-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Fiduciary Reporting Forms

-

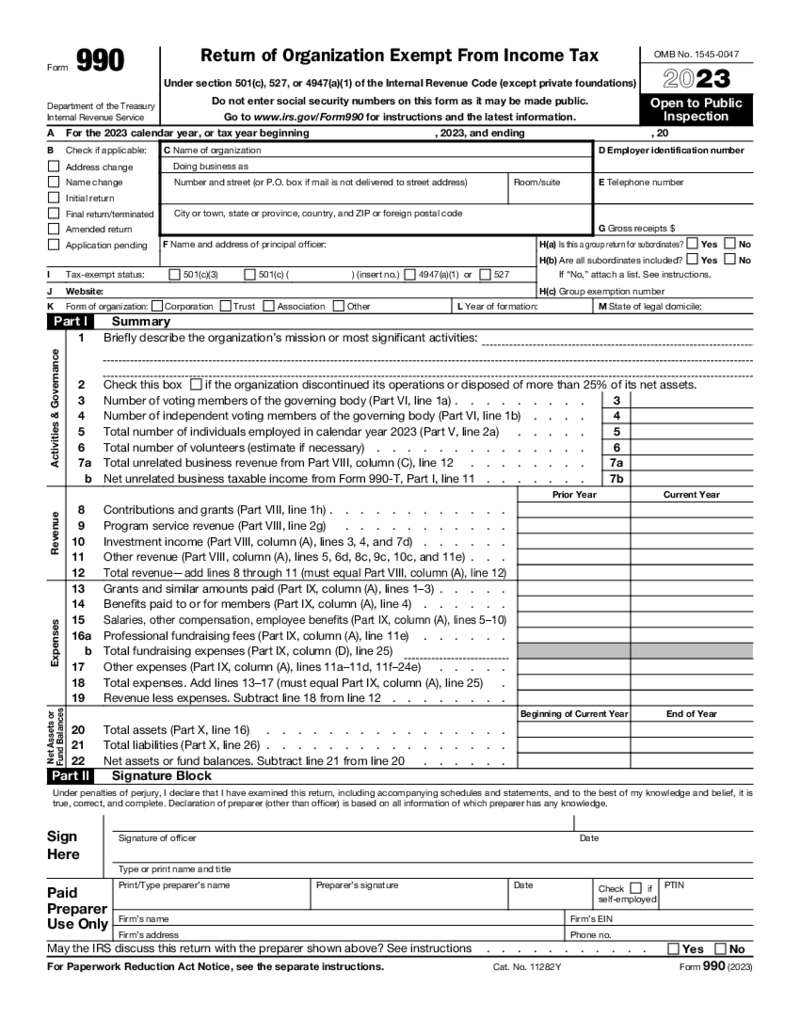

Form 990

What is Form 990 2023?

Form 990 is an annual reporting tax return that certain federally tax-exempt organizations must file with the Internal Revenue Service (IRS). It provides information on the organization's mission, programs, and finances, allowin

Form 990

What is Form 990 2023?

Form 990 is an annual reporting tax return that certain federally tax-exempt organizations must file with the Internal Revenue Service (IRS). It provides information on the organization's mission, programs, and finances, allowin

-

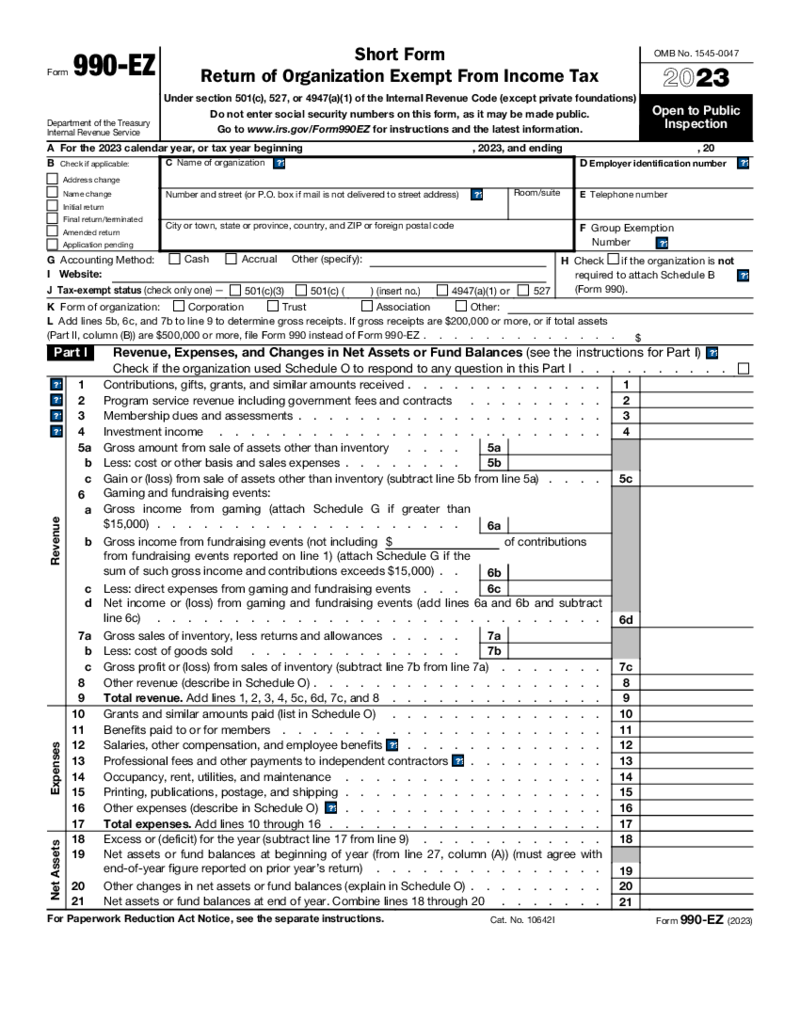

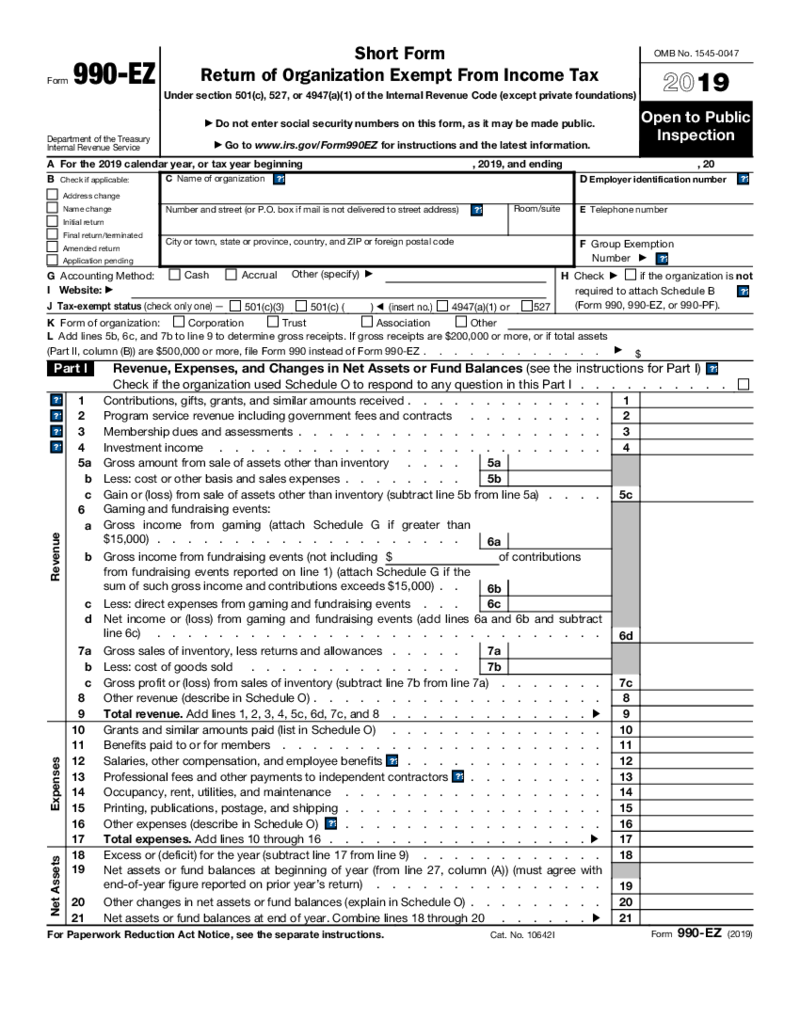

Form 990-EZ

What is form IRS 990 EZ?

The IRS 990 EZ is the shorter version of Form 990 for taxpayers to report about their incomes. Several entities should fill this form.

Form 990-EZ

What is form IRS 990 EZ?

The IRS 990 EZ is the shorter version of Form 990 for taxpayers to report about their incomes. Several entities should fill this form.

-

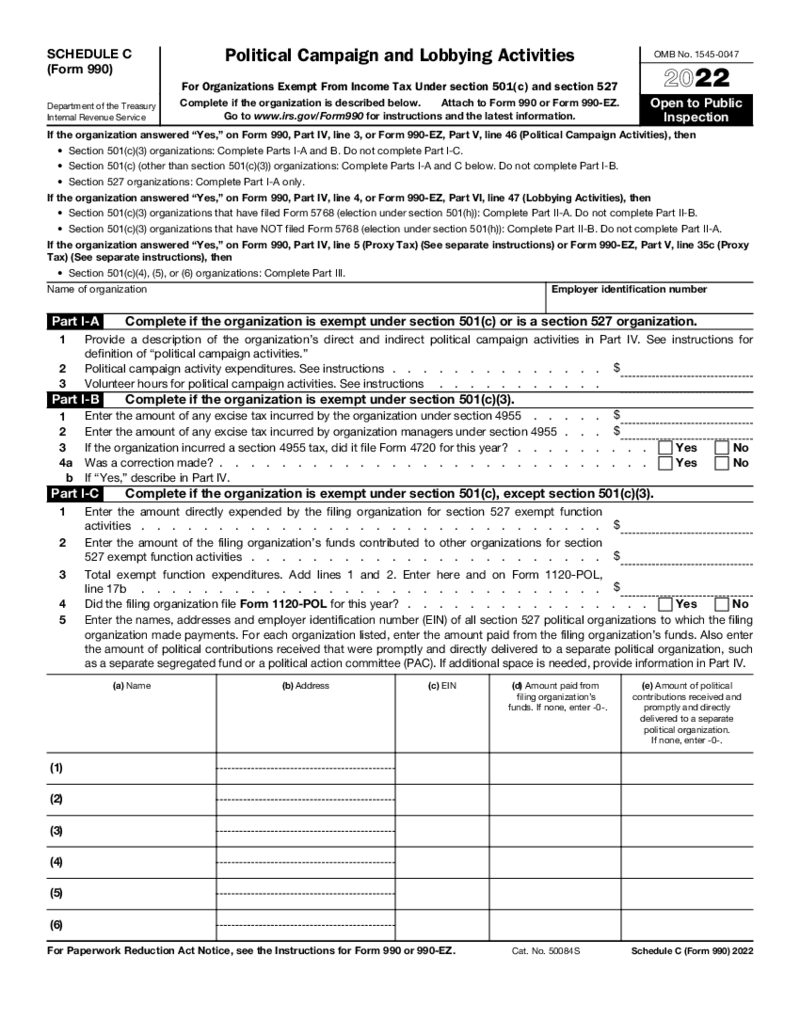

Schedule C (Form 990)

What is Form 990 Schedule C

Form 990 Schedule C is designed for organizations that engage in political campaign activities or lobbying actions. The IRS requires detailed reporting to ensure the activities align with the organization's tax-exempt statu

Schedule C (Form 990)

What is Form 990 Schedule C

Form 990 Schedule C is designed for organizations that engage in political campaign activities or lobbying actions. The IRS requires detailed reporting to ensure the activities align with the organization's tax-exempt statu

-

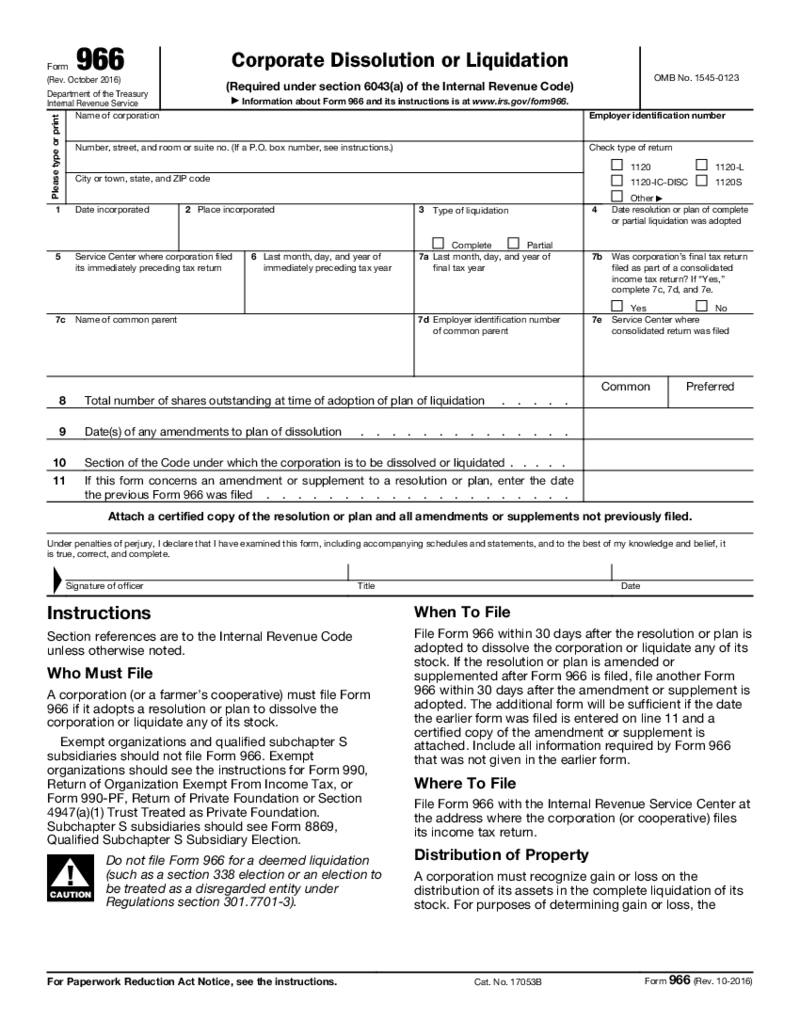

Form 966 - Corporate Dissolution or Liquidation

Understanding IRS 966 Form

Form 966, also known as the Corporate Dissolution or Liquidation form, is used by corporations to notify the Internal Revenue Service (IRS) of a decision to dissolve or liquidate a corporation. It is a crucial part of a corporat

Form 966 - Corporate Dissolution or Liquidation

Understanding IRS 966 Form

Form 966, also known as the Corporate Dissolution or Liquidation form, is used by corporations to notify the Internal Revenue Service (IRS) of a decision to dissolve or liquidate a corporation. It is a crucial part of a corporat

-

Form 990-EZ (2019)

What is Form 990-EZ 2019?

The 2019 IRS Form 990 EZ is a short form for income tax-exempt organizations. This form is commonly used by eligible organizations to file an annual return with the IRS. Form 990-EZ 2019 is a simplified version of Form 990 and is

Form 990-EZ (2019)

What is Form 990-EZ 2019?

The 2019 IRS Form 990 EZ is a short form for income tax-exempt organizations. This form is commonly used by eligible organizations to file an annual return with the IRS. Form 990-EZ 2019 is a simplified version of Form 990 and is

-

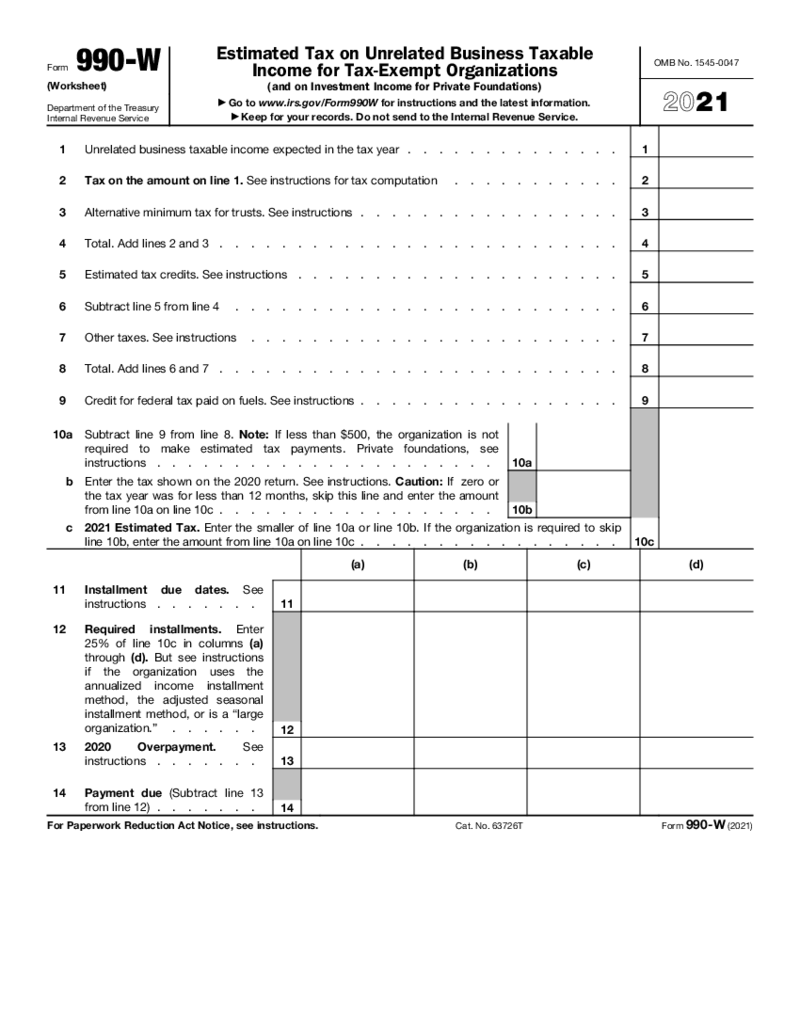

Form 990-W (2021)

What Is a Form 990-W

Form 990-W is an essential tax form used by tax-exempt organizations to estimate their federal income tax. Like businesses and individuals who pay quarterly estimated taxes, many non-profit organizations must estimate and prepay their

Form 990-W (2021)

What Is a Form 990-W

Form 990-W is an essential tax form used by tax-exempt organizations to estimate their federal income tax. Like businesses and individuals who pay quarterly estimated taxes, many non-profit organizations must estimate and prepay their

What Is a Fiduciary Income Tax Return?

Let’s start with the definition of fiduciary income tax. It’s the tax you pay on income generated from overseeing an estate or trust (i.e. being the fiduciary of that estate or trust). Now, with regard to the fiduciary tax return, as a trustee of an income-bringing trust or the administrator of a profit-generating estate, you’re going to need to file a return to the corresponding authorities. Here in this category, you’ll find some of the most frequently used IRS fiduciary income tax return forms with brief descriptions and the possibility to fill out those forms online.

When Is a Fiduciary Tax Return Required?

Wondering about the fiduciary tax return due date 2022 in your case? That depends on the specific document. Forms 990, 990-EZ, 990-PF, for example, are due on May 15. This fiduciary tax return due date can be moved to the next business day if it initially falls on weekend or legal holiday. Keep reading to learn more about these and some other popular IRS fiduciary tax return forms. You’re welcome to contact us if you have further questions about those forms. Don’t forget that PDFLiner is your go-to solution when it comes to quality digital document management.

Most Popular US Fiduciary Income Tax Return Forms

If you’re rummaging the net for one of the forms listed below, look no further. In our vast library of templates, we’ve prepared hundreds of niche-specific forms to suit all possible needs. All our templates are free of charge and fully editable. Find the most widely used federal fiduciary tax return forms below.

- Form 990-EZ. This is a concise version of Form 990 that functions as the short form return of entities exempt from income tax. These organizations must have gross income less than $200,000 and total assets less than $500,000. When filling out this form, you need to specify the details about your organization, your earnings within this fiscal year, as well as indicate if anything has been changed in your net assets. Because the document is brimming with sensitive information, ensure it’s well-protected.

- Form-990 is an information return form that the majority of tax-exempt entities must fill out on a yearly basis. In general, the document features a relatively brief summary of the entity’s activities, leadership, and complete financial background. Maximum accuracy is vital when it comes to completing this form. So, prior to getting the completion process going, you may want to gather all the necessary data in advance.

- Form 990-W. This document is utilized for pinpointing the tax-exempt entities’ estimated tax liability associated with their unrelated business income. If you want to keep your books in order, filling out this form is a definite must-do. The form features seven pages, some of which are fillable sections and others are for informational purposes only. Study the instructions provided in the informational sections of the document prior to completing it.

- IRS 990 - Schedule B. It is utilized by the nonprofit entities for the purpose of reporting details about the contributors who donated $5,000 or more. Corporations, trusts, partnerships, fiduciaries, and exempt entities are considered as contributors. This form typically features the list of contributors, along with the amount they have donated to the entity.

- Form 990-PF. It’s a document that US private foundations submit to the tax authorities. Featuring 16 sections, the form should contain such details as trustee and officer names, application data, and full grants list. Read the attached instructions and requirements prior to completing the form.

On the whole, these forms are not a cakewalk to deal with. Therefore, if you’re not a tax expert, we recommend that you turn to professional assistance to ensure maximum accuracy and compliance. Our platform provides you with all the necessary tools for successful digital document management. So, if fiduciary income tax return forms are what you specialize in, you’ll enjoy filling out the necessary forms via PDFLiner.

Where to Get Fiduciary Tax Return

Take a browse through our ample catalog of tax forms to find the necessary template. If the file you need is among the most widespread in this particular group of tax forms, feel free to open it right from this category and get the completion going. Alternatively, you can find the needed form on the IRS official website. This method, however, unlike what PDFLiner offers, does not come with the possibility of filling out the form online right here and right now. So, naturally, our service catalog is your best bet. Don’t forget that here, you can add a totally legally-binding signature to your documents. The procedure takes only a few minutes of your time and is as easy as ABC. You’re welcome to find all the necessary tips, instructions, and tutorials here on our website. Enjoy.