-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 940 PR

Get your Form 940 PR in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

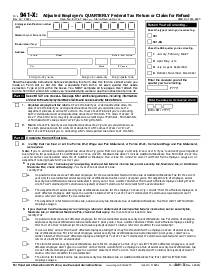

What Is a Form 940 PR?

In a nutshell, it is a tax form used in the U.S. that employers use to report their annual federal unemployment tax (FUTA). This tax is owed to the Internal Revenue Service (IRS) and is essential for funding state workforce agencies. If you're asking if you need to use it, then the answer is yes if you've paid wages of $1,500 or more in any calendar quarter or had any employee work for you any day of a week during 20 or more different weeks in a year.

Decoding the IRS form 940 PR

The IRS Form 940 PR is a critical piece of documentation for employers. This form records how much FUTA tax the employers are obligated to pay. This tax is different from the state unemployment tax; it's a separate federal tax solely utilized for unemployment funding. If an employer meets the abovementioned criteria, this form should be filled out and sent to the IRS.

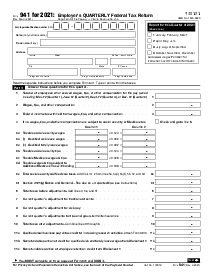

How to Fill a 940 PR Form

Though filling out tax forms can often be daunting, learning about filling out a 940 PR form is a simpler process than you might imagine. Here are the steps you need to follow when filling out a 940 PR form:

- Begin by typing your business name and Employer Identification Number (EIN) in the section labeled 'A'. Make sure to write the correct and full name of your business entity to avoid any confusion or errors.

- Proceed to address-related fields. In section ‘B’, you're required to input your detailed business address. Remember to include any suite or room number (if applicable).

- Section ‘C’ is for your business name along with the type of business entity. Select the appropriate options for your type of business.

- In section 1, enter the number of employees who received wages, tips, or other compensation for the tax year.

- In section 2, state whether you paid wages in the tax year including certain types of tax-exempt payments such as fringe benefits.

- Fill out the next sections, which ask about specific types of taxable wages and tax payments. Take your time and be accurate to avoid any potential tax liability issues.

- Fill in the section with a quick auto-calculation of the total tax after adjustments and credits. Assure all the entries in previous sections are correct for accurate tax assessment.

- Now, fill in sections, which cover balance due or overpayment. If you have overpaid, you can choose to either apply the overpayment to the next return or receive it as a refund.

- Finally, you will sign the document in an appropriate box. Include your title and the date of signing. Also, remember to provide the 'Paid Preparer' contact details if someone filled out the form on your behalf.

- Now you may download, print, or share a copy of the signed and completed 940-PR form for your records.

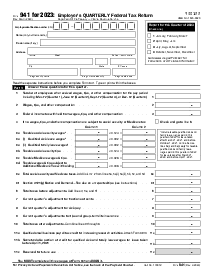

Importance of completing the form 940 PR

Filing the 940 PR form is more than just a necessity under U.S. law. It also plays a crucial role in society. Completing a 940 PR Form helps the government provide unemployment funds to people who have lost their jobs. Moreover, it contributes to reemployment services nationwide. The FUTA tax and the 940 PR Form bridge the gap between unemployment and reemployment, ensuring stability in times of job upheaval.

Fillable online Form 940 PR