-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 941-SS

Get your Form 941-SS in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

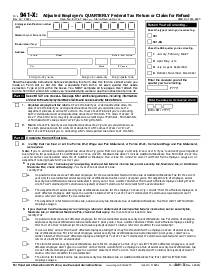

What Is 941 SS?

Also known as Employer’s Quarterly Federal Tax Return, it’s a form used for reporting social security and Medicare taxes for employees in American Samoa, US Virgin Islands, Guam, and the Commonwealth of the Northern Mariana Islands.

What Do I Need the Form 941 SS For?

The form is used for:

- documenting Medicare and social security taxes for workers in Guam, American Samoa, US Virgin Islands, and the Commonwealth of the Northern Mariana Islands;

- reporting those taxes to the IRS.

Via PDFLiner, you can get the pre-designed template of this form which also serves a specific purpose: to help you save your time filling the form out. Naturally, drafting documents from square one is time-consuming. And of course, using pre-made templates instead is something definitely worth giving a try. Along with this specific form, you can also find other templates on PDFLiner. Fillable, printable, and 100% free of charge, they are sure to give your document management aspirations the mightiest boost.

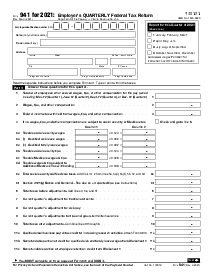

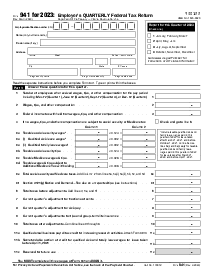

How to Fill Out 941 SS Form

The document consists of 6 pages, the last three of them being nonfillable. When assessing the first three fillable pages, follow these easy steps as you progress through completing the form via PDFLiner:

- Sign up to our service: it’s only going to take a few minutes of your time.

- Open the form and wait until all the editing tools load.

- Specify employer identification number.

- Indicate your full name, including your trade name.

- Provide contact information.

- Specify the quarter for which you’re reporting.

- Answer the questions for the quarter in Part 1.

- Provide the details about your deposit schedule and tax liability for this quarter in Part 2.

- In Part 3, provide information about your business by answering the questions.

- Add your signature and current date.

If you’re looking for a top-notch e-signature tool, consider you’ve already found it. With PDFLiner, you get the possibility to digitally sign your files in the fastest and most convenient way possible. The e-signatures our service produces are legally binding and secure. Enjoy signing your docs on the go in the comfort of your home or office.

How to File 941 SS Online

The easiest way to submit the form is online. Equip yourself with the PDFLiner editing and forwarding tools while enjoying saving loads of your precious time along the way.

Here are the perks of filing your forms online:

- convenience and flexibility: you’re no longer tied to the 9-to-5 schedule;

- saves time and money: no more scanning or printing expenses;

- maximum accuracy: digital filing prevents errors and allows you to correct any imperfections in a jiffy.

In order for these benefits to work magic for you, you need to stick with a fully compliant and secure PDF editing and filing service. And that’s where PDFLiner comes into play. Give it a try and you’ll truly enjoy the pros of online document management.

Organizations That Work With Form 941-SS

- Department of Treasury - Internal Revenue Service.

Fillable online Form 941-SS