-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

TD1 Personal Tax Credits Return Forms

-

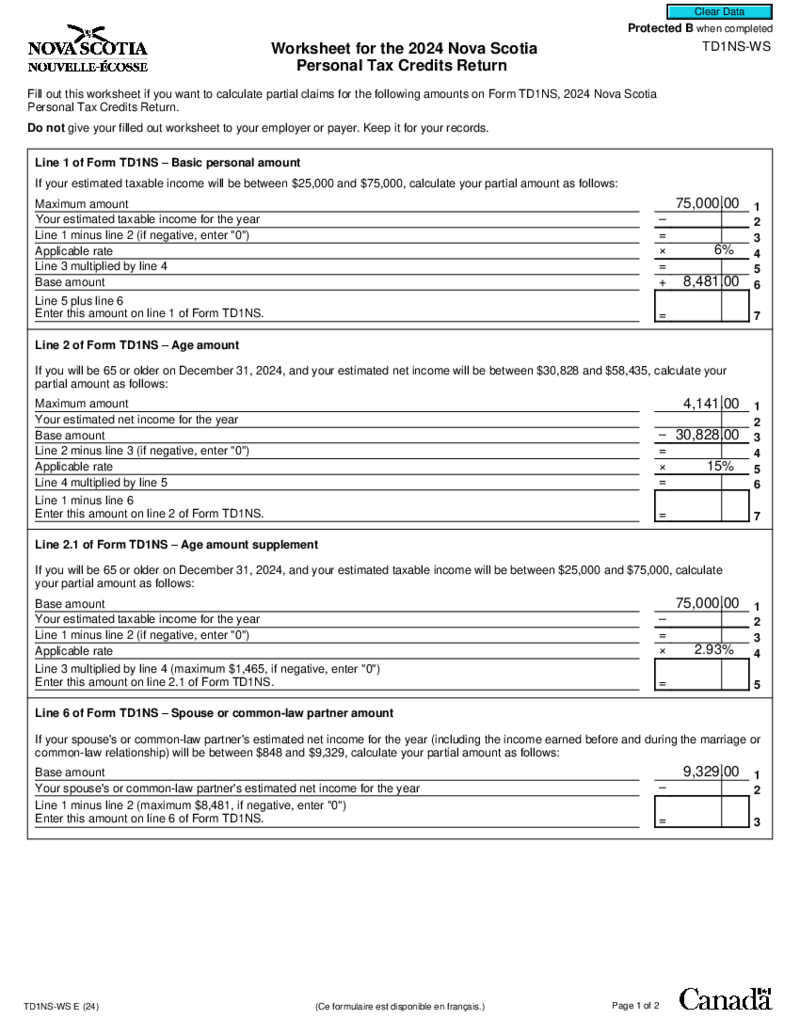

TD1NS-WS Form 2024

What Is the TD1NS-WS Form 2024?

The Nova Scotia Personal Tax Credit Refund Form is a tool that Nova Scotia residents should use to calculate personal tax credits. This worksheet you may download from the Nova Scotia government website.

What Is

TD1NS-WS Form 2024

What Is the TD1NS-WS Form 2024?

The Nova Scotia Personal Tax Credit Refund Form is a tool that Nova Scotia residents should use to calculate personal tax credits. This worksheet you may download from the Nova Scotia government website.

What Is

-

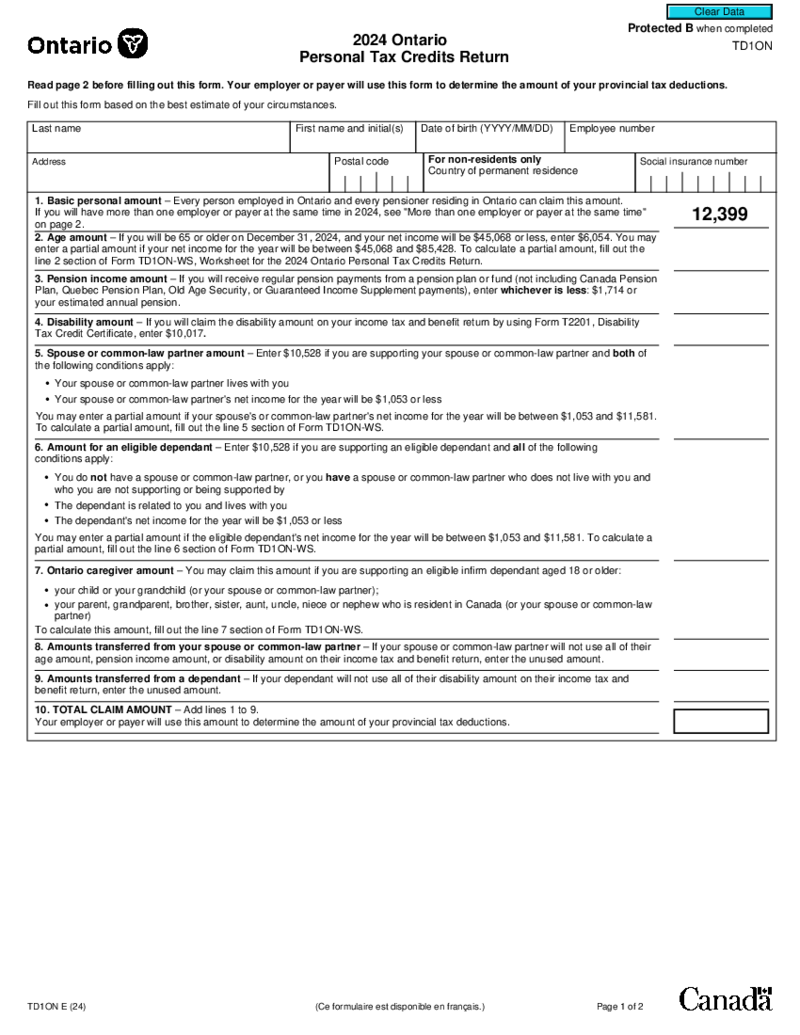

TD1ON 2024 - Ontario Personal Tax Credits Return

What Is the Ontario Personal Tax Credits Return Form 2024?

Ontario residents have the right to qualify for tax relief. For this purpose, the Canada Revenue Agency issues the TD1ON. With its help, every Canadian citizen who has official employment in Ontar

TD1ON 2024 - Ontario Personal Tax Credits Return

What Is the Ontario Personal Tax Credits Return Form 2024?

Ontario residents have the right to qualify for tax relief. For this purpose, the Canada Revenue Agency issues the TD1ON. With its help, every Canadian citizen who has official employment in Ontar

-

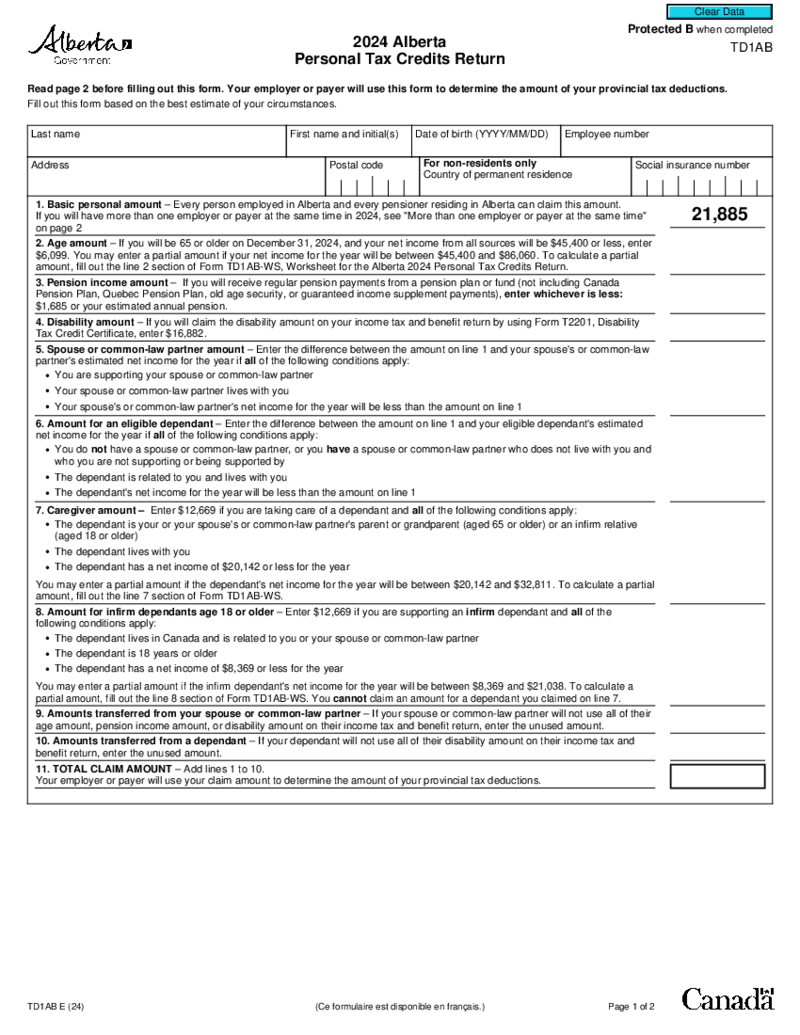

TD1AB Form

What Is Alberta Personal Tax Credits Return Form

If you are a resident of Alberta, you may be required to file a 2024 TD1AB Alberta Personal Tax Credits Return form. TD1AB 2024 is used to calculate the amount of tax credits you are eligible for.

TD1AB Form

What Is Alberta Personal Tax Credits Return Form

If you are a resident of Alberta, you may be required to file a 2024 TD1AB Alberta Personal Tax Credits Return form. TD1AB 2024 is used to calculate the amount of tax credits you are eligible for.

-

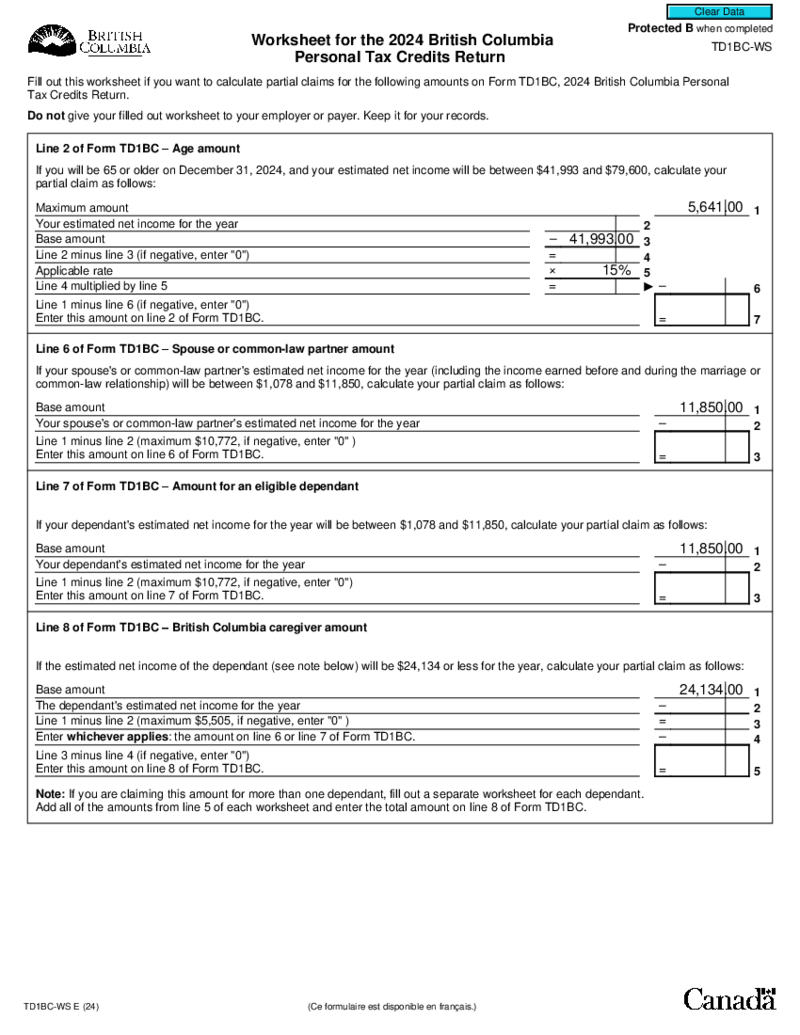

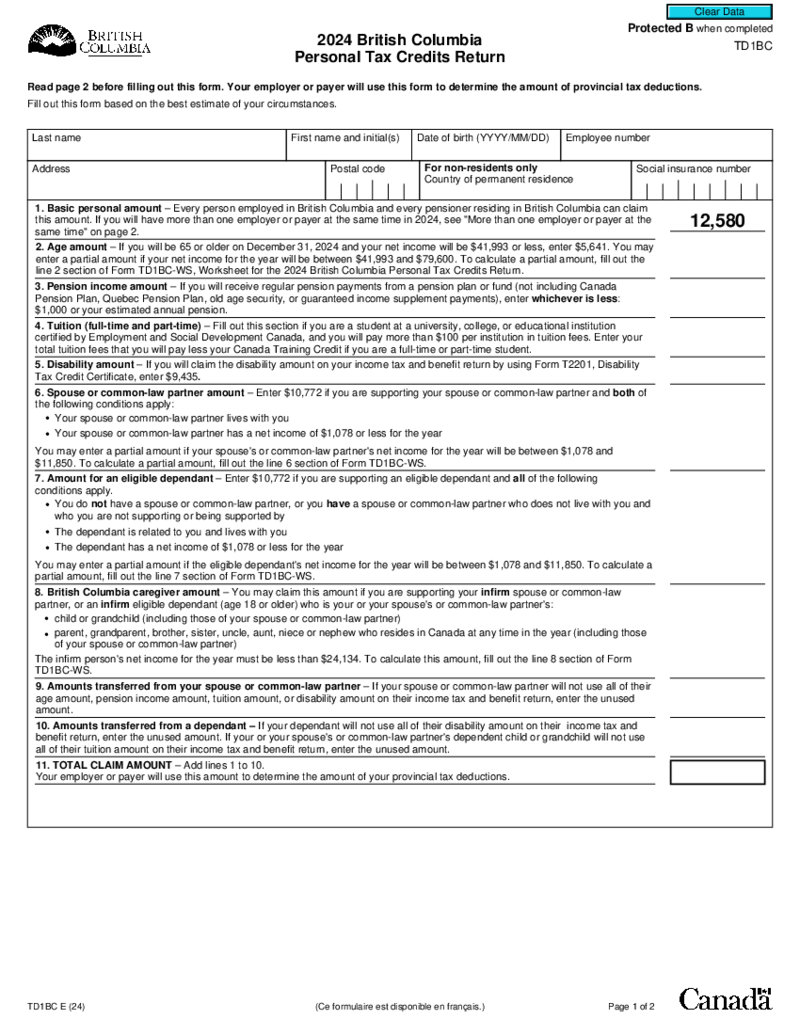

Form TD1BC-WS

Understanding the Form TD1BC-WS

Before embarking on exploring this form, it is important to fully grasp what this document is all about. The TD1BC-WS is a worksheet that falls under the TD1 Tax Credit Returns. This document is primarily for British Columb

Form TD1BC-WS

Understanding the Form TD1BC-WS

Before embarking on exploring this form, it is important to fully grasp what this document is all about. The TD1BC-WS is a worksheet that falls under the TD1 Tax Credit Returns. This document is primarily for British Columb

-

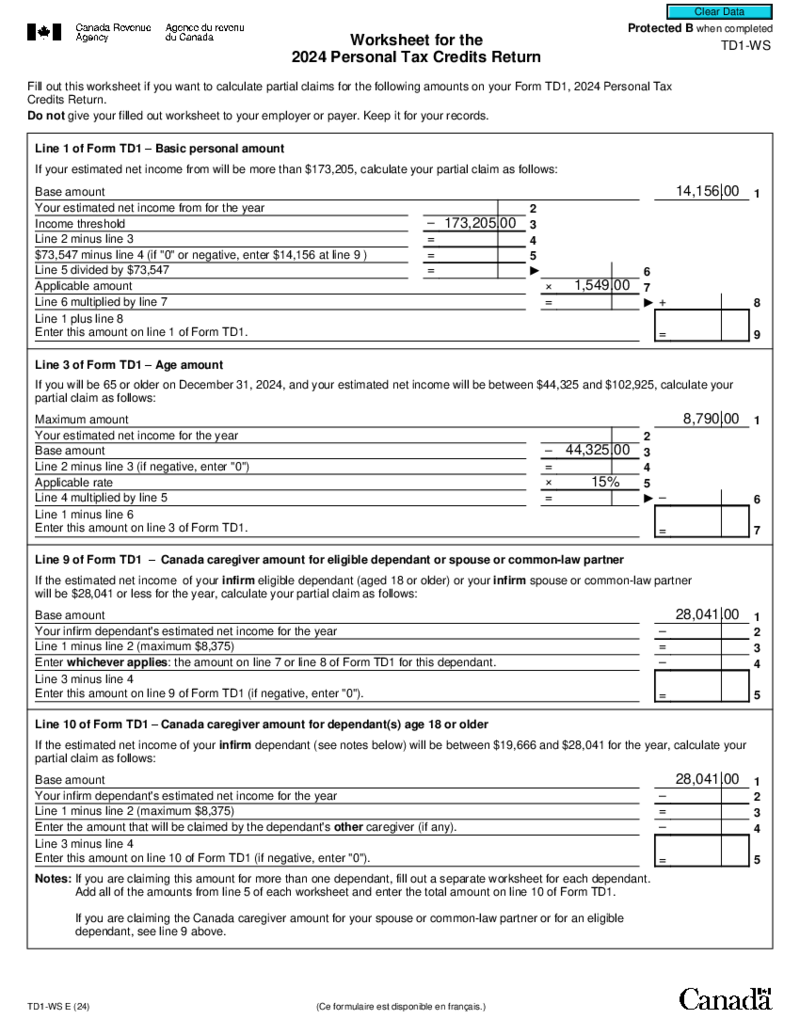

TD1-WS Worksheet for Personal Tax Credits Return 2024

TD1-WS Worksheet for Personal Tax Credits Return 2024

Gathering Necessary Documentation

Before you start filling out the worksheet, compile all necessary documents that can affect your tax credits, such as your previous year's notice of as

TD1-WS Worksheet for Personal Tax Credits Return 2024

TD1-WS Worksheet for Personal Tax Credits Return 2024

Gathering Necessary Documentation

Before you start filling out the worksheet, compile all necessary documents that can affect your tax credits, such as your previous year's notice of as

-

TD1BC Form (2024)

What Is the Fillable TD1BC 2024 Form?

The TD1BC Form is a British Columbia personal tax credits return form used to claim the Basic Personal Amount on your tax return. The Basic Personal Amount is the portion of your income that is exempt from taxati

TD1BC Form (2024)

What Is the Fillable TD1BC 2024 Form?

The TD1BC Form is a British Columbia personal tax credits return form used to claim the Basic Personal Amount on your tax return. The Basic Personal Amount is the portion of your income that is exempt from taxati

-

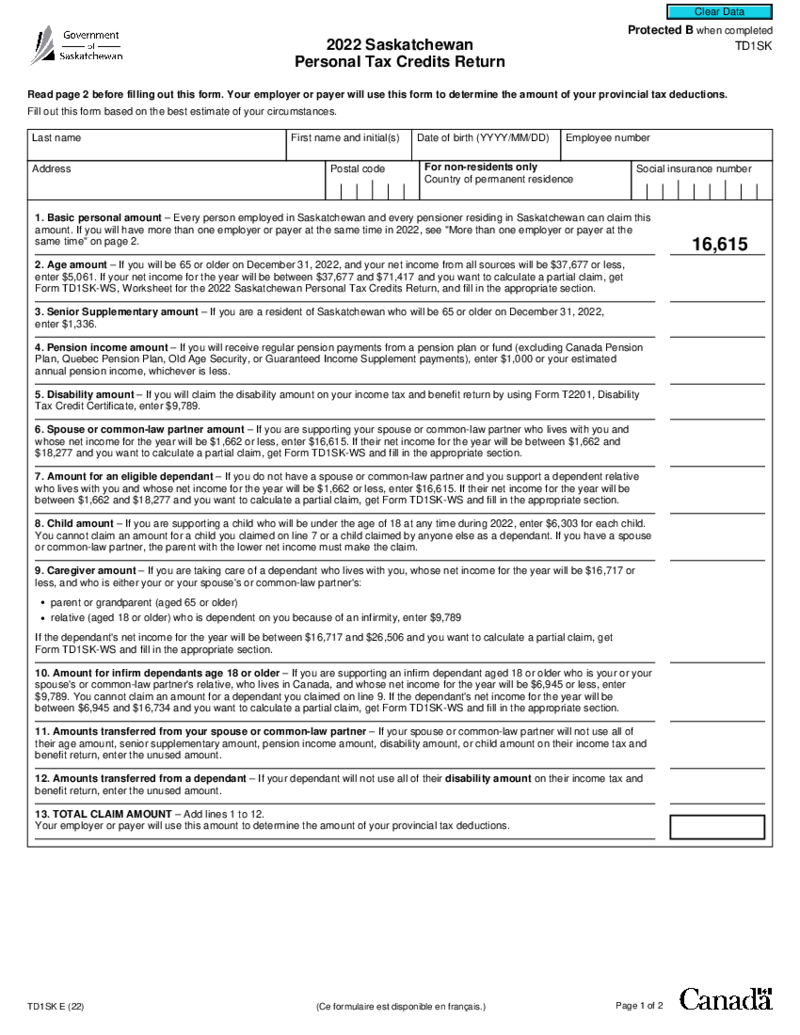

TD1SK, Personal Tax Credits Return

What Is Form TD1SK?

You can use Saskatchewan Personal Tax Credits Return to claim tax credits for Saskatchewan residents. This form is required to be completed and filed with the Saskatchewan Ministry of Finance.

How to Use the TD1SK Form?

TD1SK, Personal Tax Credits Return

What Is Form TD1SK?

You can use Saskatchewan Personal Tax Credits Return to claim tax credits for Saskatchewan residents. This form is required to be completed and filed with the Saskatchewan Ministry of Finance.

How to Use the TD1SK Form?

-

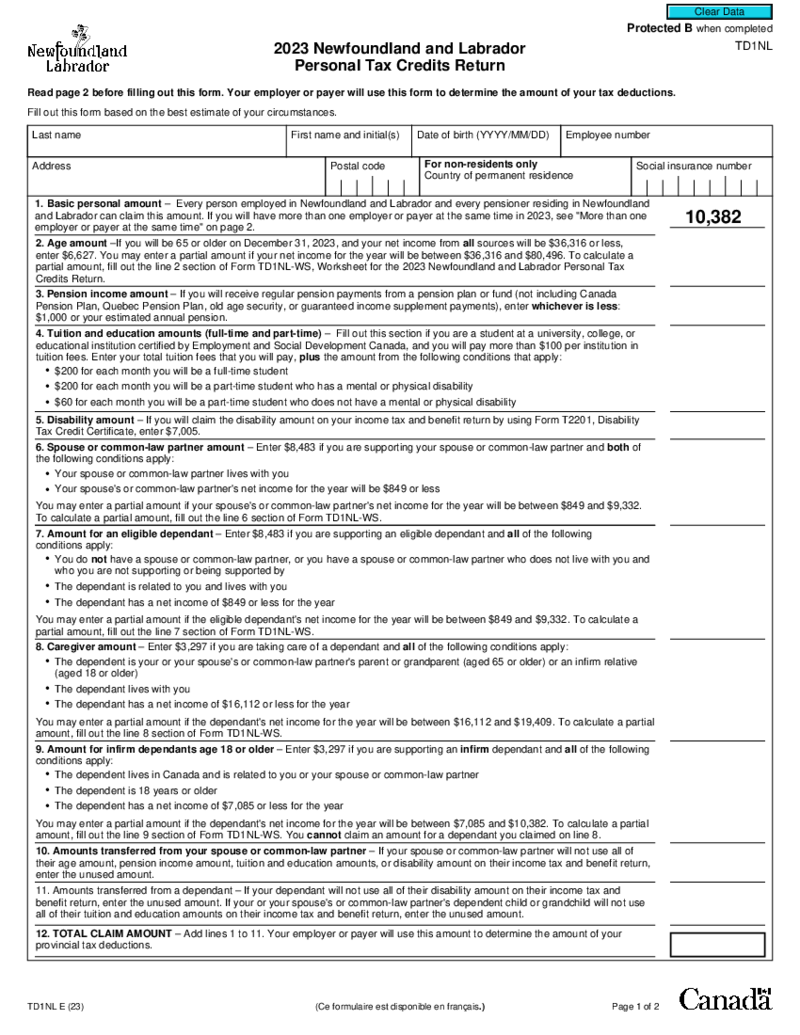

Form TD1NL

What Is Form TD1NL?

If you are a resident of Newfoundland and Labrador, you are required to file a Personal Tax Credit Return (PTCR). You will use PTCR to figure out your tax credits, which are then used to reduce the amount of tax you owe.

Form TD1NL

What Is Form TD1NL?

If you are a resident of Newfoundland and Labrador, you are required to file a Personal Tax Credit Return (PTCR). You will use PTCR to figure out your tax credits, which are then used to reduce the amount of tax you owe.

-

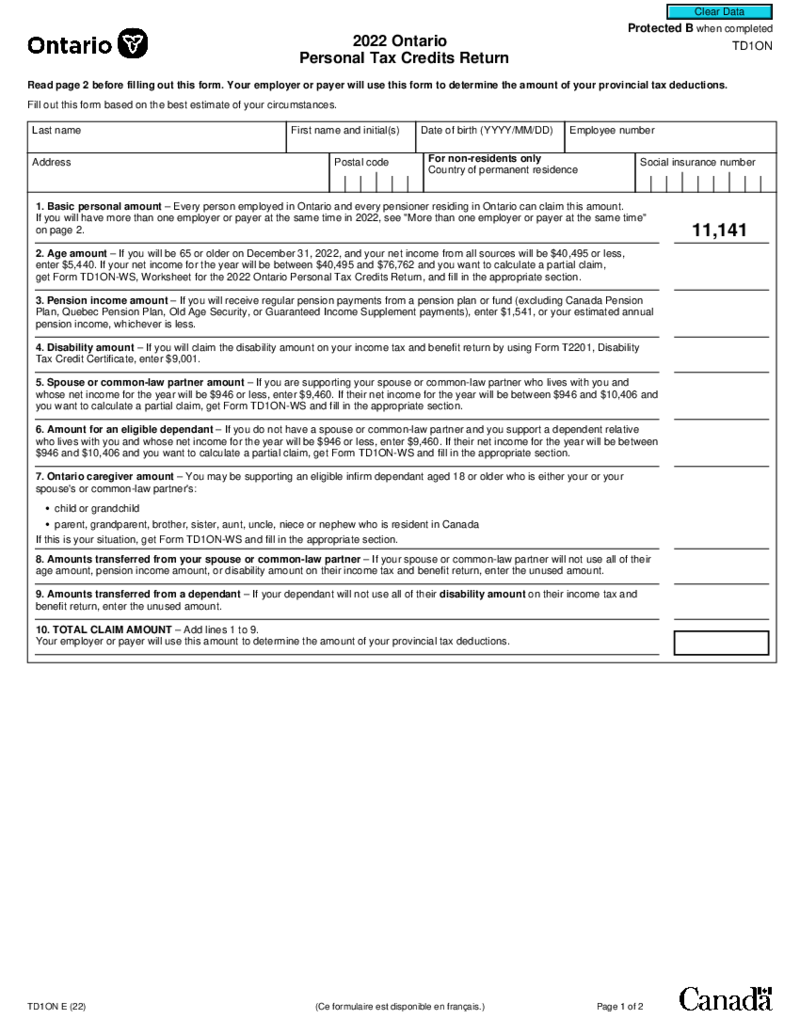

TD1ON Form 2022 - Ontario Personal Tax Credits Return

TD1ON Form 2022 - Ontario Personal Tax Credits Return

TD1ON Form 2022 - Ontario Personal Tax Credits Return

TD1ON Form 2022 - Ontario Personal Tax Credits Return

-

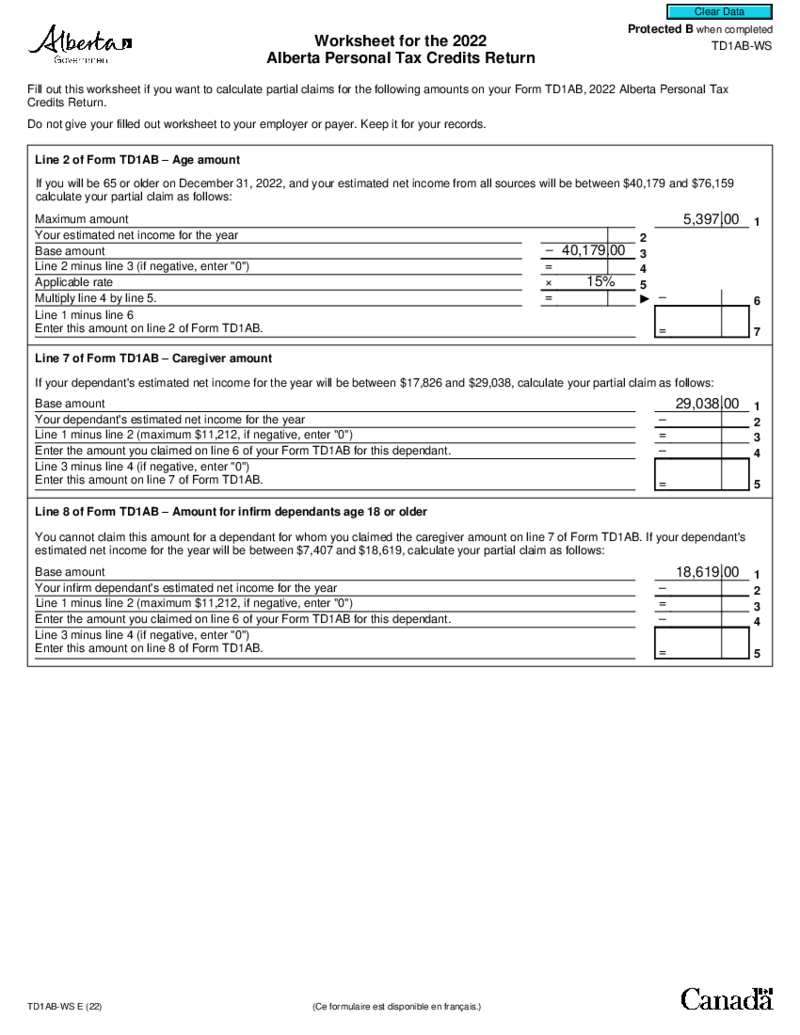

TD1AB-WS Worksheet for Alberta Personal Tax Credits Return

TD1AB-WS Worksheet for Alberta Personal Tax Credits Return

✓ Easily fill out and sign forms

✓ Download blank or editable online

TD1AB-WS Worksheet for Alberta Personal Tax Credits Return

TD1AB-WS Worksheet for Alberta Personal Tax Credits Return

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

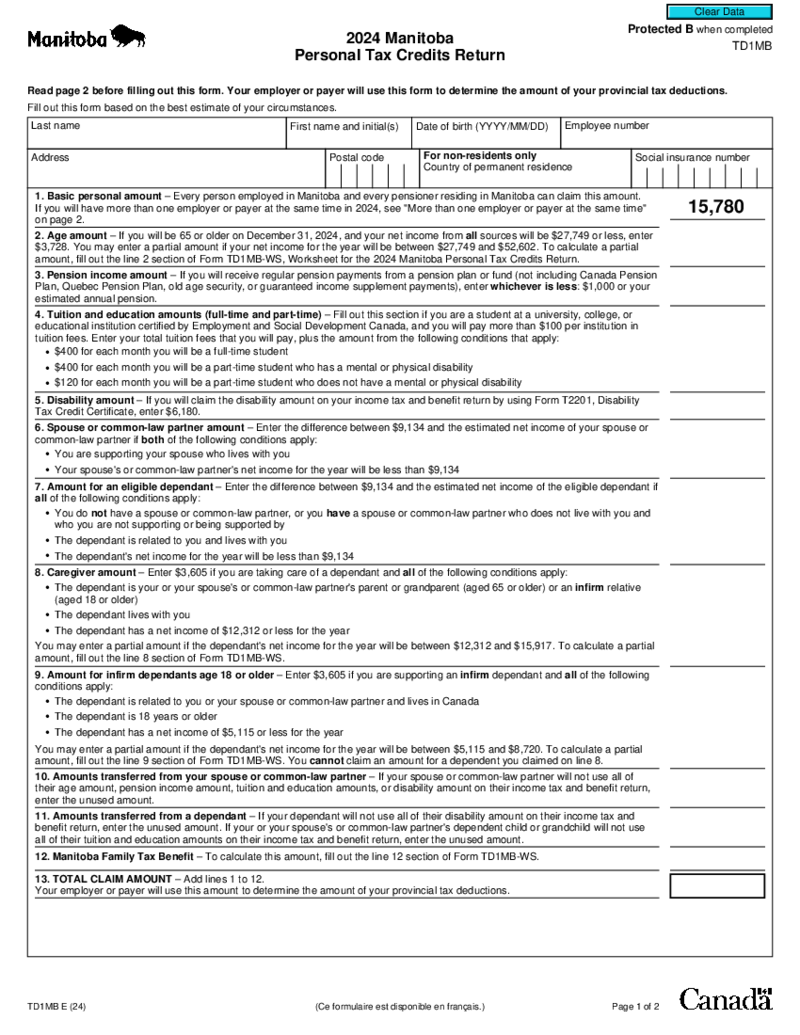

TD1MB Form (2024)

What Is the Manitoba Personal Tax Credits Return 2024 Form?

TD1MB 2024 is the Manitoba Personal Tax Credits Return form. You could use this form to calculate the income tax credits an individual is eligible to receive. Form must be completed and file

TD1MB Form (2024)

What Is the Manitoba Personal Tax Credits Return 2024 Form?

TD1MB 2024 is the Manitoba Personal Tax Credits Return form. You could use this form to calculate the income tax credits an individual is eligible to receive. Form must be completed and file

-

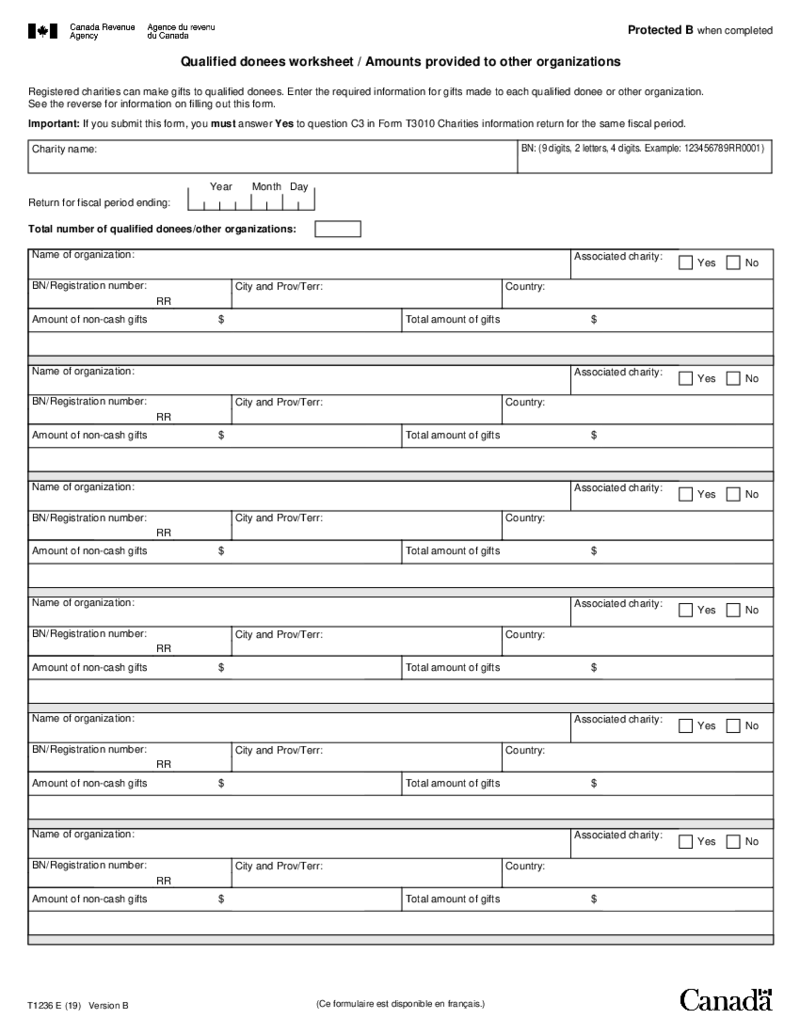

Form T1236

Understanding the CRA Form T1236

The CRA Form T1236 is an essential tax instrument utilized for the administration of income and tax-related affairs for charitable organizations and foundations in Canada. An important tool for compliance with the Canadian

Form T1236

Understanding the CRA Form T1236

The CRA Form T1236 is an essential tax instrument utilized for the administration of income and tax-related affairs for charitable organizations and foundations in Canada. An important tool for compliance with the Canadian