-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

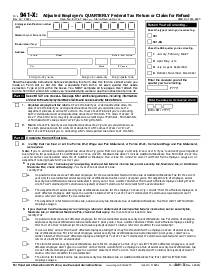

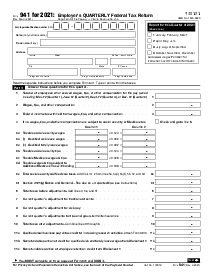

Form 941-SS (2021)

Get your Form 941-SS (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is IRS Form 941-SS 2021

The IRS form 941-SS is designed for employers in U.S. territories such as Guam, American Samoa, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands. This form is utilized to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks, as well as the employer's portion of Social Security or Medicare tax.

Key Features of Form 941-SS 2021

The 941-SS Form 2021 came with a set of instructions and requirements meant to streamline the reporting process. Some notable features included:

- The form is generally filed quarterly to report taxes for January-March, April-June, July-September, and October-December.

- Employers need to provide details about the wages paid, tips received by employees, and any adjustments, such as sick pay.

- For 2021, special tax codes were included to account for tax credits or reliefs given due to extraordinary circumstances, such as natural disasters or the COVID-19 pandemic.

- Based on the IRS schedule, employers are expected to deposit the taxes that have been withheld or are due, either electronically or by check.

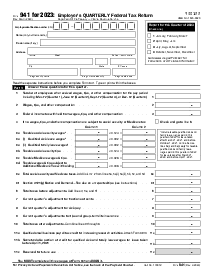

IRS Form 941-SS 2021 vs. 2023: What to Expect

While the core purpose of the form will remain the same, there are expectations of changes in the 2023 version. These updates are likely to include:

- Simplified Fields: A redesign aiming to make the form more user-friendly is expected.

- Digital Transformation: With the IRS moving towards digitization, a more seamless electronic filing process could be part of the 2023 update.

- Updated Tax Codes: As tax laws evolve, new codes for credits or special conditions are expected to be integrated into the form.

- Real-time Reporting: The IRS has been looking into real-time tax reporting, which could be incorporated in future iterations.

Fillable online Form 941-SS (2021)