-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

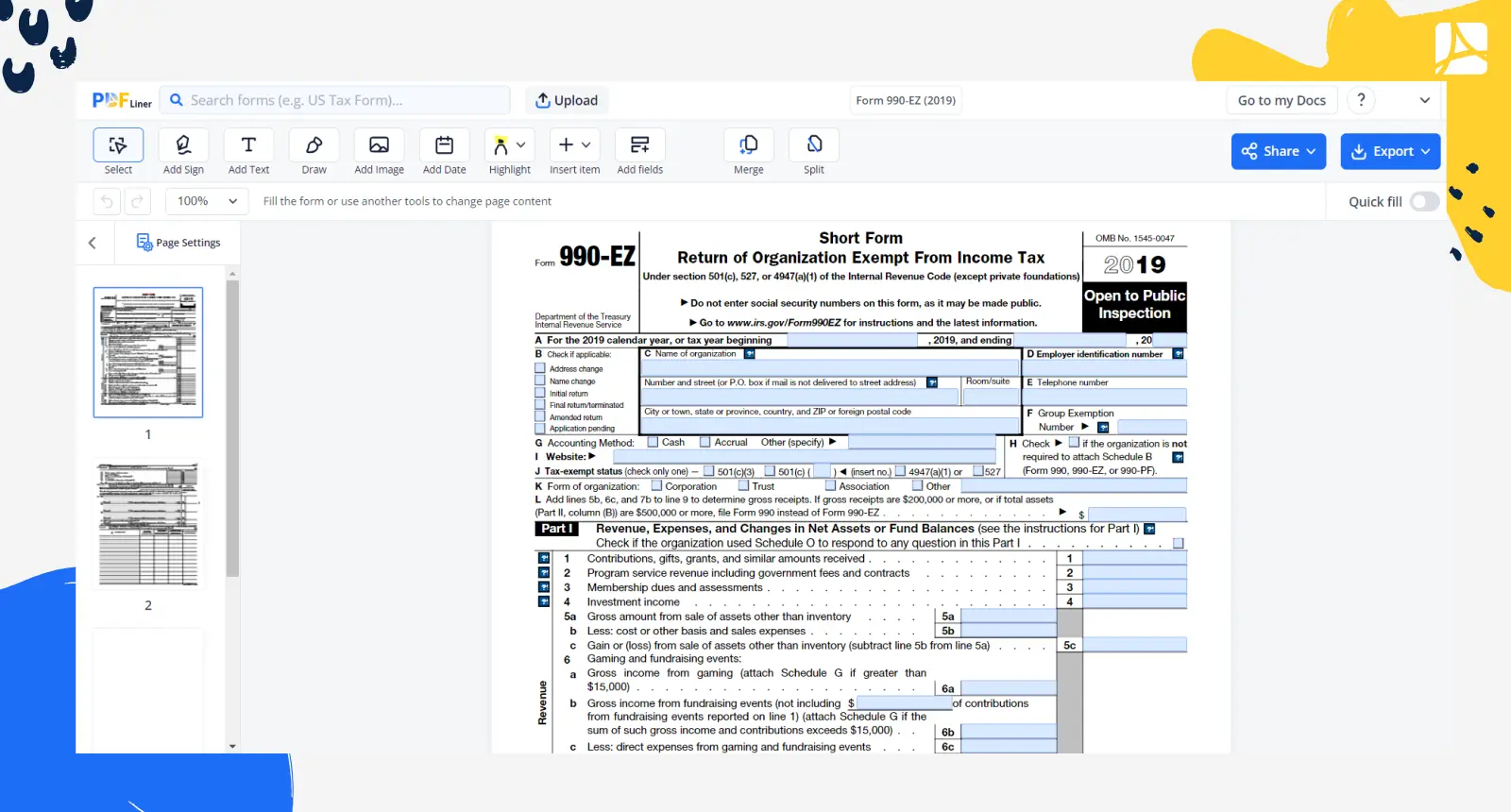

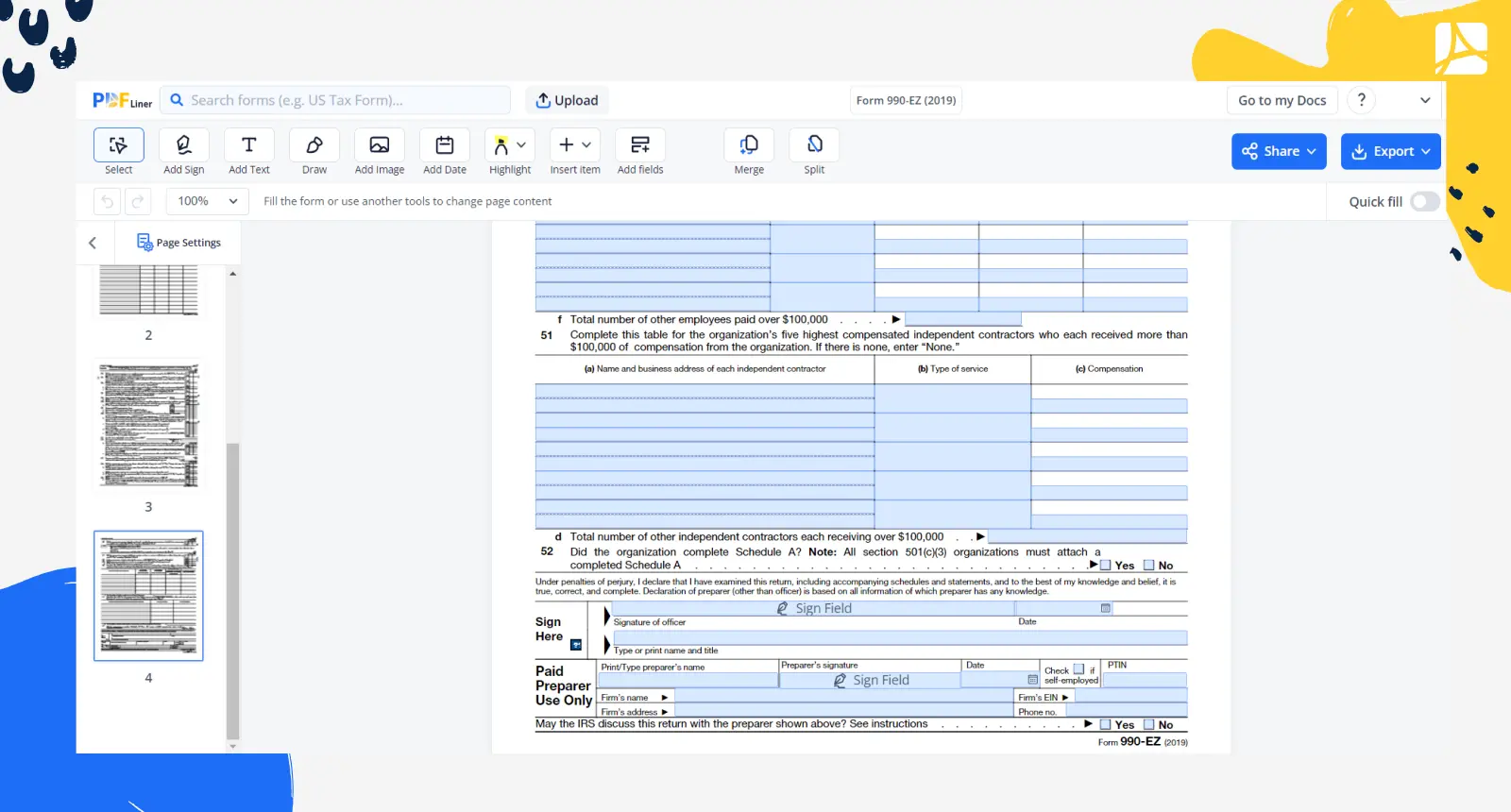

Form 990-EZ (2019)

Get your Form 990-EZ (2019) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is Form 990-EZ 2019?

The 2019 IRS Form 990 EZ is a short form for income tax-exempt organizations. This form is commonly used by eligible organizations to file an annual return with the IRS. Form 990-EZ 2019 is a simplified version of Form 990 and is less detailed than full Form 990. However, it still requires the organization to provide information about its mission, programs, and finances. Form 990-EZ 2019 pdf is the most common form filed by tax-exempt organizations.

What is form 990-EZ used for?

This form is used to file tax returns for certain types of small exempt organizations. The letter "EZ" in the name means "easy," and that's what IRS is aiming for in creating this form: a shorter, easier way to file for those who don't need to provide extensive information about their finances and activities.

How to Fill Out Form 990-EZ?

If your organization is eligible to file Form 990-EZ, also known as the "Short Form Return of Organization Exempt From Income Tax," you can use this form to give IRS the information required by law.

Once you have gathered all the information you need, you can begin filling out the form. The 2019 IRS Form 990 EZ consists of seven sections:

Section 1: Organization Information

In this section, you will provide general information about your organization, including name, address, and employer identification number. You also must indicate whether you are filing an amended return and, if so, why.

Section 2: Financial Information

In this section, you describe your organization's income and expenses. Also, you will indicate your assets and liabilities, as well as your net assets or fund balances.

Section 3: Income Statement

Here you will outline your organization's total income, including contributions, grants, and other income. You will also report the total expenses incurred in connection with your fundraising activities.

Section 4: Statement of Program Service Accomplishments

Under this section, you should describe your organization's major activities. You will also describe any other activities you conducted during the year that contributed to your exempt goal.

Section 5: List officers, directors, and employees

Complete the table and write detailed information about your officers, directors, and key employees.

Section 6: Functional Expenses Report

In this section, you should report your organization's expenses by function. Expenses should be allocated among the following functions: program, management and general administration, and fundraising.

Section 7: Signature Block

In this section, you will sign and date the form. The form should be signed by an authorized representative of your organization.

Once you have completed all six sections of the printed Form 990-EZ 2019, you can mail it to the address listed on the form. Be sure to keep a copy of the form for your records.

How to submit form 990-EZ?

After you fill out the form, you can mail or mail it electronically to the IRS.

Who should sign form 990-Ez?

The IRS 2019 990 EZ Form should be signed by an authorized officer of the organization.

Form Versions

2021

Fillable Form 990-EZ for 2021 tax year

2020

Fillable Form 990-EZ for 2020 tax year

Fillable online Form 990-EZ (2019)