-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form Y-203

Get your New York Form Y-203 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

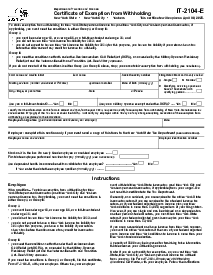

What Is A Form Y 203

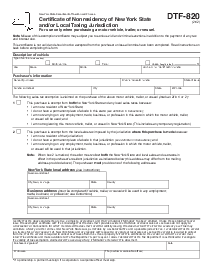

New York Form Y-203 is the Unincorporated Business Tax (UBT) Return for residents of Yonkers. This specific document is critical for individuals conducting business within the said city, as it accounts for the taxes owed on income derived from self-employment and business activities. It essentially serves as a declaration of income for the city's tax purposes and is separate from the state and federal income tax returns.

When to Use NY Form Y 203

There are several scenarios where you would need to use NY Form Y 203:

- You are a resident of Yonkers and operate a business that is not incorporated.

- You receive income from a partnership or sole proprietorship based in Yonkers.

- You are an individual who earns income from a rental property located within Yonkers.

- You are a member of an LLC that conducts business in Yonkers, and this income flows through to your tax return.

- As a resident or business owner in Yonkers, understanding when and why to file this form is vital for compliance with local tax regulations.

How To Fill Out NYS Tax Form Y 203 Instruction

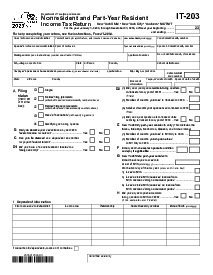

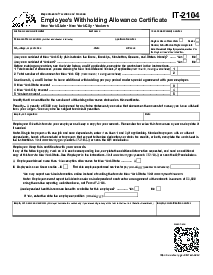

Filling out New York Form Y-203 (Yonkers Nonresident Earnings Tax Return) involves several steps to report earnings from employment and self-employment and calculate the tax due. Follow these instructions to complete the form:

Step 1: Identification

Enter your name as shown on your New York State Tax Form IT-201 or IT-203.

Provide your Social Security number in the designated space.

Step 2: Residency Status

Section A: If you were a Yonkers resident for any part of the taxable year, mark "Yes" and specify the period of Yonkers residence. If not, mark "No."

Section B: If you or your spouse maintained an apartment or other living quarters in Yonkers, mark "Yes," provide the address, and enter the number of days spent there.

Step 3: Employment and Self-Employment Income

Section C: Indicate if you are reporting income from self-employment by marking "Yes" or "No." Provide details of the business if applicable.

Line 1: Enter gross wages and other employee compensation. Include the allocated amount from Schedule A if claiming an allocation.

Line 2: Report net earnings from self-employment, including the allocated amount from Schedule C if claiming an allocation. If there is a loss, report it here.

Step 4: Schedules

Schedule A: Complete only if you must allocate wage and salary income to Yonkers, according to the instructions.

Schedule B: List all places in and out of Yonkers where you conduct business (if applicable).

Schedule C: Allocate net earnings from self-employment to Yonkers as instructed if your business is carried on in and out of Yonkers.

Step 5: Review and Checklist

Verify that you have completed all required sections, including Schedules A, B, and C.

Check that the total nonresident earnings tax is entered on your New York State return (Form IT-201 or IT-203).

Step 7: Filing

Ensure that you submit Form Y-203 with your New York State tax return.

When to File Form Tax Form Y-203

Tax form Y-203 should be filed annually. The due date typically coincides with your state or federal tax return deadline. For individuals and businesses on a calendar-year basis, the deadline is usually April 15 following the tax year. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. For those operating on a fiscal year basis, the form is due by the 15th day of the fourth month following the end of your fiscal year.

It is crucial to file on time to avoid late filing penalties and interest on any unpaid tax. The City of Yonkers takes timely filing seriously, and compliance ensures your business operations continue without disruption due to tax issues.

Fillable online New York Form Y-203