-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

BIR Form 1701

Get your BIR Form 1701 Primer in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is BIR Form 1701 Primer?

BIR Form 1701 is the form for refunding Income Tax Return. It is submitted by a citizen or non-citizen of the Philippines who wants to get a compensation income from any source.

What I need New Form 1701 BIR for?

The main goal of BIR Form 1701 taxable income Philippines is to provide information about an individual who wants to get the return. It can be:

- Resident citizen;

- Resident alien;

- Non-resident citizen.

The form is valid only on the territory of the Philippines. BIR Form 1701 has to be submitted until April 15 annually, and you need to define your income for the previous taxable year.

How to Fill Up 1701 BIR Form

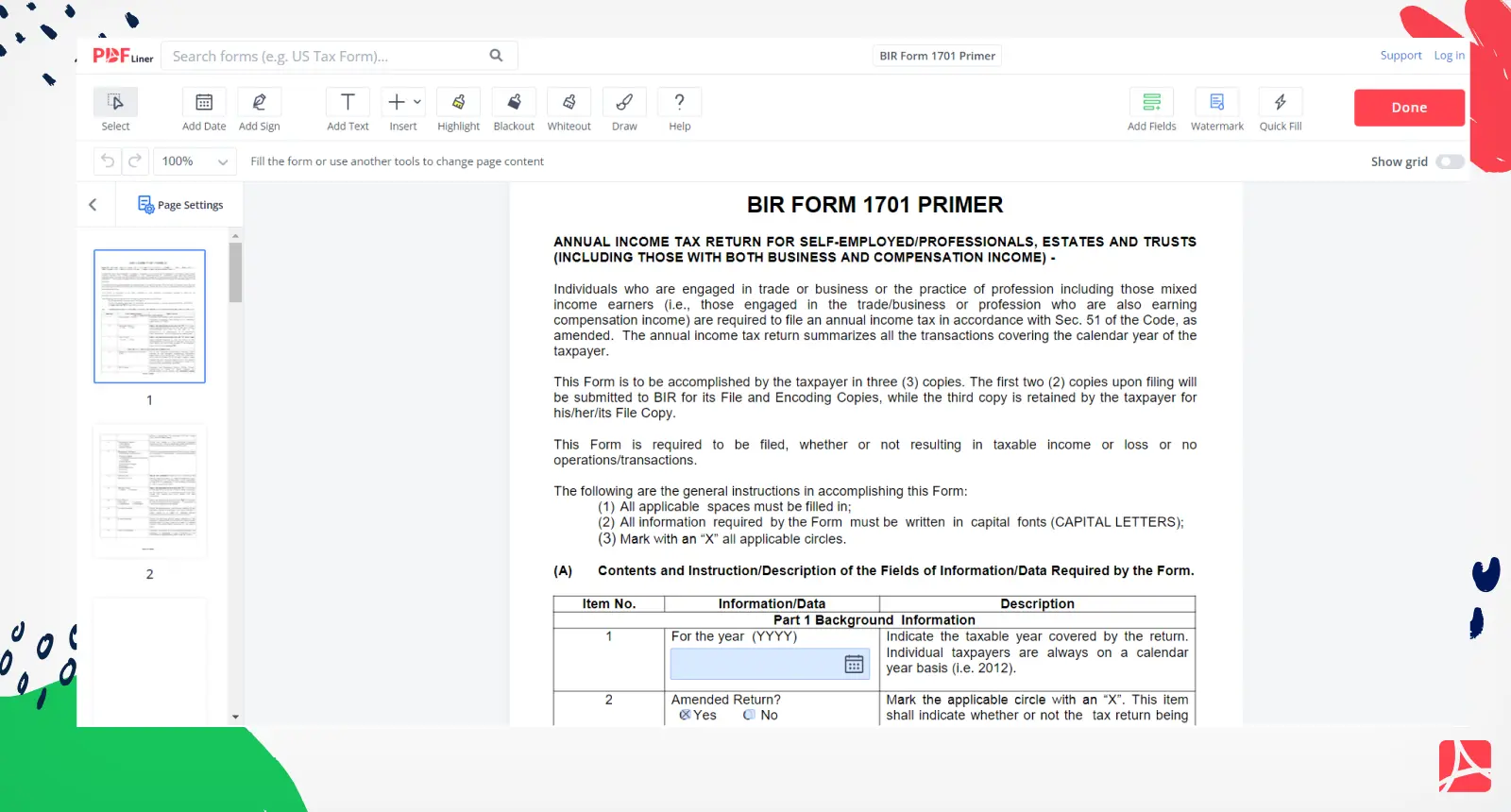

The form is pretty long and consists of 22 pages. There are several general rules on how to fill out this document:

- All spaces must be filled;

- The information must be written in capital letters;

- You have to mark the applicable circles with an ‘X’.

- Once you're completed the form, click "Done" to BIR form 1701 download.

The form looks like a table with three columns: the item number, general information, and description. You need to write the answers only in the second column. BIR Form 1701 covers all the information related to your incomes and losses, therefore, be very attentive while filling it.

Organizations that work with 1701 BIR Form PDF

- Individuals who want to get Income Tax Return in the Philippines.

Relevant to BIR Form 1701 Documents

- BIR Form 1701;

- Fillable BIR Form 1701A;

- BIR Form 1701Q.

FAQ: BIR Form 1701 Primer PDF Popular Questions

-

How do I file a BIR Form 1701 Primer?

There is no primer for filing a BIR Form 1701. The form must be filed with the Bureau of Internal Revenue (BIR).

-

What is the difference between BIR form 1700 and 1701?

BIR Form 1700 is the Annual Income Tax Return for Self-Employed Individuals, Estates and Trusts while BIR Form 1701 is the Quarterly Income Tax Return for Individuals, Estates and Trusts.

-

How do I submit BIR Form 1701 Primer?

You may submit the BIR Form 1701 Primer by mail, fax, or online.

Fillable online BIR Form 1701 Primer