-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Fillable BIR Form 2000

Get your BIR Form 2000 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the 2000 BIR Form

The 2000 BIR Form is a document specifically constructed by the Bureau of Internal Revenue (BIR) in the Philippines. This tax return form is used for Documentary Stamp Tax (DST) on: Lease and other hiring arrangements, Charter Agreements of vessels and similar agreements, Bank Check, Drafts, Certificate of Deposit not bearing interest and other instruments, Debt instrument, Loan Agreement and Promissory Notes, Life Insurance policy, Policies of insurance upon property, Documents of sale of land and buildings, Bonds, Debentures, Certificate of Stock in any association, company or corporation and Profit-sharing Agreement.

Advantages of using BIR form 2000 on PDFliner

- Easy Accessibility: The form 2000 BIR is available anytime, from anywhere. This is beneficial for individuals or corporate entities that require efficient ways to complete their tax-related transactions.

- User-friendly: The platform is designed to be easy to use for everyone, irrespective of their level of tech savviness.

- Multipurpose Functionality: Besides providing editable versions of the form, PDFliner also allows users to print, download, or e-mail the document directly from the site.

How to Fill Out BIR Form 2000 PDF

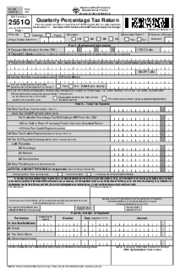

Here's a step-by-step guide on how to fill out the BIR Form 2000 on PDFLiner for a one-time transaction:

- Begin by entering the date of the transaction in the "Date of Transaction" field formatted as MM/DD/YYYY.

- Mark the "Amended Return?" box with an "X" if applicable, either "Yes" or "No".

- Choose the applicable Alphanumeric Tax Code (ATC) by marking the box with an "X". Options include DO 102, DO 122, and DO 125.

- Enter the number of sheets attached in the "Number of Sheet/s Attached" field.

- Provide your Taxpayer Identification Number (TIN) in the designated field.

- Input the RDO Code of the location of the property in its field.

- Fill in your full name or the registered name of your business in the "Taxpayer's Name" field.

- Write the complete registered address in the "Registered Address" field, including the branch address if applicable, and ZIP code in the "ZIP Code" field.

- Include your contact number and email address in their respective fields.

- Identify the other party involved in the transaction, marking either "Seller/Transferor/Donor" or "Buyer/Transferee/Donee", and provide their full name and TIN.

- Specify the nature of the transaction by marking the appropriate type such as "Transfer of Shares of Stock Not Traded Through the Local Stock Exchange" or "Transfer of Real Property".

- If applicable, fill in the "Location of Real Property" field when the transaction involves real property.

- Enter the "Taxable Base" for Shares of Stock or Real Property in the respective fields, drawn from Part IV of the form schedules.

- Specify the tax rate and calculate the "Tax Due" by multiplying the taxable base by the tax rate.

- If this is an amended return, note any "Tax Paid in Return previously filed" and subtract it from the "Tax Due" to determine the "Tax Still Due/Overpayment".

- Add any applicable penalties, such as surcharge, interest, and compromise, and fill in the "Total Amount Payable/Overpayment".

- Sign the form in the designated area and include the title/designation and TIN of the authorized representative if applicable.

- For payments, fill in the details in "Part III – Details of Payment", including payment method, bank details, date, and amount for each payment type like cash, check, or others.

Ensure all information is correct and that no required fields are left blank before finalizing the submission of the form.

Fillable online BIR Form 2000