-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

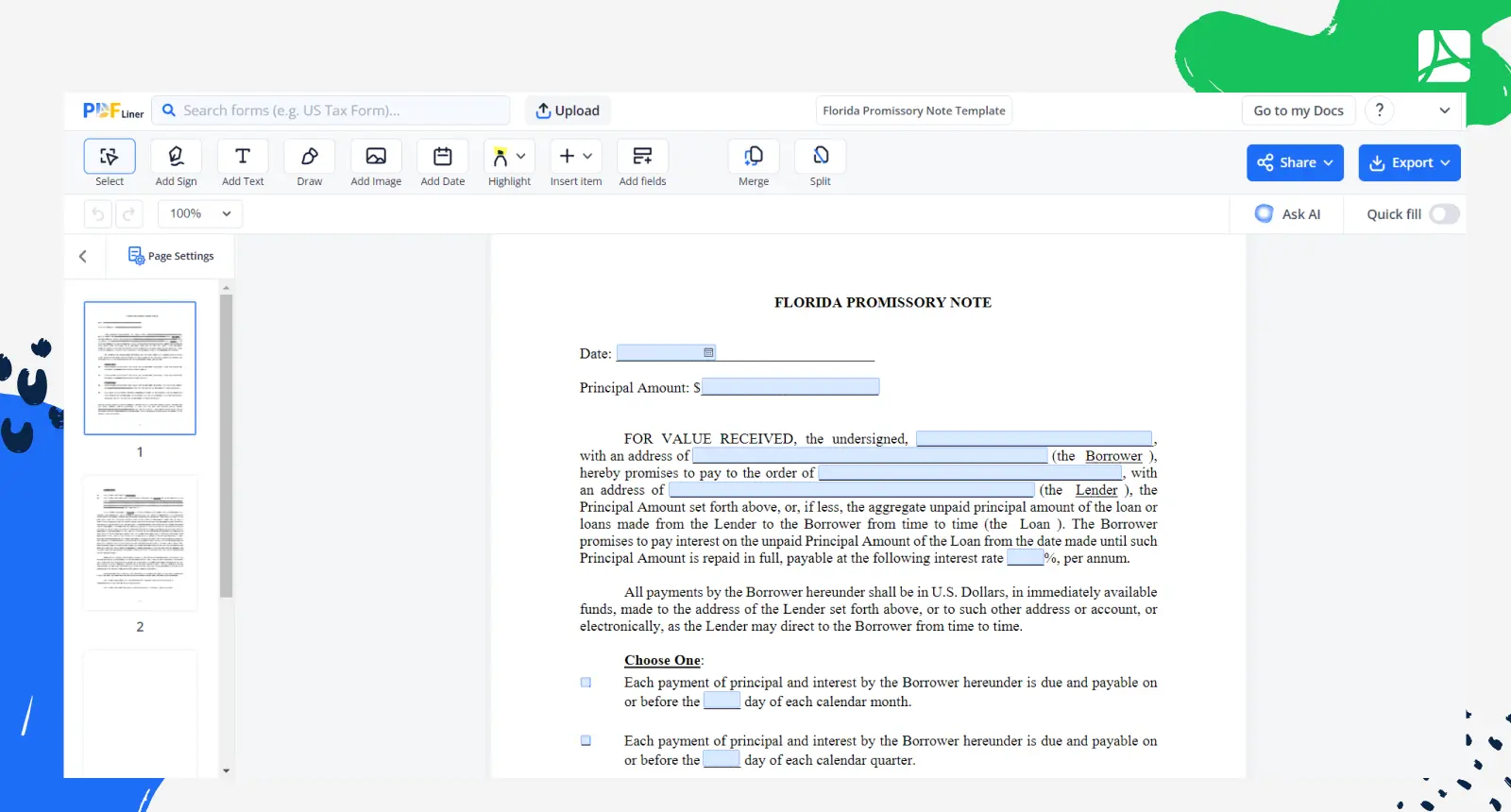

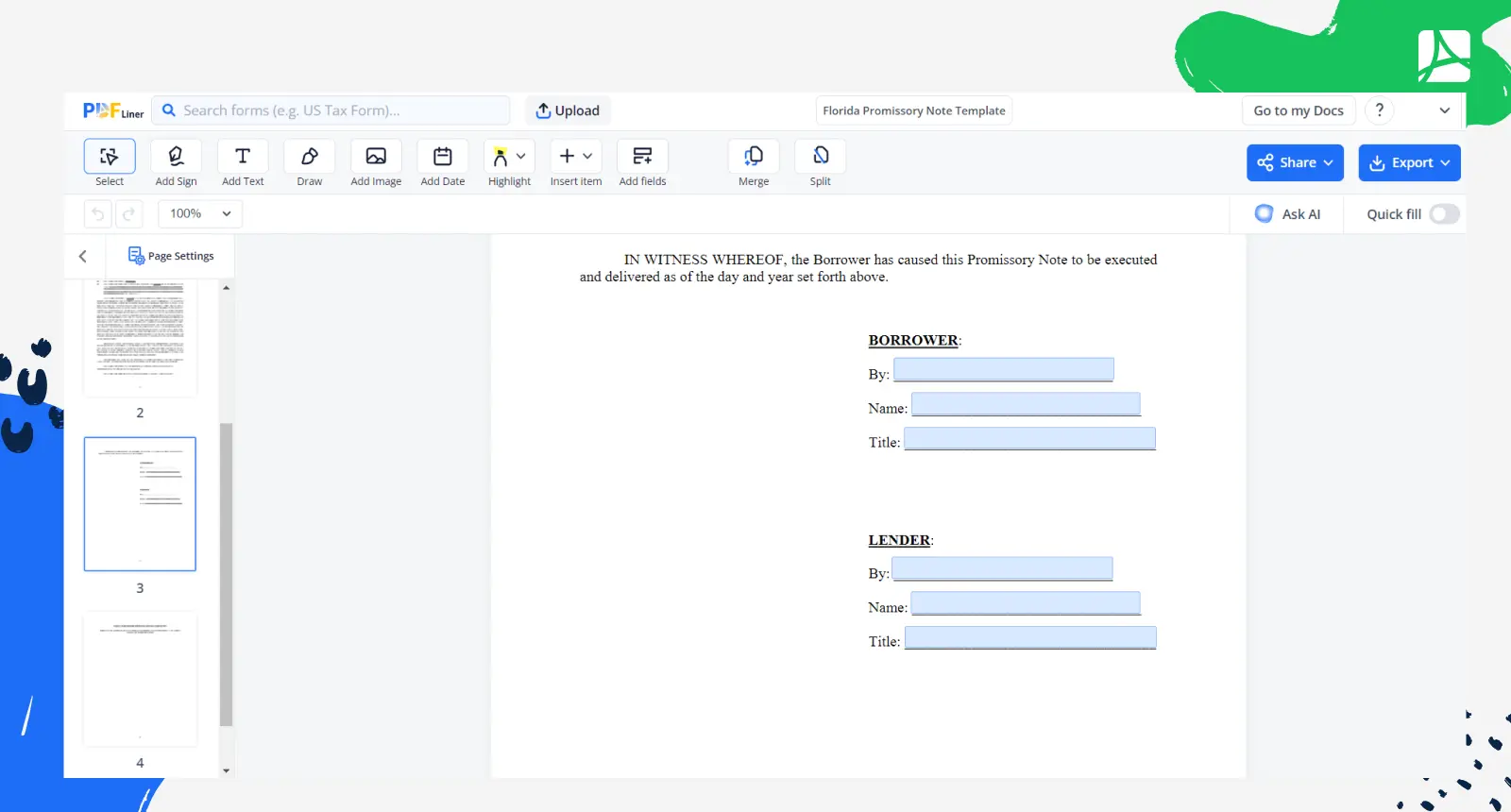

Florida Promissory Note Template

Get your Florida Promissory Note Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Florida Promissory Note Template

A Florida Promissory Note is a legally binding document used to record a promise to repay a specific amount of money, typically with interest, on a predetermined schedule. It records the borrower's commitment to repay a loan to the lender. A Florida Promissory Note template serves as a pre-made format for creating such agreements. Its purpose is to define the terms of the loan, including the principal amount, interest rate, repayment schedule, and any other relevant conditions.

Florida promissory note requirements

The Sunshine State has specific requirements for a valid Promissory Note. Find Florida Promissory Note requirements below:

- Names and Contact Information. Include full legal names and addresses of both the lender and borrower.

- Loan Details. Provide details about the loan amount, interest rate, and conditions for repayment.

- Payment Schedule. Clearly indicate when and how payments will be made.

- Interest Calculation. State how interest is calculated.

- Default Terms. Define consequences of default.

- Signatures. Leave space for both parties’ signatures. Don’t forget to date the document.

- Notarization (optional but recommended). Adding a notary seal can add legal weight to the agreement.

How to Fill Out Florida Promissory Note Form

Filling out a Promissory Note in Florida correctly is essential to create a legally binding agreement. First, find the Promissory Note template Florida in our database of free document templates. Open the form to start editing it. Then follow these 8 vital steps:

- Specify the loan date and amount.

- Enter the full names and addresses of both the borrower and lender. Include their contact information.

- Define the interest rate, if applicable.

- Indicate when payments are due.

- Include details about how payments should be made.

- Specify late fees for missed payments.

- Detail the consequences of default.

- List any collateral securing the loan.

Bear in mind that both parties should sign and date the document. Notarization is optional but adds legal validity. If required, have witnesses sign and date the form. Focus on maximum accuracy in order to prevent any errors or confusion. Make the most of PDFLiner whenever you need to find and fill out any industry-specific document template.

Does a promissory note need to be notarized in Florida

No, in Florida, a Promissory Note does not require notarization to be legally valid. However, notarizing the document is recommended as it adds an extra layer of authenticity and can make it more difficult for any party to dispute the agreement's validity as time goes by. Long story short, notarization can provide additional legal assurance and protection. That’s exactly what you’re interested in, right?

Fillable online Florida Promissory Note Template