-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

![Picture of Legal Aid Queensland Application]() Legal Aid Queensland Application

Legal Aid Queensland Application

![Picture of Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors]() Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

Pag IBIG Fund Special Power of Attorney for Accommodation Mortgagors

![Picture of Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment]() Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

![Picture of Trustee Resignation Form]() Trustee Resignation Form

Trustee Resignation Form

![Picture of Pennsylvania Last Will and Testament Form]() Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

![Picture of AU Mod(JY), Parent(s), Guardian(s) details]() AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

![Picture of Wisconsin Last Will and Testament Form]() Wisconsin Last Will and Testament Form

Wisconsin Last Will and Testament Form

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Tax Booklet

Get your New York Tax Booklet in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is A New York State Income Tax Booklet

Navigating the intricate landscape of tax obligations can challenge many New York residents. One essential tool the state provides is the New York State Income Tax Booklet, a comprehensive guide that simplifies the process of understanding and filing state taxes. This booklet encompasses all the relevant forms, schedules, and instructions to accurately complete your New York state tax return.

When to Use New York Tax Booklet

The New York Tax Booklet is a valuable resource in various scenarios:

- If you are a resident, part-year resident, or non-resident who earned income in New York State.

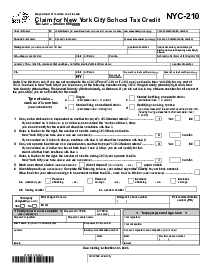

- When you need to understand specific state tax laws that affect your situation, such as deductions or credits unique to New York.

- If you are preparing your tax return without the help of a tax professional and require detailed instructions.

- Changes in your financial situation, such as a new job, property purchase, or any other event, could affect your tax liability.

- If you have to amend a previously filed state tax return.

How To Fill Out New York State Income Tax Instruction Booklet

Here is a step-by-step guide to lead you through:

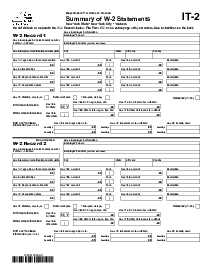

- Gather all pertinent tax documents, including W-2s, 1099s, and records of expenses that may be deductible.

- Start with the basic information section, entering your name, address, Social Security Number (SSN), and filing status.

- Move through the income section, inputting all sources of income, such as wages, interest, dividends, and any other earnings.

- Follow the instructions for deducting allowable expenses to reduce your taxable income.

- Calculate the tax amount using the rates and tables included in the booklet.

- Determine your eligibility for tax credits specific to New York State and apply them to reduce your tax due.

- If you owe tax, include your payment details or set up a payment plan. If you expect a refund, supply your bank information for direct deposit.

- Review the entire return for accuracy.

- Sign and date the tax return.

- Attach all required documentation, such as W-2s and 1099s, before mailing or electronically filing your tax return.

When to File New York State Tax Booklet

Adhering to tax deadlines ensures that you avoid penalties and interest charges. For New York State residents, the tax return and the New York State Tax Booklet typically must be filed by April 15th, following the end of the tax year. If April 15th falls on a weekend or a holiday, the deadline shifts to the next business day. It's imperative to keep abreast of any changes in the filing deadline announced by New York State's Department of Taxation and Finance. For those who cannot file by the due date, requesting an extension is crucial, although this does not extend the time to pay any taxes due.

By utilizing the New York State Tax Booklet for guidance and adhering to the state's filing deadlines, taxpayers can navigate New York's tax landscape with greater confidence and accuracy.

Fillable online New York Tax Booklet