-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

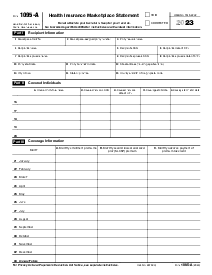

- 1099 Forms

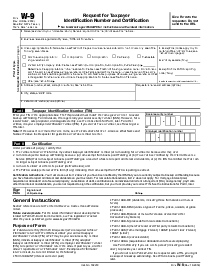

- W-9 Forms

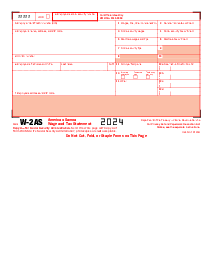

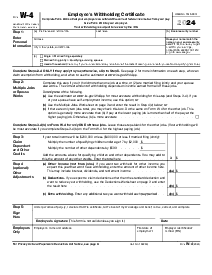

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Florida Last Will and Testament Form

Florida Last Will and Testament Form

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 1095-C (2020)

Get your Form 1095-C (2020) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a 1095 C Form 2020

The 2020 Form 1095 C is a tax document employers provide to employees to report on health insurance coverage offered and provided under employer-sponsored health plans. Individuals must understand what coverage they were eligible for and the coverage they opted for throughout the year. This form is part of the Employer Shared Responsibility Provisions under the Affordable Care Act.

When to Use IRS 1095 C Form 2020

Employers must utilize the IRS 1095 C Form 2020 in several key situations:

- Organizations classified as large employers (typically those with 50 or more full-time employees) must send out this form.

- For any employee who was full-time for one or more months of the calendar year and was offered health coverage.

- Employers of any size that offer self-insured plans must issue a Form 1095-C to employees, covering them and their families.

How To Fill Out Form 1095 C 2020

Filling out the Form 1095 C 2020 is a meticulous process that involves several crucial steps:

Employee Information:

Complete Part I by providing detailed employee information such as their name, social security number, and the employer's contact information.

Offer of Coverage (Part II):

In this section, the employer will indicate the type of insurance coverage offered to the employee for each month of the year. This involves marking the appropriate codes for the offer of coverage and the employee's share of the lowest cost monthly premium for self-only minimum value coverage.

Covered Individuals (Part III):

For employers with self-insured plans, this section requires listing all individuals (including dependents) covered under the plan and their months of coverage.

Employer Information (Part III):

The employer's name, EIN, and address must be accurately filled in this section to ensure proper identification.

When to File 2020 Form 1095 C Deadline

Employers must furnish a copy of Form 1095-C to each employee by March 2, 2021. This date allows employees to receive their tax forms in time to file their income taxes.

For submitting to the IRS, the deadline was February 28, 2021, for paper filings and March 31, 2021, for those filing electronically. Employers need to adhere to these deadlines to avoid penalties.

This document is a comprehensive guide to understanding, using, and submitting the 2020 Form 1095 C. Both employers and employees should familiarize themselves with the form's requirements to ensure compliance with healthcare reporting obligations.

Fillable online Form 1095-C (2020)