-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Canada Tax Forms - page 4

-

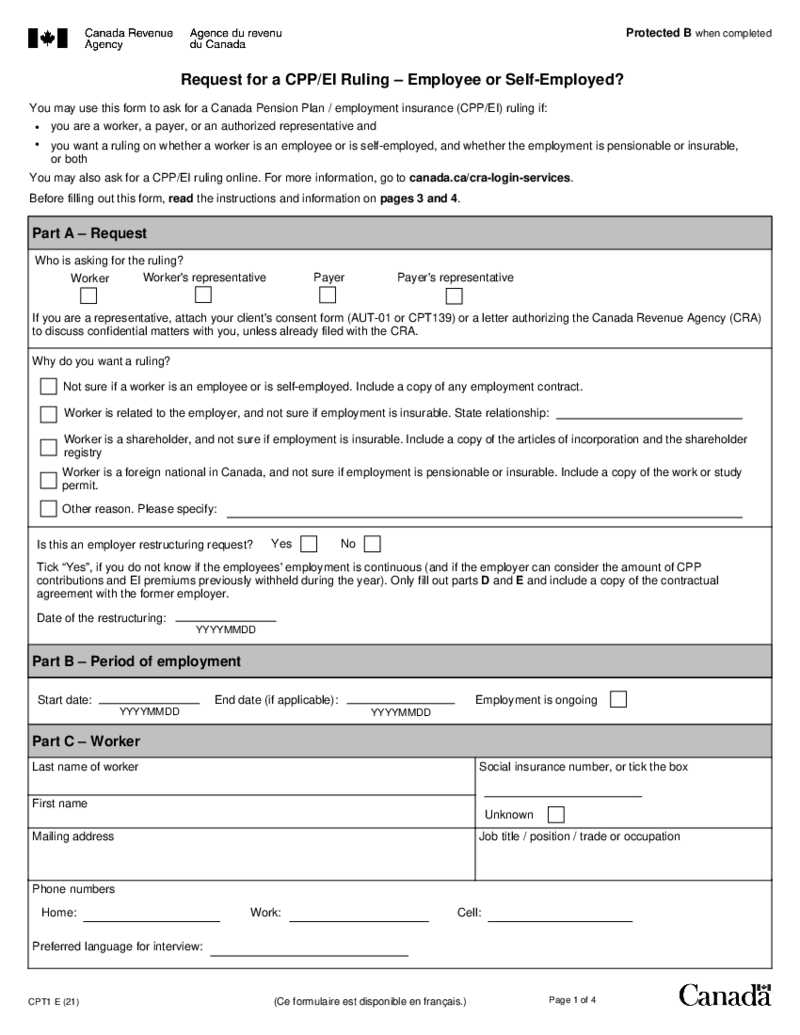

Form CPT1

What Is Form CPT1

Form CPT1, or the CPT1 Form Canada, is a critical document used for various tax-related purposes in Canada. It is primarily employed to report and reconcile certain tax payments and transactions. This form is essential for ensuring compl

Form CPT1

What Is Form CPT1

Form CPT1, or the CPT1 Form Canada, is a critical document used for various tax-related purposes in Canada. It is primarily employed to report and reconcile certain tax payments and transactions. This form is essential for ensuring compl

FAQ

-

How to fill federal tax form Canada?

Absolutely, the best way to fill out your templates is online. By doing it digitally, you won’t have to spend hours on the affair and deal with the oh-so-prone-to-getting-lost-and-damaged paper piles. As a matter of fact, going digital may be the only way to survive as a successful business these days.

-

How to fill out income tax return forms Canada?

Follow these tips if you want to complete your templates in the most effective way possible. First, be prepared. Prepare all the necessary documents you’ll rely upon when filling out your forms. Second, be precise. You don’t want to send tax forms with factual errors or typos and then start all over again or even face penalties. Third, monitor the deadlines. That’s a given. Fourth, seek professional help whenever necessary. Peace of mind should be your ultimate priority here.

-

Where to send tax forms Canada?

When you finish sorting out your forms, feel free to submit them to the Canada Revenue Agency, also referred to as CRA. Do it either online or by mail. Naturally, the former method is the best because it’s super fast, smooth, and flexible. If you’re outside the country, the only option is to send the ready forms by mail. Don’t forget to keep your CRA info updated and keep up with new technical tax information, for it will surely add up to your ultimate peace of mind throughout the tax season.