-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

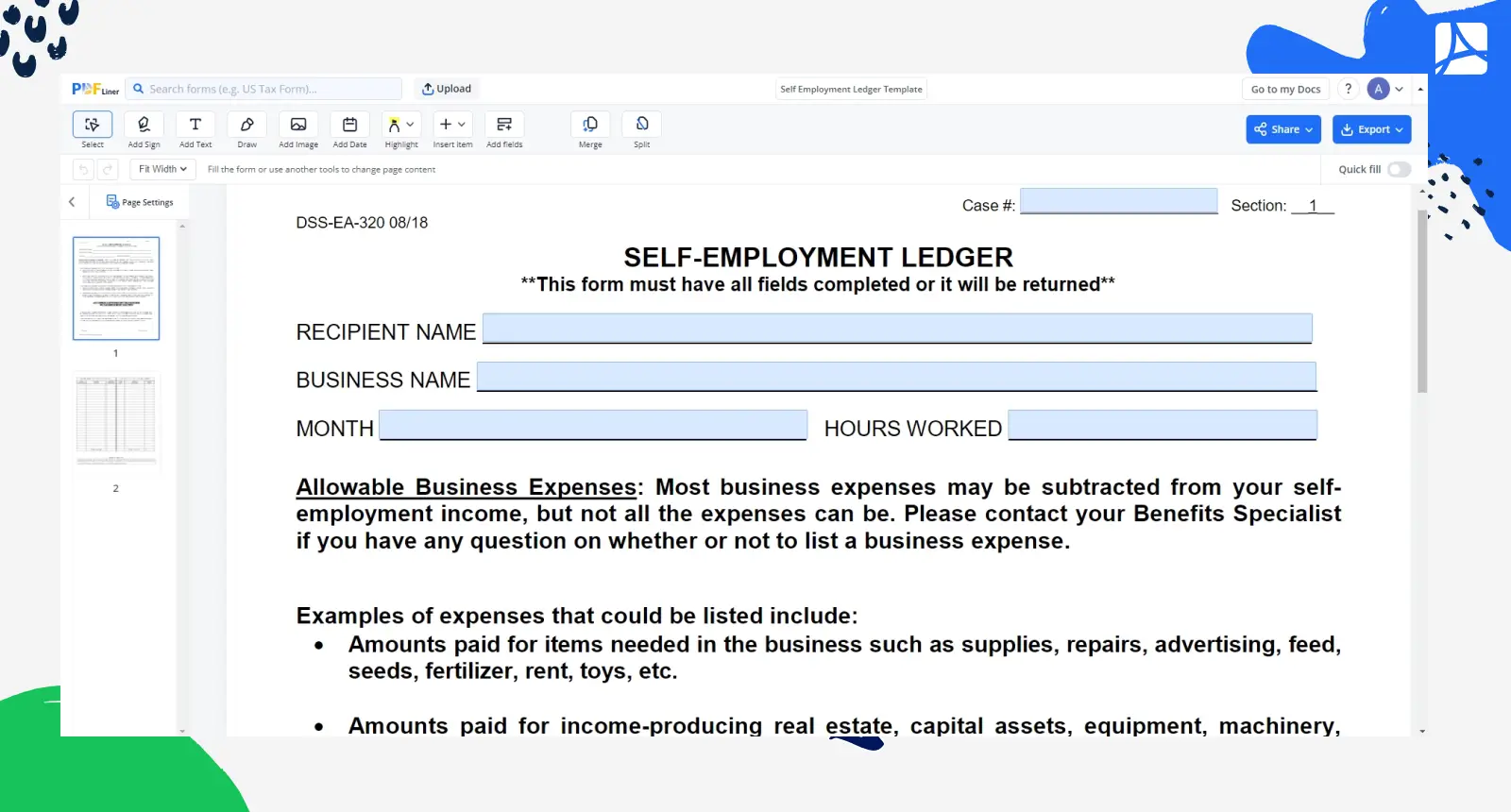

Fillable Self Employment Ledger Template

Get your Self Employment Ledger Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Self-Employed Ledger

A Self-Employed Ledger Form is a financial document utilized by self-employed individuals to track income and expenses related to their business activities. Its fundamental purpose is to maintain a detailed record of earnings, deductions, and business-associated costs, aiding in accurate tax reporting and financial management. This ledger serves as evidence of income for various purposes, including tax filings, loan applications, and financial planning for self-employed professionals and freelancers.

Self-employment ledger documentation requirements

Are you interested in streamlining your tax filings as a self-employed pro? Then do your best to focus on accurate financial reporting and meeting the following Self-Employment Ledger Form requirements:

- Maintain detailed records of all your income sources, including invoices, receipts, and sales records.

- Keep receipts and invoices for your business-related expenses, such as supplies, equipment, and operational costs.

- Document mileage for business-related travel with a mileage log.

- Maintain copies of business bank statements to verify income and expenses.

- Keep copies of filed tax returns and relevant tax documents.

- Store all relevant receipts and invoices neatly for easy reference.

- If applicable, maintain payroll records, including employee wages and taxes.

- Keep copies of client contracts and agreements.

- Prepare and retain financial statements such as profit and loss statements and balance sheets.

- If you have business insurance, keep records of policy details and payments.

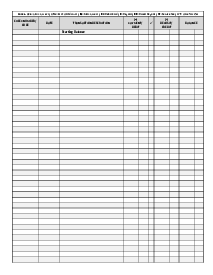

How to Fill Out a Self-Employment Ledger Template

Begin by browsing through the PDFLiner’s catalog of free pre-formatted templates. Find the Self-Employed ledger template there and click on it to open the doc. Look through the file to figure out what you need to complete it accurately. Then follow these 10 vital steps:

- Enter your name, business name (if applicable), and contact information.

- Fill in the self-explanatory ‘Date’ and ‘Hours Worked’ fields.

- List all your sources of income, including client payments, sales, or any other revenue streams.

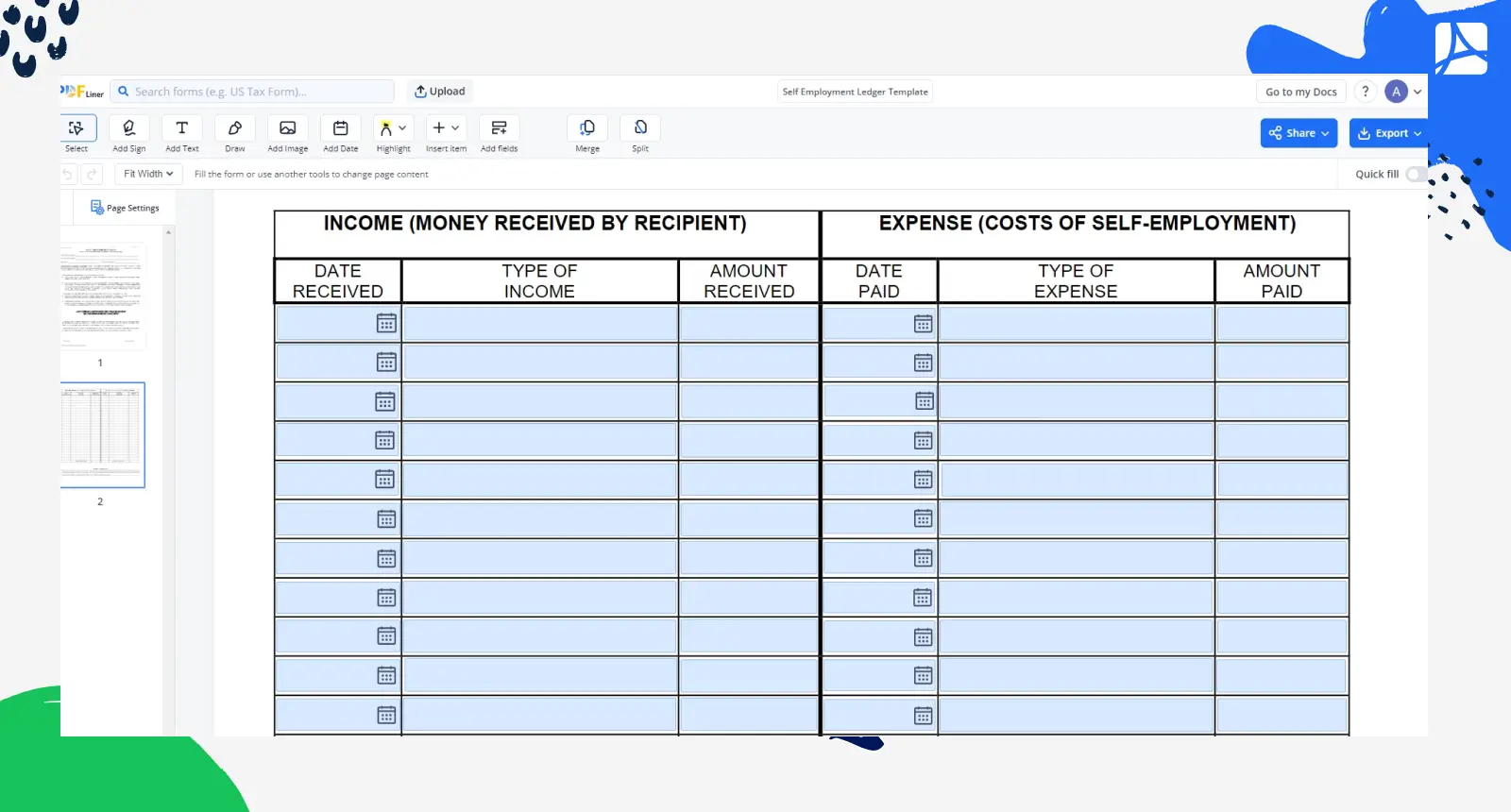

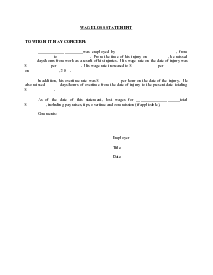

- On Page 2, specify dates, amounts, and payment methods.

- Detail all your business-related expenses such as rent, utilities, supplies, and equipment.

- Include dates, descriptions, and amounts.

- If you use your vehicle for business purposes, record mileage for each trip. Include dates, destinations, and miles driven.

- Calculate the total income and total expenses for the reporting period.

- Attach relevant receipts, invoices, bank statements, and any other documentation that supports your entries.

- Regularly update the ledger (monthly or quarterly) to ensure accurate financial tracking.

Keep completed ledgers for a minimum of three years for tax and auditing purposes.

A properly filled out Self-Employment Ledger PDF helps track financial performance, simplifies tax reporting, and ensures compliance with financial regulations for self-employed professionals and freelancers.

How to file fillable self-employment ledger

To submit the form, ensure it's accurately filled out with your income and expense details. Then, include it when filing your income tax return or other financial documentation where needed. For digital submissions, save the file and upload it to the relevant platform or attach it to an email. If requested in hard copy, mail or deliver it to the appropriate recipient such as tax authorities or financial institutions.

Fillable online Self Employment Ledger Template