-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

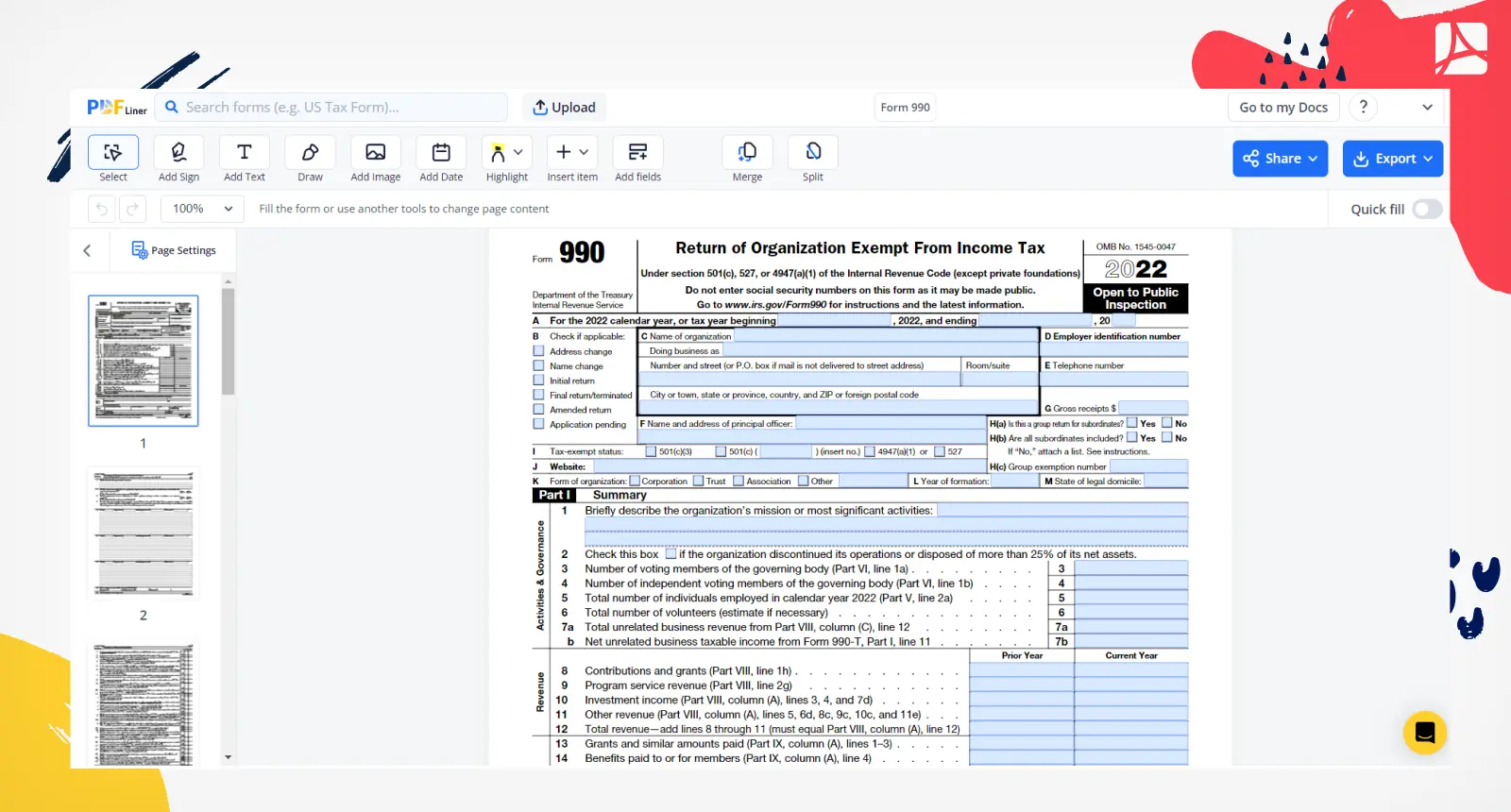

Form 990 (2023)

Get your Form 990 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 990 2023?

Form 990 is an annual reporting tax return that certain federally tax-exempt organizations must file with the Internal Revenue Service (IRS). It provides information on the organization's mission, programs, and finances, allowing the IRS and the general public to evaluate its operations, ensuring it uses its funds for tax-exempt purposes. Completing the form correctly is essential for maintaining tax-exempt status and avoiding penalties.

IRS form 990: Who needs to file?

Organizations required to file the IRS form 990 include tax-exempt organizations, non-profit groups, and charitable institutions with gross receipts totaling $200,000 or more or total assets worth at least $500,000. Smaller organizations may file form 990-EZ instead. Keep in mind that certain organizations, such as religious organizations, state institutions, and government corporations, are exempt from filing form 990.

How to Fill Out an IRS 990 Tax Form: Key Sections and Tips

To complete Form 990 accurately, follow these steps:

- Provide the organization's full legal name, address, and contact information at the top of Page 1 in the "Heading" section.

- Select the appropriate checkboxes for the organization's tax year, type of organization, exemption, and group return if applicable.

- Check the box for the website address, if available, and write the address.

- Fill in the "A" and "B" columns by providing every line's respective amounts in the "Revenue, Expenses, and Changes in Net Assets" section.

- In the "Part III - Statement of Program Service Accomplishments," describe the organization's mission and specific activities that accomplish its goals in lines 1-4. Include expense amounts for each activity mentioned.

- Complete "Part IV - Checklist of Required Schedules" by checking "Yes" or "No" for each question based on the organization's financial activities and requirements. Attach additional schedules if required.

- Fill in "Part V - Statements Regarding Other IRS Filings and Tax Compliance" by providing information on the organization's IRS filings, such as payroll taxes, 1099 forms, and employee compensation disclosures.

- In "Part VI - Governance, Management, and Disclosure," provide information about the organization's governing body, policies, and disclosure practices.

- Complete "Part VII - Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors" by listing the required individuals and their compensation details.

- In "Part VIII - Statement of Revenue," report the organization's various sources of revenue, including contributions, program service revenue, investment income, and others.

- Fill in "Part IX - Statement of Functional Expenses" to provide a detailed breakdown of the organization's expenses, including program services, management, and general and fundraising expenses.

- Complete "Part X - Balance Sheet" by providing the organization's assets, liabilities, and net assets at the beginning and end of the tax year.

- Fill in "Part XI - Reconciliation of Net Assets" to show the changes in the organization's net assets during the tax year, including any prior period adjustments and other changes.

- Complete any additional schedules required based on the organization's activities and responses in "Part IV - Checklist of Required Schedules."

- Review the completed form 990 for accuracy and sign the form electronically using the PDFLiner editor's e-signature feature. An organization officer, such as the president, treasurer, or executive director, should sign the form.

Why choose to file form 990 online?

Filing the 990 form template online is advantageous due to its convenience, efficiency, and accuracy. By choosing to e-file, organizations can quickly submit their tax information securely, minimize errors through electronic validations, receive instant confirmation of submission, and reduce the risk of late filing or penalties. Additionally, online filing is environmentally friendly, reducing the need for physical paperwork.

Form Versions

2019

Fillable Form 990 for 2019 tax year

2020

Fillable Form 990 for 2020 tax year

2021

Fillable Form 990 for 2021 tax year

2022

Fillable Form 990 for 2022 tax year

Fillable online Form 990