-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

BIR Form 1907

Get your BIR Form 1907 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the 1907 BIR Form

The 1907 BIR Form is also known as the Certificate for Final Income Tax Withheld. It is a certificate issued by the withholding agent to reflect the income subjected to final withholding tax. This form is applicable to any income subjected to final withholding tax as described under Filipino regulations. Utilized by withholding agents, it ensures that the necessary taxes are accounted for and paid to the governing institution.

Importance of properly filling the BIR form No 1907

The careful and correct completion of BIR Form no 1907 is a step that cannot be skipped for any individual or establishment subjected to final tax withholding. Therefore, you must pay attention to ensure the form is accurately completed and submitted timely, as it forms the basis for recording and reporting income subjected to the final withholding tax. Remember, the onus is on the withholding agent to withhold and remit the correct amount of tax, as any false declaration can lead to penalties.

How to Fill Out Form 1907 BIR

Here's a detailed step-by-step guide on how to fill out the BIR Form 1907 on PDFLiner:

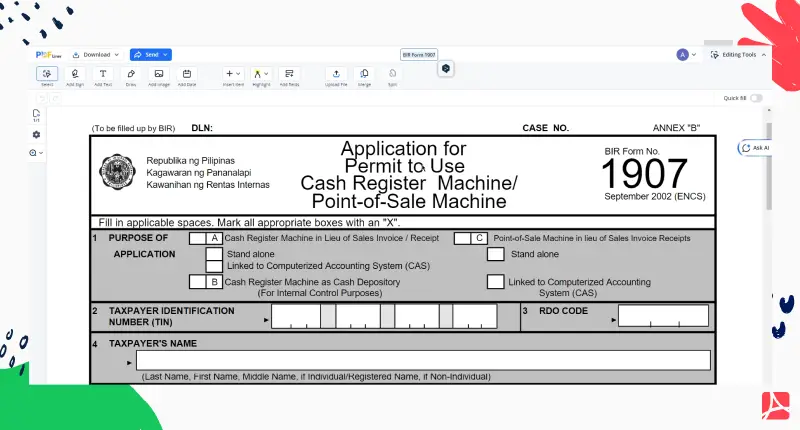

- Under "Purpose of Application", choose the appropriate option by marking the box with an "X". Select from Cash Register Machine in lieu of Sales Invoice/Receipt, Point-of-Sale Machine in lieu of Sales Invoice Receipts, Cash Register Machine as Cash Depository, and specify if the machine is Stand alone or Linked to Computerized Accounting System (CAS).

- Enter your Taxpayer Identification Number (TIN) in the section labeled "Taxpayer Identification Number (TIN)".

- Provide the RDO Code in the section designated "RDO CODE".

- Write your name or registered name in "TAXPAYER'S NAME". If you are an individual, include your Last Name, First Name, Middle Name. If it is for a Non-Individual, provide the Registered Name.

- Fill in your Business/Trade Name in the space provided under "BUSINESS/TRADE NAME".

- Specify your Kind/Line of Business in the section marked "KIND/LINE OF BUSINESS".

- Enter the Address where the machine will be used in the section "ADDRESS WHERE MACHINE WILL BE USED". Attach an additional list if necessary.

- Input the Machine Supplier's TIN in the section "MACHINE SUPPLIER'S TIN". Attach additional lists if necessary.

- Provide the Machine Supplier's Name in the section labeled "MACHINE SUPPLIER'S NAME". Include Last Name, First Name, Middle Name if individual, or the Registered Name if Non-Individual.

- Fill in the Supplier's Trade Name under "SUPPLIER'S TRADE NAME". Attach additional lists if necessary.

- Enter the Supplier's Address in the section "SUPPLIER'S ADDRESS". Attach additional lists if necessary.

- In the section "DESCRIPTION OF THE MACHINE/S", detail the Serial No., Model, Function (using the provided Function Code), and Condition of the Machine (using the provided Condition Code). Mention any essential features of the machine as listed, such as equipped with two rollers, consecutive numbering of customer receipts, simultaneous reflection on audit roll, inclusion of a reset counter, and the non-resettable nature of the reset counter.

- Under "DECLARATION", confirm the accuracy of the provided information and completeness of attachments by signing under "Applicant" and "Distributor/Dealer/Vendor", as applicable. Mark the "Yes" box if all attachments are complete, otherwise mark "No".

Now, BIR form 1907 downloads from the PDFLiner website and can be submitted to the official BIR website to efficiently apply for a permit to use a cash register or point-of-sale machine.

Fillable online BIR Form 1907