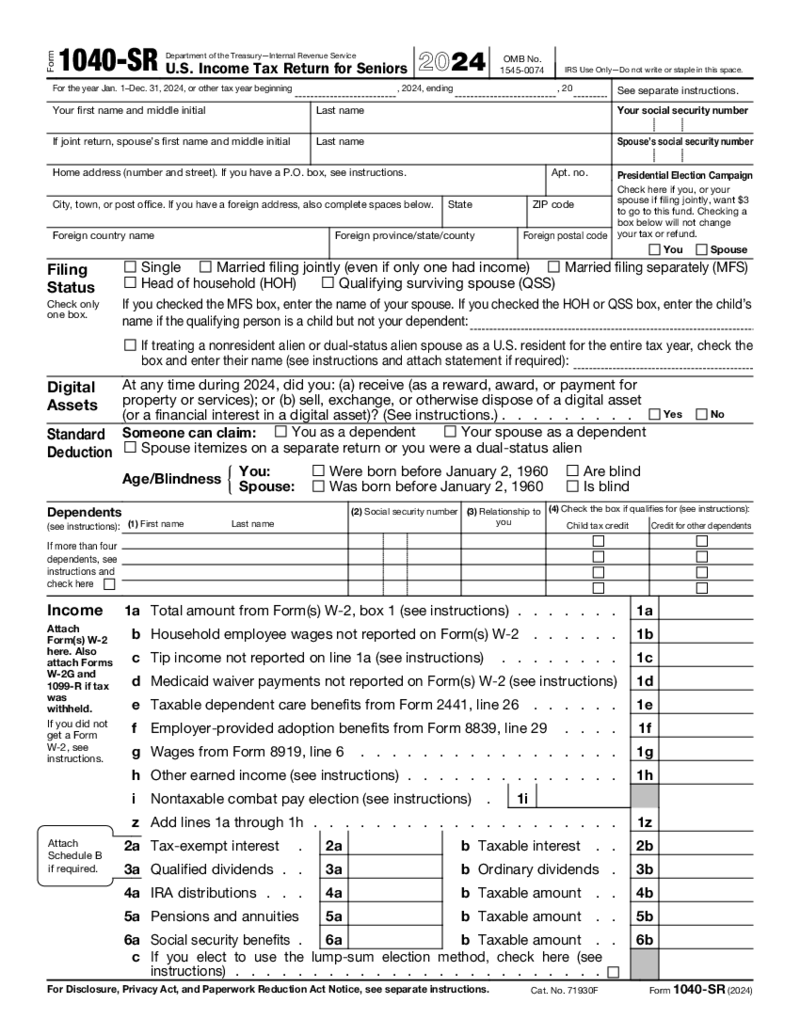

Form 1040-SR (2024)

What Is the 1040-SR form 2023 - 2024

This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. One can download the 1040-SR blank PDF form for free from the PDFLiner and pri

Form 1040-SR (2024)

What Is the 1040-SR form 2023 - 2024

This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. One can download the 1040-SR blank PDF form for free from the PDFLiner and pri

What Are Accounting Templates?

Financial reports, reconciliations, invoices, budgets, and more are all that accountants have to deal with literally every day. A small business accounting template can help you with all these difficult tasks. Our site has a collection of over 300 accounting templates PDF that you can use to create a paperless workflow in your workplace. With their help, you can speed up the collection and processing of information, as well as simplify its storage. Also, using our forms helps to unify work processes, adhere to generally accepted standards of quality and structure, and reduce the number of errors.

What Are the Accounting Templates Used For?

In short, accounting templates are used to perform various accounting tasks. The purpose of such forms can be different: from tax reports of self-employed people to the annual budgets of corporations. They can be used both to provide information about activities to higher authorities, such as the IRS, and to obtain data for internal work. You can customize templates by including additional fields and pages or, conversely, by removing unnecessary blocks in the current situation. With these ready-made forms, you can speed up workflows and improve communication between departments. Considering the volume of documents accountants have to deal with, templates are essential tools in their work.

Types of Accounting Templates

In the PDFLiner collection, accountants, bookkeepers, small business owners, and freelancers can find various categories of free accounting templates for any case. The choice of specific blank accounting forms depends on the task assigned to you and the business characteristics. Among the most common forms are the following:

- Balance sheets. It is perhaps one of the most critical accounting documents that help to calculate assets, liabilities, and capital. That is, it shows the current financial condition of an object.

- Cash flow. If the previous template reflects static data, then this one shows the direction of finance movements: expenses and income. Based on this kind of form, financial plans for the next month, six months, and even a year can be drawn up.

- Income statement. This template allows you to get deep insights into all your acquisitions so you can decide how to grow your business.

Other less popular but still regularly used accounting templates include forms for inventory, tracking receivables, and controlling payrolls, as well as forms for use in specialized bookkeeping software.

What Should Be Included in Accounting Templates?

The content of an accounting contract template may differ depending on what exactly you will use it for. As a rule, the first thing that should be entered on the form is information about the business. Whether you issue an invoice or prepare a tax return, recipients need to know which company you’re talking about. Usually, these are the owners’ names, company names, contact details, addresses, IDs, and more.

Other data may vary greatly depending on the template type. Most often, the forms ask for financial information about companies, such as a list of income, expenses, assets, and so on. Based on such data, budgets and development plans for subsequent periods are created.

Another type of information required is customer and order data. It can be the contact details of your clients, goods and services provided, invoices issued and their amounts, and much more. With these templates, you can track your customer accounts, monitor receipts and debts, and report earnings to the tax office.

The third data category is information about your employees: names and contact details, salary, bonuses, hours worked, tax credits, etc. All this allows you to monitor the performance of each individual worker and the entire team. Besides, employers are required to pay taxes for officially employed persons; tax documents are compiled based on the listed personal data.

How to Create Accounting Templates: Step by Step

Use our ready-made forms if they fully suit your needs, or make your own accounting template that is perfect for the current situation. The PDFLiner editor simplifies the work with forms, allowing you to fill in all the fields in a matter of minutes, or generate a new document from scratch. If you’d rather build templates yourself, here’s how to do it with PDFLiner:

- First, decide on the list of information you need. Think over all the details to create the perfect blank.

- Open the editor and select the “Create New” option to start working on a new document.

- Tap “Upload PDF” and pick any file you want to use as a base template.

- After uploading the document, start editing: add text, insert symbols and pictures, strike out or white out unnecessary elements, and so on.

- When you’re done with the template, save it to your device or your account’s cloud.

The document generated in this way can be reused as much as you need and sent to recipients in a couple of clicks.