-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Missouri Templates

-

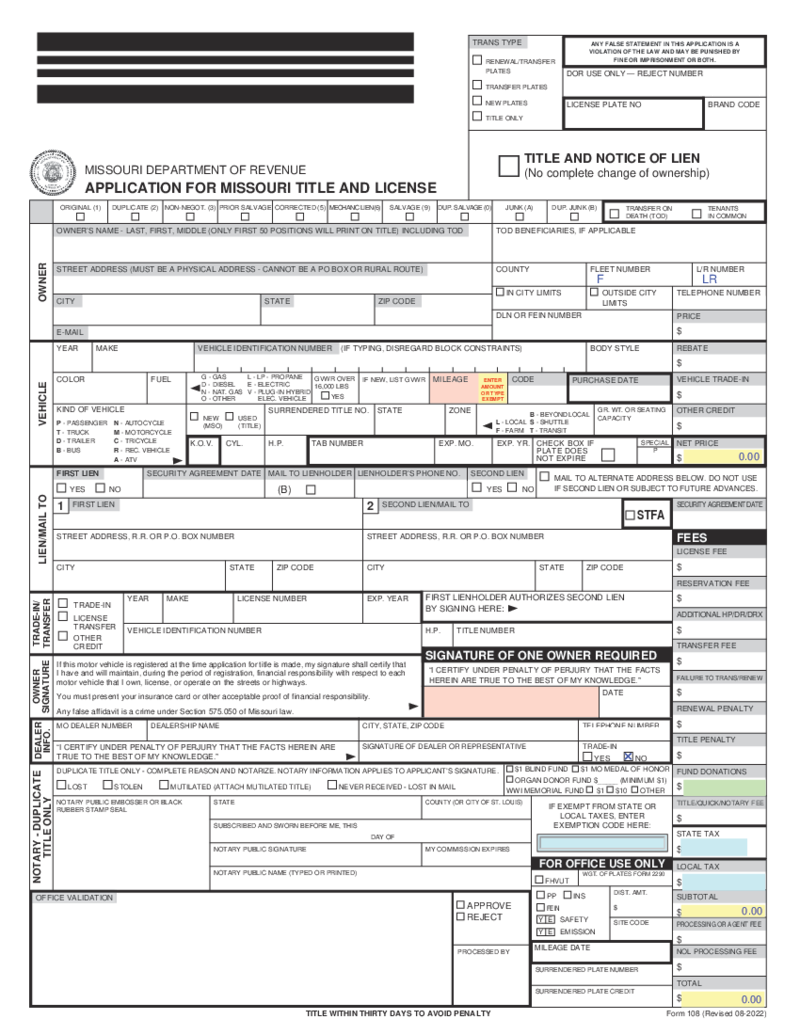

Missouri Form 108

What Is Application for Missouri Title and License?

Missouri application for title and license is also known as DOR 108 form for all drivers who registered their vehicle in Missouri. This is an official document that must be filled out by the local reside

Missouri Form 108

What Is Application for Missouri Title and License?

Missouri application for title and license is also known as DOR 108 form for all drivers who registered their vehicle in Missouri. This is an official document that must be filled out by the local reside

-

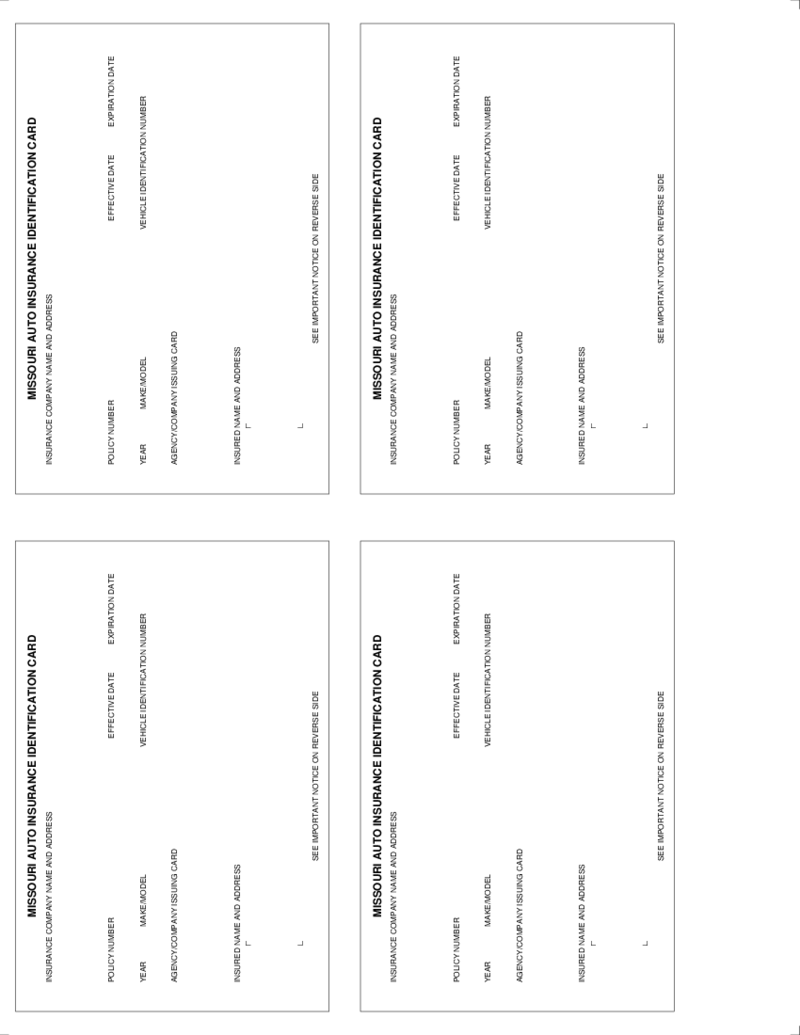

MO Auto Insurance Identification Card

What Is a MO Auto Insurance Identification Card Form?

A MO Auto Insurance Identification Card form is a document that proves you have valid auto insurance coverage in the state of Missouri. It is also known as a proof of insurance card. The MO Auto Insura

MO Auto Insurance Identification Card

What Is a MO Auto Insurance Identification Card Form?

A MO Auto Insurance Identification Card form is a document that proves you have valid auto insurance coverage in the state of Missouri. It is also known as a proof of insurance card. The MO Auto Insura

-

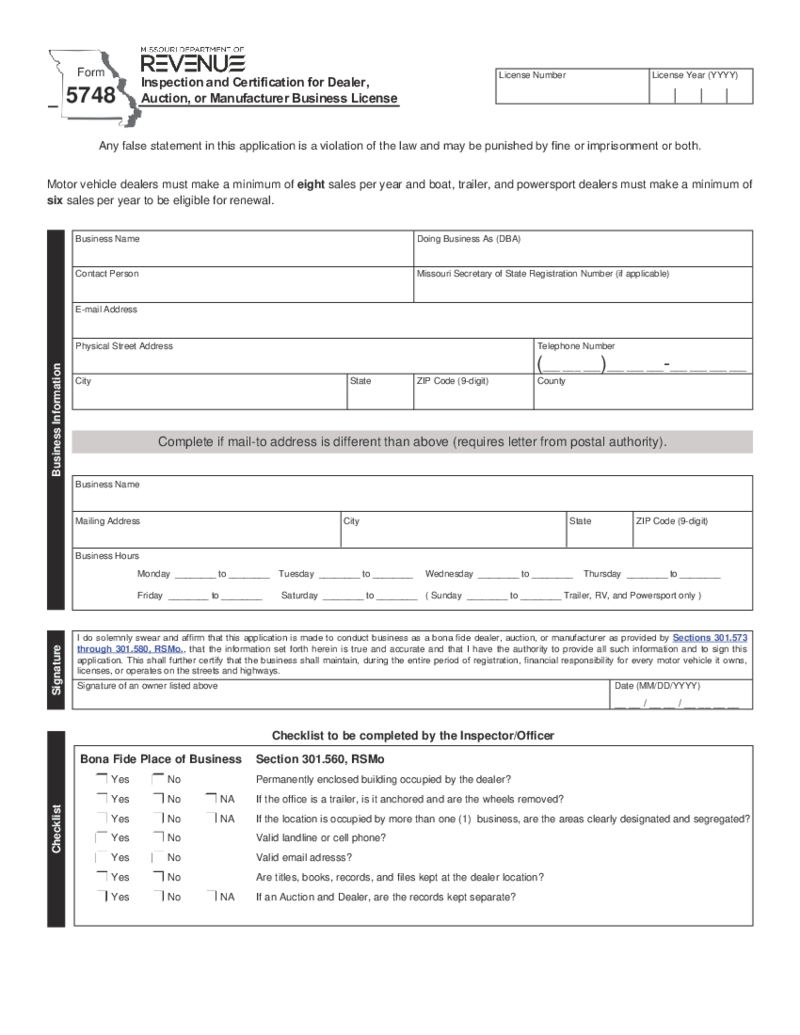

5748 - Missouri Department of Revenue

General Overview of the Form 5748

The form 5748, officially produced by the Missouri Department of Revenue, acts as a procedural recourse for taxpayers who express dissent about their tax liabilities. This easy-to-understand form requires applicants to pr

5748 - Missouri Department of Revenue

General Overview of the Form 5748

The form 5748, officially produced by the Missouri Department of Revenue, acts as a procedural recourse for taxpayers who express dissent about their tax liabilities. This easy-to-understand form requires applicants to pr

-

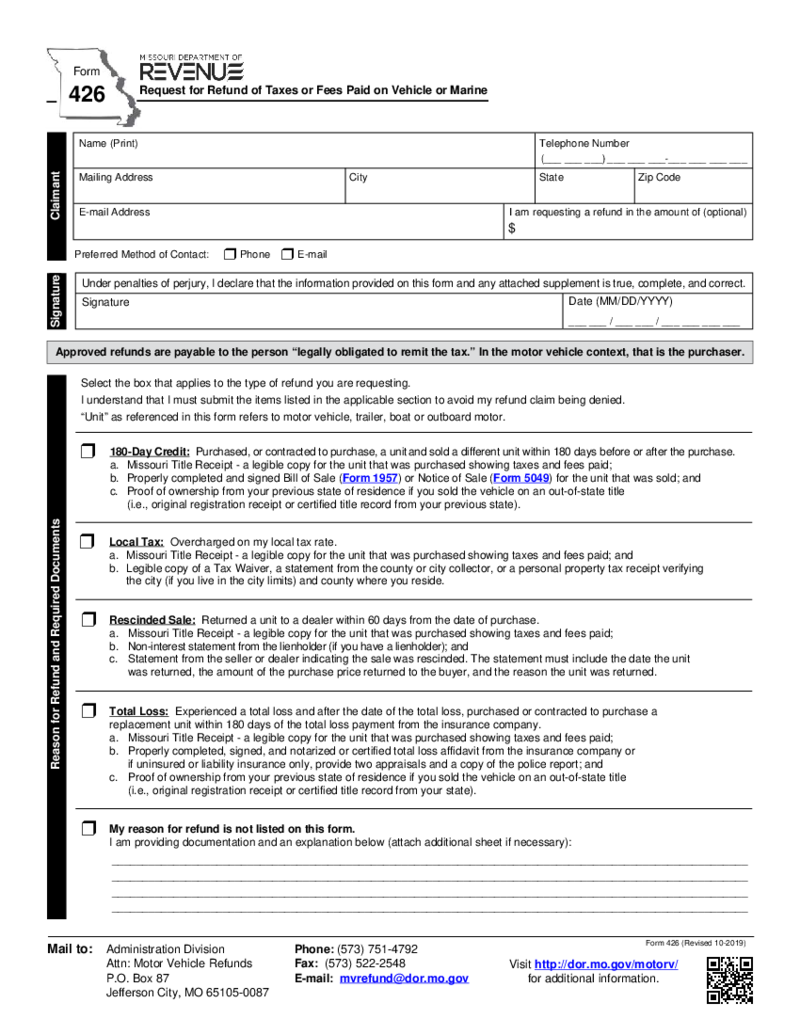

Form 426 - Request for Refund of Taxes or Fees Paid on

What Is Request For Refund Of Taxes Or Fees Paid On Vehicle Or Marine

A Request For Refund Of Taxes Or Fees Paid On Vehicle Or Marine is a formal document submitted to the relevant tax authority to seek reimbursement for overpaid or erroneously paid taxes

Form 426 - Request for Refund of Taxes or Fees Paid on

What Is Request For Refund Of Taxes Or Fees Paid On Vehicle Or Marine

A Request For Refund Of Taxes Or Fees Paid On Vehicle Or Marine is a formal document submitted to the relevant tax authority to seek reimbursement for overpaid or erroneously paid taxes

-

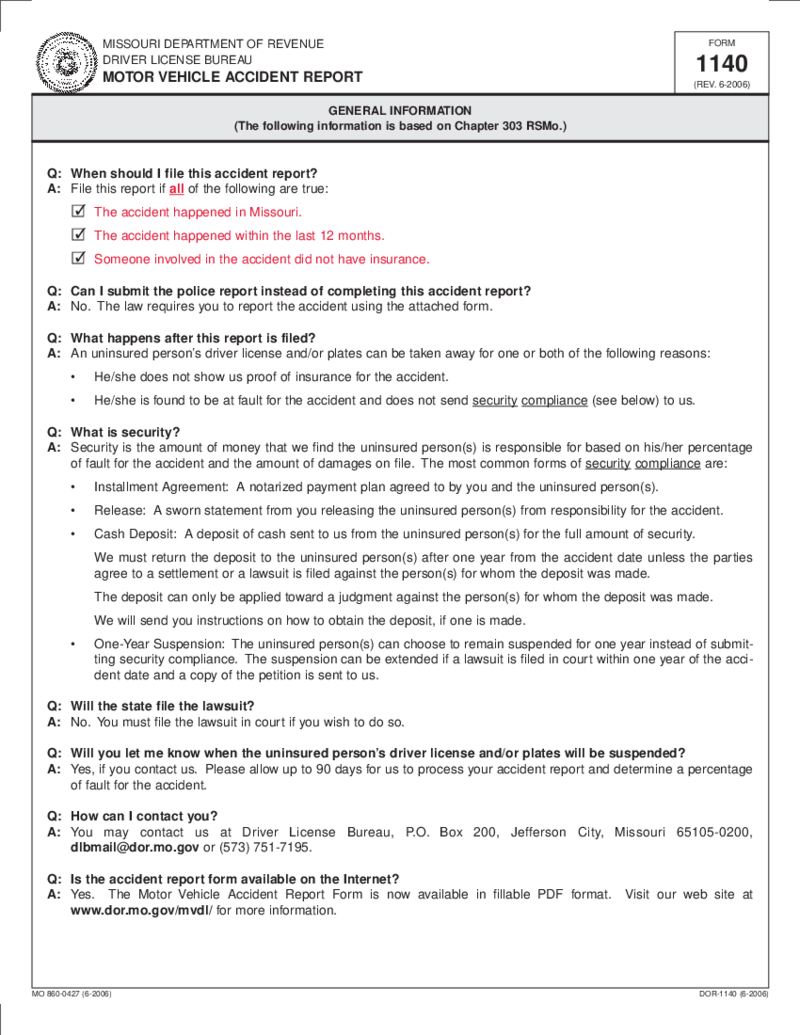

Form 1140 - Motor Vehicle Accident Report

How to Redact and Fill Out Form 1140, Missouri Motor Vehicle Accident Report Online

To redact and fill out the Missouri Motor Vehicle Accident Report (Form 1140) online, you will need to follow these steps:

Obtain a digital copy of the M

Form 1140 - Motor Vehicle Accident Report

How to Redact and Fill Out Form 1140, Missouri Motor Vehicle Accident Report Online

To redact and fill out the Missouri Motor Vehicle Accident Report (Form 1140) online, you will need to follow these steps:

Obtain a digital copy of the M

-

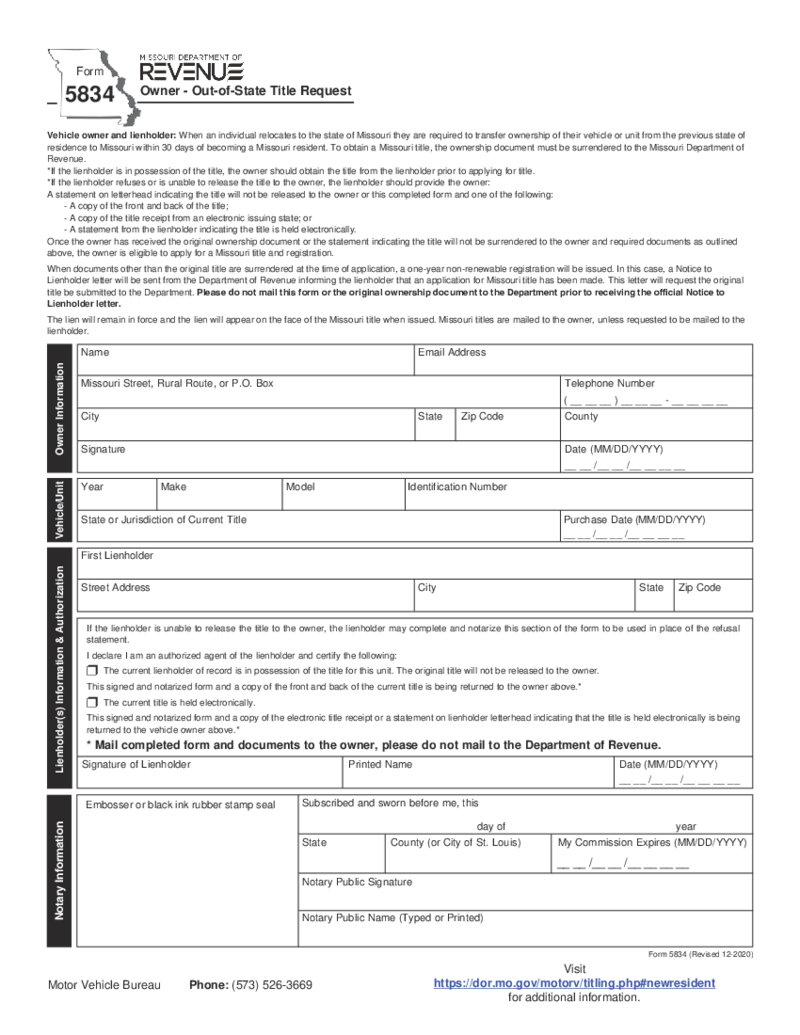

Form 5834 - Owner - Out-of-State Title Request

What Is MO Form 5834?

When moving to Missouri, residents must transfer their vehicle or unit ownership from their previous state within 30 days of becoming a Missouri resident. Missouri 5834 Form, also called Out of State Title Request, records these owne

Form 5834 - Owner - Out-of-State Title Request

What Is MO Form 5834?

When moving to Missouri, residents must transfer their vehicle or unit ownership from their previous state within 30 days of becoming a Missouri resident. Missouri 5834 Form, also called Out of State Title Request, records these owne

-

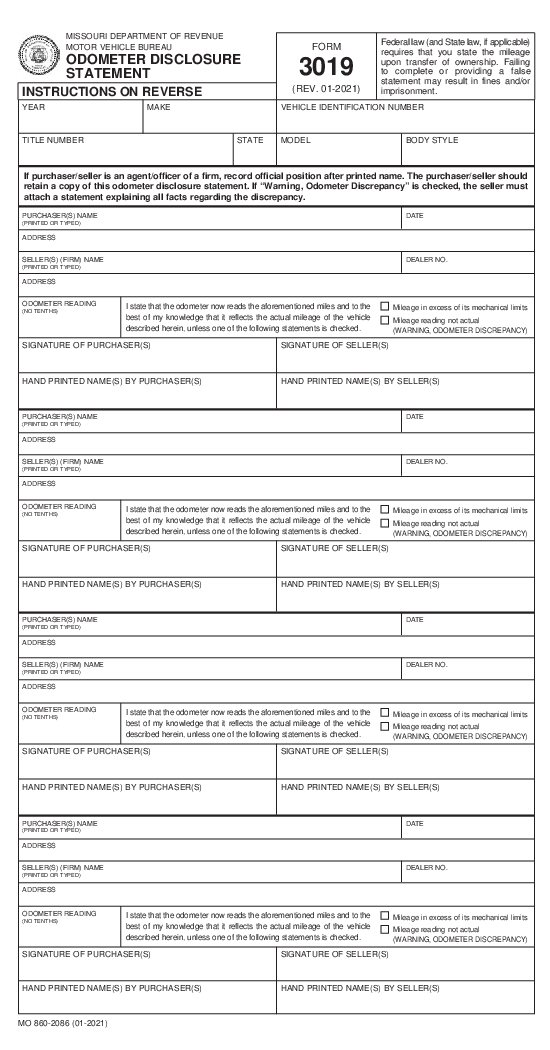

Missouri Form 3019 - Odometer Disclosure Statement

Complete Guide to Vehicle Transfers Using Missouri Form 3019

When selling or buying a vehicle in Missouri, it's critical to ensure that all the legal documentation is in order, and this includes the Missouri Department of

Missouri Form 3019 - Odometer Disclosure Statement

Complete Guide to Vehicle Transfers Using Missouri Form 3019

When selling or buying a vehicle in Missouri, it's critical to ensure that all the legal documentation is in order, and this includes the Missouri Department of

-

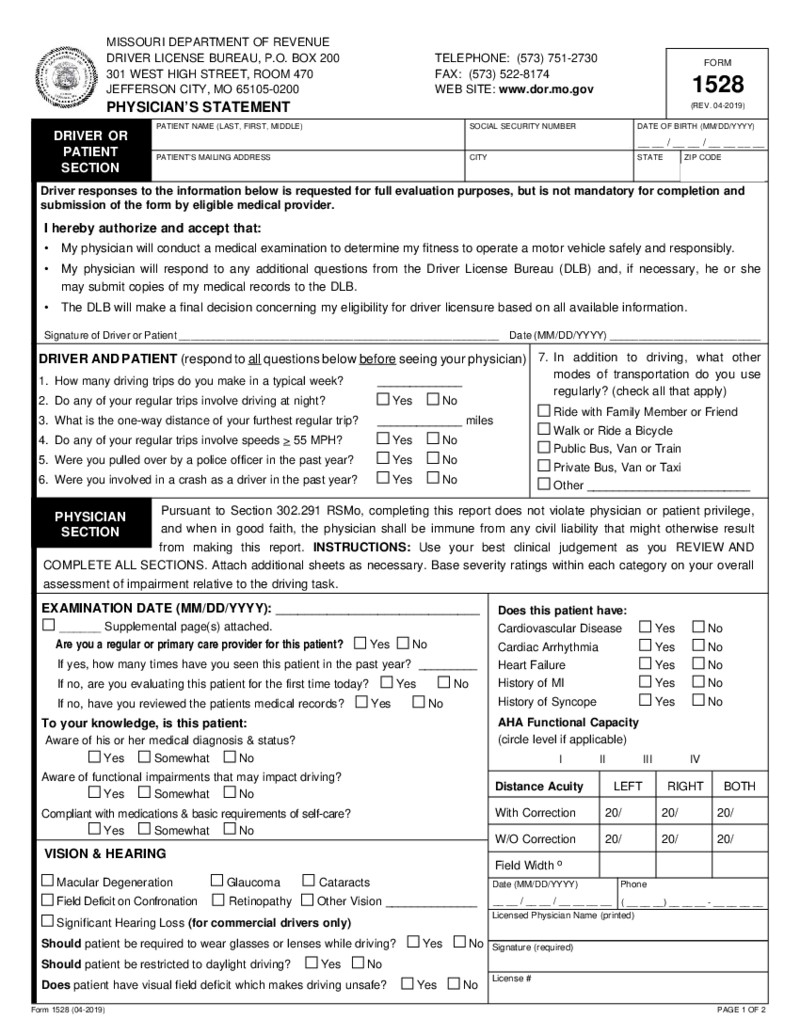

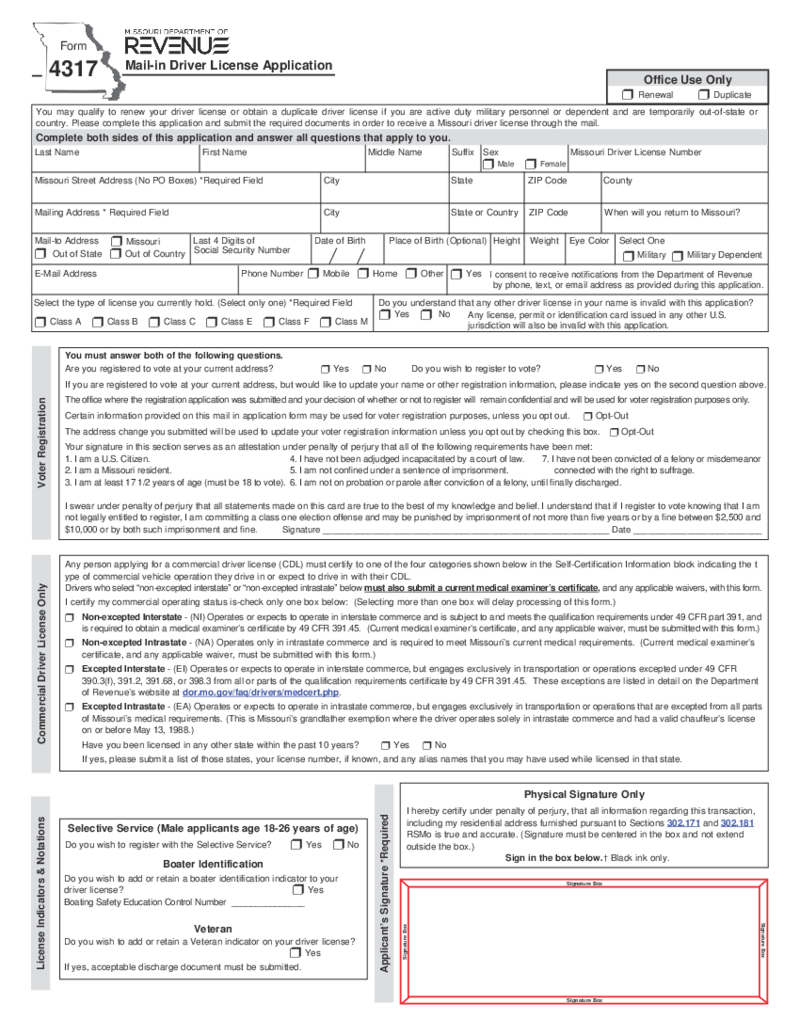

Missouri Form 1528 - Physicians Statement

In the state of Missouri, a variety of forms are used for various legal and official purposes. This guide will provide comprehensive insights on Missouri Form 1528, Blank Missouri Drivers License Template, Form 426, and Form 4317. Each of these forms serves a unique

Missouri Form 1528 - Physicians Statement

In the state of Missouri, a variety of forms are used for various legal and official purposes. This guide will provide comprehensive insights on Missouri Form 1528, Blank Missouri Drivers License Template, Form 426, and Form 4317. Each of these forms serves a unique

-

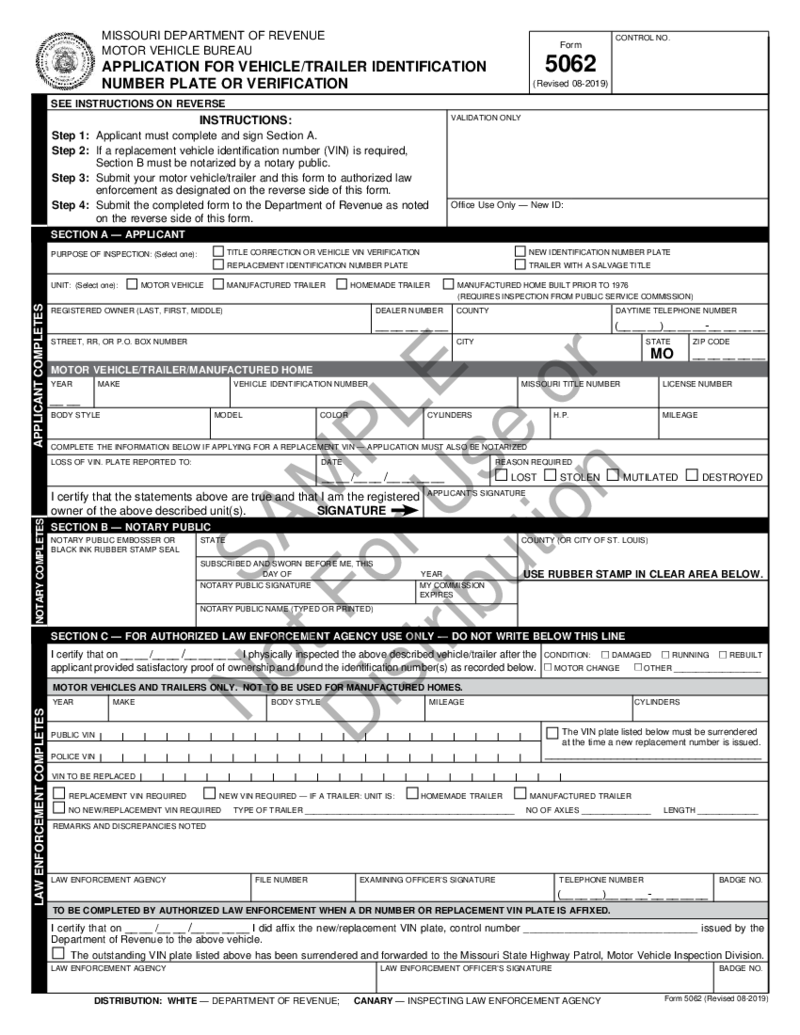

Missouri Department of Revenue Form 5062

Comprehensive Guide on the Missouri Department of Revenue Form 5062

Missouri Form 5062 is an important document instituted by the Missouri Department of Revenue. This form, known as the Notice of Lien, Lien Release, or Au

Missouri Department of Revenue Form 5062

Comprehensive Guide on the Missouri Department of Revenue Form 5062

Missouri Form 5062 is an important document instituted by the Missouri Department of Revenue. This form, known as the Notice of Lien, Lien Release, or Au

-

Missouri Driver License Renewal

What Is a Driver License Renewal Missouri?

A Driver License Renewal Missouri Form is an indispensable document if you are a driver willing to update a standard Missouri Driver’s License. If you do not renew it within 184 days after the license expir

Missouri Driver License Renewal

What Is a Driver License Renewal Missouri?

A Driver License Renewal Missouri Form is an indispensable document if you are a driver willing to update a standard Missouri Driver’s License. If you do not renew it within 184 days after the license expir