-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

California State Forms

-

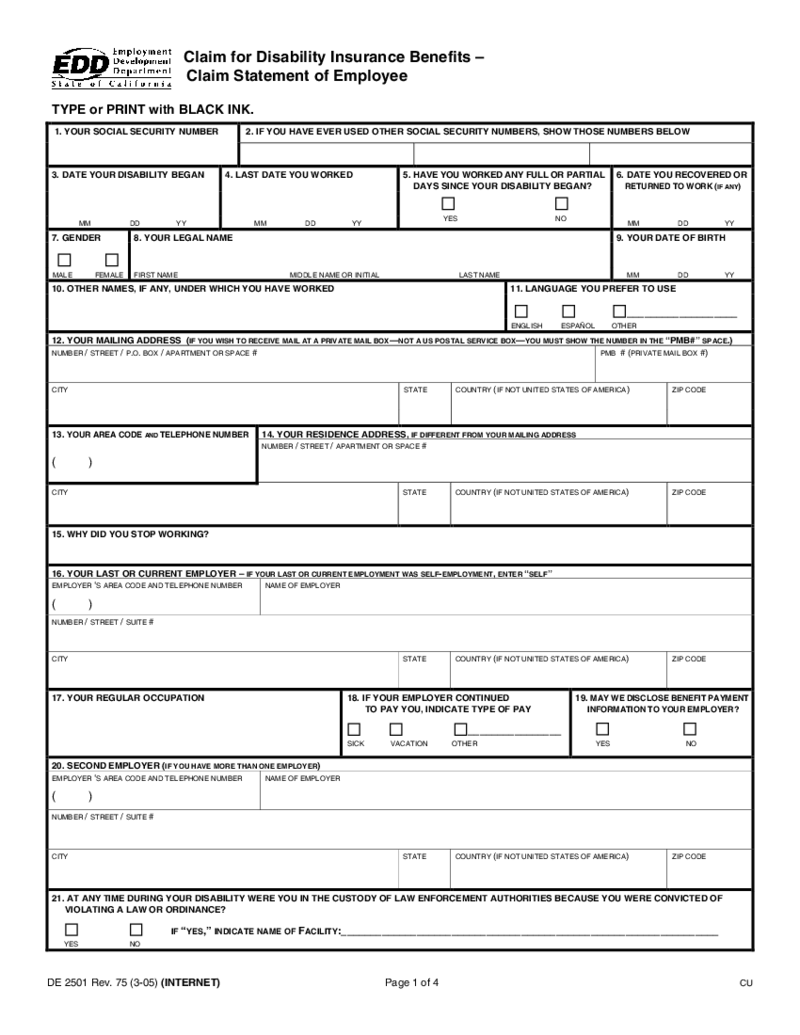

Form DE 2501 - Claim for Disability Insurance Benefits

What is Claim for Disability Insurance Benefits?

The claim for disability insurance (di) benefits is also known as the form DE 2501. It was created by the Employment Development Department as the Claim Statement of Employee. EDD has to use the California

Form DE 2501 - Claim for Disability Insurance Benefits

What is Claim for Disability Insurance Benefits?

The claim for disability insurance (di) benefits is also known as the form DE 2501. It was created by the Employment Development Department as the Claim Statement of Employee. EDD has to use the California

-

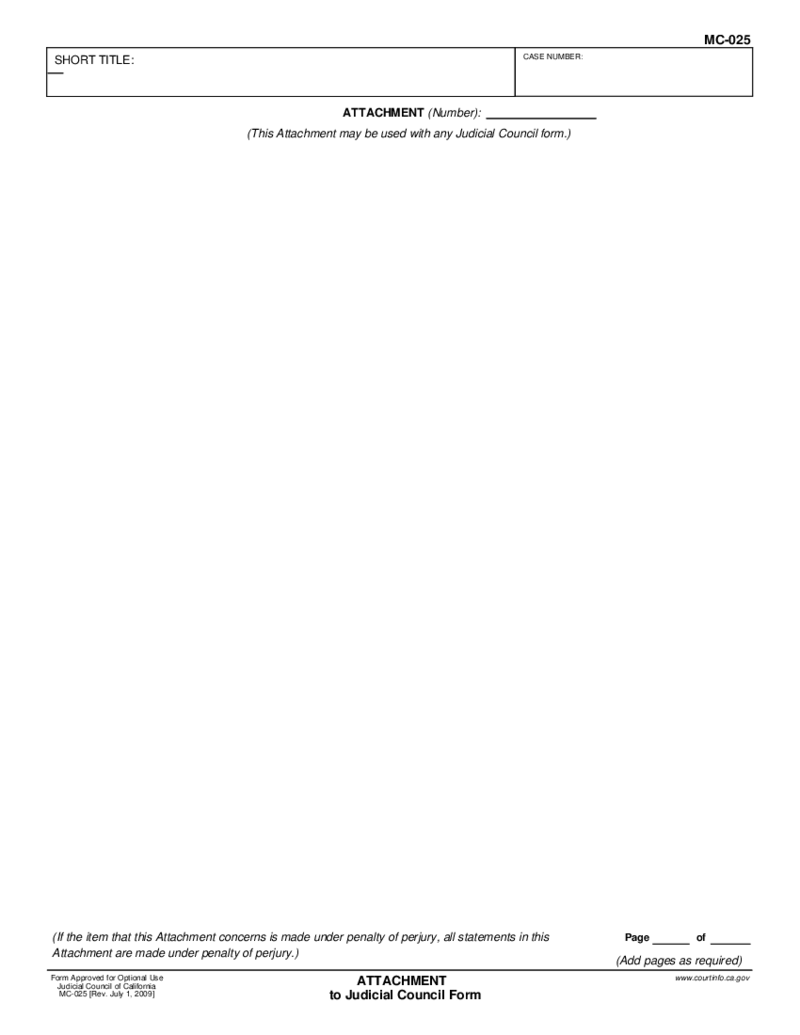

Form MC-025

What Is Form MC-025?

Titled Attachment to Judicial Council Form, form MC-025, is used for filing primary forms with the Judicial Council of California. What is an MC-025 form as such? The blank does not function except as an attachment to other forms occu

Form MC-025

What Is Form MC-025?

Titled Attachment to Judicial Council Form, form MC-025, is used for filing primary forms with the Judicial Council of California. What is an MC-025 form as such? The blank does not function except as an attachment to other forms occu

-

MC-030 Declaration

Overview of the MC-030 Declaration

The legal world is abound with myriad forms and documents needed to communicate important information. One such essential document is the MC 030 Declaration. This California-based form offers a platform for written fact

MC-030 Declaration

Overview of the MC-030 Declaration

The legal world is abound with myriad forms and documents needed to communicate important information. One such essential document is the MC 030 Declaration. This California-based form offers a platform for written fact

-

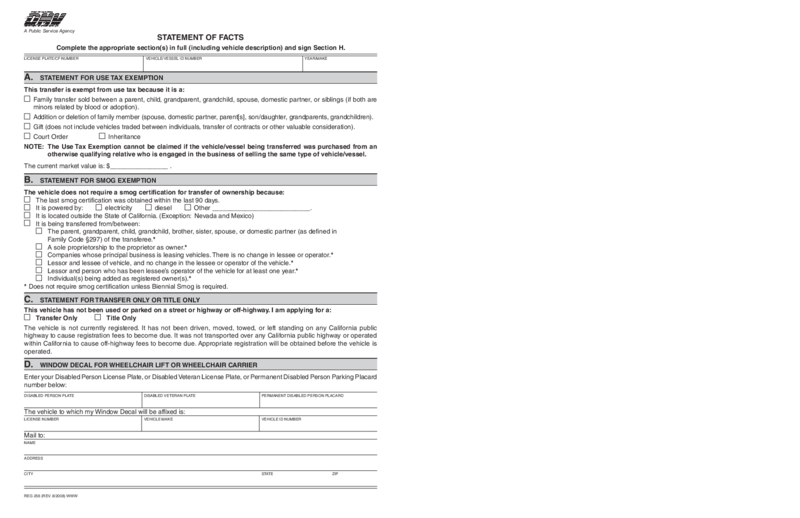

REG 256, Statement of Facts Form

What is a Statement of Facts for DMV?

The fillable REG 256 form is also known as a Statement of Facts. This document is used by owners of vessels or vehicles who want to provide more information about them. Usually, the REG 256 Statement of Facts provides

REG 256, Statement of Facts Form

What is a Statement of Facts for DMV?

The fillable REG 256 form is also known as a Statement of Facts. This document is used by owners of vessels or vehicles who want to provide more information about them. Usually, the REG 256 Statement of Facts provides

-

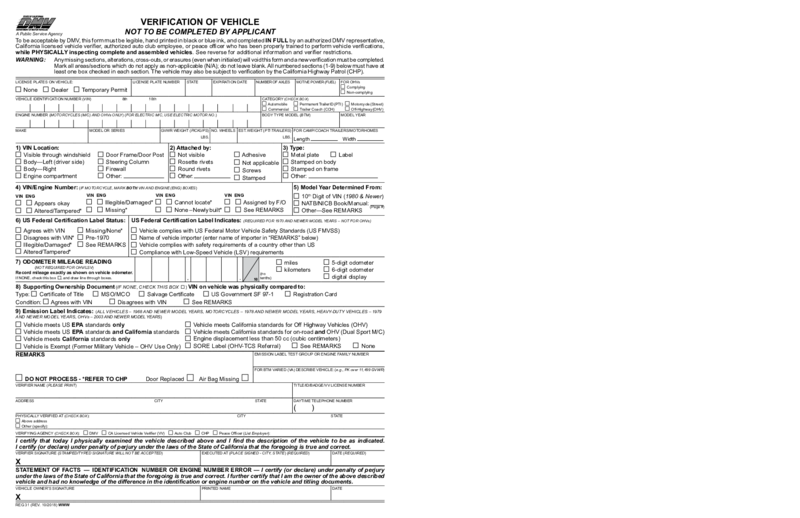

REG 31, Verification of Vehicle

What Is form REG 31 Verification of Vehicle?

The answer to what is a REG 31 form is suggested by its full title, Verification of Vehicle. It is a blank introduced by the California Department of Motor Vehicles and used for recording vehicle inspectio

REG 31, Verification of Vehicle

What Is form REG 31 Verification of Vehicle?

The answer to what is a REG 31 form is suggested by its full title, Verification of Vehicle. It is a blank introduced by the California Department of Motor Vehicles and used for recording vehicle inspectio

-

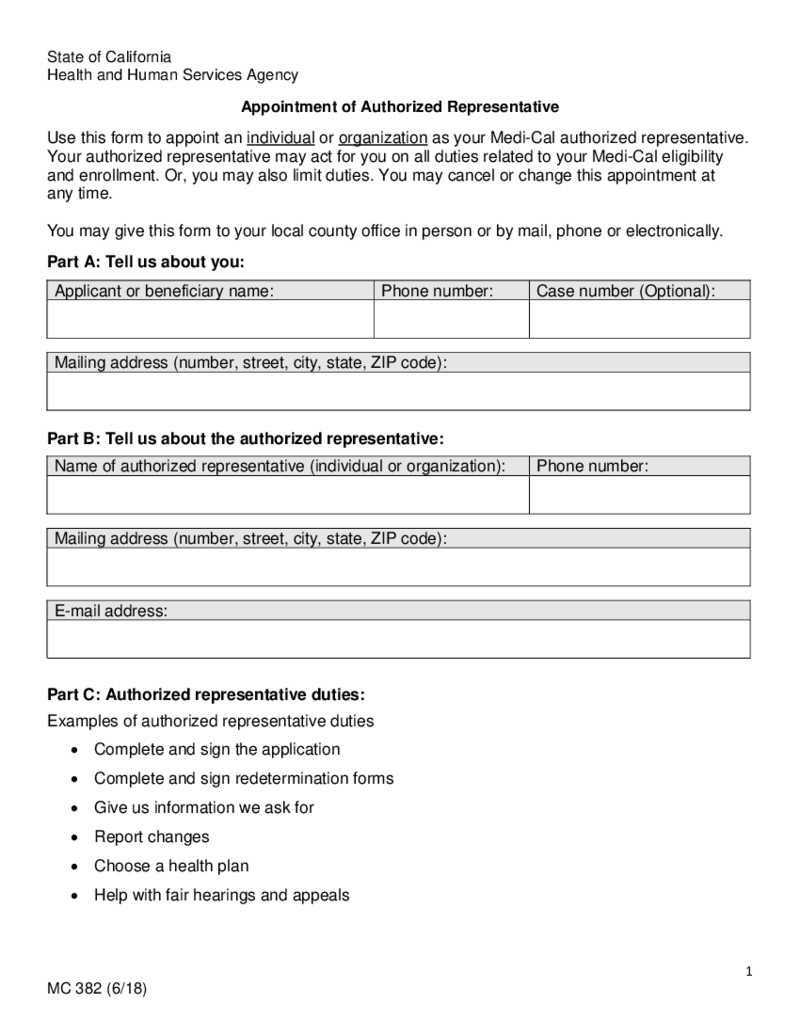

MC382 Appointment of Authorized Representative

What Is Form MC382?

The MC382 document is also known as the Appointment of Authorized Representative. You can fill in the blank if you need to name some organization or specific individual as your own Medi-Cal representative.

This person, based

MC382 Appointment of Authorized Representative

What Is Form MC382?

The MC382 document is also known as the Appointment of Authorized Representative. You can fill in the blank if you need to name some organization or specific individual as your own Medi-Cal representative.

This person, based

-

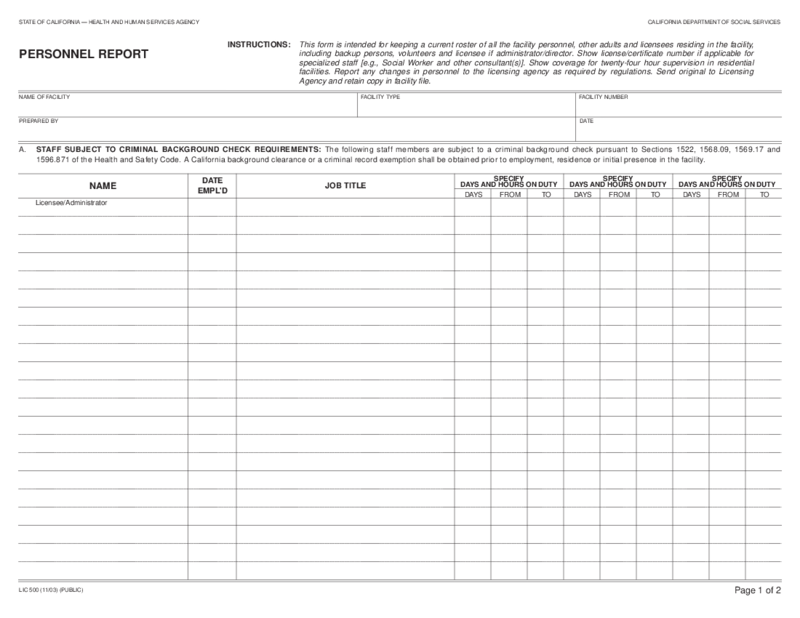

LIC 500 Personnel Report

What Is LIC 500 Personnel Report Form?

The LIC 500 Personnel Report Form is a type of form that is used to present information about a company's personnel.

LIC 500 Personnel Report

What Is LIC 500 Personnel Report Form?

The LIC 500 Personnel Report Form is a type of form that is used to present information about a company's personnel.

-

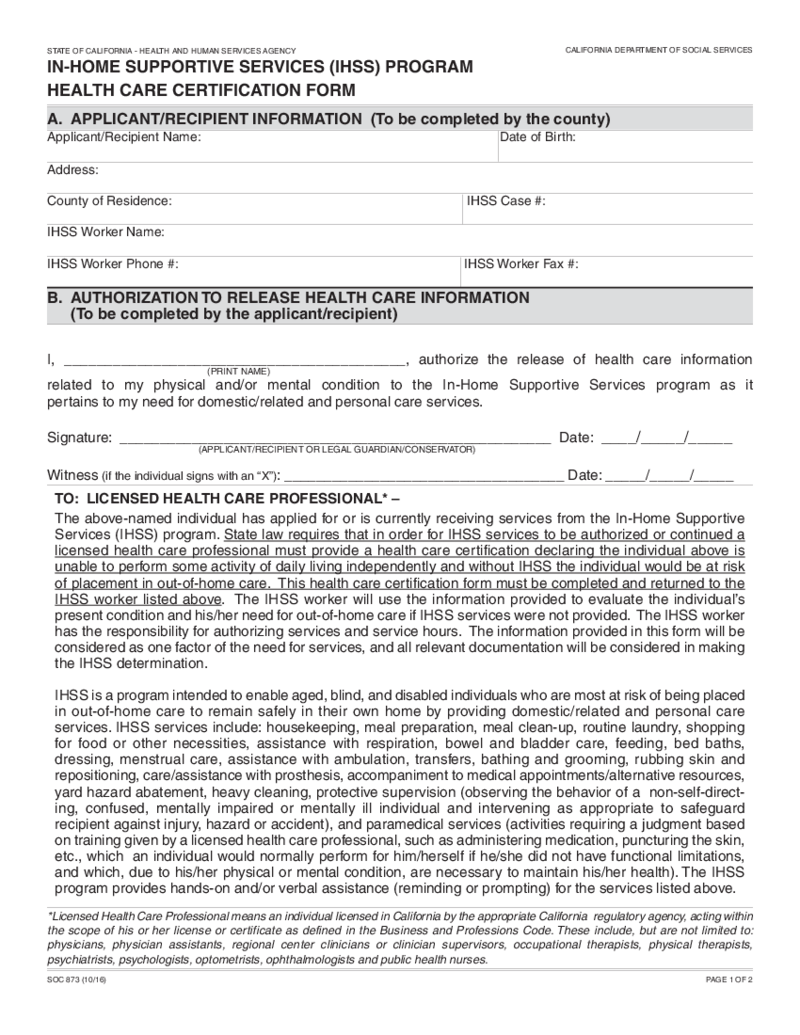

FORM SOC 873

What is SOC 873 Form?

IHSS SOC 873 is known as In-Home Supportive Services Program Health Care Certification Form. This document can be used by the person who needs services from the IHSS program. The form has to prove to the state of California that the

FORM SOC 873

What is SOC 873 Form?

IHSS SOC 873 is known as In-Home Supportive Services Program Health Care Certification Form. This document can be used by the person who needs services from the IHSS program. The form has to prove to the state of California that the

-

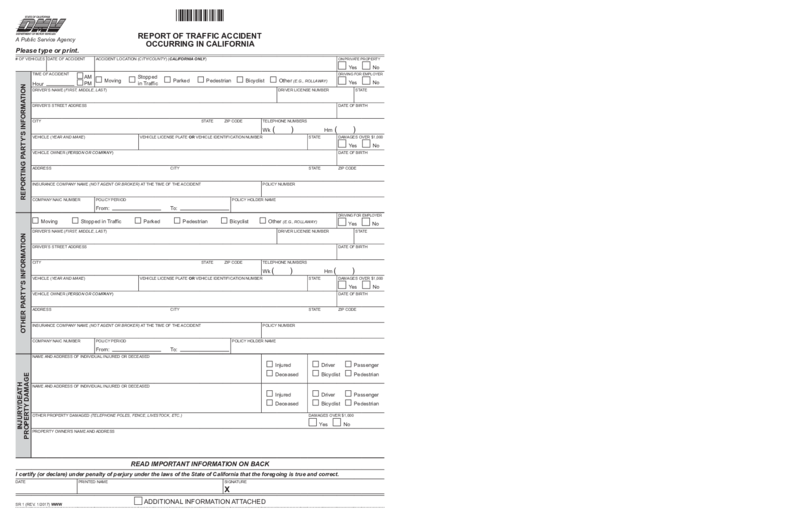

California DMV SR 1 Form - Report of Traffic Accident

What is DMV SR-1 Form?

California DMV Form SR 1 is a standard two-page report of traffic accidents that have occurred in California. Any participant (or their official representatives) in the incident must complete this document and submit it to the DMV w

California DMV SR 1 Form - Report of Traffic Accident

What is DMV SR-1 Form?

California DMV Form SR 1 is a standard two-page report of traffic accidents that have occurred in California. Any participant (or their official representatives) in the incident must complete this document and submit it to the DMV w

-

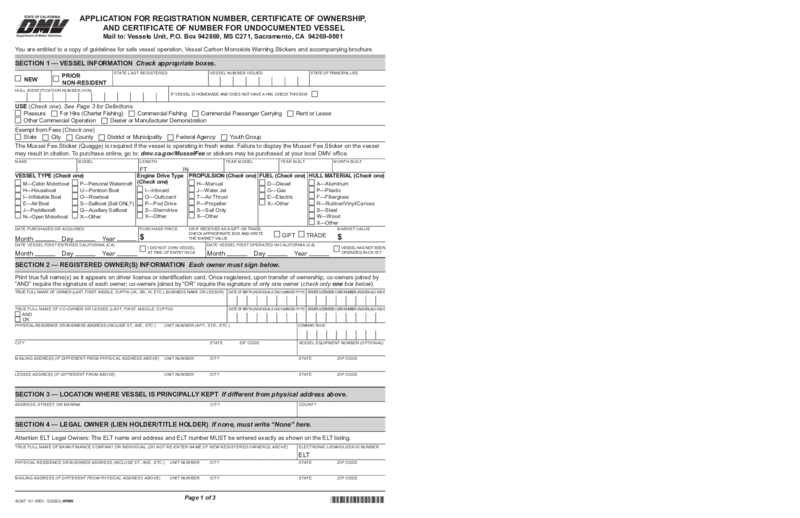

Application for Vessel Certificate of Number (BOAT 101)

Boat 101 Application Form for Vessel Certificate of Number & More

Understanding the Boat 101 form, the importance of a Vessel Certificate of Number, and the associated application process can be complex. This guide simplifies the process for boat owne

Application for Vessel Certificate of Number (BOAT 101)

Boat 101 Application Form for Vessel Certificate of Number & More

Understanding the Boat 101 form, the importance of a Vessel Certificate of Number, and the associated application process can be complex. This guide simplifies the process for boat owne

-

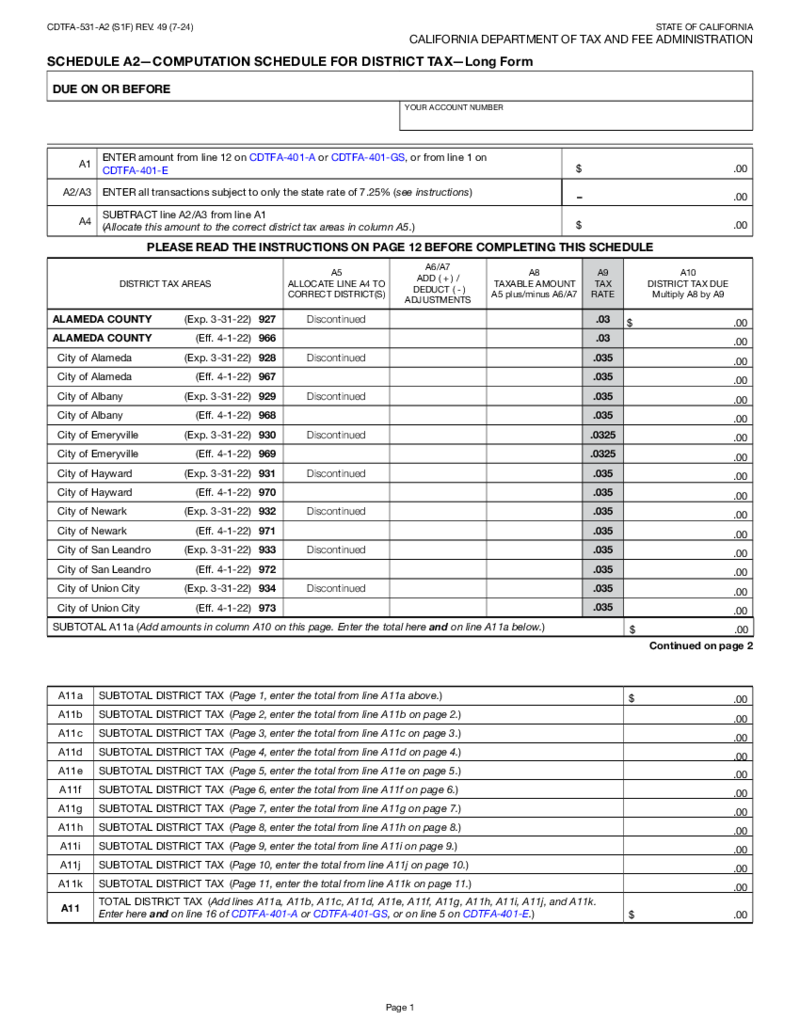

CDTFA-531-A2, Schedule A2 - Computation Schedule for District Tax - Long Form

Introduction to California Sales Tax Schedule A2 Computation Schedule for District Tax

The CDTFA-531-A2, also known as Schedule A2 - Computation Schedule for District Tax is an important document used for calculating district tax in California. This form

CDTFA-531-A2, Schedule A2 - Computation Schedule for District Tax - Long Form

Introduction to California Sales Tax Schedule A2 Computation Schedule for District Tax

The CDTFA-531-A2, also known as Schedule A2 - Computation Schedule for District Tax is an important document used for calculating district tax in California. This form

-

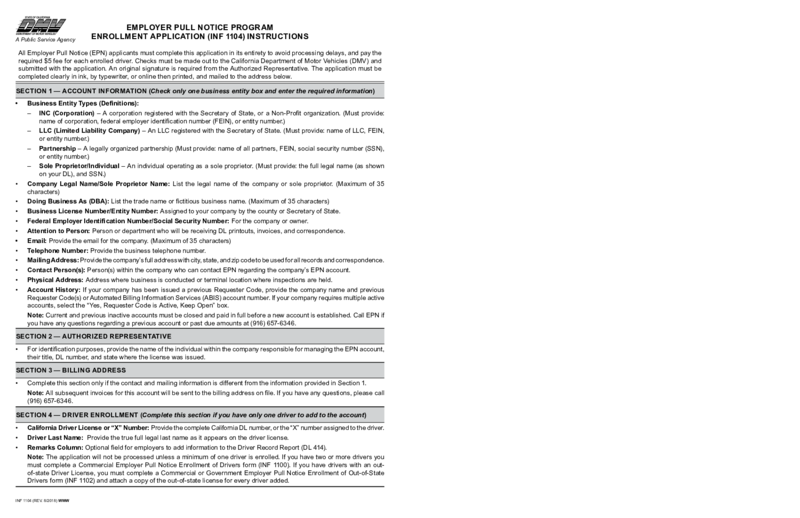

Employer Pull Notice Program Application (INF 1104)

Understanding INF 1104 Form

For employers who wish to join the Employee Pull Notice program, the DMV inf 1104 form is their ticket in. This form is an application that commands the DMV to provide the driving records of an employer's current, new, and

Employer Pull Notice Program Application (INF 1104)

Understanding INF 1104 Form

For employers who wish to join the Employee Pull Notice program, the DMV inf 1104 form is their ticket in. This form is an application that commands the DMV to provide the driving records of an employer's current, new, and

What Are California Templates Used For?

You can use California templates for a variety of purposes. For example, California forms can create legal documents such as divorce papers and child custody agreements or will template California. Also, they can be used to create contracts and other legal agreements. Before you choose a form, it is essential to ensure that it is current and complies with California law. You should also read the form carefully to ensure you understand all the terms and conditions.

What Are California Templates?

California form is used to create various documents, including letters, contracts, and legal forms. Also, you can create forms using a template. So. you can easily customize the pre-designed document to meet your specific needs.

Types of California Templates

Today, there are many different California templates. Some templates are for general use, others are more specialized. The most common for your use are the following types:

- Employment Verification Form

The employment verification form is used to verify an applicant's employment history. This template must be completed by the applicant's current or last employer.

- California Department of Motor Vehicles Templates

The California department of motor vehicles offers various templates to help you when registering your vehicle.

- California Civil Case Cover Sheet

This form may start a civil case in a superior court. You should fill out the cover sheet completely and file it with the first document filed in the case. The court will use the information on the cover sheet to start the case and assign a case number.

- Request to Waive Court Fees

You should fill out this type of form and submit it to the court to have the court costs waived. Some people cannot afford to pay them, while others may believe they have a good chance of winning their case and that court costs will be in vain if they lose.

- Protest Form Sample

Form DE 428T can be used to protest the amount of taxes owed to the state.

- Request for Verification of Identity

The California Department of Motor Vehicles (DMV) uses a document called Request for Identity Verification (RIV) to verify an applicant's identity when applying for a driver's license, permit, or identification card. RIV is also used to verify an applicant's identity when changing the name or address on a driver's license, permit, or identification card.

- CDTFA Form Templates

California Department of Taxes and Fees (CDTFA) offers you many templates to help businesses complete their tax returns. Below is a list of the most commonly used California tax forms:

- Sales and Use Tax Return

- Business Tax Return

- Payment Voucher

- Annual Tax Return

- Employer's Quarterly Tax Return

What Should Include in California Forms?

There are several key pieces of information that should be included on any California form:

- Full name and contact information for the person or business filling out the form.

- A description of what the form is for.

- The date the form was completed.

- Any instructions needed to properly complete the form.

- The signature of the person filling out the form.

How to Create California State Forms: Step by Step

California state tax form templates are a powerful tool that allows you to create custom documents, forms, or contracts with the specific information you enter into the document. In this article, we'll show you how to create a California template step by step.

- First, you should gather the information you want to include in the document. This can be text, images, or other data.

- Then, open a new document in the PDFliner text editor.

- After you've done this, start creating a template by adding the necessary text, images, and other data. Be sure to format the document to suit your needs.

- When you're done, just click "Save" and give the document a name so you can easily access it whenever you need it. That's it! Now you've created a California template using PDFliner.

- So, you may now use this template to create new documents. Just open the template file and enter the necessary information into the document. When you're done, save the document with a new name.

Are California Templates Legally Binding?

The advantage of using a California template is that it can help ensure that your documents are legally binding. By using a template, you can make sure that all the necessary information is included. This will help prevent any legal problems in the future.