-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Stock Issuance Transfer Ledger

Get your Stock Issuance Transfer Ledger in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Stock Transfer Ledger: The Basics

A stock transfer ledger is a crucial document that records all transactions involving the transfer of stocks from one shareholder to another. It is an essential part of corporate governance and facilitates transparency in understanding the number of shares each shareholder possesses.

Convenience of using a stock transfer ledger PDF

An excellent choice is to use a stock transfer ledger in a PDF format. It is a convenient format that allows you to fill out, save, and print the data without any distortion. This digital version is ideal for maintaining records, and it offers peace of mind that any important transactions involving shares won't be lost or damaged. Also, using a digital form template can help the trees and save our planet by using less paper.

How to Fill Out Stock Transfer Ledger

Learning how to fill out a stock transfer ledger template is crucial in efficiently managing shares within a company. For your convenience, we'll discuss the stock transfer ledger instructions step by step:

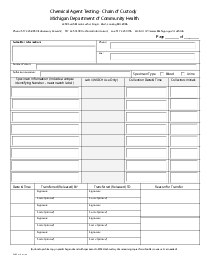

- Start by locating the "Stock Issuance/Transfer Ledger for" section at the top of the form. This section requires the name of the company or organization whose stocks are being transferred or issued. Enter the accurate and correct official name of the entity.

- Proceeding with the next field, you have to fill in the "Name of Stockholder". Ensure to write the full name of the individual or the organization owning the stock. In case of multiple stockholders, maintain a separate ledger for each.

- Then, provide the "Place of Residence" of the stockholder which refers to either their residential address or the registered address of the company.

- In "Certificates Issued" section, you have to fill in three sub-sections: "Cert. No.", "No. of Shares" and "Date Issued". You can find these details on the actual hardcopy or softcopy of the stock certificate.

- The next field is "From Whom Shares Were Transferred". In this section, if the stock issuance is an original issue, you need to mention "Original Issue" in the space provided. If not, write the name or details of the entity from whom the shares were transferred.

- Fill in the "Amount Paid Thereon". This is the amount that the stockholder paid for the shares.

- In the next section, "Date of Transfer of Shares", provide the exact date when the shares were transferred from the issuer to the stockholder.

- Next, indicate "To Whom Shares Were Transferred". Write down the details of the entity or individual to whom the shares were transferred after the original stockholder.

- The "Certificates Surrendered" section again contains "Cert. No." and "No. of Shares". Here, mention the certificate details and the number of shares that were surrendered, if any.

- The final section is "Number of Shares Held". Here, you need to put down the balance of shares held after issuance or transfer.

- After the form is filled accurately and correctly, save it and proceed to its submission as per the company’s or organization’s protocols. It's always advisable to double-check all the information before you submit the form.

Remember, this form is a record of every stock transaction in a company. Make sure you keep this form updated on all transfers or issuances to maintain accurate records.

Application of the stock transfer ledger form

The stock issuance transfer ledger comes into use in multiple scenarios. Understanding when to employ this essential tool will significantly aid your company's equity management and ensure accurate record-keeping.

- Stock Issuance: Whenever your company issues new shares, it is crucial to record this transaction in the stock transfer ledger form. Recording the issuance will establish an official record of the shareholder name, certificate number, issuance date, and the number of shares issued.

- Stock Transfers: When shares transfer from one shareholder to another, documenting this transaction on the stock transfer ledger form is essential. Transfer details, including the previous and new holder’s names, the certificate number, transaction date, and amount of transferred shares, provide a clear picture of company ownership.

- Shareholder Record Updates: Stock transfer ledger forms aid in updating records of company shareholders. By cross-checking with the ledger, you can easily confirm the records' accuracy and rectify discrepancies.

- Corporate Record Accuracy: The ledger serves as a powerful tool to guarantee accuracy in all your corporate actions. When disputes occur over ownership or equity distribution, your ledger provides a definitive historical record.

- Compliance: Statutory requirements often mandate that companies maintain an updated stock transfer ledger. It validates corporate actions during legal disputes and allows for timely disclosures during company audits or inspections.

Fillable online Stock Issuance Transfer Ledger