-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

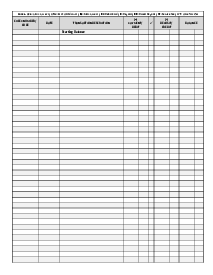

Employee Payroll Deduction Authorization Form

Get your Employee Payroll Deduction Authorization Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Simplify Your Payroll Process with Our Payroll Deduction Form Template

In the ever-evolving business world, effective management of employee compensation is of paramount importance. A crucial part of this process involves handling payroll deductions accurately.

What is the Payroll Deduction Form Template?

Payroll deductions are amounts taken out of an employee's paycheck for various reasons, including taxes, benefits, and loan repayments. Accurate payroll deductions are crucial for maintaining employee trust, complying with legal requirements, and ensuring smooth financial operations within a company. Without an efficient system for managing these deductions, errors can occur, leading to financial discrepancies and legal complications. Thus, incorporating a well-structured form can mitigate these risks significantly.

This form helps in tracking the components deducted from an employee's gross pay, such as:

- Federal and state taxes

- Social Security and Medicare

- Health insurance premiums

- Retirement contributions

- Union dues

- Miscellaneous deductions (e.g., charity contributions, garnishments)

Benefits of Using a Payroll Deduction Authorization Form Template

- Easy customization: Templates are usually customizable to suit the specific needs of an organization. Whether you are a small business or a large corporation, you can tweak the forms to meet your requirements.

- Time-saving: Pre-designed templates eliminate the need for creating documents from scratch, thus saving hours of administrative time.

- Error reduction: A template helps reduce manual errors by providing a standardized format to enter data, aiding in better accuracy.

- Compliance: Using a standardized form ensures that you're meeting all legal requirements, helping you stay compliant with federal and state laws.

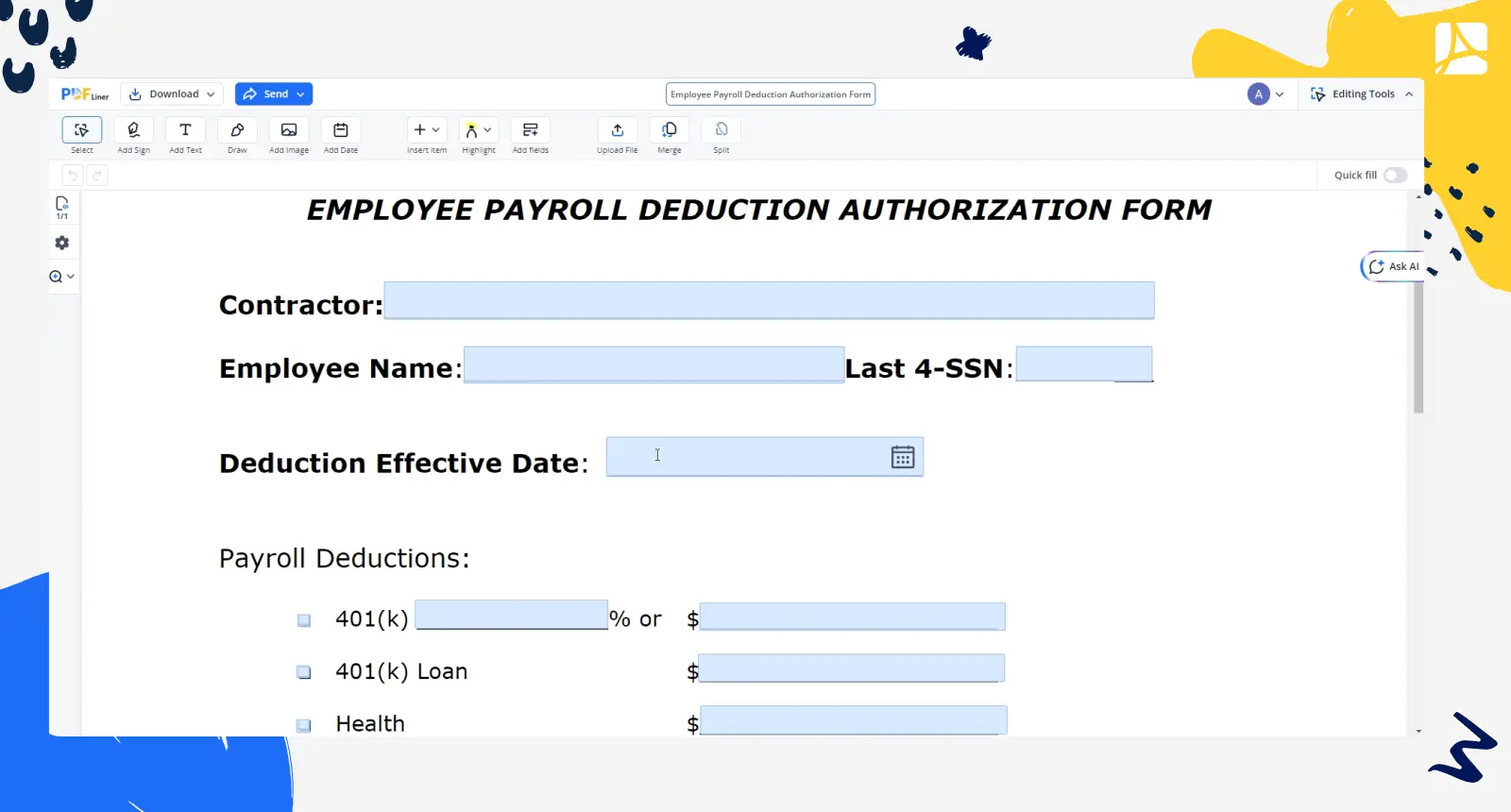

How to Fill Out the Payroll Deduction Authorization Form Template

Filling out our Payroll Deduction form is straightforward and user-friendly. Follow these steps to ensure all required information is accurately documented:

Here is a step-by-step guide to filling out your Payroll Deduction Form Template:

- Start with employee details: Enter the employee’s full name, ID number, department, and job title at the top of the form.

- Specify deduction types: List all types of deductions applicable to the employee, such as federal taxes, state taxes, health insurance, and retirement contributions.

- Input deduction amounts: Carefully fill in the exact amounts or percentages for each deduction. This information can typically be found in the employee’s contract or company policy.

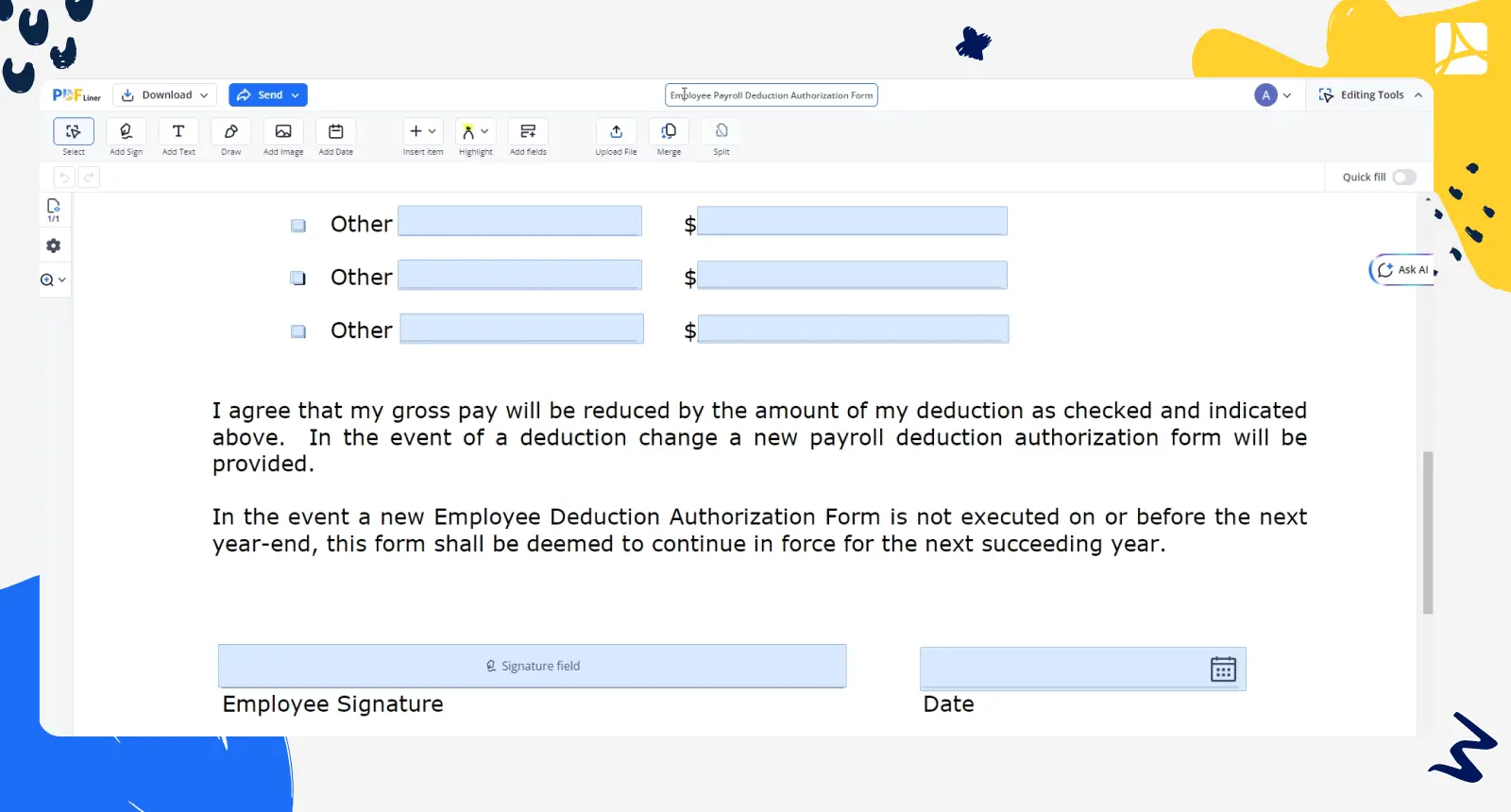

- Employee authorization: Have the employee review the deductions and sign the form to authorize the deductions.

- Employer validation: The employer or payroll officer should also review the form for accuracy and sign it to validate the deductions.

- Submission: Once completed, file the form as per company policy – either physically or digitally – and ensure a copy is provided to the employee for their records.

Best Practices for Managing Payroll Deductions

To make the most out of our employee payroll deduction form template, consider the following best practices:

- Regular reviews: Conduct periodic reviews of deductions to ensure ongoing accuracy and compliance with current laws and regulations.

- Employee communication: Maintain an open line of communication with employees regarding their deductions to address any questions or concerns promptly.

- Secure documentation: Keep all filled forms securely stored for future reference and to comply with record-keeping requirements.

By incorporating this template into your payroll system, you can save time, reduce errors, and maintain employee trust. Simplify your payroll process today with our easy-to-use Payroll Deduction form and experience the difference it brings to your business operations.

Fillable online Employee Payroll Deduction Authorization Form