-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

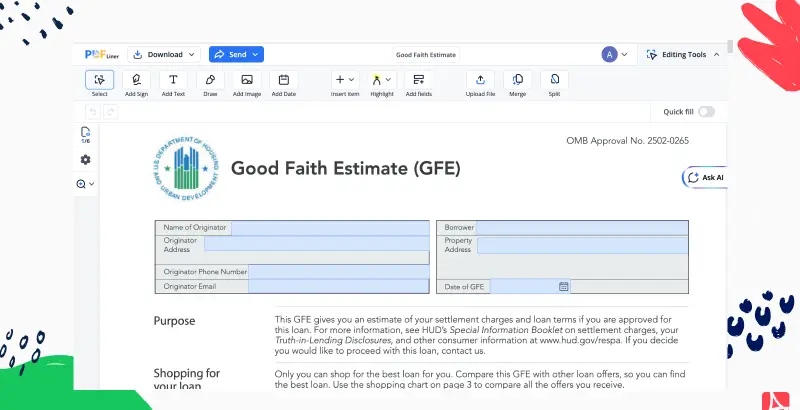

Fillable Good Faith Estimate

Get your Good Faith Estimate in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

The real estate market is riddled with complex terms and processes. However, understanding these terms is crucial to making informed decisions. In this article, we will explore one such term - the Good Faith Estimate (GFE), its importance, and how to use it effectively.

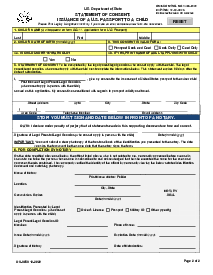

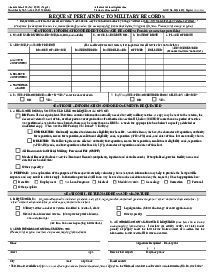

What is a Good Faith Estimate

A Good Faith Estimate, often abbreviated as GFE, is a form that lenders are required to give to borrowers within three days of a loan application. It provides an estimate of the charges and fees associated with obtaining a mortgage.

Importance of a Good Faith Estimate

- Helps borrowers understand the costs involved in the loan process.

- Provides transparency in the lending process.

- Enables borrowers to compare loan offers from different lenders.

How to Use Good Faith Estimate Form PDF

- Download the GFE form from a reliable source.

- Fill in the required details such as property address, loan amount, etc.

- Review the costs and charges mentioned in the form.

- Use this form to compare offers from different lenders.

Good Faith Estimate vs Loan Estimate

| Good Faith Estimate | Loan Estimate |

|---|---|

| Provided by the lender within three days of loan application. | Also provided by the lender within three days of loan application. |

| Contains estimated costs of the loan. | Contains both estimated and actual costs of the loan. |

Steps to Download the Fillable Good Faith Estimate Form

- Navigate to the PDFliner website.

- Search for the 'Good Faith Estimate Form' in the search bar.

- Click on the form and hit the 'Download' button.

- Save the form and open it using any PDF reader.

Conclusion

Being well-informed about the GFE can help you navigate the complex process of home loans more easily. Remember, comparing different loan offers using the GFE can lead to significant savings. Happy home buying!

Fillable online Good Faith Estimate