-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Warranty Deed Forms

-

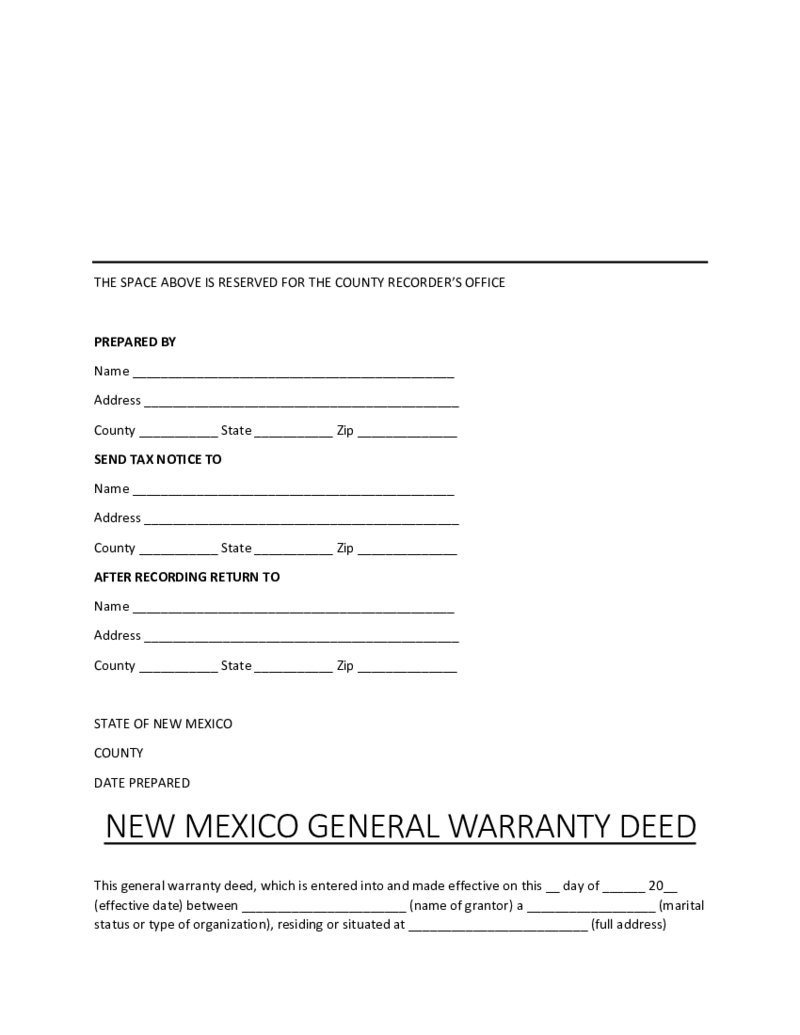

New Mexico General Warranty Deed Form

New Mexico General Warranty Deed: Guide and Process

In the realm of property transactions, understanding the role and importance of a General Warranty Deed is crucial. This legal document transfers ownership of a property from the seller (grantor) to the

New Mexico General Warranty Deed Form

New Mexico General Warranty Deed: Guide and Process

In the realm of property transactions, understanding the role and importance of a General Warranty Deed is crucial. This legal document transfers ownership of a property from the seller (grantor) to the

-

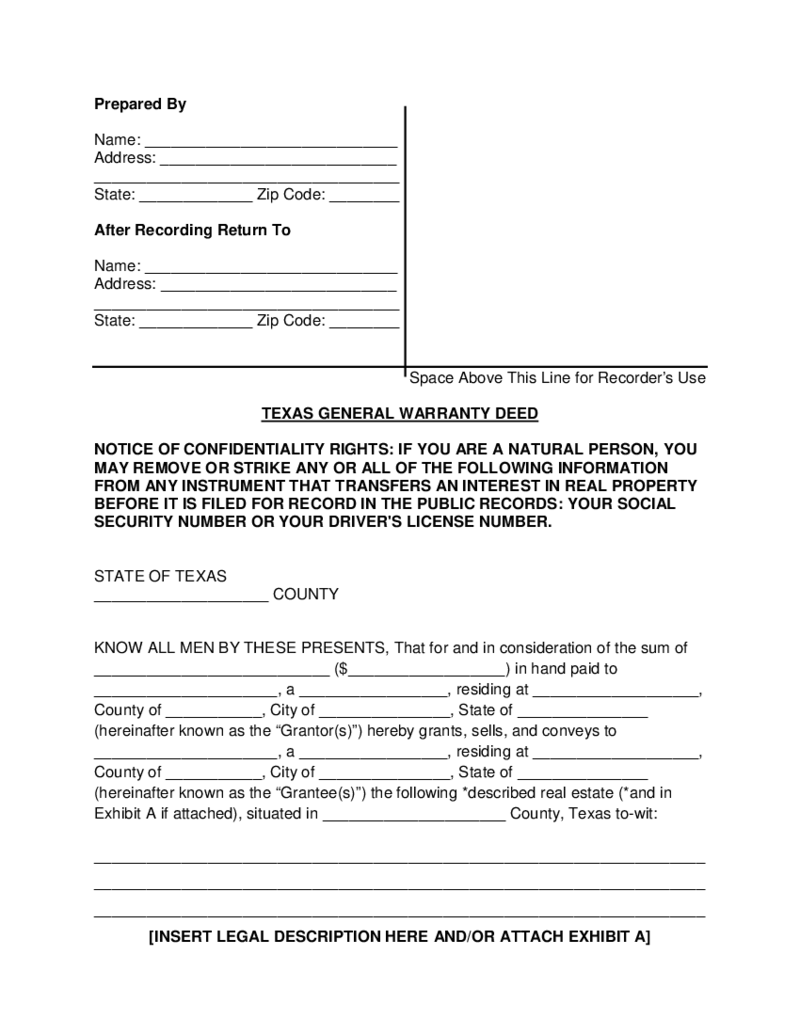

Texas General Warranty Deed Form

What Is a Special Warranty Deed In Texas?

A special warranty deed is a legal document used in Texas to transfer ownership of real estate from one party to another. Unlike a general warranty deed form Texas, which offers broad protections for the buyer, a

Texas General Warranty Deed Form

What Is a Special Warranty Deed In Texas?

A special warranty deed is a legal document used in Texas to transfer ownership of real estate from one party to another. Unlike a general warranty deed form Texas, which offers broad protections for the buyer, a

-

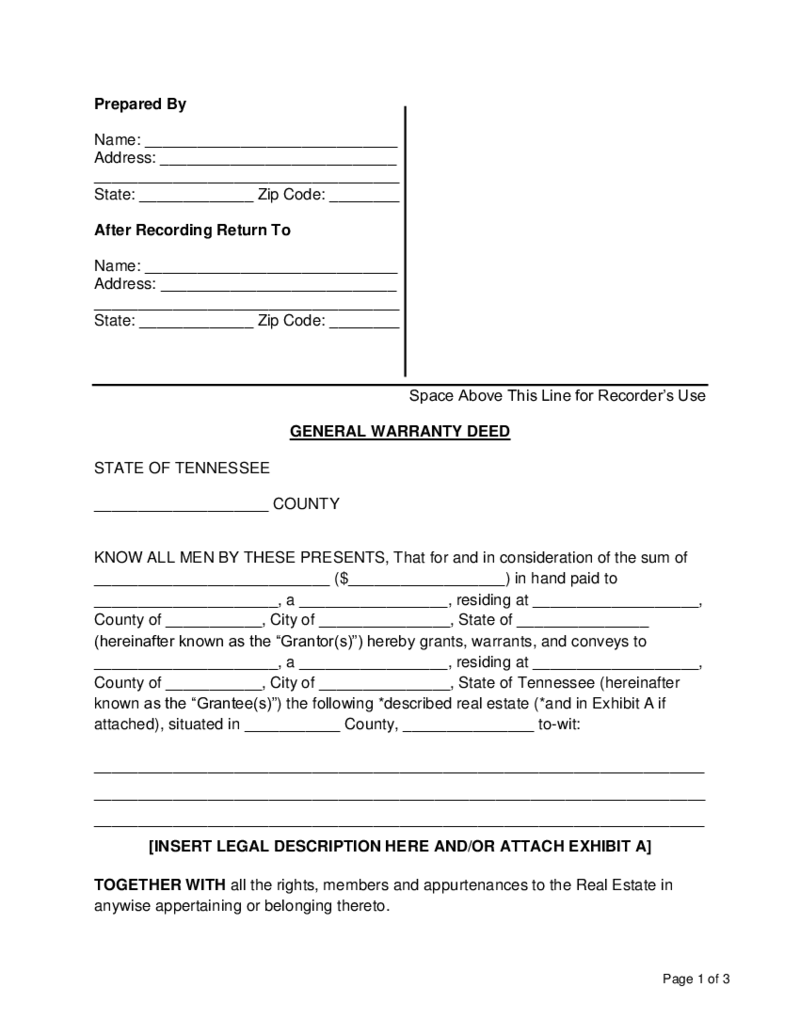

Tennessee Warranty Deed Form

What Is a Special Warranty Deed In Tennessee?

A Special Warranty Deed is a legal document that is used to transfer property ownership from one party to another in the state of Tennessee. The deed guarantees that the seller of the property has the legal ri

Tennessee Warranty Deed Form

What Is a Special Warranty Deed In Tennessee?

A Special Warranty Deed is a legal document that is used to transfer property ownership from one party to another in the state of Tennessee. The deed guarantees that the seller of the property has the legal ri

-

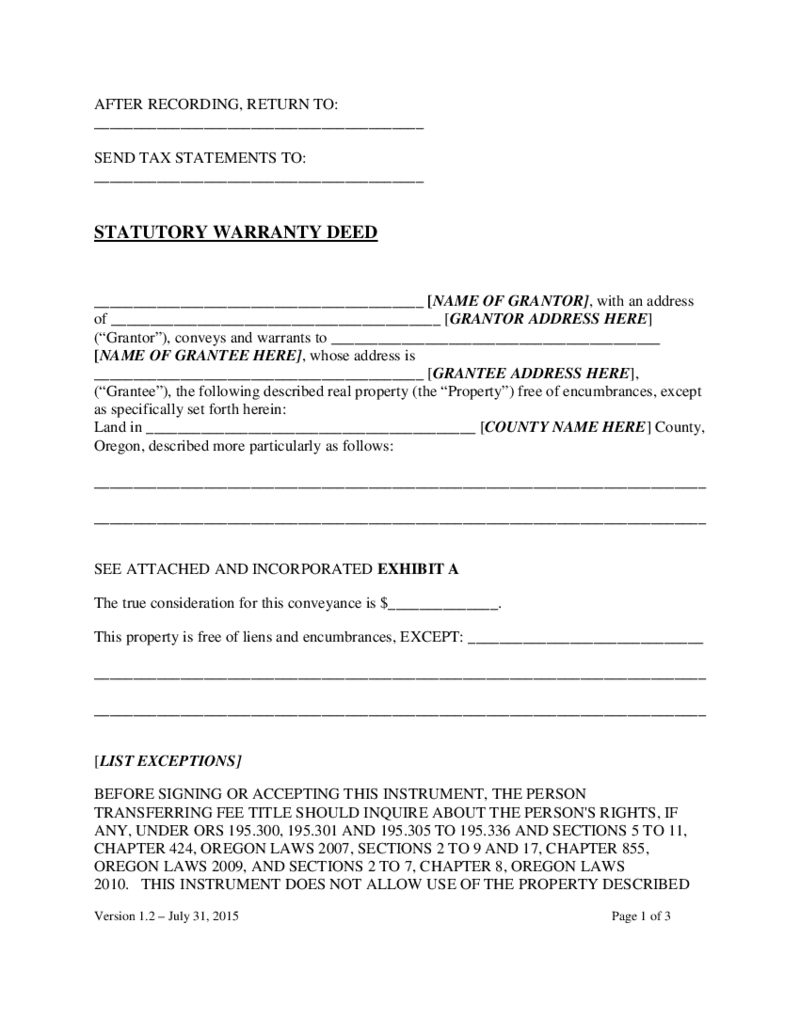

Oregon Warranty Deed Form

What Is a Warranty Deed In Oregon?

A warranty deed is a legal document that transfers ownership of a property from the seller to the bu

Oregon Warranty Deed Form

What Is a Warranty Deed In Oregon?

A warranty deed is a legal document that transfers ownership of a property from the seller to the bu

-

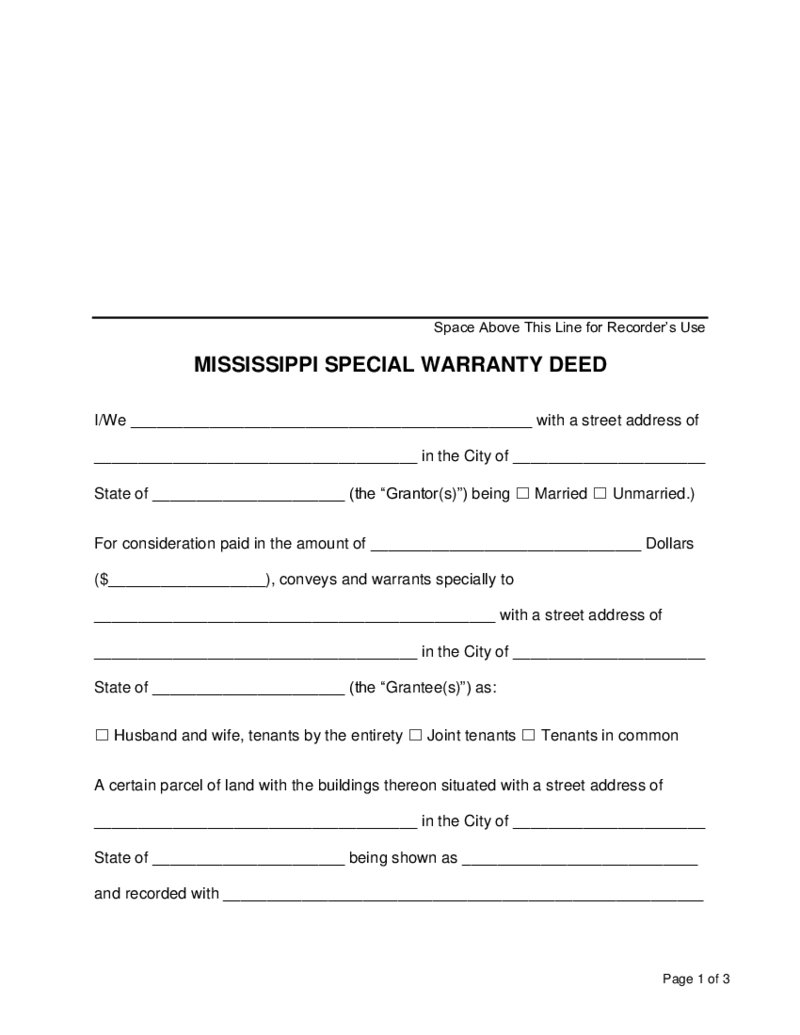

Mississippi Warranty Deed Form

What Is a Special Warranty Deed In Mississippi?

A Mississippi special warranty deed is a legal document that is commonly used in real estate transactions in Mississippi. This type of deed provides a limited warranty, meaning that the seller is only guaran

Mississippi Warranty Deed Form

What Is a Special Warranty Deed In Mississippi?

A Mississippi special warranty deed is a legal document that is commonly used in real estate transactions in Mississippi. This type of deed provides a limited warranty, meaning that the seller is only guaran

-

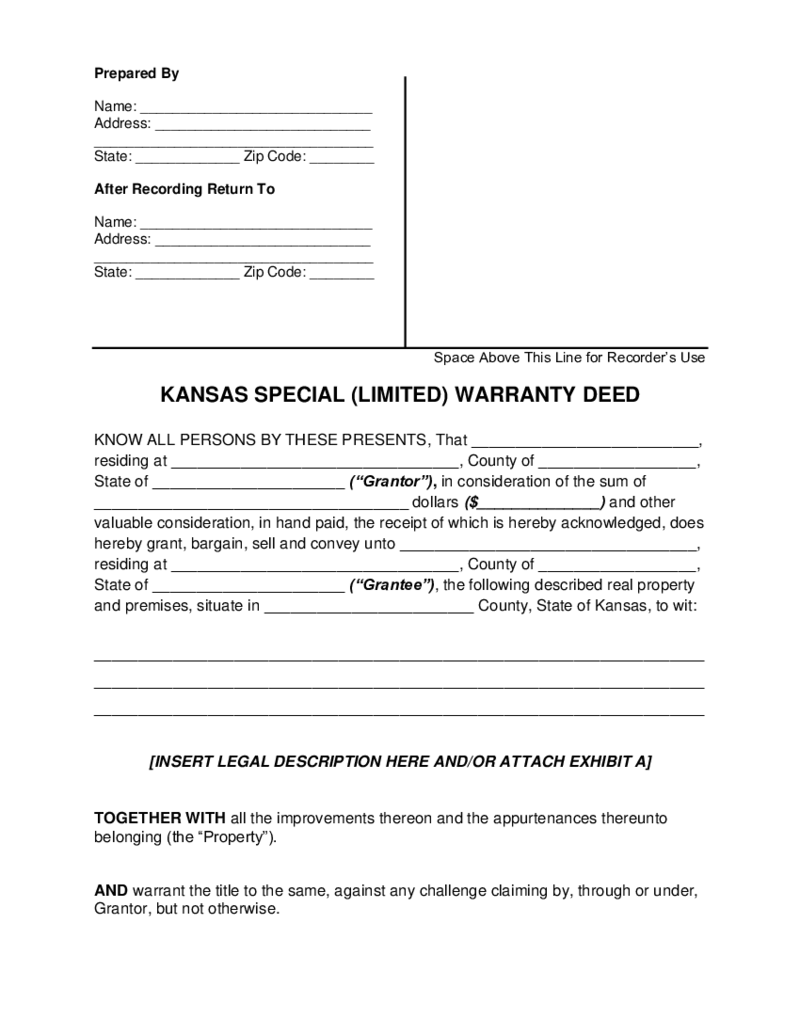

Kansas Special Warranty Deed Form

What Is a Special Warranty Deed In Kansas?

A Kansas special warranty deed form is a type of deed that provides a limited guarantee of title to the property being transferred. The grantor (seller) only warrants that they have not done anything to encumber

Kansas Special Warranty Deed Form

What Is a Special Warranty Deed In Kansas?

A Kansas special warranty deed form is a type of deed that provides a limited guarantee of title to the property being transferred. The grantor (seller) only warrants that they have not done anything to encumber

-

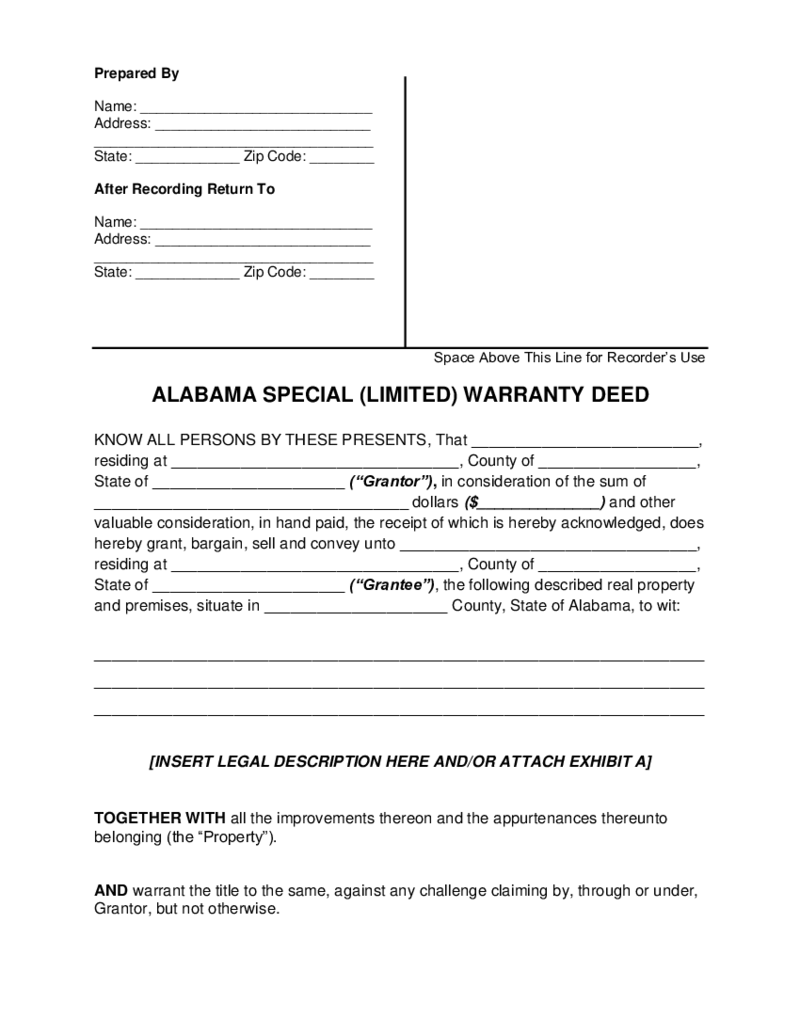

Alabama Special Warranty Deed Form

What Is a Special Warranty Deed In Alabama?

An Alabama Special Warranty Deed Form is a type of deed that provides a limited warranty of title to the grantee. The grantor, or seller, warrants that they have not conveyed the property to any other person dur

Alabama Special Warranty Deed Form

What Is a Special Warranty Deed In Alabama?

An Alabama Special Warranty Deed Form is a type of deed that provides a limited warranty of title to the grantee. The grantor, or seller, warrants that they have not conveyed the property to any other person dur

Search by State

What Are Warranty Deed Forms?

Warranty deed forms are quite popular in the real estate business. They offer extra security to a buyer who pays for real estate, whether it is private or commercial. The warranty deed tights a seller and ensures that they keep the title to the property clear, without any mortgages or liens. The buyer receives the guarantee that no one will claim the very same title in the future. The parties are named the grantor, which is the seller, and the grantee, which is the buyer. Lenders usually prefer to work only with the warranty deeds on a property. The Warranty Deed Form is considered to be the friendliest to the buyer agreement when it comes to real property transfer.

Warranty Deed Forms Types

There are several types of warranty deed forms. Though you might not need all of them, since they all have their own pros and cons, you’d better learn this information in advance to have a choice. Based on your particular situation, you may choose one of them for one property transfer and something different for another. Check them out:

General Warranty Deed

This is the most used template among all blank warranty deed forms on the market. It is almost similar to a special warranty deed when it comes to the basics, but it still comes with unique features. This insurance form contains the entire package of protection known for its highest-level standards. It handles property issues, security from fraud, and claims for the real estate buyer. The grantor holds total responsibility for any possible problems within the real estate’s legal cases. Even if the issues were before the seller bought the property, they would have to solve them before the transaction is made.

Special Warranty Deed

This form does not offer as much protection as a general one. Based on this legal form's warranty deed, the grantor is responsible for any problems that might occur during the grantor’s ownership of the property. This form doesn’t cover the property’s entire history, so the grantee may deal with debts and claims from the previous owner.

Quitclaim Deed

This document is used by owners who can transfer their interest in the property. This form does not confirm that the grantor is the real owner of the real estate. It does not specify that the grantor is responsible for any potential claims for the property. Real estate agents consider this document as the one that contains the highest risk for the grantee.

Bargain and Sale Deed

This type covers cases that involve real estate from a tax sale, foreclosure, or deceased people. They are widely used around the US. This document certifies that the grantor owns the title but there still can be claims regarding the property. This type is slightly more secure than the quitclaim one, but it is not as efficient and protective as the general warranty deed. If the document contains some extra guarantees, it is called a bargain and sale deed with the covenants. The grantor might prefer the deed to limit the liability.

Warranty Deed Requirements

Basic requirements apply to any warranty deed, no matter the type. The template you choose has to match these demands. Once you download the form or open it online using PDFLiner, you will see empty, fillable sections. You have to make sure that you complete those you need before you send the document to another party. Here are the main “ingredients” of a warranty deed:

- Information about the preparer. You need to be specific about the person who creates the warranty deed, including their name, address, and phone number. If the document is made by a third party, you need to indicate it as well. In this case, the grantor has to sign the agreement to be represented by this person;

- Information on the recipients. Provide basic data on recipients, including addresses and names;

- Provide details on the transaction. You have to be specific about the money that was paid for the property, the address, and any extra details that come with the document;

- Share details of the warranty deed based on its type. You have to understand that the grantee will not receive the same attitude from every type of deed. Make sure that the grantee understands that as well before signing the document. The grantee receives a detailed description of the benefits made in the document;

- Signatures. Both the grantor and grantee need to read the document in advance. They have to put their signatures on it. Based on your decision and the local laws, you can offer an electronic signature option to simplify the procedure. Both parties have to provide their full names and addresses;

- Notary Public signature. The Notary Public must sign the document to prove that the professional has read the document and got familiar with the case. You can specify the deadline for the commission as well.

How to Make a Warranty Deed

If you don’t know where to start, we advise searching among legal warranty deed forms on PDFLiner to find the one you need. You can always hire a professional Notary Public or a third party that will act on your behalf to create the document from the very beginning. If you are familiar with the laws, it does not mean that you can create a warranty deed by yourself, but some taxpayers try. It is preferable to use ready-built templates. You have to fill in the following information there:

- Share information on the preparer of the document.

- Provide data on the party that will receive the document after recording if it is a different person.

- Include information on the property.

- Specify the names of the grantor and grantee, as well as their current addresses.

- Make sure that all the specifics of the warranty deed are listed in the document. Pay attention to the type, and if it does not match the original agreement, change it to the one which both parties agree upon.

- Ask both parties to sign the document.

- Hire Notary Public to sign the template, certifying the current date of the agreement. It must be done once both parties sign the document.

How to Get a Warranty Deed

There is nothing complicated in finding the warranty deed you need: Numerous services offer them on the Web. However, almost all of them are available only for reading or downloading. To be able to work with printable warranty deed forms online on your computer, you need a PDF editor such as PDFLiner. You will find impressive collections of forms on this service.

There are over 50 templates, and the number is steadily growing. Pay attention to the specific type you need. Open the document and start filling out its empty sections. Once it is done, you have to save the document on your device. You may send the form via email to another party or print it out and give it to them manually.