-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Form Arkansas No-Fault Divorce (Minor Children)

Form Arkansas No-Fault Divorce (Minor Children)

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form IT-2104

Get your New York Form IT-2104 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

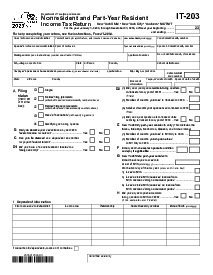

What Is The New York State IT 2104

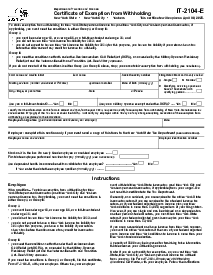

Form The New York State IT 2104 form, often called the Employee's Withholding Allowance Certificate, is a crucial document for anyone who earns an income in the Empire State. This form allows employees to determine the amount of state income tax that should be withheld from their paychecks. Tailoring tax withholdings to each individual's circumstances means workers can better manage their annual tax liabilities, potentially avoiding underpayment penalties or oversized tax refunds that give the government an interest-free loan.

When to Use New York State Tax Form IT-2104

Individuals should use the New York state tax form IT-2104 in various situations, such as when starting a new job or when personal or financial circumstances change. This could include life events like marriage, divorce, the birth of a child, or a change in income. Additionally, those who consistently owe money or receive large refunds after filing their taxes may also consider updating their IT-2104 to align withholdings with their actual tax responsibility better.

How To Fill Out New York State Tax Form IT 2104

Personal Information:

At the top, enter your first and middle initial, last name, and Social Security number.

Address:

Provide your permanent home address, including the number and street or rural route, city, village, or post office, and your apartment number if applicable.

ZIP Code:

Enter the ZIP code of your permanent home address.

Filing Status:

Select the appropriate filing status by marking "Single or Head of household," "Married," or "Married but withhold at a higher single rate." If you’re married but legally separated, select "Single or Head of household."

Residency Information:

Indicate whether you are a New York City or Yonkers resident by marking “Yes” or “No” in the provided boxes.

Certification and Signature

Read the certification, and if you agree, sign and date the form to verify that you are entitled to the number of allowances you've claimed. Remember, there are penalties for false statements.

Form Versions

2023

New York Form IT-2104 (2023)

Fillable online New York Form IT-2104