-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

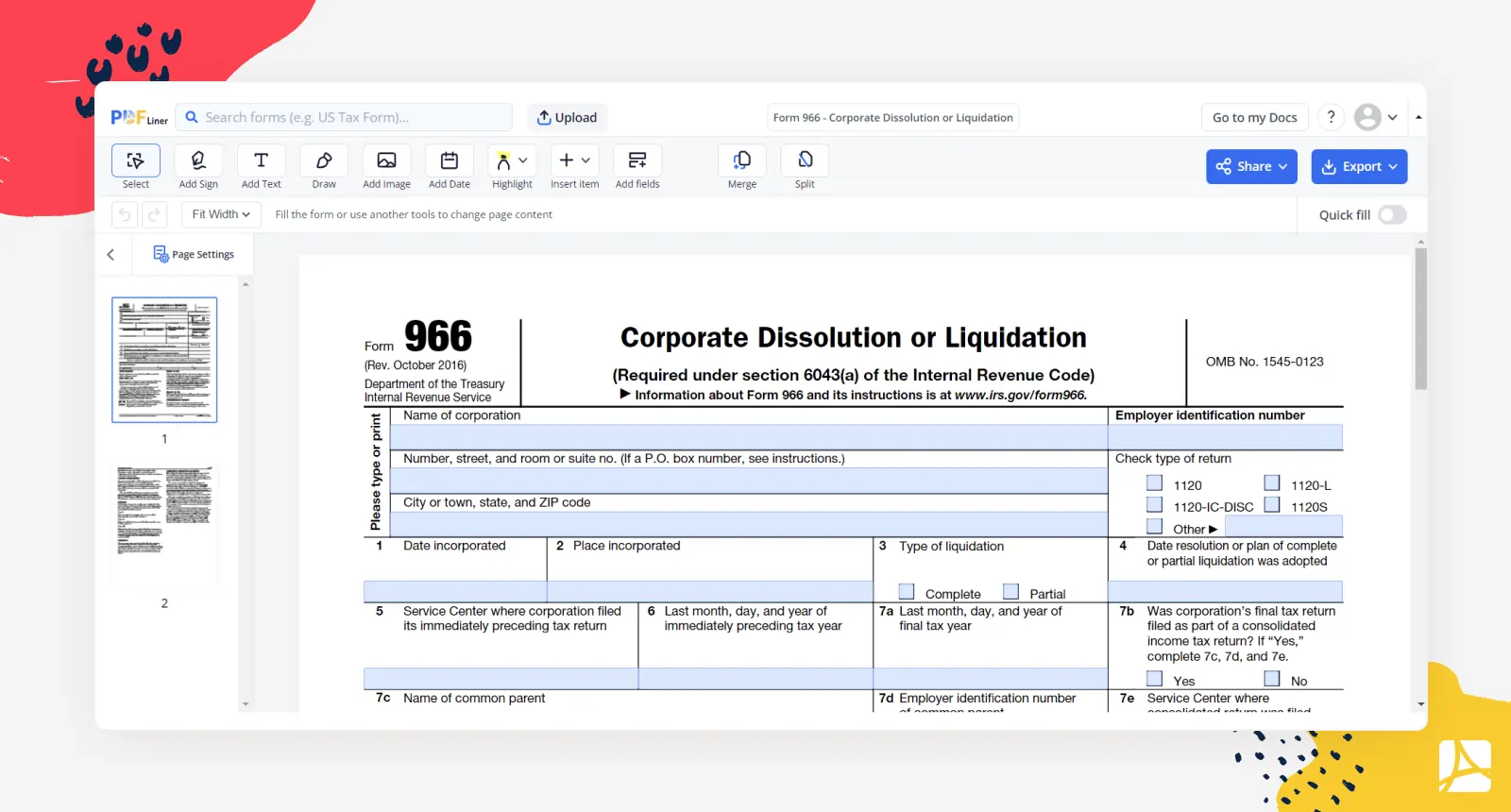

Form 966 - Corporate Dissolution or Liquidation

Get your Form 966 - Corporate Dissolution or Liquidation in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding IRS 966 Form

Form 966, also known as the Corporate Dissolution or Liquidation form, is used by corporations to notify the Internal Revenue Service (IRS) of a decision to dissolve or liquidate a corporation. It is a crucial part of a corporation's formal winding-up process, enabling it to settle its tax obligations correctly.

Where to File Form 966

Filing Form 966 involves both online and offline methods. Initially, you must download the 966 Form from the IRS website. Ensure to fill it out accurately, as it contains essential information regarding your corporation's decision to dissolve or liquidate.

After completing the form, you can file it electronically if your business has the required software that supports the IRS e-file. E-filing is the most efficient and convenient method and is increasingly becoming the standard for many corporations.

If e-filing isn't possible, Form 966 can be mailed to the IRS. The specific mailing address depends on the state where your corporation is based.

Where to Mail Form 966

The address to mail IRS 966 Form depends largely on the principal location of your business. Form 966 corporate dissolution or liquidation should be mailed to the same address you send your corporate tax return. The IRS website lists addresses categorized according to the corporation location for mailing various forms. Ensure to use the correct address to avoid delays in processing your dissolution.

While mailing, use a method that provides proof of delivery, such as registered mail or a courier service. This will offer you evidence that the IRS received the form in case there are any disputes or issues later.

How to Fill Out Form 966

Filling out Form 966 can be a bit complex, but with a careful approach, it's manageable. The form requires information like the corporation's name, employer identification number (EIN), date of incorporation, and details about the dissolution or liquidation plan.

Part 1

Enter your corporation's information such as the name, EIN, address, and the tax year ending month.

Part 2

Specify the type of action (dissolution or liquidation), date of action, and details of the adoption of resolution or plan. If the corporation has shareholders, a majority must consent to this plan.

Part 3

Provide information about any tax forms related to the dissolution that the corporation intends to file, such as Form 1120 or 1120S.

Part 4

If the corporation has changed its name or address since the last return was filed, indicate this here.

Part 5

Complete this section if the corporation has disposed of its assets or stock.

Signature

An authorized corporate officer must sign and date the form.

Fillable online Form 966 - Corporate Dissolution or Liquidation