-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

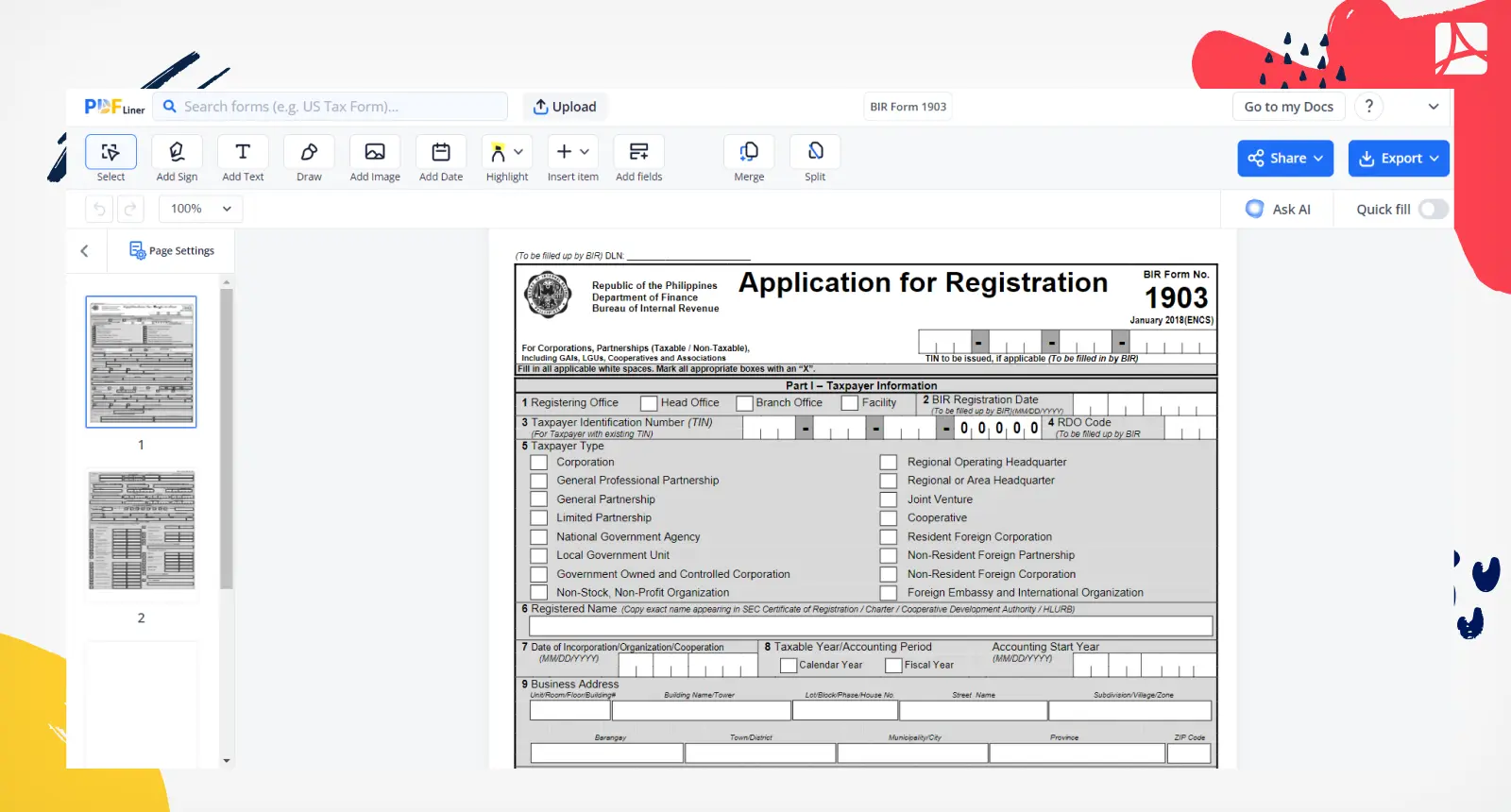

BIR Form 1903

Get your BIR Form 1903 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is BIR Form 1903?

The 1903 BIR Form is also known as Application for Registration for Corporations, Partnerships (Taxable/Non-Taxable), Including Government Agencies and Instrumentalities (GAIs), Local Government Units (LGUs), Cooperatives and Associations. It is a vital document in the Philippines. Corporate taxpayers utilize it to register their entity with the Bureau of Internal Revenue (BIR) and secure a TIN. Corporations are obliged to submit the form on or prior to the start of their operations.

1902 BIR form vs. 1904 BIR form

BIR 1902 and BIR 1904 forms serve distinct registration purposes in the Philippines. 1902 is designated for Individuals Earning Purely Compensation Income, including both local and alien employees. On the other hand, 1904 is tailored for One-Time Taxpayers and individuals registering under Executive Order 98. Below, you’ll find the main distinctions:

- Applicant Type. Form 1902 caters to salaried individuals, while Form 1904 is designed for one-time taxpayers and those under E.O. 98.

- Income Source. 1902 focuses on compensation income, while 1904 covers various income sources.

- Frequency. 1902 is typically for regular, recurring taxpayers, whereas 1904 is for irregular or one-time taxpayers.

- Registration Process. The process and requirements for these docs vary due to the differing taxpayer categories.

How to Fill Out BIR 1903

The application doc might seem confusing, but filling it out online via PDFLiner is going to simplify the process for you — while helping you keep mistakes and typos at bay. Follow these 10 vital steps to cope with the completion task:

- Find the doc in the PDFLiner’s huge library of free pre-made templates.

- Open the template by clicking on it and start the editing process.

- In Part I, specify taxpayer information.

- In Part II, provide details about an authorized representative.

- In Part III, indicate business information.

- In Part IV, provide facility details.

- In Part V, specify tax types.

- In Part VI, fill out the Authority to Print data.

- In Part VII, specify Stakeholder/Partner/Member details.

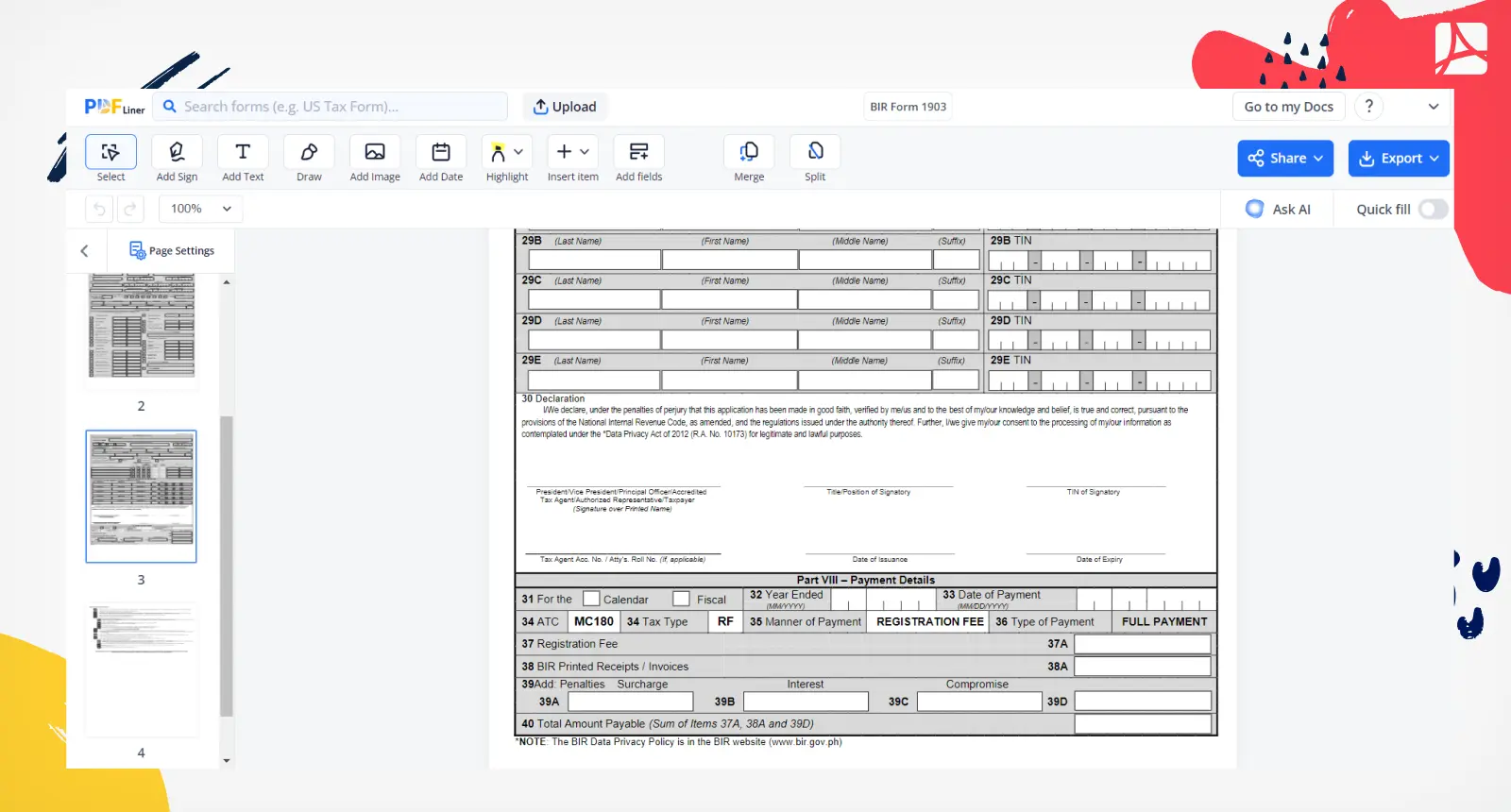

- In Part VIII, provide payment details.

Don’t forget to sign and date the document. You can do it via PDFLiner’s legally binding digital signature feature. It’s speedy and as easy as pie!

How to apply with BIR online registration form

To apply with BIR online registration blank, visit the official Bureau of Internal Revenue website and access the Electronic Tax Information System. Fill out the required information, provide the necessary documents, and generate a reference number. This enables you to complete the application process, helping individuals and businesses efficiently register for tax purposes.

FAQ

-

Who should use BIR Form 1903?

The document is utilized by a wide spectrum of entities in the Philippines, including corporations, partnerships, government agencies, cooperatives, and associations, for the purpose of tax registration and compliance.

-

How to print 1903 Form BIR?

To print the document directly from PDFLiner, first, open the completed file within the PDFLiner’s platform. Then, select the print option to generate a hard copy of the document for submission or records. Don’t forget to make sure that you have the necessary printer setup.

-

What is the deadline for Form BIR 1903?

The deadline for submitting this document varies based on individual circumstances and the specific registration requirements for the entities mentioned. Consult the Bureau of Internal Revenue or tax guidelines for accurate deadlines in your situation.

Fillable online BIR Form 1903