-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

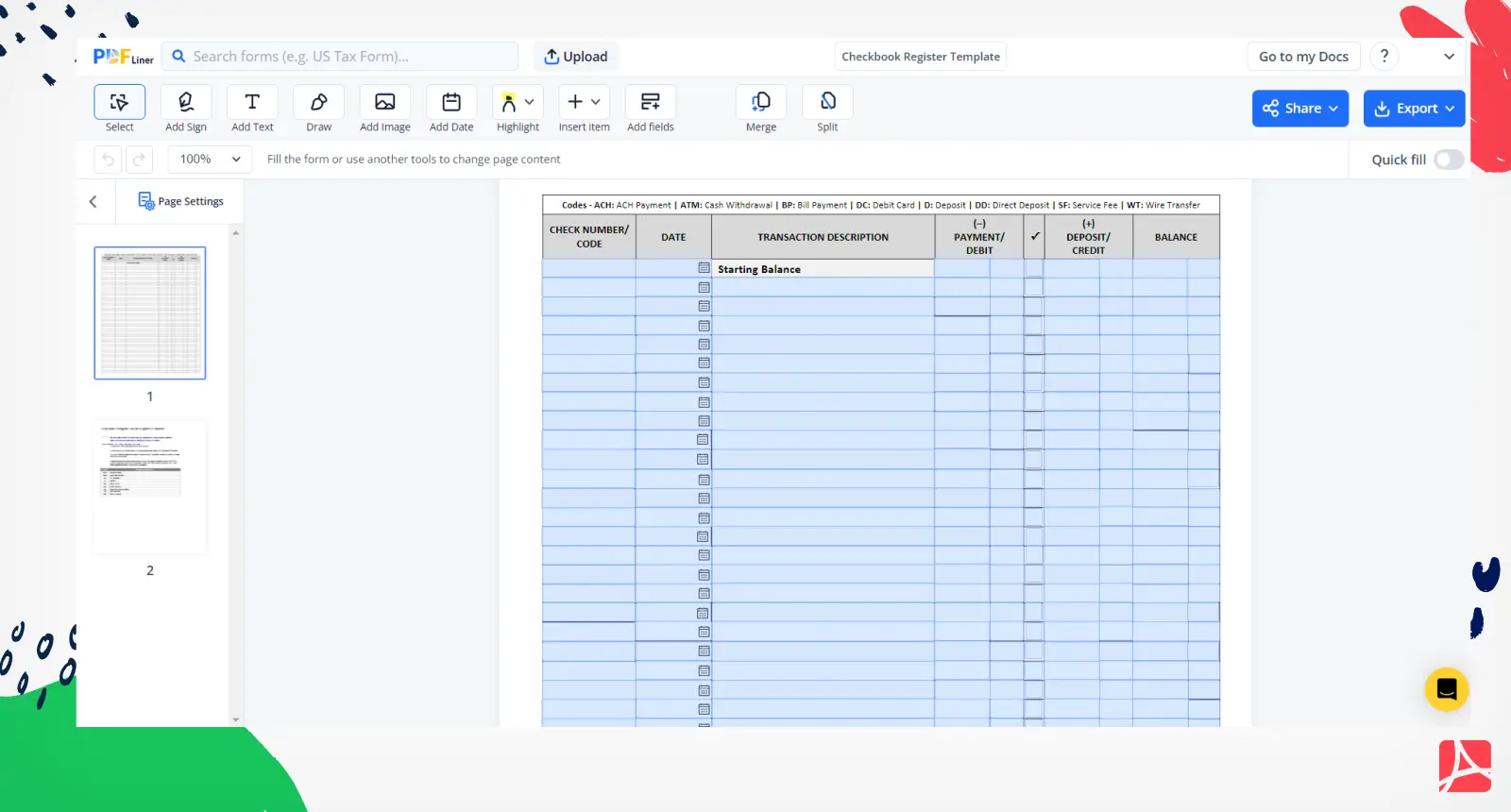

Checkbook Register Template

Get your Checkbook Register Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Checkbook Register Template?

The checkbook register template is a must-have for everyone who pays with checks and has to keep records of transactions. Even if you don’t need to do it, it is better to keep up with the checks you sign and organize your money transactions. Those who have to use checks multiple times per day know how valuable a simple order is.

Using an online checkbook register template will save you from hours of searching for the specific check you’ve signed but lost or think that you’ve lost it. Moreover, such a system can protect your money and save you lots of time. While the first templates were made on paper, nowadays, many business owners prefer to use paperless options, including PDF documents they can fill online and keep on their laptops.

The record of the checks must be made on a daily basis. The template has to be simple, and all the numbers are visible. Use a printable PDF checkbook register template from PDFLiner to organize documentation.

What I need the checkbook register template for?

- You need a checkbook register template PDF to keep records of all checks you sign or receive. This document is vital if you have your own business and send checks every day. Yet, even if you use your checkbook from time to time, you may want to save the numbers and your checks on the template rather than keeping everything in mind;

- If you are a customer who prefers to sign checks for the products and services, you may need to print checkbook register template or create it online to be able to compare your expenses. This template might help you to organize your finances as well. Moreover, if the seller asks for proof of the payment, you may easily provide it.

How to Fill Out Checkbook Register Template?

You can easily learn how to fill out the template for checkbook register once you see the form. It is only one page long, and you can adjust everything to your needs. You can even create your own template based on your preferences if you use PDFLiner. This service works with PDF documents allowing you to edit them and create new templates from the very beginning.

It also contains the already-made template you can use. It is the best option for people who have never seen such templates before. All you need to do is to open the form and fill empty sections in the table. You will see all the tools in front of you. Save the document whenever you think it is filled. You may even print it if you need to send it to the other person by email. Here is what you need to include:

- Provide information on the number of the check you sign;

- Include the current date;

- Describe the transaction you make, whether it is a transaction for goods or services;

- Provide information on the payment, deposit, and the total balance you have after the procedure;

- Pick the type of payment for your comfort.

Organizations that work with checkbook register template

- Anyone who uses checks to pay for services and goods.

Fillable online Checkbook Register Template