-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

CDTFA-531-A2, Schedule A2 - Computation Schedule for District Tax

Get your CDTFA-531-A2, Schedule A2 - Computation Schedule for District Tax - Long Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Introduction to California Sales Tax Schedule A2 Computation Schedule for District Tax

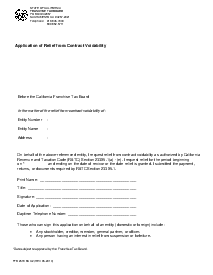

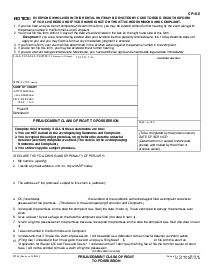

The CDTFA-531-A2, also known as Schedule A2 - Computation Schedule for District Tax is an important document used for calculating district tax in California. This form is pivotal for business owners and accounting professionals who need to compute the due district tax. The form consists of a simple yet comprehensive layout that makes it easy for individuals to decipher the information needed and subsequently carry out the necessary computations.

Importance of the CDTFA-531-A2 Schedule A2 Computation Schedule

The CDTFA-531-A2 is integral in ensuring that businesses are accurately reporting and paying their due taxes. Since it provides a systematic way of computing district tax, it mitigates the potential of under or over-reporting. Furthermore, using the schedule helps businesses recognize the different district rates applicable to them, considering California has variable rates depending on the district.

How to Fill Out CDTFA-531-A2 Form

Here's a detailed guide on how to fill out the CDTFA-531-A2, Schedule A2 - computation schedule for district tax form on the PDFLiner website:

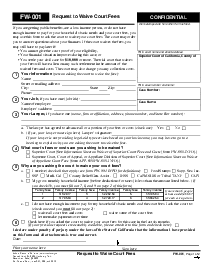

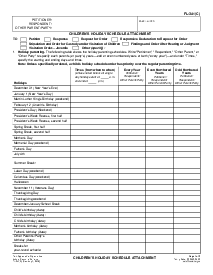

- Enter the amount from line 12 on CDTFA-401-A or CDTFA-401-GS, or from line 1 on CDTFA-401-E in box A1 to record your taxable transactions or total purchases.

- In boxes A2/A3, enter all transactions that are subject only to the state rate of 7.25%, which includes purchases for use in a location with no district tax and sales of items delivered to such locations.

- Subtract the total in A2/A3 from A1 and enter the result in A4. This amount represents transactions subject to district tax allocation.

- Allocate the amount from A4 to the correct district(s) in column A5, ensuring accurate distribution based on the specific districts applicable to your transactions.

- For any adjustments, add (+) or deduct (-) in column A6/A7 based on the district-specific transactions that require modification, such as uncollected taxes from discontinued districts or corrections for transactions taxed before the effective date of a district.

- Combine the figures from A5 and adjustments from A6/A7 to compute the taxable amount for each district in A8.

- Apply the appropriate tax rates listed next to each district in A9 to calculate the district tax due by multiplying A8 by A9 for each district. Enter these results in A10.

- On the first page, sum up the district tax due from each district and enter these subtotals from A11a to A11k. Finally, calculate the total district tax and enter it in A11.

Fillable online CDTFA-531-A2, Schedule A2 - Computation Schedule for District Tax - Long Form