-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

1040 forms

-

1040 Form

Filling Out the IRS 1040 Form 2024 - 2025: Guide with Example

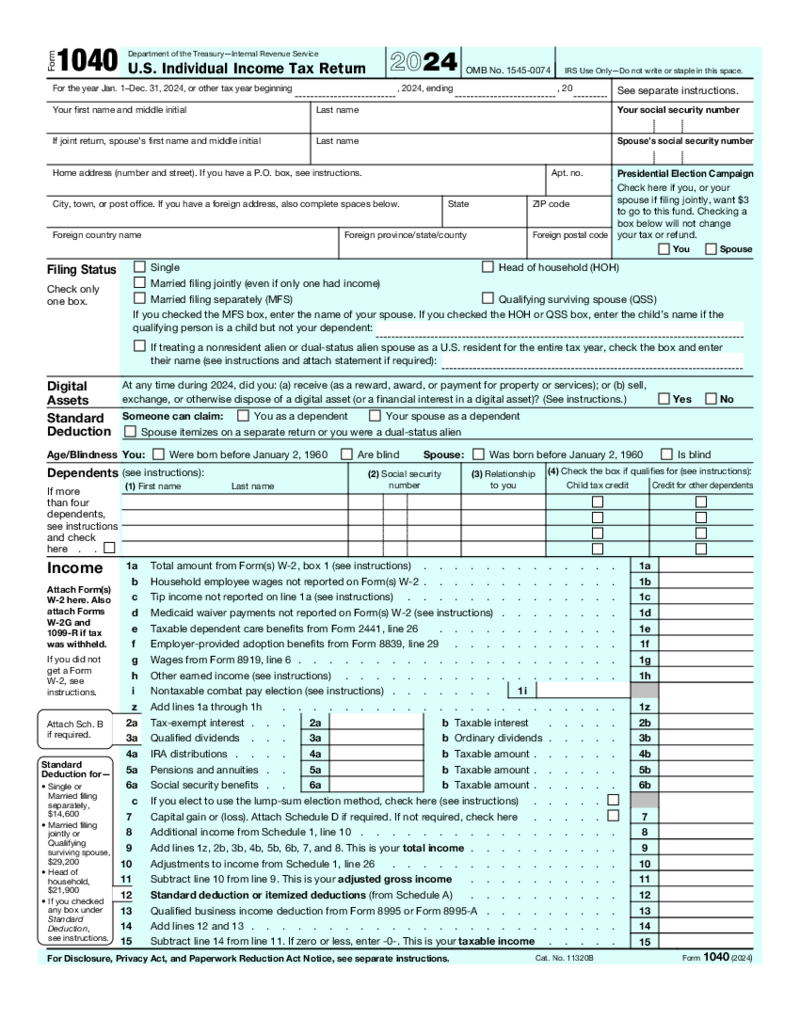

Form 1040 is the standard tax form individuals in the United States use to file annual income tax returns. This form is issued by the Internal Revenue Service (IRS) and is used to report v

1040 Form

Filling Out the IRS 1040 Form 2024 - 2025: Guide with Example

Form 1040 is the standard tax form individuals in the United States use to file annual income tax returns. This form is issued by the Internal Revenue Service (IRS) and is used to report v

-

Qualified Dividends and Capital Gain Tax Worksheet 2024

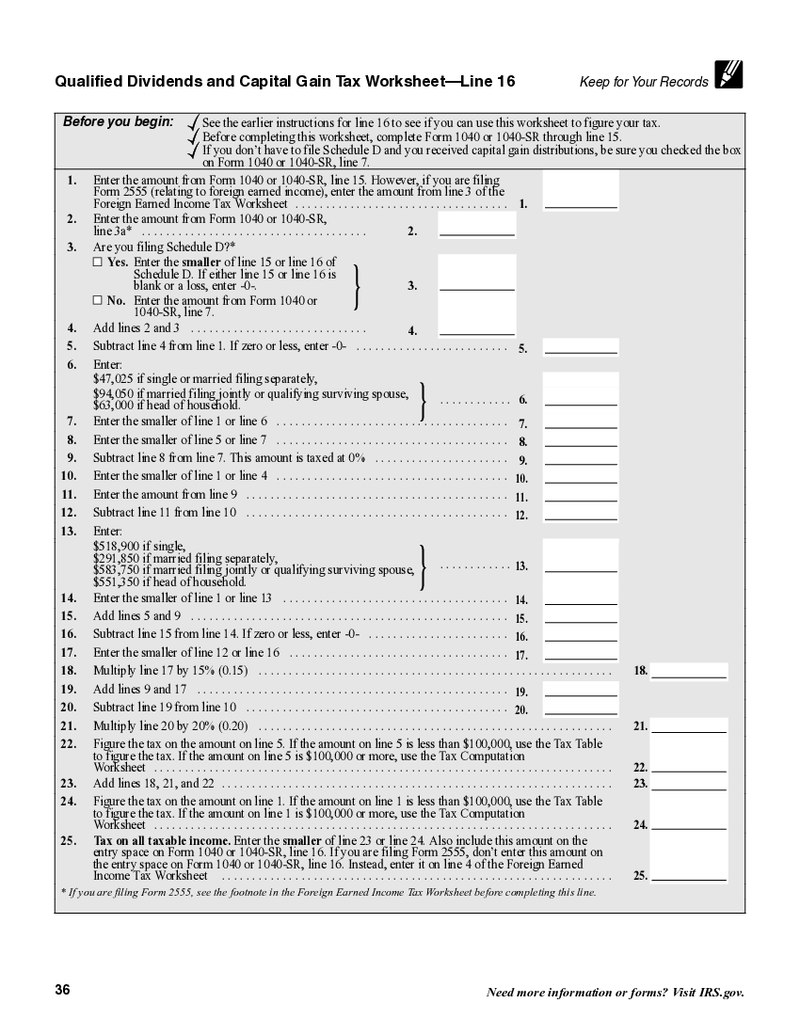

What Is Qualified Dividends and Capital Gain Tax Worksheet 2024-2025?

This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term cap

Qualified Dividends and Capital Gain Tax Worksheet 2024

What Is Qualified Dividends and Capital Gain Tax Worksheet 2024-2025?

This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term cap

-

Tax Computation Worksheet (Form 1040)

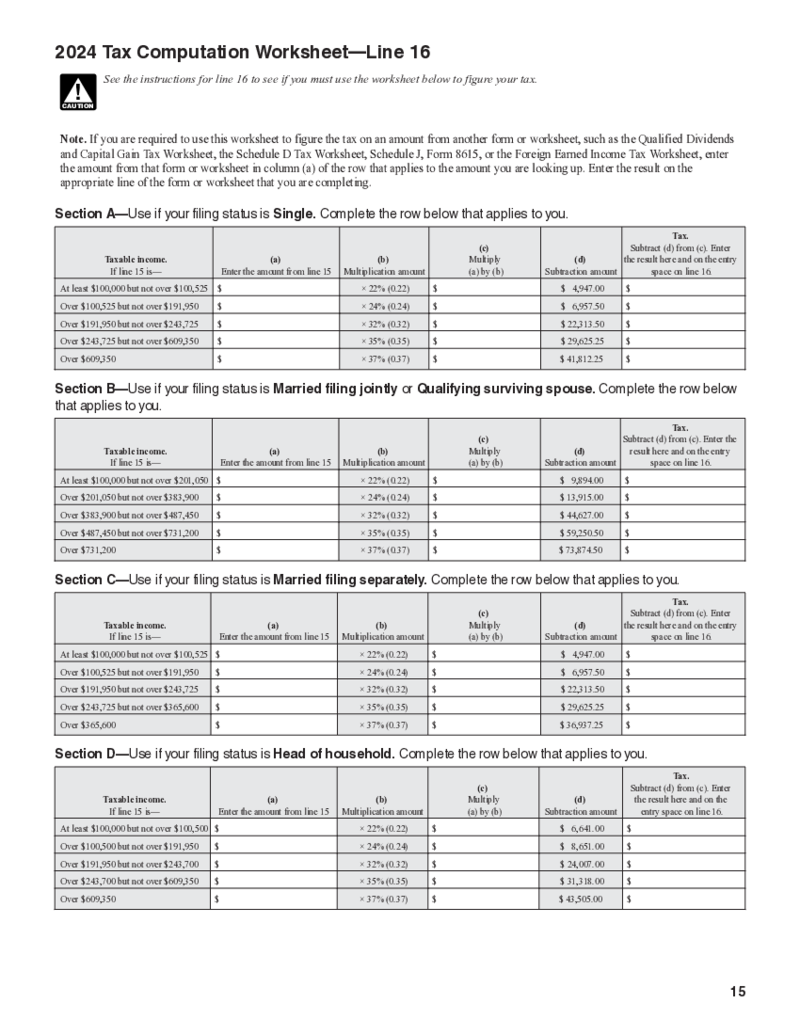

What Is Form 1040 Tax Computation Worksheet

The form 1040 tax computation worksheet is an essential tool furnished by the Internal Revenue Service (IRS) that allows taxpayers to detail their income and adjust it with relevant deductions. The content and c

Tax Computation Worksheet (Form 1040)

What Is Form 1040 Tax Computation Worksheet

The form 1040 tax computation worksheet is an essential tool furnished by the Internal Revenue Service (IRS) that allows taxpayers to detail their income and adjust it with relevant deductions. The content and c

-

Social Security Benefits Worksheet (2023)

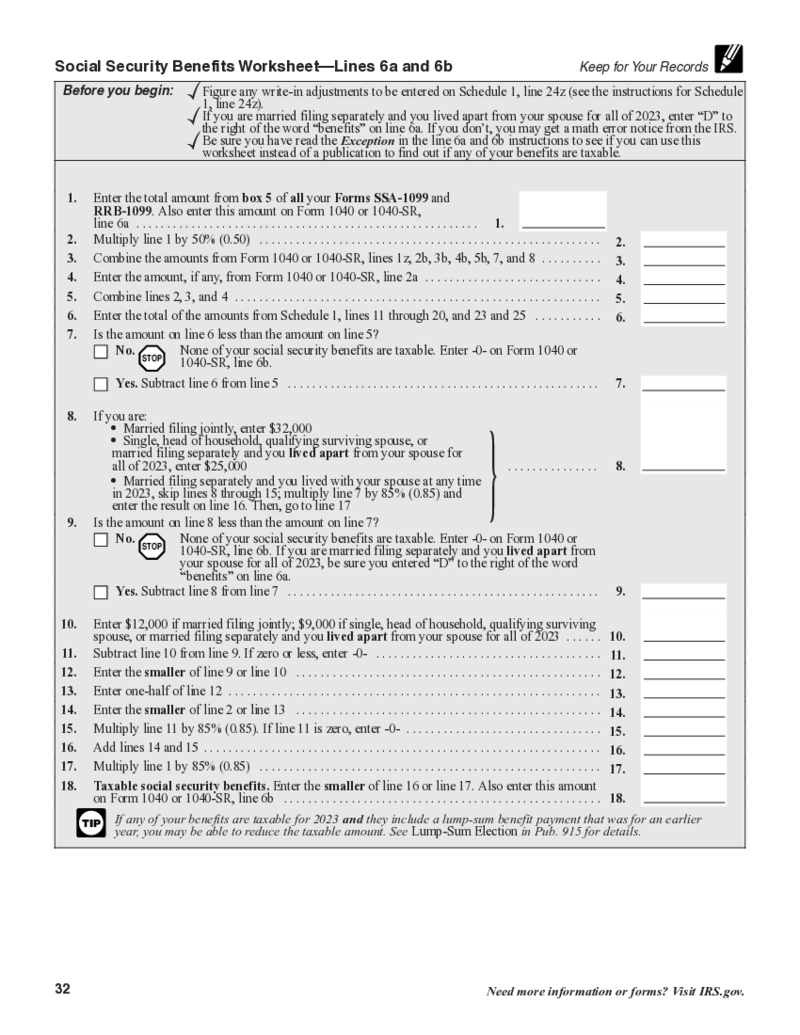

What Is Social Security Benefits Worksheet in 2023 - 2024?

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen. If the benefits are not taxed, then the sheet is not created.

Social Security Benefits Worksheet (2023)

What Is Social Security Benefits Worksheet in 2023 - 2024?

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen. If the benefits are not taxed, then the sheet is not created.

-

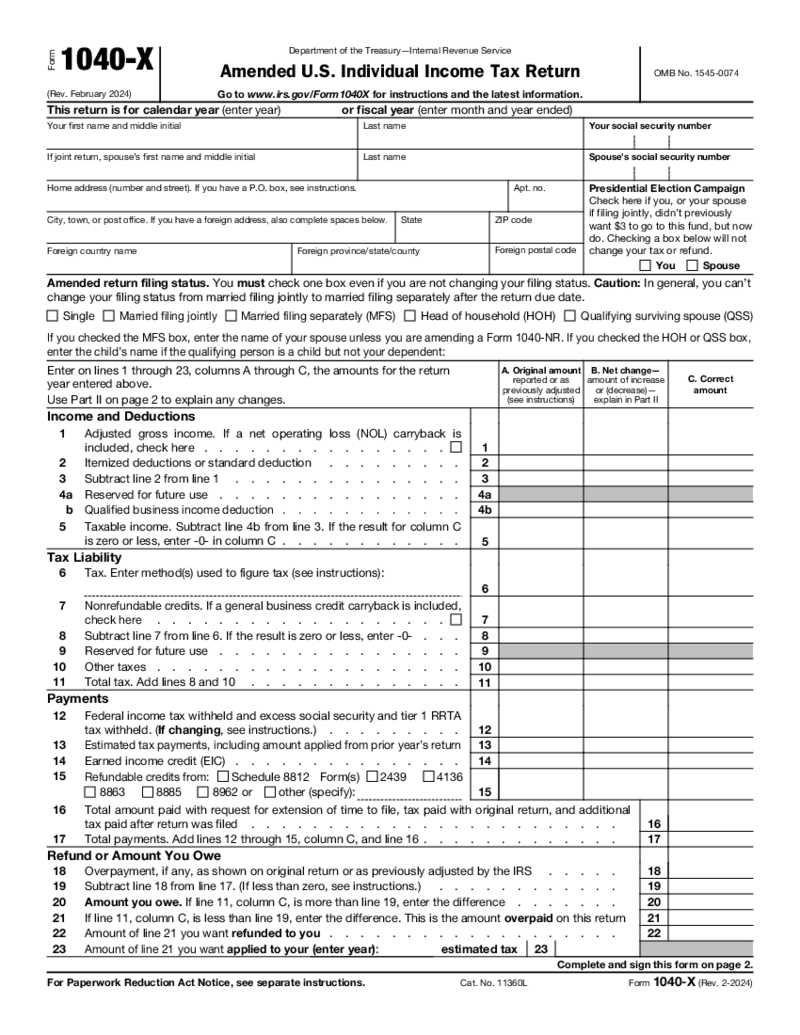

Form 1040X

What is 1040x 2025 form?

1040x form is used to correct the information in 1040, 1040EZ, 1040NR and

Form 1040X

What is 1040x 2025 form?

1040x form is used to correct the information in 1040, 1040EZ, 1040NR and

-

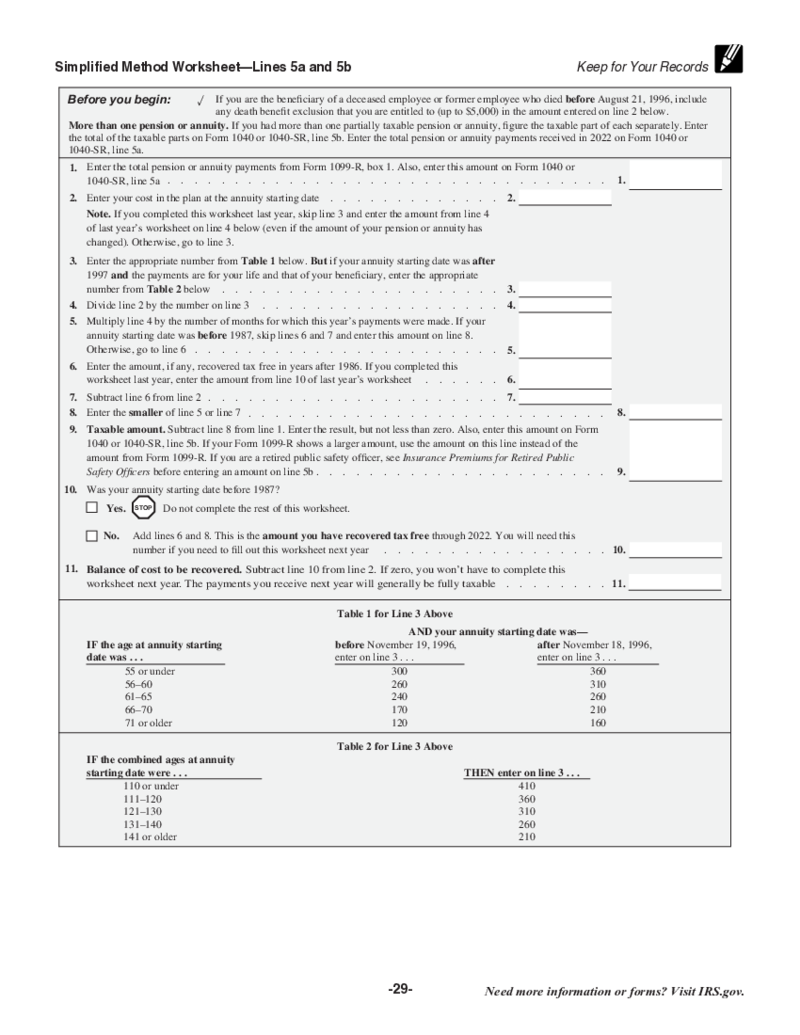

Simplified Method Worksheet

What Is the Simplified Method Worksheet

The Simplified Method Worksheet is an IRS tax form that helps determine the taxable pension and annuity payments amount. It is used to calculate the portion of pension and annuity income that is taxable for federal

Simplified Method Worksheet

What Is the Simplified Method Worksheet

The Simplified Method Worksheet is an IRS tax form that helps determine the taxable pension and annuity payments amount. It is used to calculate the portion of pension and annuity income that is taxable for federal

-

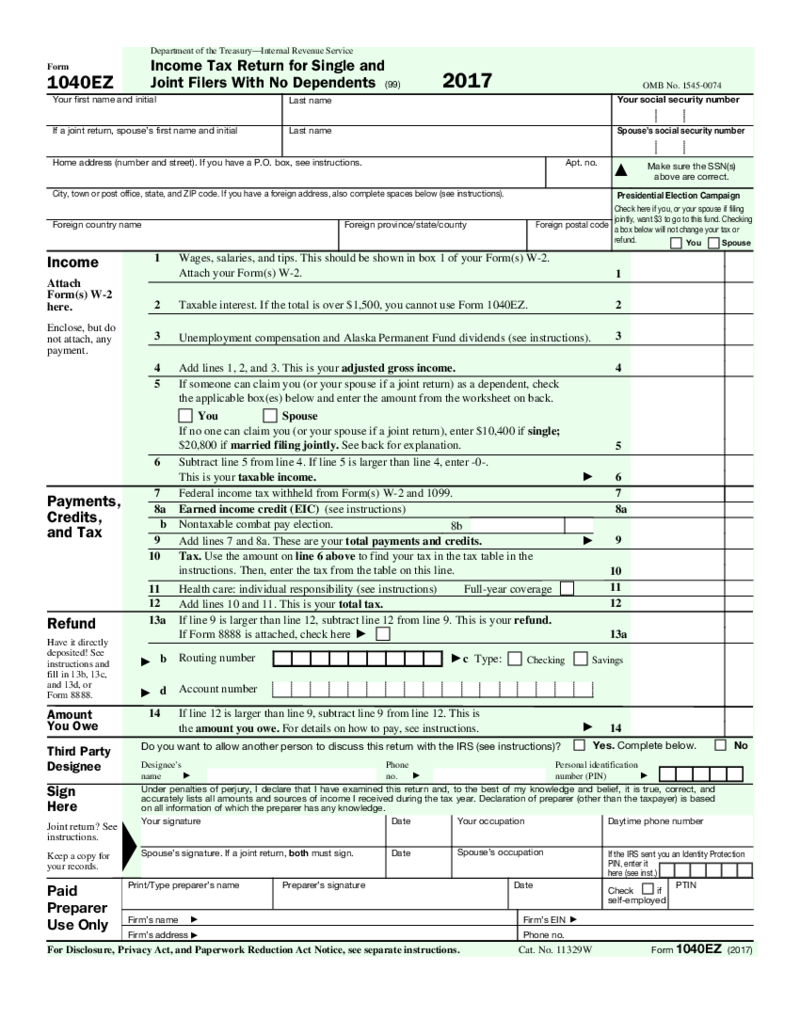

IRS Form 1040EZ

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayer

IRS Form 1040EZ

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayer

-

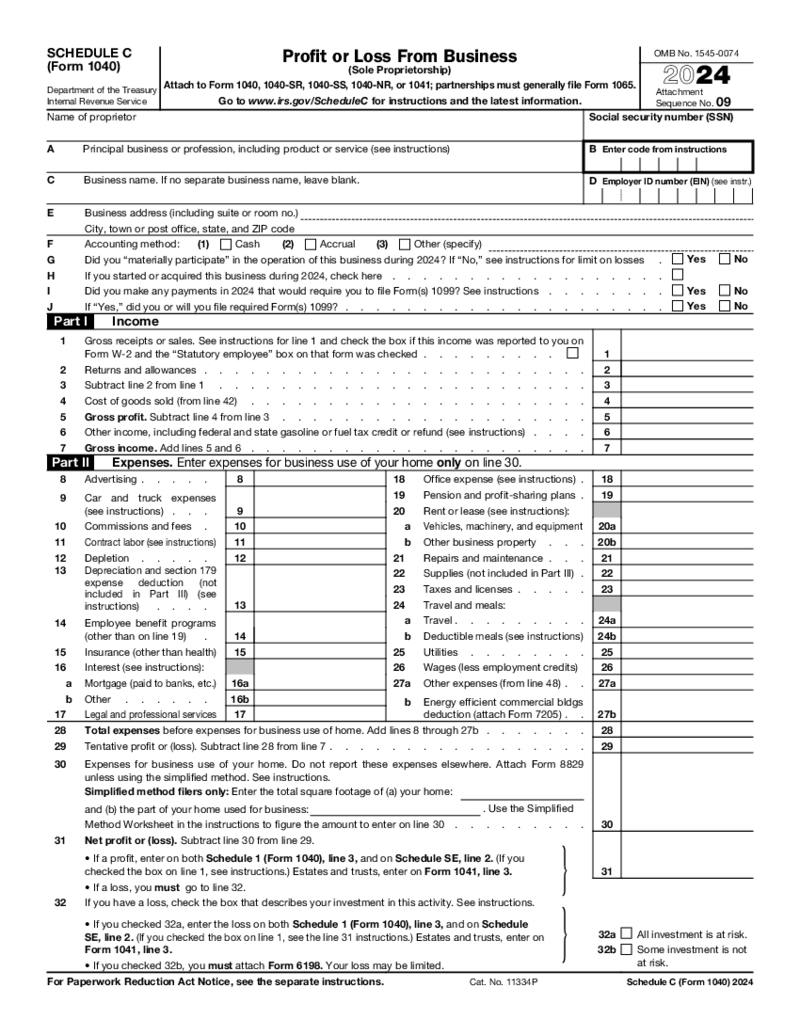

SCHEDULE C (Form 1040) 2024 - 2025

When To Use Fillable Schedule C 2024 - 2025

Schedule C is an addition to Form 1040 for:

1. Small business owners;

2. Independent contractors;

SCHEDULE C (Form 1040) 2024 - 2025

When To Use Fillable Schedule C 2024 - 2025

Schedule C is an addition to Form 1040 for:

1. Small business owners;

2. Independent contractors;

-

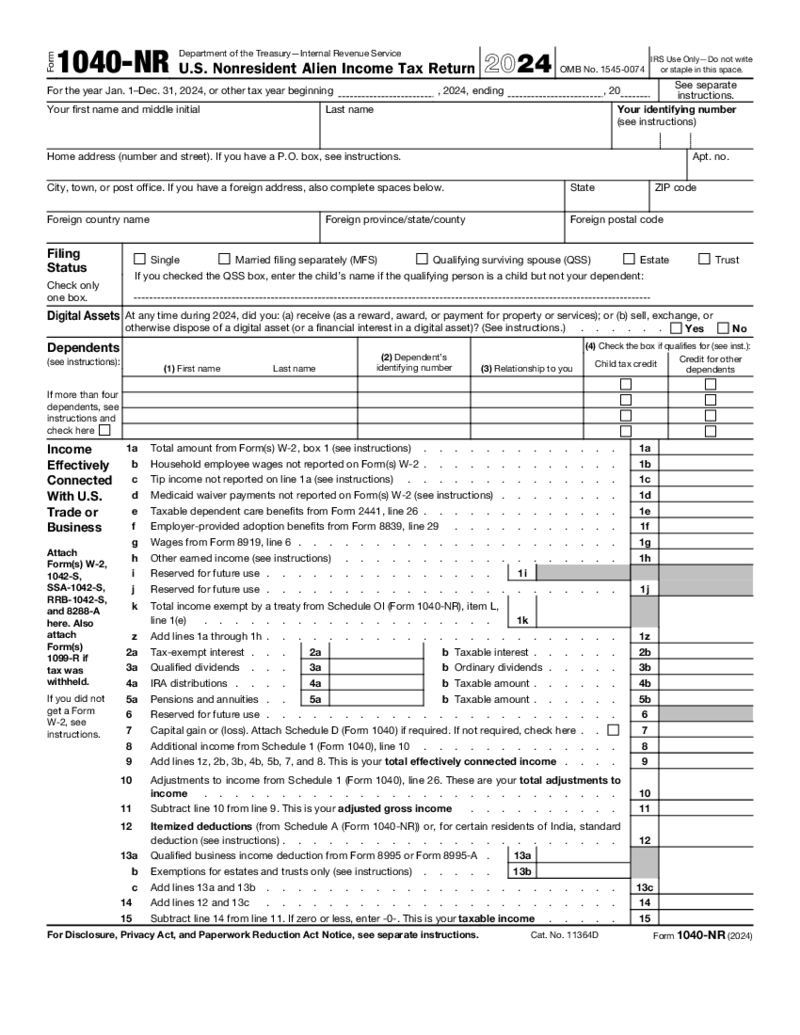

Form 1040-NR (2024)

What Is an IRS Form 1040-NR 2024: The Outline

Form 1040-NR is a variation of the standard income tax Form 1040 that lets you file your income tax return to the IRS if you are a nonresident alien in the United States, and you receive income from business o

Form 1040-NR (2024)

What Is an IRS Form 1040-NR 2024: The Outline

Form 1040-NR is a variation of the standard income tax Form 1040 that lets you file your income tax return to the IRS if you are a nonresident alien in the United States, and you receive income from business o

-

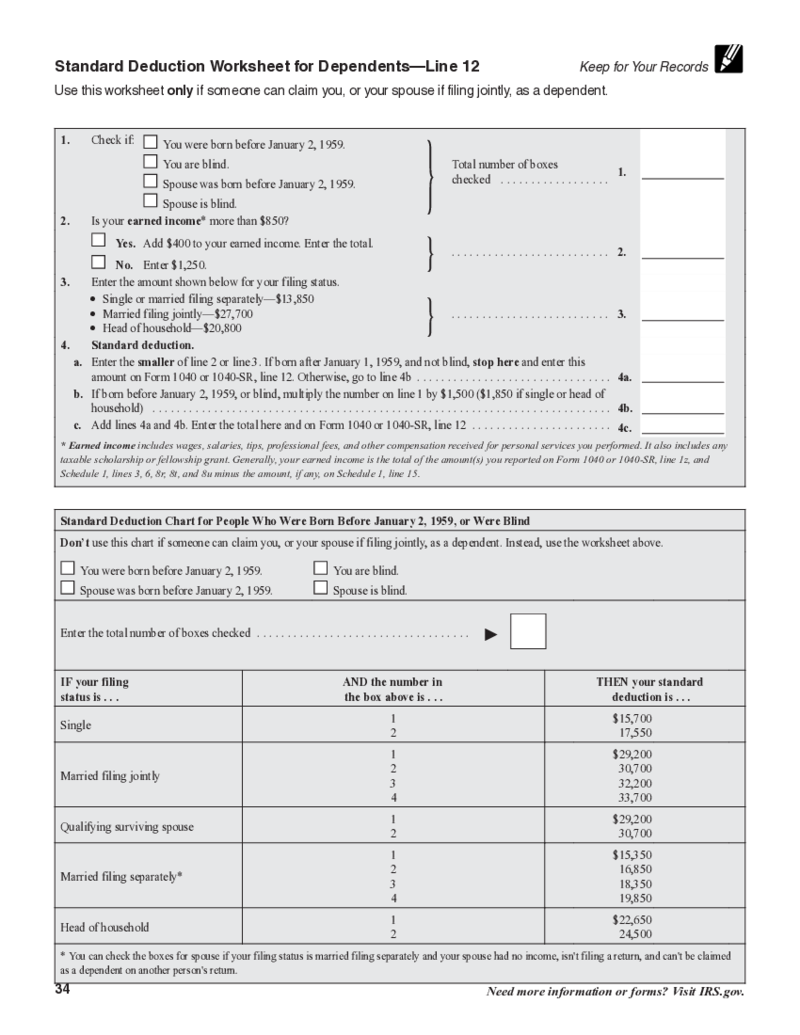

Standard Deduction Worksheet for Dependents

What Is a Standard Deduction Worksheet for Dependents

Standard deduction is an amount in US dollars deductible from your taxable earnings. Usually, this amount is influenced yearly by inflation, and is largely dependent on your marital or household status

Standard Deduction Worksheet for Dependents

What Is a Standard Deduction Worksheet for Dependents

Standard deduction is an amount in US dollars deductible from your taxable earnings. Usually, this amount is influenced yearly by inflation, and is largely dependent on your marital or household status

-

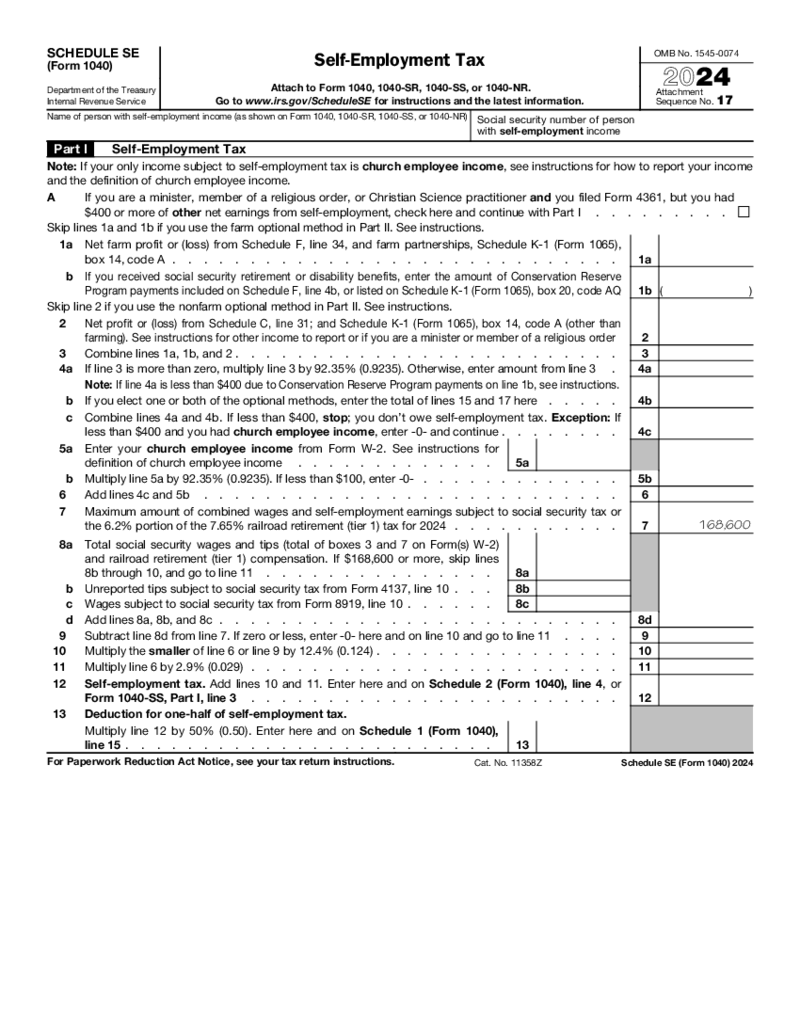

Form 1040 (Schedule SE) (2024)

What Is Schedule SE Form 1040?

Also known as Self-Employment Tax, Schedule SE Form 1040 calculates the Social Security and Medicare taxes for individuals who are self-employed. It helps determine the amount of tax owed based on net earnin

Form 1040 (Schedule SE) (2024)

What Is Schedule SE Form 1040?

Also known as Self-Employment Tax, Schedule SE Form 1040 calculates the Social Security and Medicare taxes for individuals who are self-employed. It helps determine the amount of tax owed based on net earnin

-

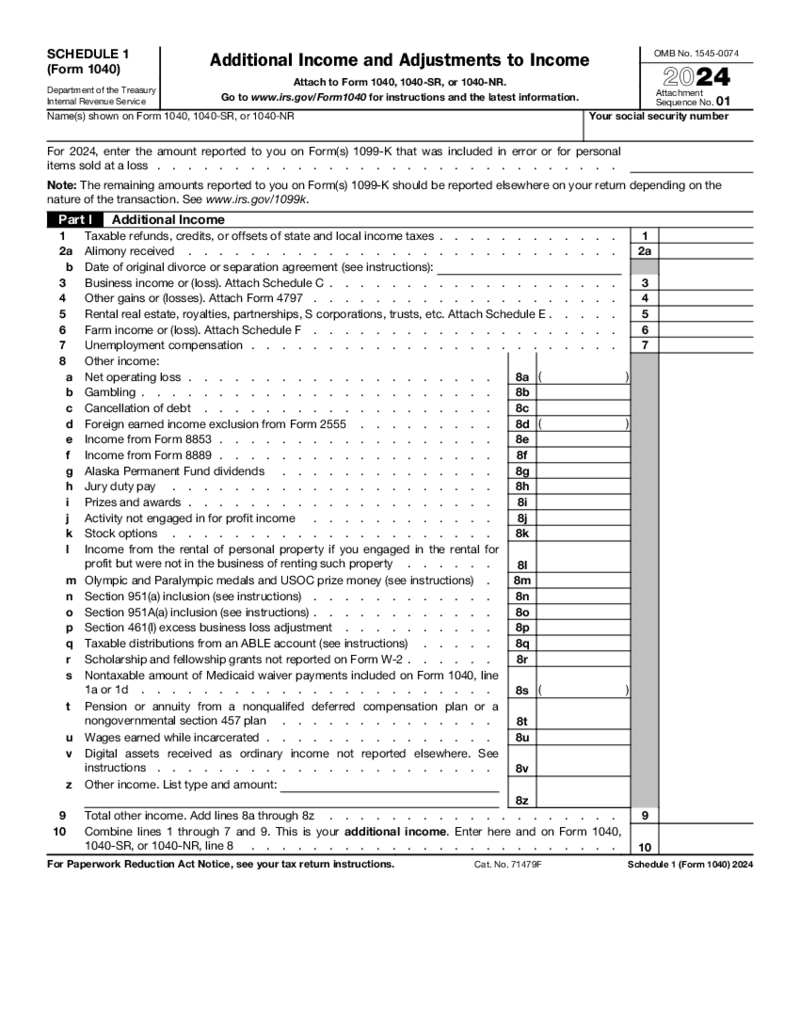

Form 1040 Schedule 1 (2024)

What is the Fillable Form 1040 Schedule 1?

Fillable Form 1040 Schedule 1 is a form that was released by the IRS. It is an addition to the IRS Form 1040. With its help, you are able to specify additional income and adjustments to income.

Form 1040 Schedule 1 (2024)

What is the Fillable Form 1040 Schedule 1?

Fillable Form 1040 Schedule 1 is a form that was released by the IRS. It is an addition to the IRS Form 1040. With its help, you are able to specify additional income and adjustments to income.

What Are 1040 Tax Forms?

First set up over a century ago, Form 1040 is among the most widely used tax documents that individual US taxpayers need to get to grips with. You need it for reporting your total annual earnings to the government and therefore, for pinpointing your annual tax refund. Simply put, the form shows the amount of your earnings within the last tax year. The document’s basic format hasn’t changed since it was introduced in 1913. But it does have several types and supplementary forms, depending on the specific calculations you need to make. In this piece, we’ll cover these additional forms in detail and dive deeper into the topic of 1040 tax forms.

Most Popular Federal 1040 Forms

Don’t forget that on PDFLiner, you’ll easily find perfectly customizable and printable 1040 tax forms to suit your most specific needs. Just choose the needed document version from our gallery and feel free to modify it right here and right now by making the most of our multiple super handy editing features. Now, when it comes to the IRS forms 1040 classification, we’ve outlined the main types below.

- Form 1040. For the most part, this main iteration comes down to conveniently collecting general data about your income, credits, and deductions.

- Schedule C. This document is a must-file for freelancers. It’s used to report your annual freelance earnings and losses to the authorities. The file is infused with sensitive data, so stick with the most reliable way of filing it to the corresponding government organization.

- Form 1040-SR. Are you sixty-five or older and need to file your tax return? This doc is exactly what you need. Its ultimate purpose is to aid seniors with clear and simple tax histories in submitting their returns. This one is among the 1040 easy forms.

- Form 1040-ES. Are you self-employed or operate your own business? Then this form is for you. Unlike the previous-year-related Form 1040, this particular iteration is utilized for calculating your return for the current year. Feel free to customize this form to suit your needs, e-sign it, and submit it via PDFLiner. With our service, it’s super easy.

- Form 1040X. Figured out you’d made a mistake or forgotten to include something important in your previously submitted tax return? No worries. You don’t have to start from scratch and fill out a brand new return. Use this iteration instead for the purpose of updating the necessary numbers.

With all that said, the classification of the federal 1040 forms is quite ample — and it’s not limited by the selection above. Don’t hesitate to use PDFLiner to manage your files online. Going digital comes with a multitude of benefits. It saves hours of your time and gives your productivity a mighty boost. Why draft docs from square one when you can effortlessly use a premade template. No need to scan or print anything. Fill it out online, send it for digital signature speedily, and voila! You’re all set.

Where to Get IRS Gov Forms 1040

Our platform features an extensive library of predesigned templates aimed at catering to your most sophisticated requirements. Additionally, here, you are free to manage any doc online, and that’s exceptionally time-saving. Just find the required form, click Fill Online, wait a few seconds until it loads, and get the completion process started.

Explore our smart functionality introduced to help you modify any doc to suit your in-depth needs. Don’t forget to sign your docs using our top-notch digital signature tool. Adding legally binding e-signatures to your 2022 tax forms 1040 has never been faster and easier.

FAQ

-

Where can I get blank 1040 forms?

You can get these forms either on our website or on the website of the corresponding tax authorities. The benefit of using PDFLiner for this purpose is that here, you can easily proceed with working on the file by editing it via our digital instruments.

-

What does a 1040 stand for?

It’s a document used for calculating your total assessable earnings and pinpointing the amount to be paid or refunded by the authorities. And it’s one of the most widespread IRS tax forms 1040. Simple as that.

-

How many US taxes forms 1040 are there?

There are more than five popular types of this document. Assess this point in detail in order to determine the type you currently need.