-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 940 Schedule R

Get your Form 940 Schedule R in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Schedule R (Form 940)

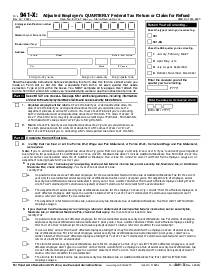

The Internal Revenue Service (IRS) uses Form 940 to determine the annual Federal Unemployment Tax Act (FUTA) tax owed by employers. For multi-state employers or those with multiple entities, Schedule R (Form 940) becomes a vital tool. It's primarily used to allocate the aggregate FUTA liability shown on Form 940 to the individual state(s) where the employer carries out their business.

Important to remember

After completing Schedule R (Form 940), attach it to Form 940 when filing. Ensuring it's correct and precise is crucial, as any inaccuracies can result in paying more or less FUTA tax than required which could lead to penalties.

How to Fill Out Form 940 Schedule R

The question about filling out the form ranks high on the anticipation charts for many employers, as it’s a crucial but oft-confusing process. The improper filling could lead to complications or discrepancies during tax assessment. However, once you know the steps, it's quite straightforward:

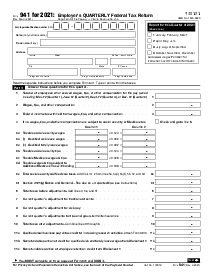

- Start by inputting your EIN (Employer Identification Number) and full name in the top of the box.

- Move on to the next section. Here, you will need to provide information about the type of filer you are.

- Check the box that applies to you, and if necessary, add your business's name and address in the allocated boxes.

- Navigate to the next section, and fill the table given with the necessary information. Write down the name of the state, the Employer's state Identification number, and, if applicable, the credit reduction rate as per the sequence and guidelines in the form.

- Now, if you had different FUTA tax rates during the year, you need to fill next part. Add the periods, the FUTA rates, and payments that were paid at each rate.

- Next, you will have to calculate your total FUTA tax after all allowable adjustments have been made. Make sure to add the figures correctly.

- Now come to the final section 6, labeled as "Total FUTA tax." Here calculate your total FUTA tax by adding the four components and pen down the amount.

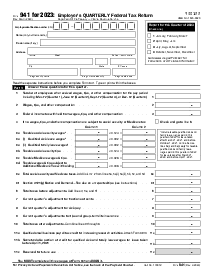

- Lastly, check through the entire form to ensure all the entered information is accurate before submitting the form.

- Once you're through, you may save a copy, print, download, or share this form for your records.

Common mistakes to avoid

Filling the form can occasionally lead to confusion which sometimes results in errors. The most common error is incorrect state coding. Always ensure to supply the correct state code for every team member's primary work location. Other common mistakes are overestimated exemptions and under-reported taxable wages. This can lead to an underpayment or overpayment of FUTA taxes, which might involve penalties or delays in refunds.

Fillable online Form 940 Schedule R