-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Payment Schedule Sample

Get your Payment Schedule Sample in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Payment Schedule Sample

A payment schedule sample is a form that outlines when payments should be made, how much those payments are, and what they're for. It allows you to visualize your future financial obligations in a more manageable format. If you are in a business that often requires several payments or are managing personal finances, this schedule can be incredibly helpful.

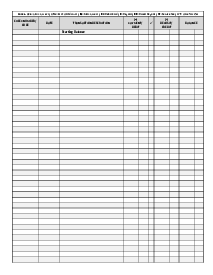

Exploring the features of a sample payment schedule

The sample payment schedule on the PDFliner website is designed to keep track of payments in the most organized manner possible. Its features include dates, payment amounts, payment purpose, total payments made, balance remaining, and more. The same exact details can be differently organized depending on the user’s requirement. This way, you can easily comprehend your payment status and remaining balance at any given time.

Yielding the benefits of payment schedule samples

-

Improved Organization: A payment schedule sample enables you to keep track of your payments conveniently. You can quickly reference when payments are due and how much is owed.

-

Time Savings: Rather than searching through stacks of bills or scrolling through endless online accounts, you can have all of your payment information in one well-organized form.

-

Better Financial Planning: By providing a clear view of your financial obligations in the future, a payment schedule sample can assist in forecasting your financial status and helping you make better financial decisions.

-

Increased Transparency: Payment schedules offer increased transparency in financial operations, particularly in businesses. They can serve as a proof of transparency amongst various stakeholders.

How to Fill Out the Payment Schedule Sample

Begin by entering the names of the claimant and respondent in the designated fields. You'll find these fields at the top of the form under 'Claimant' and 'Respondent'.

- Provide the Australian Business Number (ABN) for both the claimant and the respondent next to their respective names.

- Fill in the addresses for both parties in the spaces provided immediately after the ABN.

- Enter the project name, contract or job reference number, and the site address in the subsequent fields to define the project context.

- Specify the Payment Claim Number and the Date of the Payment Claim to track this specific claim.

- Note the date when the Payment Claim was given to keep a record of communication timelines.

- State the total amount of the Payment Claim excluding GST in the designated area.

- Detail the works completed under the original contract for this claim, along with any variations, in the provided fields.

- Calculate and record the total works completed in this claim excluding GST, then list any deductions along with their details and amounts.

- Enter the Scheduled Amount of this Claim excluding GST, which is the sum due after deductions.

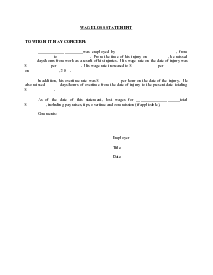

- Sign the form and fill in your position and the date at the bottom under the Signed section to authenticate the claim.

- Document any reasons for withholding payment and the reasons for deductions, including the amounts deducted, at the end of the form.

- Finally, ensure the payment schedule number is entered, and provide a detailed breakdown of the Scheduled Amount at the end of the form. This breakdown should itemize the amounts and relate them back to the contract specifics and completed works.

Each field should be filled accurately to reflect the details of the payment claim as per the contract and work completed. Remember to check all the amounts and details for accuracy before finalizing the schedule.

Fillable online Payment Schedule Sample