-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Payroll Correction Form

Get your Payroll Correction Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Insight Into the Payroll Correction Form

Payroll management is an integral part of any business. Various forms and documents are usually instrumental to the smooth running of payroll operations, one of which is the payroll correction form. This form is an essential tool used to correct any errors or discrepancies identified in an employee's payroll information. It ensures that the business remains compliant and that the employee's wage and tax details are accurate and up-to-date.

Revealing the Layout of a Payroll Correction Form

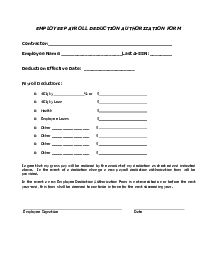

The Payroll Correction Form is essentially a document that records payroll errors while outlining associated details about the error and its proposed correction. Typically, it includes relevant fields such as the name of the employee, employee ID, payroll date, details of the payroll error, and proposed correction details. Unlike other forms, a payroll correction form requires the approval of both the employee and the employer to ensure an agreement on the suggested correction.

How to Fill Out Payroll Correction Form

Here's a detailed step-by-step guide on how to fill out the payroll correction form template on PDFliner:

- Enter your full name and employee number at the top of the form where indicated.

- Provide your contact phone number in the section that requests it for any necessary follow-up.

- Fill in today’s date and the payroll date(s) in question. You should list the dates during which you believe the payroll error occurred.

- Specify the total number of hours in question and list the program(s) these hours were meant for. This part of the form is crucial for identifying which areas of your payroll need correction.

- In the fields provided, show the actual hours you worked for each date in question. Beside each entry, record the total number of hours worked for that day.

- Explain why you believe an error was made in your payroll. This could be due to forgetting to clock in or out, not reporting hours properly, or other similar issues.

- Indicate your preference for adjusting the payroll error by selecting either to adjust your next payroll check or to issue a new check that reflects the correction.

- Sign the form and include the date of your signature in the space provided at the bottom.

- Have your supervisor sign and date the form to verify the accuracy of the information and the need for a correction.

- Forward the completed and signed form to the Front Desk and ensure it is date-stamped for official recording. This step is important for the timely processing of your payroll correction.

Perks of using PDFliner's payroll correction form template

By adopting the payroll correction form template from PDFliner's expansive template library, businesses reap numerous benefits. Besides the ability to correct payroll discrepancies quickly, companies can avoid miscommunication and maintain transparency throughout the organization.

The digitally accessible form also allows you to go paperless and reduce your carbon footprint, making it an environmentally friendly choice. Plus, you can use the built-in AI, and if you don't like this document, you can choose another one of the accounting templates.

Fillable online Payroll Correction Form