-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Individual Forms

-

1040 Form

Filling Out the IRS 1040 Form 2024 - 2025: Guide with Example

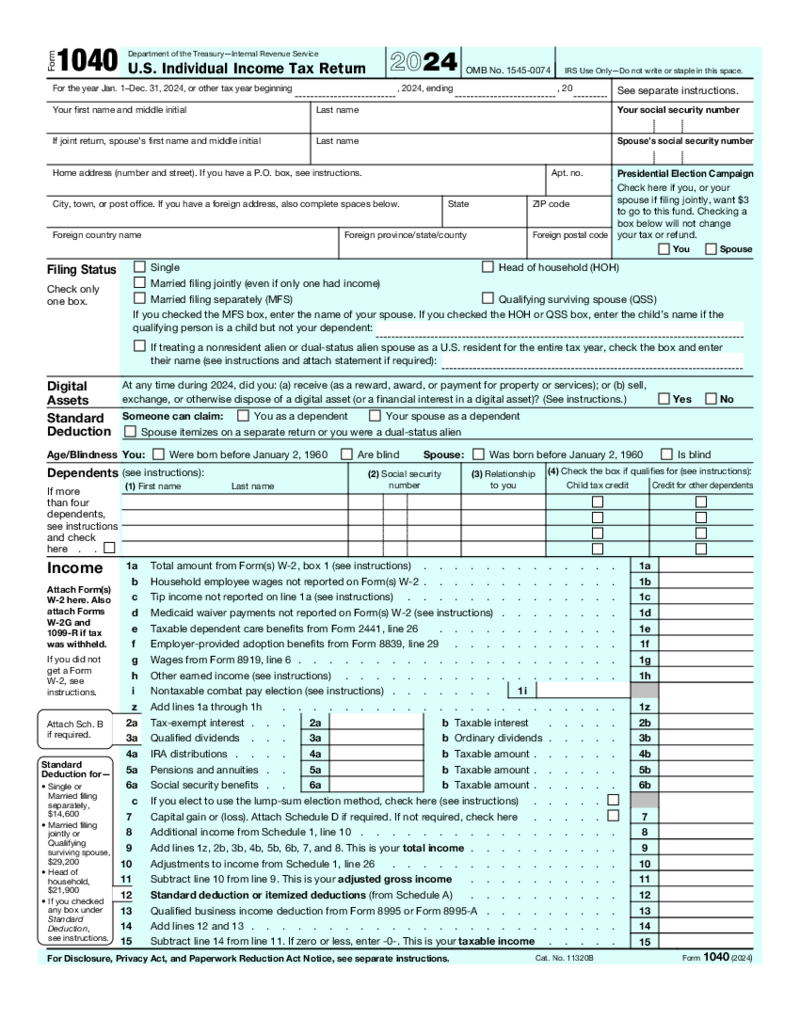

Form 1040 is the standard tax form individuals in the United States use to file annual income tax returns. This form is issued by the Internal Revenue Service (IRS) and is used to report v

1040 Form

Filling Out the IRS 1040 Form 2024 - 2025: Guide with Example

Form 1040 is the standard tax form individuals in the United States use to file annual income tax returns. This form is issued by the Internal Revenue Service (IRS) and is used to report v

-

Qualified Dividends and Capital Gain Tax Worksheet 2024

What Is Qualified Dividends and Capital Gain Tax Worksheet 2024-2025?

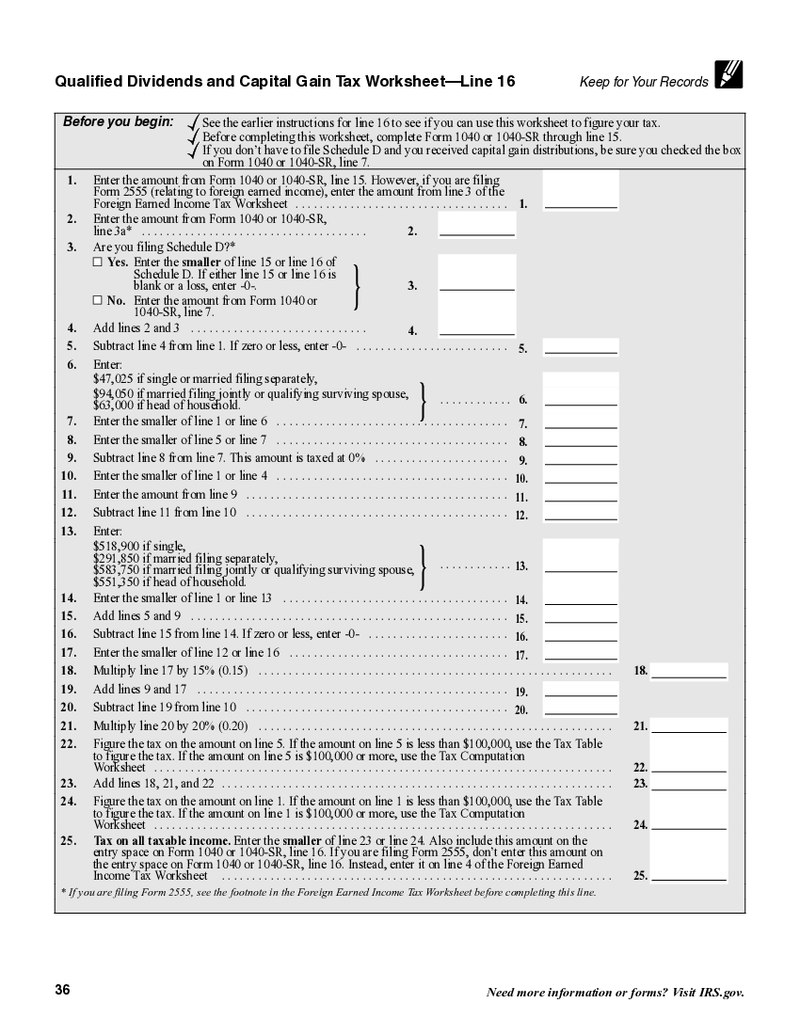

This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term cap

Qualified Dividends and Capital Gain Tax Worksheet 2024

What Is Qualified Dividends and Capital Gain Tax Worksheet 2024-2025?

This printable PDF blank is a part of the 1040 guide-you-on-your-way brochure’s ‘Tax and Credits’ section. It is used only if you have dividend income or long-term cap

-

Social Security Benefits Worksheet (2023)

What Is Social Security Benefits Worksheet in 2023 - 2024?

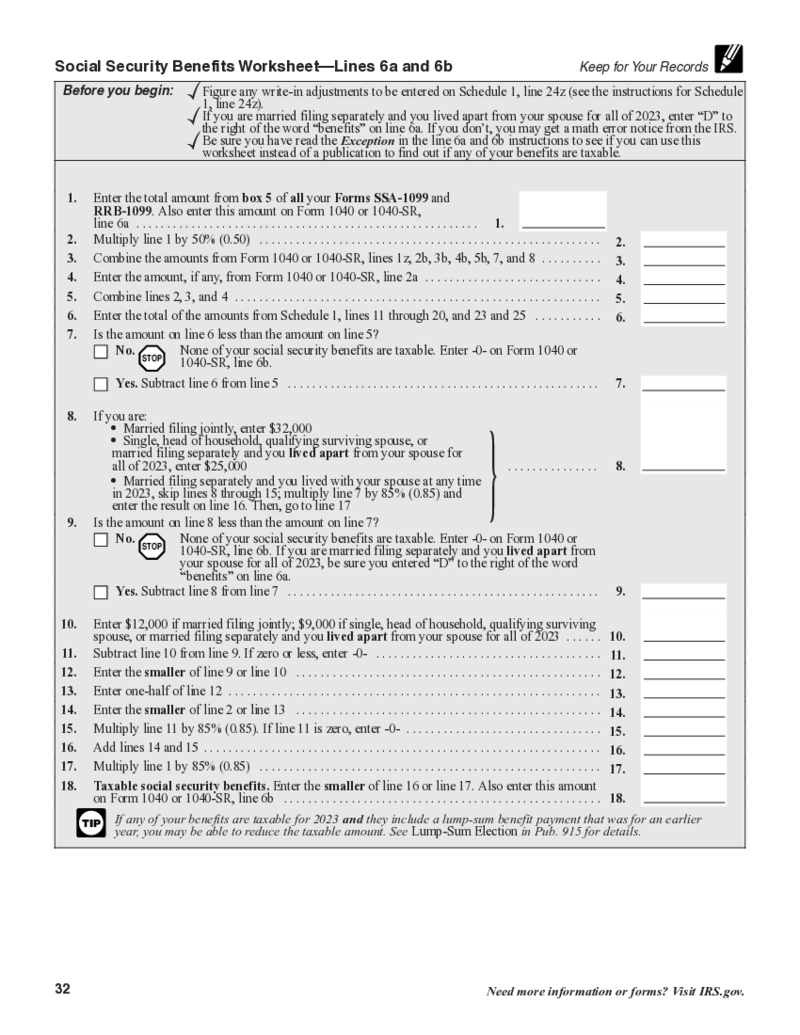

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen. If the benefits are not taxed, then the sheet is not created.

Social Security Benefits Worksheet (2023)

What Is Social Security Benefits Worksheet in 2023 - 2024?

The worksheet is created as a refund if social security benefits that are partially or fully taxed are entered on the SSA screen. If the benefits are not taxed, then the sheet is not created.

-

Tax Computation Worksheet (Form 1040)

What Is Form 1040 Tax Computation Worksheet

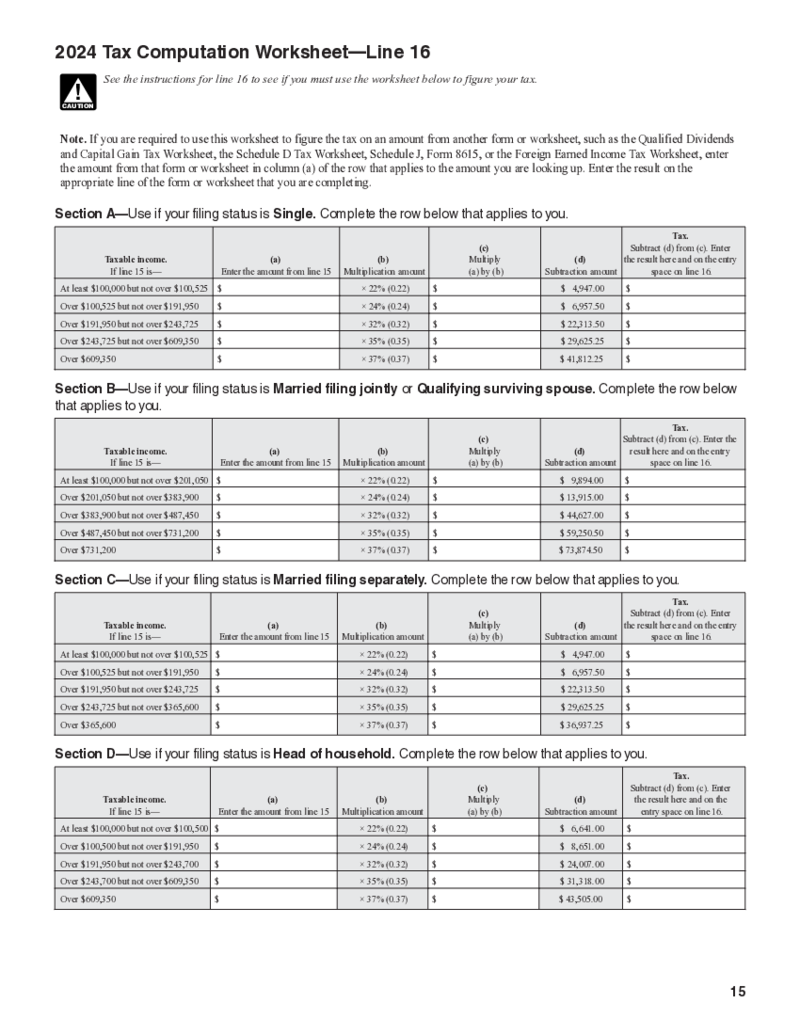

The form 1040 tax computation worksheet is an essential tool furnished by the Internal Revenue Service (IRS) that allows taxpayers to detail their income and adjust it with relevant deductions. The content and c

Tax Computation Worksheet (Form 1040)

What Is Form 1040 Tax Computation Worksheet

The form 1040 tax computation worksheet is an essential tool furnished by the Internal Revenue Service (IRS) that allows taxpayers to detail their income and adjust it with relevant deductions. The content and c

-

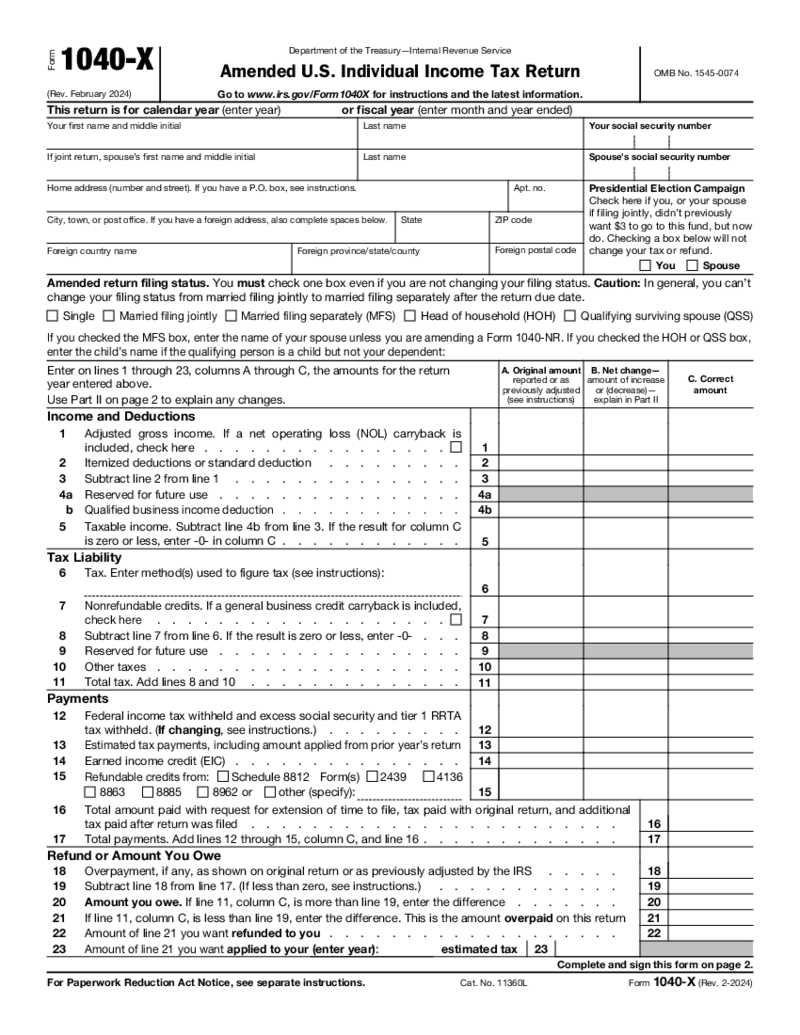

Form 1040X

What is 1040x 2025 form?

1040x form is used to correct the information in 1040, 1040EZ, 1040NR and

Form 1040X

What is 1040x 2025 form?

1040x form is used to correct the information in 1040, 1040EZ, 1040NR and

-

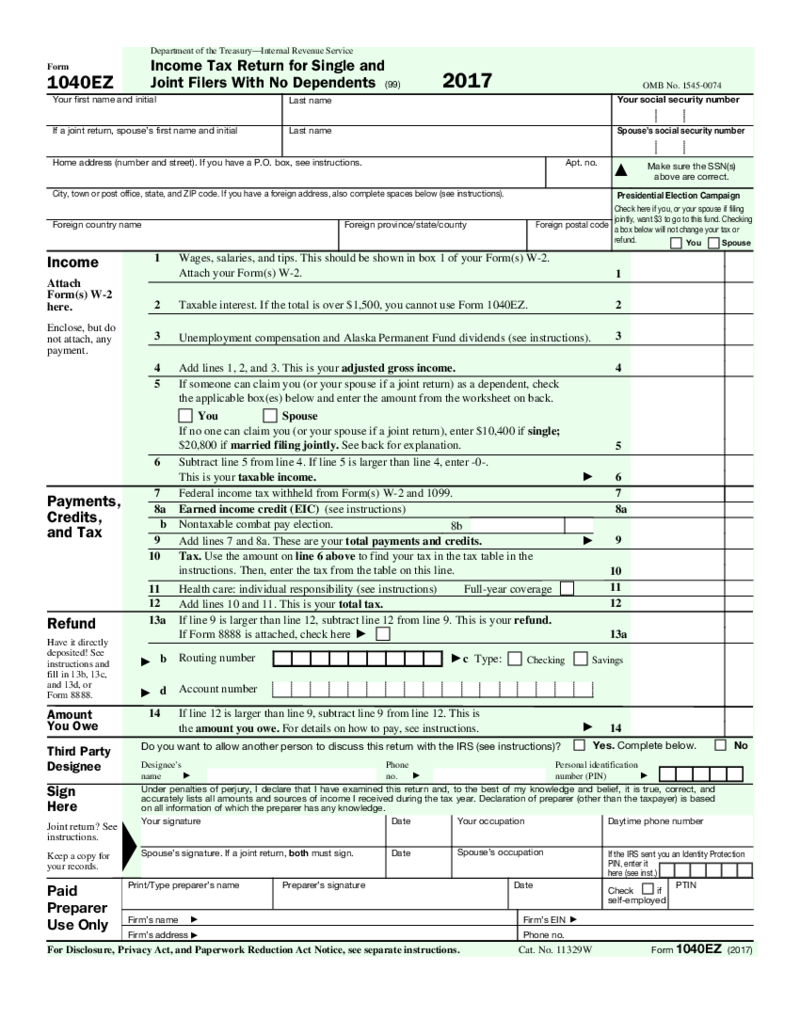

IRS Form 1040EZ

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayer

IRS Form 1040EZ

What is Form 1040EZ?

Form 1040EZ PDF is the shortest form of tax declaring. As it was designed for individuals without dependents and an income of less than $100,000, the form allows to quickly fill the fields. Starting from 2018 and later, taxpayer

-

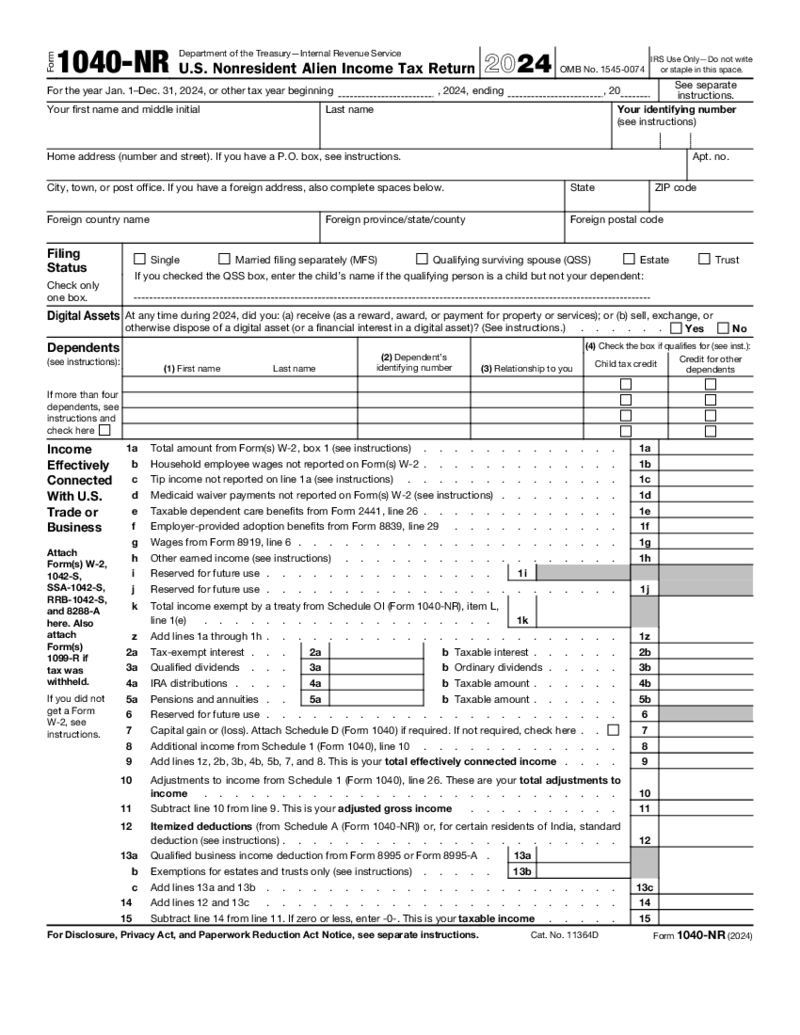

Form 1040-NR (2024)

What Is an IRS Form 1040-NR 2024: The Outline

Form 1040-NR is a variation of the standard income tax Form 1040 that lets you file your income tax return to the IRS if you are a nonresident alien in the United States, and you receive income from business o

Form 1040-NR (2024)

What Is an IRS Form 1040-NR 2024: The Outline

Form 1040-NR is a variation of the standard income tax Form 1040 that lets you file your income tax return to the IRS if you are a nonresident alien in the United States, and you receive income from business o

-

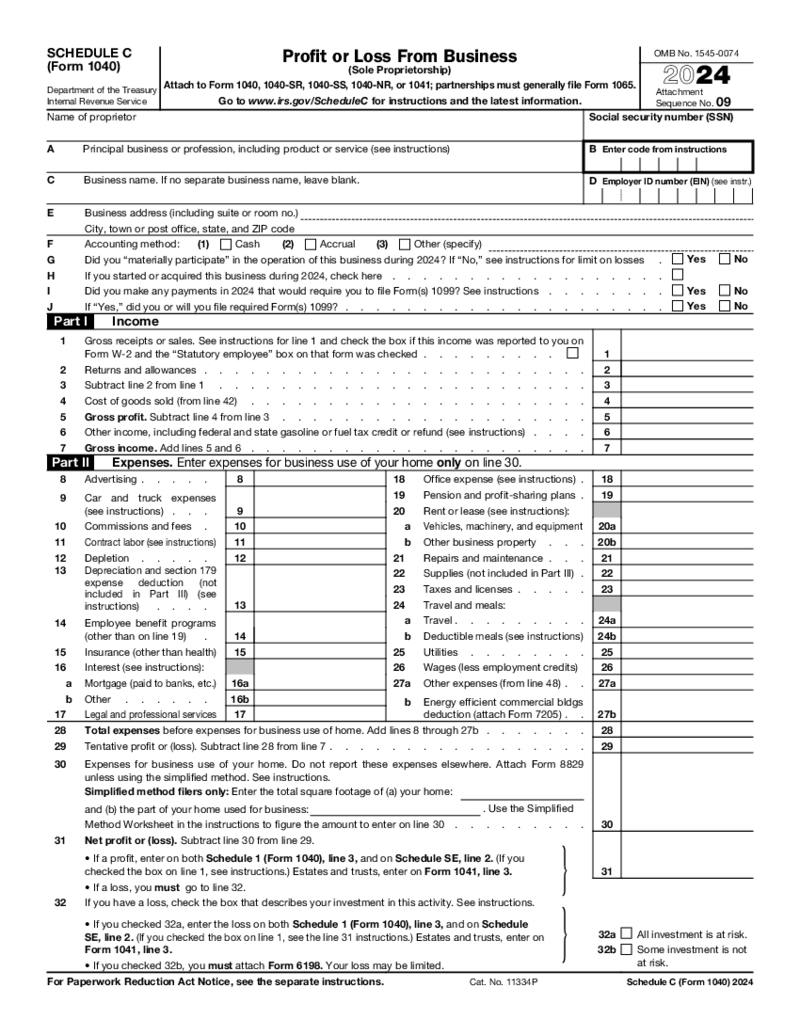

SCHEDULE C (Form 1040) 2024 - 2025

When To Use Fillable Schedule C 2024 - 2025

Schedule C is an addition to Form 1040 for:

1. Small business owners;

2. Independent contractors;

SCHEDULE C (Form 1040) 2024 - 2025

When To Use Fillable Schedule C 2024 - 2025

Schedule C is an addition to Form 1040 for:

1. Small business owners;

2. Independent contractors;

-

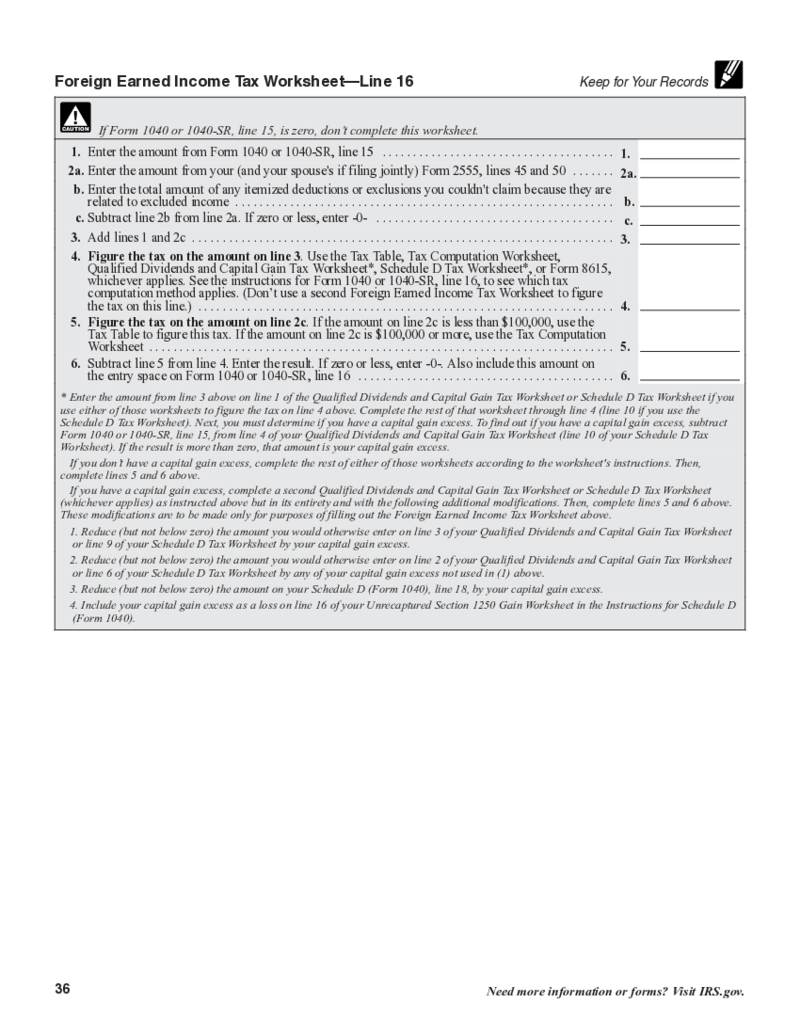

Foreign Earned Income Tax Worksheet

What is the Foreign Earned Income Tax Worksheet 2023

The Foreign Earned Income Tax Worksheet is a tool the IRS (Internal Revenue Service) provides to help U.S. citizens and resident aliens determine the amount of income earned abroad that can be excluded

Foreign Earned Income Tax Worksheet

What is the Foreign Earned Income Tax Worksheet 2023

The Foreign Earned Income Tax Worksheet is a tool the IRS (Internal Revenue Service) provides to help U.S. citizens and resident aliens determine the amount of income earned abroad that can be excluded

-

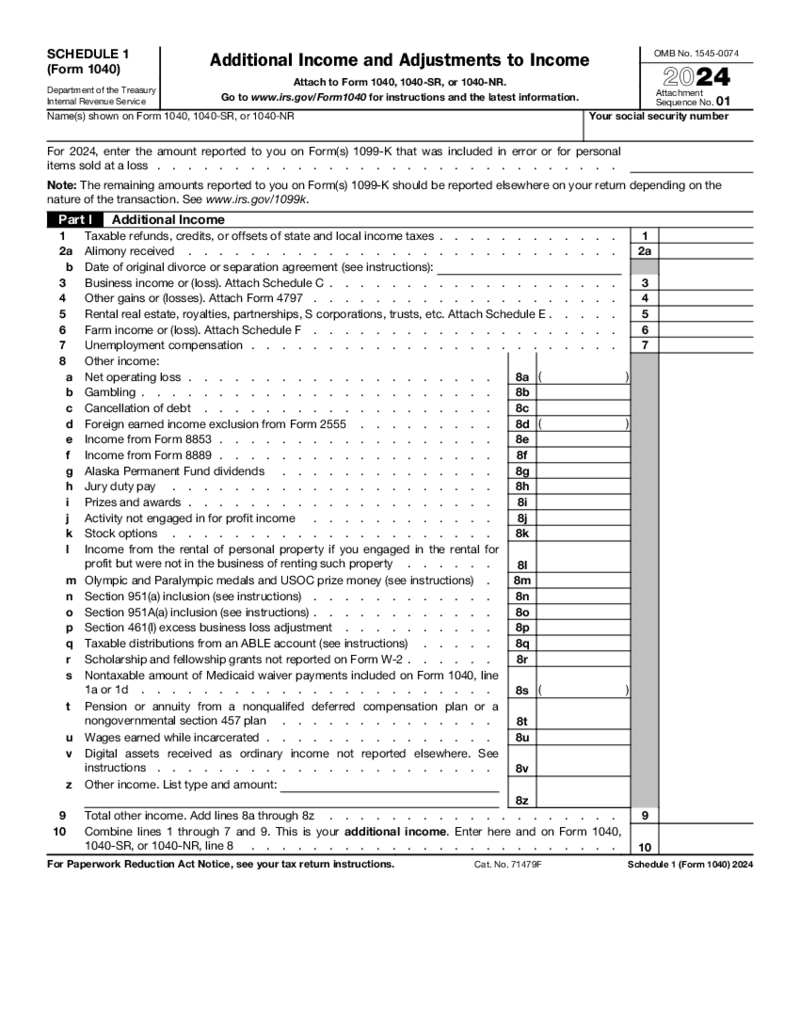

Form 1040 Schedule 1 (2024)

What is the Fillable Form 1040 Schedule 1?

Fillable Form 1040 Schedule 1 is a form that was released by the IRS. It is an addition to the IRS Form 1040. With its help, you are able to specify additional income and adjustments to income.

Form 1040 Schedule 1 (2024)

What is the Fillable Form 1040 Schedule 1?

Fillable Form 1040 Schedule 1 is a form that was released by the IRS. It is an addition to the IRS Form 1040. With its help, you are able to specify additional income and adjustments to income.

-

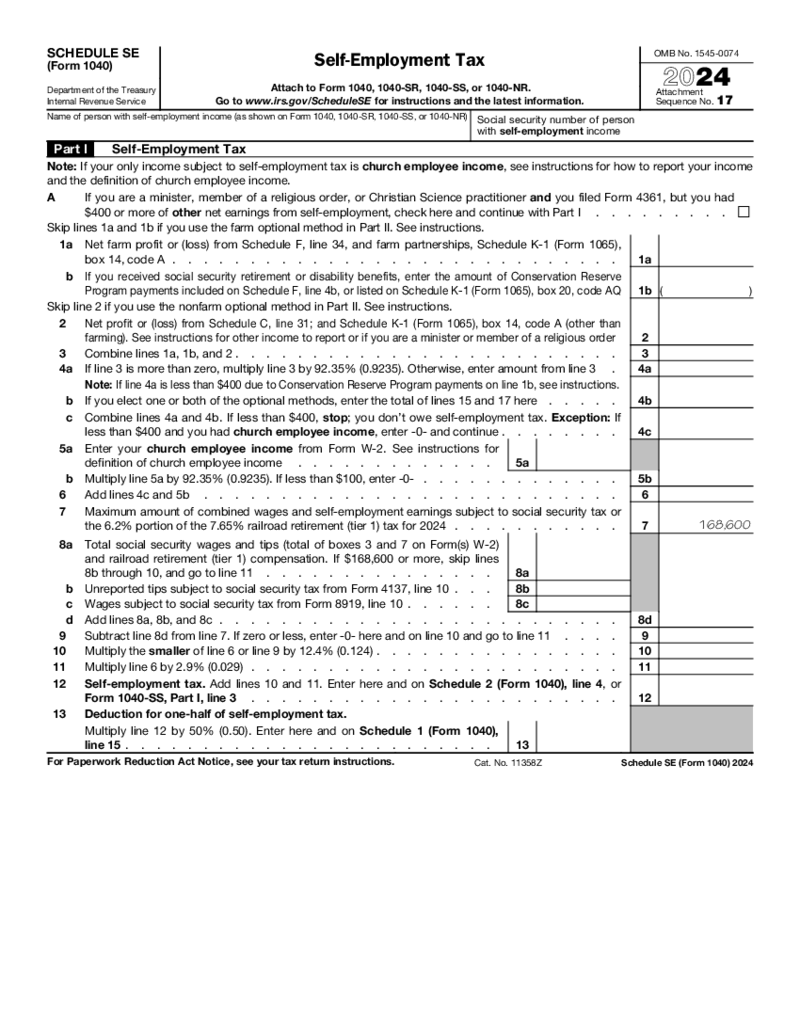

Form 1040 (Schedule SE) (2024)

What Is Schedule SE Form 1040?

Also known as Self-Employment Tax, Schedule SE Form 1040 calculates the Social Security and Medicare taxes for individuals who are self-employed. It helps determine the amount of tax owed based on net earnin

Form 1040 (Schedule SE) (2024)

What Is Schedule SE Form 1040?

Also known as Self-Employment Tax, Schedule SE Form 1040 calculates the Social Security and Medicare taxes for individuals who are self-employed. It helps determine the amount of tax owed based on net earnin

-

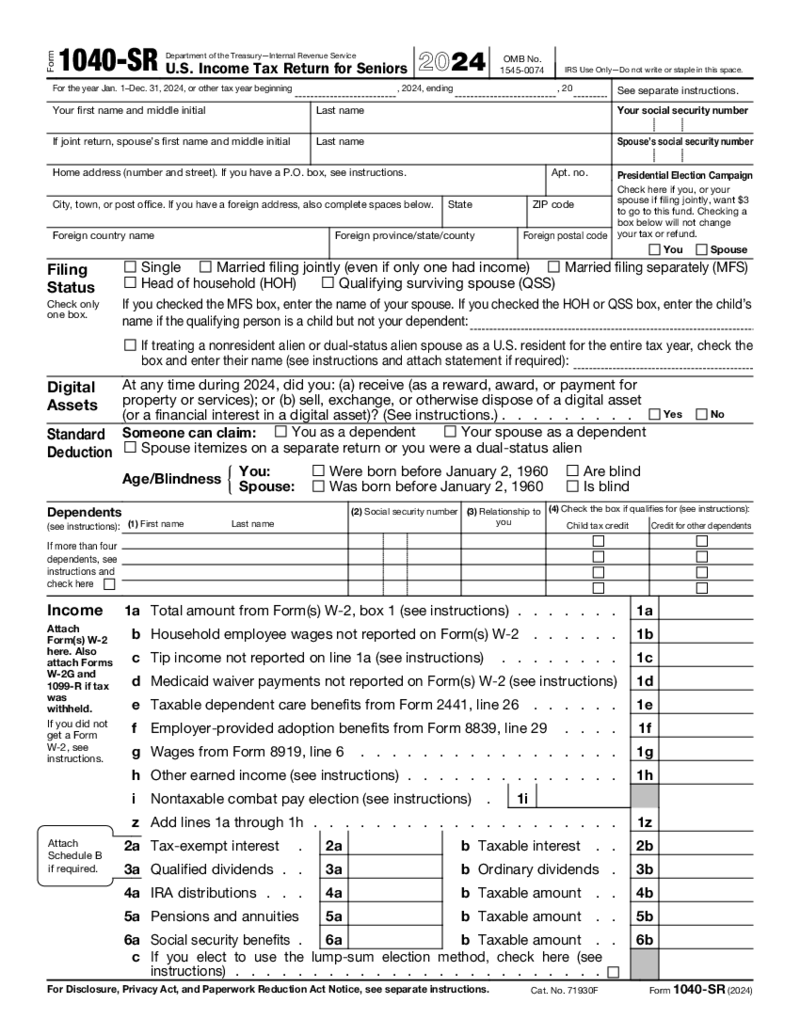

Form 1040-SR (2024)

What Is the 1040-SR form 2023 - 2024

This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. One can download the 1040-SR blank PDF form for free from the PDFLiner and pri

Form 1040-SR (2024)

What Is the 1040-SR form 2023 - 2024

This document is used for the adults (65 years old or higher) to file their taxes through the IRS system to report other sources of income. One can download the 1040-SR blank PDF form for free from the PDFLiner and pri

What Are IRS Individual Tax Forms?

In this category, you’ll lay your fingertips on the most widely used templates for individuals. These pre-designed docs are utilized for reporting all assessable earnings generated within a certain time frame, typically the past year. Don’t forget that our extensive catalog is not limited to tax-related files only. Here, you’ll explore a multitude of other niche-specific templates that are perfectly customizable and a pleasure to make use of. PDFLiner features a slew of smart editing tools to aid you in automating your administrative tasks and speeding up your digital document management processes. We are on a mission to save your precious time.

Most Popular Individual Tax Forms

Here are some of the most frequently used IRS individual income tax forms with their descriptions.

- Form 1040. If you’ve ever been curious how the authorities pinpoint your taxes, this is your one-stop file to unveil all the goodies. This document is one of the most vital docs on the tax management scene. It is used for reporting one’s total yearly revenue to the government. This, in its turn, helps pinpoint the amount of your yearly tax refund. Simply put, the doc unveils the details about your earnings within the almost-gone year. It has several editions. Figuring out the best-suiting edition for you requires knowing the taxpayer category you fall into.

- Social Security Benefits Worksheet. This document is utilized for paying taxes on all or some of your retirement benefits. The worksheet features eighteen sections where you specify the details about your benefits, as well as your earnings and financial background. In case you’re confused about this or any other of the forms we’re covering in this piece, you’re welcome to get in touch with an experienced bookkeeper.

- Qualified Dividends and Capital Gain Tax Worksheet. It is used by individuals with dividend income only or those with capital gains. Ensure your accuracy is at its highest when you fill out this form, because it can feel quite overwhelming, especially for tax newbies.

- Schedule C (Form 1040). If you’re an independent contractor, you’re going to need to attach this document to your main form for reporting how much you’ve earned and lost. The form contains your sensitive information, so do your best to opt for a secure method of submitting it to the corresponding tax authorities.

- Form 1040-SR. This document is utilized by people aged sixty-five or older for the purpose of filing their tax returns. The idea behind this form is to help seniors with straightforward tax backgrounds submit their returns.

So, whether you’re seeking one of the aforelisted federal individual income tax forms or need any other niche-specific document template, PDFLiner serves it all on the silver platter for you.

Where Can I Get Individual Tax Forms?

PDFLiner features a huge catalog of templates to cater to your most complex needs. Furthermore, here, you can fill out any form you need online. Save tons of your time by choosing any of the templates right from this page. Then hit Fill Online and fill out the form when it opens. Enjoy a multitude of useful features for editing and polishing your docs to the absolute refinement. Remember to sign your files with our super handy e-signature tool. It grants you the possibility to add digital signatures to your docs in a matter of mere moments.

Where to Send US Individual Income Tax Return Forms?

Usually, federal estimated tax forms individual-wise are sent to the corresponding governmental entities. You’re welcome to stick with the best-suiting way of submitting the needed form(s) out of the two major ones: online or offline. If you decide to file the documents online, it will save loads of your time and prevent the docs from getting lost or damaged. If you opt for the offline by-mail method, you’re going to have to wait a lot longer until the docs are processed. In either case, if you deal with documents on a daily basis, our platform is sure to come in handy.

FAQ

-

What tax forms does an LLC file to report an individual return?

Usually, it comes down to Schedule C in this particular case. Concentrate on maximum accuracy when completing this form. Otherwise, you may face problems with tax authorities or even end up being audited. Have further questions on this narrow topic? Consult an expert who will advise you based on your unique situation.

-

What tax forms are required by the IRS in individual accounts?

1040 is the most frequently utilized doc for sorting out your annual income tax return in the US. So, keep the template handy and be ready to adjust it to suit your circumstances by using our top-notch editing features. Taxes are a serious matter, so if you feel that you need professional help in this respect, feel free to throw some money on it and have it solved in a flash.