-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

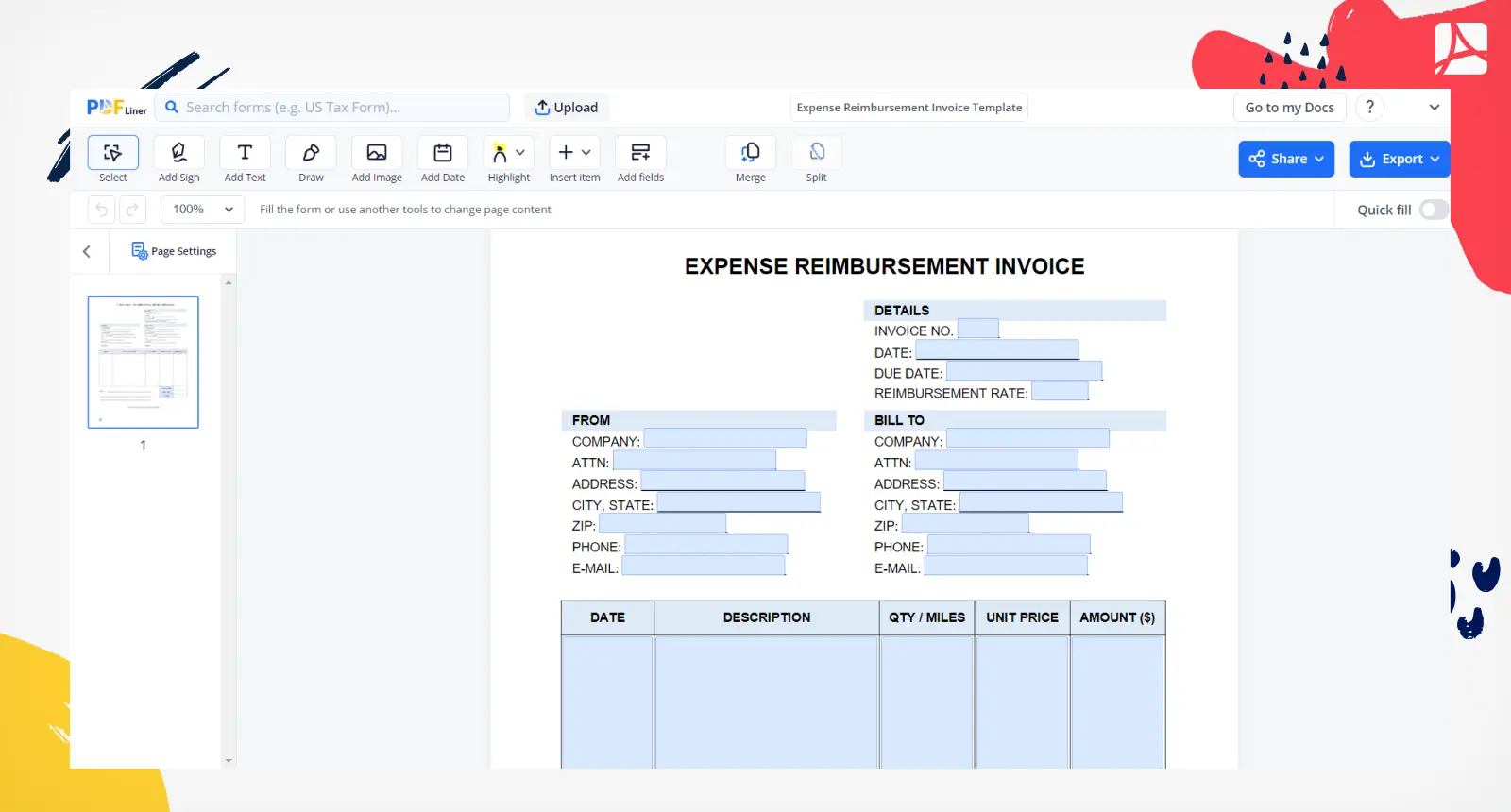

Fillable Expense Reimbursement Invoice Template

Get your Expense Reimbursement Invoice Template in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding Expense Reimbursement Invoice

An expense reimbursement invoice is an important document that acts as both an acknowledgment and proof of any expenditures made by an employee on behalf of a company. These costs may include travel expenses, procurement costs, or any other operational expenses that were initially paid for by the employee but for which they need to be reimbursed by the company later.

Importance of the expense reimbursement invoice template

Primarily, this form is submitted by an employee or contractor seeking to have their expenditures incurred on behalf of their employer or client reimbursed. This invoice grows in necessity as it transparently outlines the incurred charges, thus eliminating any possible ambiguity or conflict. By using an invoice for reimbursement of expenses, you ensure that all costs are documented and verified prior to refunding.

How to Fill Out Invoice for Reimbursement of Expenses

Wondering how to fill out this invoice for reimbursement expenses template? Start by gathering all receipts or proof of purchases related to the expenses you want to claim. Then, follow the following steps:

- Begin with the "Details" field. Fill in the "Invoice No." field with the correct invoice number. This is a unique identifier that is used for tracking purposes.

- Input the "Date" field with the date the invoice is being generated, and then the "Due Date," the time by which the reimbursement needs to be paid.

- Continue to the "Reimbursement Rate" section. Here, you'll need to indicate the current rate for the reimbursement.

- Move on to the "From" section. Start with the "Company" field by typing the name of the company from which the reimbursement is originating.

- Proceed to the "ATTN" field. Enter the name of the person or department in your company who should receive any queries about this invoice.

- Fill in the necessary details in the "Address," "City," "State," "ZIP," "Phone," and "Email" fields regarding the originating company’s contact information.

- Switch to the "Bill To" section. Just like the "From" section, you'll similarly fill in the "Company," "ATTN," "Address," "City," "State," "ZIP," "Phone," and "Email" fields with the receiving company’s or individual's details.

- Approach the "Date, Description, QTY / Miles, Unit Price, Amount ($), Subtotal, Tax/VAT, Total" section. Here, you'd need to itemize your expenses.

- In the "Date" field, type in the date the expense was incurred.

- Next, in the "Description" box, provide details of each specific expense.

- Fill the "QTY / Miles" field with the quantity of items purchased or the number of miles traveled, as applicable.

- In the "Unit Price," indicate the price per each quantity or mile.

- Provide the total amount incurred for each expense in the "Amount ($)" field.

- Your "Subtotal" is the sum of all your amounts.

- Where applicable, factor in any "Tax/VAT."

- The "Total" field should automatically calculate your subtotal plus any tax/VAT.

- Finally, use the "Notes" area for any additional explanations or comments regarding the reimbursement.

How do I invoice a customer for reimbursable expenses?

Creating and sending an invoice for reimbursable expenses to a client follows a very similar approach to invoicing a company for expenses. Before generating an invoice, ensure you have a written agreement stating your client will reimburse the expenses you incur as part of your service provision. This agreement can then be referenced in the invoice's notes section. When drafting the invoice, always itemize each expense accurately with applicable dates and total amounts.

Fillable online Expense Reimbursement Invoice Template